Borislav Shterev / Профиль

- Информация

|

4 года

опыт работы

|

2

продуктов

|

49

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

5) Also draw TradePanel who shows you account information: Today and Yesterday Profits, Balance,Last Profit, Last Open Lot Size, All Open Buy/Sell Position and total lots , Free Margin Level, Equity, 24 hour timer, Spread, Currency and Period. Moved candle timer shows you the time to close the last candle of currently period.The One Click Trading window will open over of the panel.

Here you can TEST EasyWay TradePanel indicatorfor - https://www.mql5.com/en/market/product/60610

Also, if you Rent the EasyWay TradePanel indicatorfor for minimum of 12 months, as bonus I will send you for free another three indicators for suports of EasyWay TradePanel system for #MetaTrader4 ,... EasyWayOscillator Alert , EasyWay Symbol Changer and EasyWay News Panel

You can use it with the following indicators or to create your own strategies.

Индикатор EasyWay TradePanel для МТ4 - это торговые помощники для ручной торговли любой валютой на Форекс и Криптовалутой как Биткойн, Етериум, Лайткойн и другими. Также EasyWay можно использовать для Золата,Сребра и Акции,Петрол . При установке на график в выбранном вами таймфрейме и торговом инструменте индикатор автоматически рисует следующие пользовательские индикаторы, используемые в торговой стратегии EasyWayTradePanel. 1) Zigzag_Extreme_Indicator, 2) Regression_Channel_Indicator, 3)

FiboZZ Trade Panel is trade assistants designed for manual trading and include account information panel with automatic drawing of ZigZag Extreme Arrows , Daily Fibonacci Extension with 3 levels for targets. You can use it with the following tow strategies or to use the indicators to create your own strategies. The information panel shows you: -Today and Yesterday Profits, -Balance, -Last Profit, -Last Open Lot Size, -All Open Buy/Sell Position and total lots , -Free Margin Level, -Equity, -24

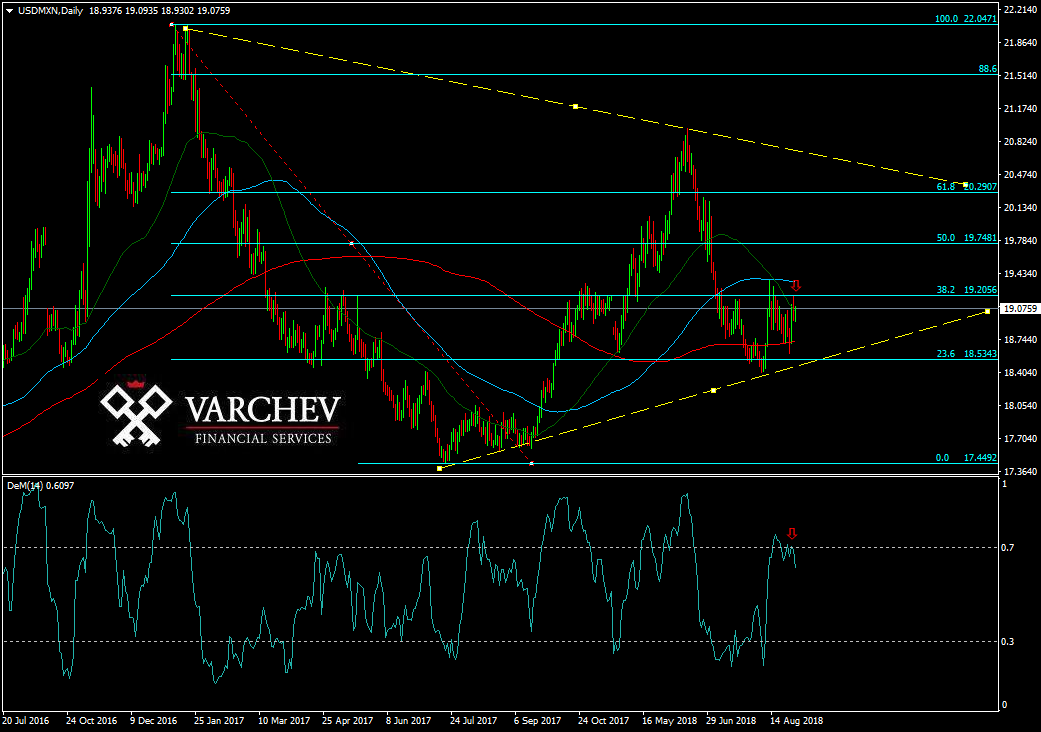

Bloomberg identified three key uncertainties for traders around the NAFTA deal between the U.S., Mexico and Canada. By the end of this week it is expected that the U.S. and Canada will reach a preliminary agreement on NAFTA renewal.

Source: Bloomberg Finance L.P.

READ MORE https://www.varchev.com/en/usd-mxn-nafta-uncertainties-and-technical-analysis/

30.08.2018

The legendary Marc Chaikin tells TheStreet that from a historical point of view, the moment is right for investing in energy sector stocks.

Technically, the MSCI Energy Sector Index tries to make a breakthrough over 50SMA, and if a successful one comes, it can give a boost to breakthrough diagonal resistance. Historically, for the period August - November last year, the index has risen by about 11.75%.

Chart: Used with permission of Bloomberg Finance L.P.

READ MORE https://www.varchev.com/en/historically-now-is-the-time-to-invest-in-energy-stocks/

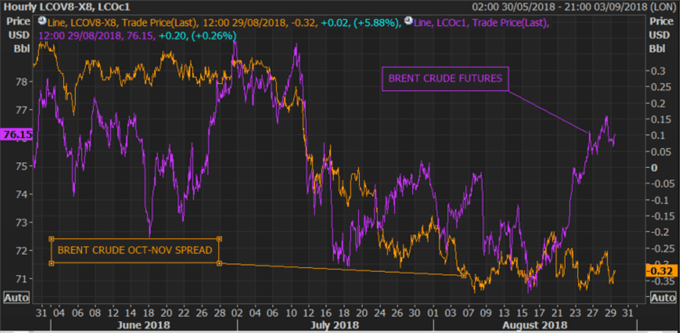

Oil prices are a nudge higher this morning, with Brent crude futures back above $76 a barrel, dismissing yesterday’s slightly bearish API report as focus turns to Iran. Reports from WSJ stated that Iran’s crude oil and condensate exports in August are set to drop below 70mln bpd for the first time since April 2017, ahead of the second round of US sanctions on November 4th. This consequently suggests that countries are indeed following the United States demands in regard to reducing Iranian oil imports. However, seasonal factors is also likely to have played a part in the drop in crude loadings, with August typically seeing fewer exports than any other month.

Read more in DailyFX .... https://www.dailyfx.com/forex/market_alert/2018/08/29/Crude-Oil-Price-Analysis-Further-Correction-Higher-as-Irans-Oil-Loadings-Drop.html

29.08.2018 / 11:27

Even after the worse data on consumer confidence in Germany today, the data remains close to the record for the country over the past 12 months. Like the IFO's strong performance in the country, consumer confidence has proven Germany's good development.

Reed more ....https://www.varchev.com/en/eur-take-support-aafter-good-consumer-and-ifo-business-confidence/

The trade deal with Mexico offers U.S. President Donald Trump "some wins from a political perspective that the administration can point to ahead of the mid-terms," said John Woods, the chief investment officer for Asia Pacific at Credit Suisse.

That could mean the country's ongoing dispute with China may drag on, Woods said.

Source: CNBC

Read more.....original post: The US-Mexico trade deal may be bad news for China https://www.cnbc.com/2018/08/28/the-us-mexico-trade-deal-may-be-bad-news-for-china-experts-say.html

Video: https://www.cnbc.com/video/2018/08/27/us-mexico-deal-not-necessarily-positive-for-china-says-credit-suisse.html

For starters, shares of Goldman Sachs were on a tear, having rallied about 30 percent in the month since Donald Trump was elected president. Trump had also restarted an age-old tradition of presidents naming Goldmanites to top spots in their administration.....Read more: http://www.varchevbrokers.com/goldman-is-back-on-top-in-the-trump-administration-positive-for-the-company-stock-price/?lang=en

Being contrarian may not be popular, but it's usually profitable.

Inspiration can come from unexpected places. I was trading silver slv in late June and early July and at some point on July 1st, around the time silver ripped another +5%, I thought to myself, 'this feels like 2011 all over again'.

In miniature, of course. Fractals are repetitions of patterns / sentiment / behavior in different timeframes.

Read more:

http://www.varchevbrokers.com/silver-whos-crazy-now/?lang=en

Russia to support UNSC reform if backed by over 2/3 of member states – Foreign Ministry

California burning: One dead, 1,000s evacuated as wildfires scorch 400 homes