Francis Dogbe / Профиль

- Информация

|

9+ лет

опыт работы

|

2

продуктов

|

36

демо-версий

|

|

1

работ

|

0

сигналов

|

0

подписчиков

|

Друзья

1783

Заявки

Исходящие

Francis Dogbe

Показать все комментарии (4)

Wagdy Abdelrahman

2014.04.28

not almost but offen happen :)

Rogerio Figurelli

2014.04.28

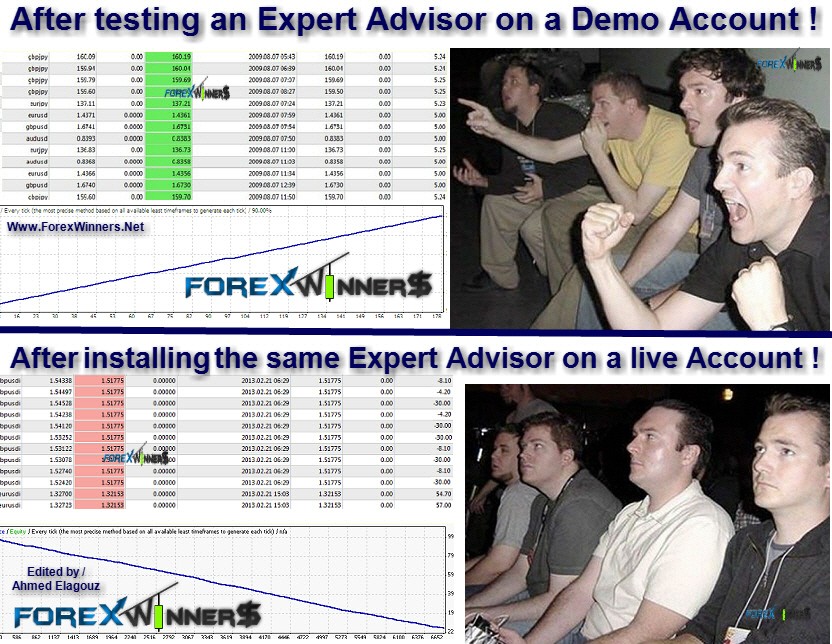

Can happen for all kind of accounts, since being past against the future! The secret is not jump from demo to final real account. After good demo, why not jump to a very very small real account? Note that even a small real past and a final real account future this can happen. Or worst, a nice past with final real account and a bad future final real account.

Francis Dogbe

2014.04.28

You are right Rogerio...

Francis Dogbe

Can someone create a forum where traders discuss day trading strategies daily....? ;-)

Francis Dogbe

Sergey Golubev

Комментарий к теме Something Interesting to Read May 2014

Chan: Algorithmic Trading: Winning Strategies and Their Rationale (Wiley Trading) Engaging and informative, Algorithmic Trading skillfully covers a wide array of strategies. Broadly divided into the

Francis Dogbe

Sergey Golubev

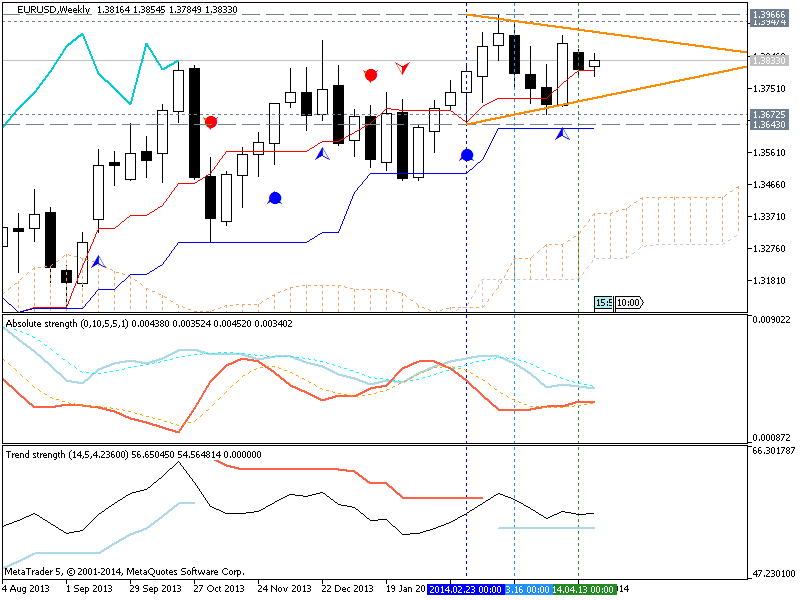

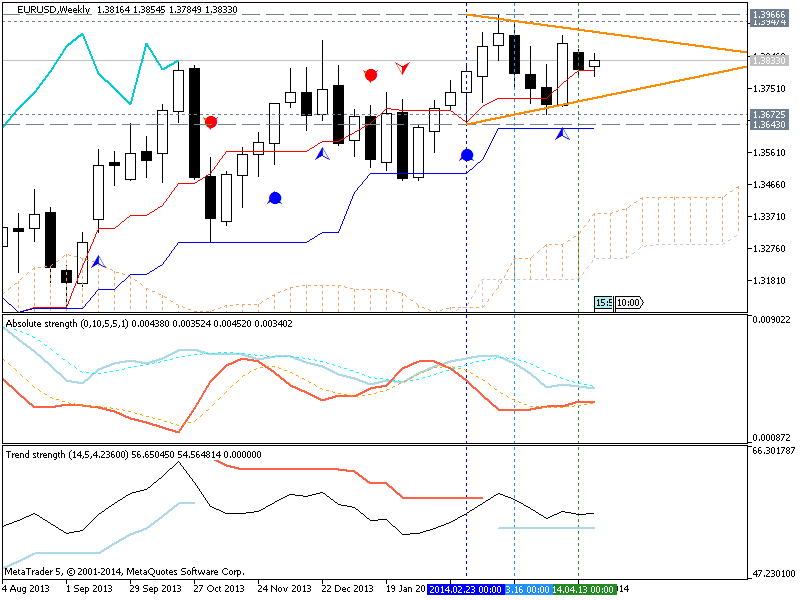

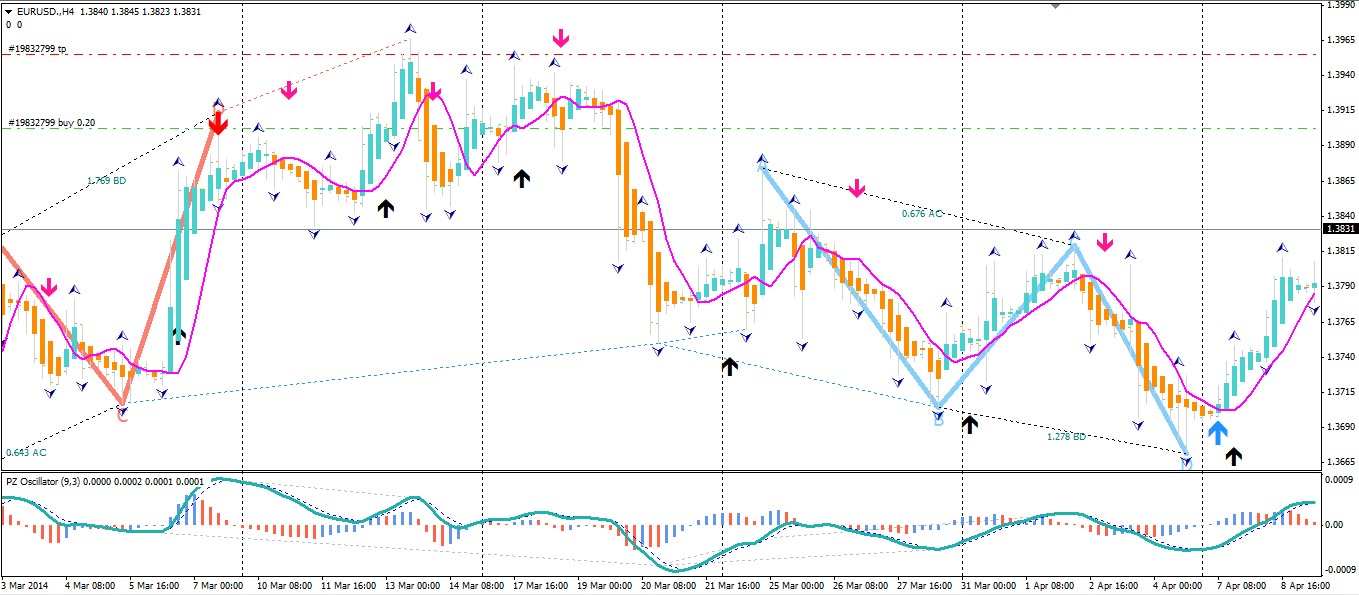

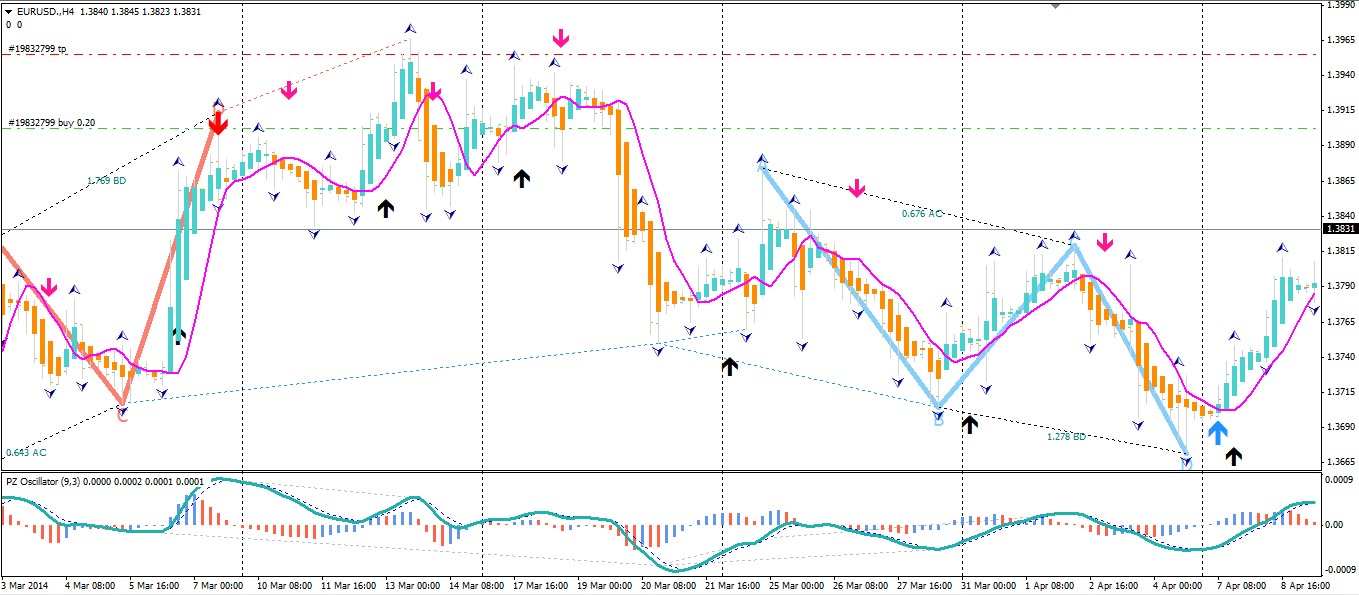

EURUSD Technical Analysis 2014, 27.04 - 04.05: Ranging

D1 price was going along Sinkou Span A line which is virtual border between primary bullish and primary bearish for D1/H4 timeframes. Chinkou Span line crossed the prifce but on horizantal way which is indicating flat within primary bullish. If D1

Francis Dogbe

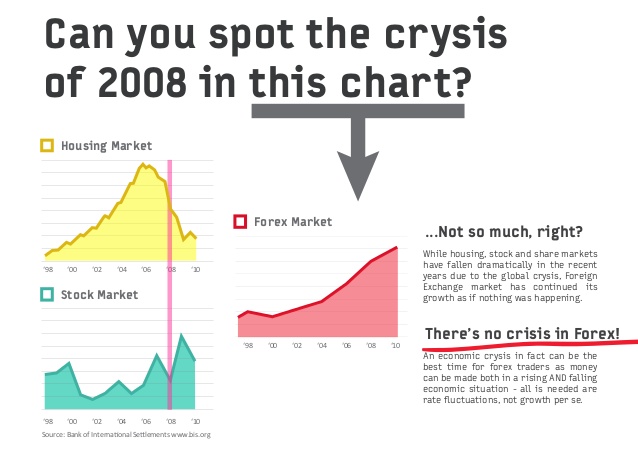

Ignore the usual advice you are given, on how to make money in online FOREX trading - and do the opposite!

Francis Dogbe

EUROPE & USA.... aka EURUSD. i have learnt to believe that it is the easiest to trade which i think is true. :)

Imtiaz Ahmed

2014.04.23

yes absolutely after this its gbp-usd i trade mostly with these two and after a long time i am doing very good ...

Francis Dogbe

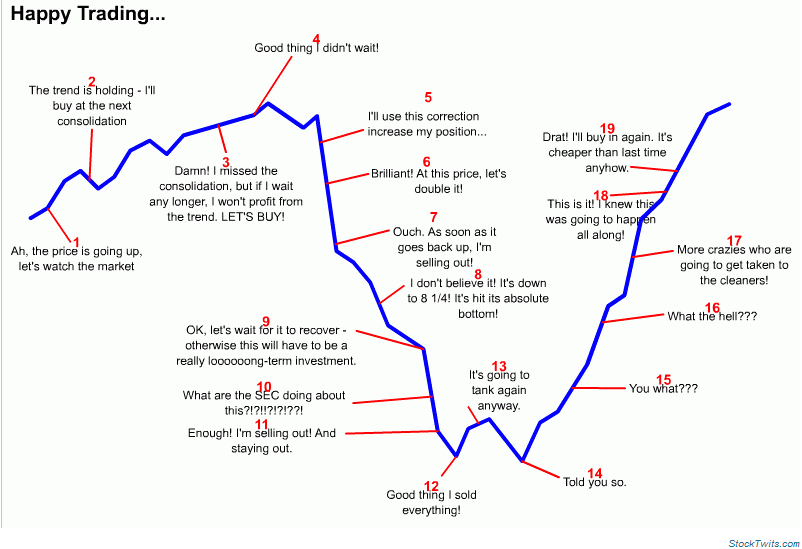

There is two BIG camps of trading style. Those that use stops and those that don't.

There's good reason NOT to use stop orders, as it's a common trading tactic of BIG money, to take out your stop order, for their own profit. BIG money are are players who's money actually moves the market.

The most common strategy is to use a mental stop, which works well, if you are there watching the market and disciplined enough to follow you plan. Many don't. But of course, being glued to monitor day and night, is a stiff burden.

While you may not use them, whether you use stop orders to protect your new position against loss, or as a way of protect your existing profits, it's an essential strategy to have in your arsenal. ESPECIALLY if you want to be able to leave the monitor, or sleep nights.

If you've never done this before USE your demo account to experiment. When you place a trade, you have the option of also placing a stop and limit order. Also, if you enter a trade with a market order, you ALWAYS have the option of adding these contingency stop and limit orders, afterwards.

The nice thing about linking the stop and limit orders to your position, is that if any one is hit, then the other is cancelled. ALSO if you close that position with a market order, then the stop and limit orders linked to that position are automatically cancelled. Nice. Huh?

Lets use 20 pips as an example. You enter the market and take a position. You link a 20 pip stop loss and a 20 pip limit order to your position. Once this is done, you can walk away. Either one of two things can happen, depending on which way the market moves. Either you're going to make 20 pips or you're going to loose 20 pips.

Of course that's just a hypothetical example. But you get the idea. When you start trading like this, or at least learning to trade this way as an exercise, you are forcing yourself, to seek out the lowest risk entry points, which is ALWAYS a good thing to do.

The BIG upside to learning how to trade this way, is you are become MUCH less inclined to make gut decision based of the emotions of and greed.

There's good reason NOT to use stop orders, as it's a common trading tactic of BIG money, to take out your stop order, for their own profit. BIG money are are players who's money actually moves the market.

The most common strategy is to use a mental stop, which works well, if you are there watching the market and disciplined enough to follow you plan. Many don't. But of course, being glued to monitor day and night, is a stiff burden.

While you may not use them, whether you use stop orders to protect your new position against loss, or as a way of protect your existing profits, it's an essential strategy to have in your arsenal. ESPECIALLY if you want to be able to leave the monitor, or sleep nights.

If you've never done this before USE your demo account to experiment. When you place a trade, you have the option of also placing a stop and limit order. Also, if you enter a trade with a market order, you ALWAYS have the option of adding these contingency stop and limit orders, afterwards.

The nice thing about linking the stop and limit orders to your position, is that if any one is hit, then the other is cancelled. ALSO if you close that position with a market order, then the stop and limit orders linked to that position are automatically cancelled. Nice. Huh?

Lets use 20 pips as an example. You enter the market and take a position. You link a 20 pip stop loss and a 20 pip limit order to your position. Once this is done, you can walk away. Either one of two things can happen, depending on which way the market moves. Either you're going to make 20 pips or you're going to loose 20 pips.

Of course that's just a hypothetical example. But you get the idea. When you start trading like this, or at least learning to trade this way as an exercise, you are forcing yourself, to seek out the lowest risk entry points, which is ALWAYS a good thing to do.

The BIG upside to learning how to trade this way, is you are become MUCH less inclined to make gut decision based of the emotions of and greed.

Daniel Stein

2014.04.22

Mental stops are like Martingale. Sooner or later you'll get killed.

That's my experience of 15 years being part of this business.

The real big money doesn't care were your stops are.

Their trading decision were made by high professional technical trading systems.

Catching your stops is a common tactic of Market Maker Brokers because your loss is their profit.

It's better to trade with an agency broker.

That's my experience of 15 years being part of this business.

The real big money doesn't care were your stops are.

Their trading decision were made by high professional technical trading systems.

Catching your stops is a common tactic of Market Maker Brokers because your loss is their profit.

It's better to trade with an agency broker.

Francis Dogbe

Daniel Stein

2014.04.21

Rule No 2: Trade the same fixed lot size to get comparable results for your trading analysis.

Imtiaz Ahmed

2014.04.21

how long u r trading forex its ok at first or even after a year to get similar results.....

Francis Dogbe

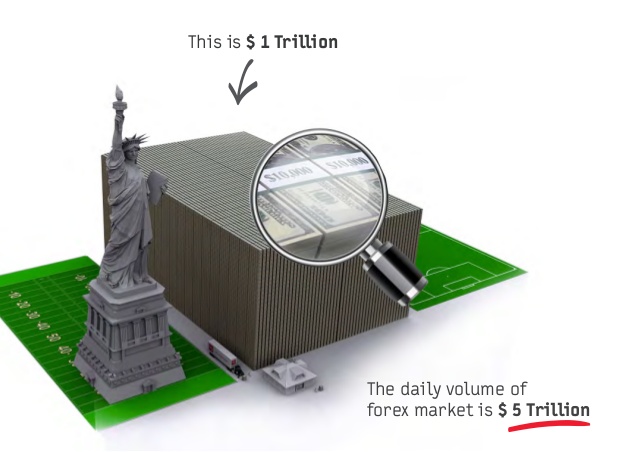

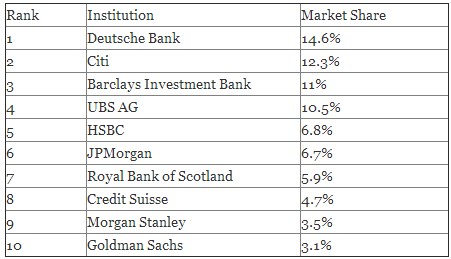

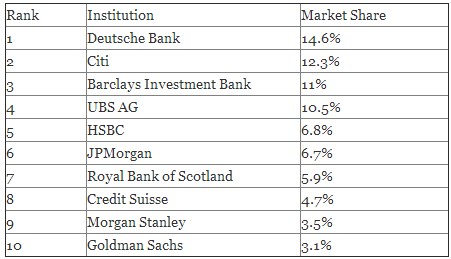

The simple truth is that anyone who trades in a direction opposite to what the major players are trading will fail.

That makes banking institutions some of the biggest players in the forex market. The fact of the matter is that 70% of all daily forex day trading is done by banks.

That makes banking institutions some of the biggest players in the forex market. The fact of the matter is that 70% of all daily forex day trading is done by banks.

Rogerio Figurelli

2014.04.20

This is a paradigm, no one trader, small or big, knows the right direction of the market.

Francis Dogbe

The biggest fact about the forex trading is that ninety five percent of the traders lose their investments in the first six month as a result they get disappointed and leave the forex trade. Only the five percent of the forex traders who enter the market survive over six months and make the profit that they desire. Of this five percent only a two percent can use forex trading to make a living. :-(

Daniel Stein

2014.04.20

I think this statistic applies to any form of self-employment.

Courage and iron discipline make dreams become reality. :-)

Courage and iron discipline make dreams become reality. :-)

: