Om Prakash Arora / Профиль

- Информация

|

3 года

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Om Prakash Arora

USDCHF Price Is Testing a Potential Bullish Reversal Level

Should the bears can push the price below the support level of $0.87, then, $0.86 and $0.85 level may be tested. In case the bulls defend the $0.87 level; the price may reverse and be confronted with the resistance level at $0.88, $0.89, and $0.90.

Key Levels:

Supply levels: $0.88, $0.89, $0.90

Demand levels: $0.87, $0.86, $0.85

Should the bears can push the price below the support level of $0.87, then, $0.86 and $0.85 level may be tested. In case the bulls defend the $0.87 level; the price may reverse and be confronted with the resistance level at $0.88, $0.89, and $0.90.

Key Levels:

Supply levels: $0.88, $0.89, $0.90

Demand levels: $0.87, $0.86, $0.85

Показать все комментарии (11)

Sergio Andres Lobel Emhart

2021.01.08

Om, I believe definitively are not having access to your computer and you replaced a good strategy for a random robot playing with all our butts not even telling us before doing it. As you can or could someday see, you worked with the wrong symbol. You talk about USDCHF meanwhile your signal is fucking us up with compulsive sales of NZDJPY clearly not made by a human brain and your signal reputation went to shit. You had the strategy at some point, a good explanation is required since you have loose the hope in your signal, but I still could pay attention to your answer if you like

Pavel Dzenisenka

2021.01.08

Торговля конечно просто ужас у данного трейдера! Решил слить всем счета в 2021 году - подарочек под елочку. Лучше подписывайтесь на реальных профессионалов Forex - https://izfx.ru/

Ali Memarzadeh

2021.01.08

There is a consonant unwritten law in Forex world. "If you have a good strategy or EA, you do not share it or sell it,because it's treasure." We all know this by heart, but don't abide. Any good trader who earns money from his strategy, will be an idiot if gives away or sell his signals. This signal provider proved it once more to all of us that no one gives a damn about our money, so: START TRADING FOR YOURSLEF AND FORGET SIGNAL\EA

Om Prakash Arora

Chart Of The Day: AUD/USD

Intraday, AUD/USD set up a double top (which is currently playing out), but the tweezer top daily candles and possible break below the .7630 level could expose a move back to the .7420 August highs.

Daily RSI is divergent, which is a stern warning for the bulls. We should also note the multi-year Fibonacci retracement (38.2%) is also at .7630

Intraday, AUD/USD set up a double top (which is currently playing out), but the tweezer top daily candles and possible break below the .7630 level could expose a move back to the .7420 August highs.

Daily RSI is divergent, which is a stern warning for the bulls. We should also note the multi-year Fibonacci retracement (38.2%) is also at .7630

Om Prakash Arora

Dollar Down, But Still Finds Support Amid COVID-19, Georgia Election Worries

The dollar was down on Tuesday morning in Asia, but with investors turning to safe-haven assets as the number of COVID-19 cases and uncertainty about a U.S. runoff election in Georgia mount.

The U.S. Dollar Index that tracks the greenback against a basket of other currencies inched down 0.04% to 89.812 by 8:49 PM ET (1:49 AM GMT), little changed and holding onto gains from the previous session.

The dollar was down on Tuesday morning in Asia, but with investors turning to safe-haven assets as the number of COVID-19 cases and uncertainty about a U.S. runoff election in Georgia mount.

The U.S. Dollar Index that tracks the greenback against a basket of other currencies inched down 0.04% to 89.812 by 8:49 PM ET (1:49 AM GMT), little changed and holding onto gains from the previous session.

Om Prakash Arora

Dollar starts 2021 in the cellar with a hangover

The dollar started the new year by slipping broadly on Monday as investors sold it for just about everything else in the Asia session, wagering the world's pandemic recovery will drive other currencies higher.

The dollar started the new year by slipping broadly on Monday as investors sold it for just about everything else in the Asia session, wagering the world's pandemic recovery will drive other currencies higher.

Om Prakash Arora

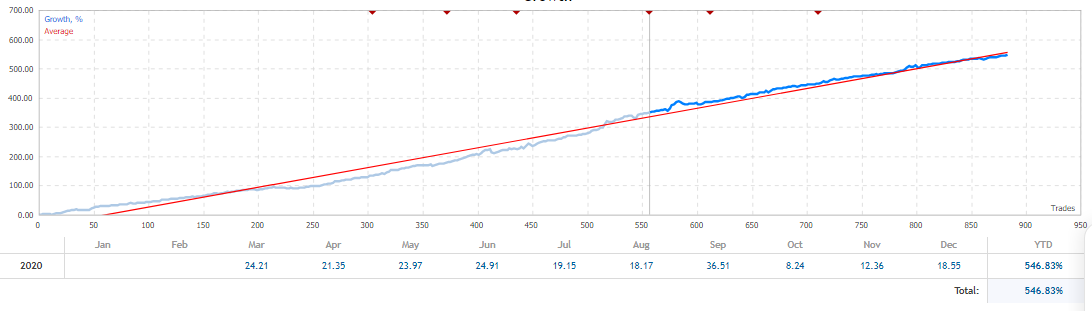

2020 return 549%

We are keen to maintain same consistency in 2021 as well.

Our Signal: https://www.mql5.com/en/signals/849167

We are keen to maintain same consistency in 2021 as well.

Our Signal: https://www.mql5.com/en/signals/849167

Om Prakash Arora

Dear Subscribers,

It has come to our attention that there are few telegram channels running with our name and are misguiding members by selling several other services.

We hereby confirm that we don't have any official telegram group. Kindly refrain yourself from any such groups. You can contact us on mql5 messages.

Thanks!

We are all set for trading in 2021.

It has come to our attention that there are few telegram channels running with our name and are misguiding members by selling several other services.

We hereby confirm that we don't have any official telegram group. Kindly refrain yourself from any such groups. You can contact us on mql5 messages.

Thanks!

We are all set for trading in 2021.

Om Prakash Arora

Happy New year Friends!!

May all your endeavors are met with huge success and appreciation.

May all your endeavors are met with huge success and appreciation.

Mario de Jesus Reina Orellana

2021.01.02

Igualmente amigo, deseo para Ud y toda su flia un propero año nuevo lleno de existos...Dios lo bendiga

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

We had a successful year with 547% increase in our equity.

We are ready for next year as well and will try hard to make 2021 a happy and lucky year for all of you as well.

Subscribe us!!

We had a successful year with 547% increase in our equity.

We are ready for next year as well and will try hard to make 2021 a happy and lucky year for all of you as well.

Om Prakash Arora

Dollar on borrowed time as U.S. twin deficits balloon

The dollar was ending 2020 in a downward spiral on Thursday with investors wagering a global economic recovery will suck money into riskier assets even as the U.S. has to borrow ever more to fund its swelling twin deficits.

The euro stood at $1.2291, having hit its highest since April 2018 with a gain of almost 10% for the year. The next stops for the bull train are $1.2413 and $1.2476, on the way to the 2018 peak at $1.2555.

The dollar was ending 2020 in a downward spiral on Thursday with investors wagering a global economic recovery will suck money into riskier assets even as the U.S. has to borrow ever more to fund its swelling twin deficits.

The euro stood at $1.2291, having hit its highest since April 2018 with a gain of almost 10% for the year. The next stops for the bull train are $1.2413 and $1.2476, on the way to the 2018 peak at $1.2555.

Om Prakash Arora

Dollar trampled as riskier assets rally on U.S. stimulus hopes

The dollar slumped to multi-year lows against many currencies on Wednesday as currency traders looked past a new delay in U.S. stimulus cheques and maintained bets that additional financial aid was still likely.

The greenback hit its weakest level in more than two years against the euro, the Australian and the New Zealand dollars. The greenback also fell to the lowest in more than five years against the Swiss franc and fell broadly against Asian currencies.

U.S. Senate Majority Leader Mitch McConnell on Tuesday blocked immediate consideration of a measure to increase COVID-19 relief payments to $2,000, adding another twist to fractious negotiations over fiscal stimulus.

The dollar slumped to multi-year lows against many currencies on Wednesday as currency traders looked past a new delay in U.S. stimulus cheques and maintained bets that additional financial aid was still likely.

The greenback hit its weakest level in more than two years against the euro, the Australian and the New Zealand dollars. The greenback also fell to the lowest in more than five years against the Swiss franc and fell broadly against Asian currencies.

U.S. Senate Majority Leader Mitch McConnell on Tuesday blocked immediate consideration of a measure to increase COVID-19 relief payments to $2,000, adding another twist to fractious negotiations over fiscal stimulus.

Om Prakash Arora

Euro Trying to Rise

After the United Kingdom and the European Union managed to make a deal on the trade agreement just days shy of the deadline and saved Europe from the “uncontrolled” Brexit, the major currency pair is trying to grow. On Monday, December 28th, EUR/USD is looking good and trading at 1.2210.

After the United Kingdom and the European Union managed to make a deal on the trade agreement just days shy of the deadline and saved Europe from the “uncontrolled” Brexit, the major currency pair is trying to grow. On Monday, December 28th, EUR/USD is looking good and trading at 1.2210.

Jaydeep Jaganbhai Patel

2020.12.29

Today, I subscribe your signal, you open trade NZDJPY but some error shows in me, I talk with my broker they says "this restriction is from your signals side. Kindly contact your signal provider for the issue."

Error====" 2020.12.29 09:10:00.770 Signal '43012628': signal copying for 'NZDJPY' is prohibited by your broker "

Please reply

Error====" 2020.12.29 09:10:00.770 Signal '43012628': signal copying for 'NZDJPY' is prohibited by your broker "

Please reply

Jaydeep Jaganbhai Patel

2020.12.29

Please reply in private msg . https://www.mql5.com/en/messages/013445AB9FDDD601

Om Prakash Arora

Dollar Drifts Lower as Trump Signs Stimulus Bill

The dollar edged lower on Monday after President Donald Trump finally signed the government spending and coronavirus relief packages, after a bizarre intervention before the Christmas holiday in which he took issue with a number of spending proposals previously approved by his administration.

The dollar edged lower on Monday after President Donald Trump finally signed the government spending and coronavirus relief packages, after a bizarre intervention before the Christmas holiday in which he took issue with a number of spending proposals previously approved by his administration.

Om Prakash Arora

Annual forecast for EURJPY (2021): EURJPY May break up the $126 and Increase to $131

The breakup of the $126 resistance level may push the price to $128 and $131 price level. In case the resistance level of $126 holds, the price may reverse and descend to the previous low of $116 provided the support level of $124, $122, and $120 does not hold.

EURJPY Market

Key Levels:

Supply levels: $126, $128, $131

Demand levels: $124, $122, $120

The breakup of the $126 resistance level may push the price to $128 and $131 price level. In case the resistance level of $126 holds, the price may reverse and descend to the previous low of $116 provided the support level of $124, $122, and $120 does not hold.

EURJPY Market

Key Levels:

Supply levels: $126, $128, $131

Demand levels: $124, $122, $120

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!

Yet another month of steady and consistent profit to our subscribers.

Thank You all for your positive feedback in reviews.

We hope you will have a happy holidays and here we are working hard again in holidays too, to deliver you Christmas and new year gift in your trading account.

Subscribe us!

Yet another month of steady and consistent profit to our subscribers.

Thank You all for your positive feedback in reviews.

We hope you will have a happy holidays and here we are working hard again in holidays too, to deliver you Christmas and new year gift in your trading account.

Om Prakash Arora

Pound Rally Seen Capped to 2018 Level on a Brexit Trade Deal

The ink is barely dry on the historic outline for a Brexit trade deal, yet pound prognosticators are delivering a reality check on the rally.

The general consensus is that much of the optimism is already priced in, with the currency up more than 9% since the end of June while the relative cost of hedging pound weakness over the next year at its lowest since March.

Investors are conscious of the limitations of any incoming accord and are looking ahead to the prospect of further coronavirus restrictions and the U.K.’s bleak economic outlook.

The pound will probably advance to $1.37 if the U.K. and European Union finalize a trade deal on Christmas Eve, according to Credit Agricole While that’s the highest level since May 2018, it’s just under a 1% gain from Thursday’s peak of $1.3586.

The ink is barely dry on the historic outline for a Brexit trade deal, yet pound prognosticators are delivering a reality check on the rally.

The general consensus is that much of the optimism is already priced in, with the currency up more than 9% since the end of June while the relative cost of hedging pound weakness over the next year at its lowest since March.

Investors are conscious of the limitations of any incoming accord and are looking ahead to the prospect of further coronavirus restrictions and the U.K.’s bleak economic outlook.

The pound will probably advance to $1.37 if the U.K. and European Union finalize a trade deal on Christmas Eve, according to Credit Agricole While that’s the highest level since May 2018, it’s just under a 1% gain from Thursday’s peak of $1.3586.

Om Prakash Arora

Sterling gains, dollar on back foot amid hopes Brexit deal imminent

Sterling extended gains on Thursday amid expectations a long-elusive Brexit deal was imminent, raising hopes the UK can avoid a turbulent economic rupture on New Year's Day.

The dollar was on the back foot in holiday-thinned trading as hopes for an agreement that would protect some $1 trillion in annual cross-channel trade from tariffs and quotas sapped demand for the safest assets.

The British pound strengthened 0.4% to $1.3546 in Asian hours after surging 0.9% in the previous session to snap a three-day losing streak.

Sterling extended gains on Thursday amid expectations a long-elusive Brexit deal was imminent, raising hopes the UK can avoid a turbulent economic rupture on New Year's Day.

The dollar was on the back foot in holiday-thinned trading as hopes for an agreement that would protect some $1 trillion in annual cross-channel trade from tariffs and quotas sapped demand for the safest assets.

The British pound strengthened 0.4% to $1.3546 in Asian hours after surging 0.9% in the previous session to snap a three-day losing streak.

Om Prakash Arora

Virus worries buoy dollar, pound swung by Brexit gyrations

The dollar held gains against major peers in holiday-thinned trading on Wednesday as caution about a fast-spreading coronavirus variant in the UK stoked demand for the safest assets.

The pound has fallen for three straight days as time runs out for London to reach a trade deal with Brussels before the UK completes its exit from the European Union at year-end.

The dollar held gains against major peers in holiday-thinned trading on Wednesday as caution about a fast-spreading coronavirus variant in the UK stoked demand for the safest assets.

The pound has fallen for three straight days as time runs out for London to reach a trade deal with Brussels before the UK completes its exit from the European Union at year-end.

Om Prakash Arora

Excitement Picks Up In FX Markets. Here's Why

The US dollar index rose 80 points to 91.00 at one stage overnight, as panicked investors rushed for safe-havens. However, as order was restored in New York, it retreated, finishing the day 0.10% lower at 91.04, cunningly disguising the day’s volatility. EUR/USD spiked as low as 1.2130 before rallying to finish almost unchanged at 1.2240. GBP/USD traded both sides of 1.3200 and 1.3500 in a Covid-19/Brexit induced sell-off. The UK’s fishing fig-leaf though, saw it close only 0.45% lower for the day at 1.3460. The story was much the same for AUD/USD, NZD/USD and USD/JPY, all suffering 1.0% plus sell-offs, before recovering all of those losses.

The US dollar index rose 80 points to 91.00 at one stage overnight, as panicked investors rushed for safe-havens. However, as order was restored in New York, it retreated, finishing the day 0.10% lower at 91.04, cunningly disguising the day’s volatility. EUR/USD spiked as low as 1.2130 before rallying to finish almost unchanged at 1.2240. GBP/USD traded both sides of 1.3200 and 1.3500 in a Covid-19/Brexit induced sell-off. The UK’s fishing fig-leaf though, saw it close only 0.45% lower for the day at 1.3460. The story was much the same for AUD/USD, NZD/USD and USD/JPY, all suffering 1.0% plus sell-offs, before recovering all of those losses.

: