Evgeniy Scherbina / Профиль

- Информация

|

10+ лет

опыт работы

|

27

продуктов

|

618

демо-версий

|

|

0

работ

|

1

сигналов

|

0

подписчиков

|

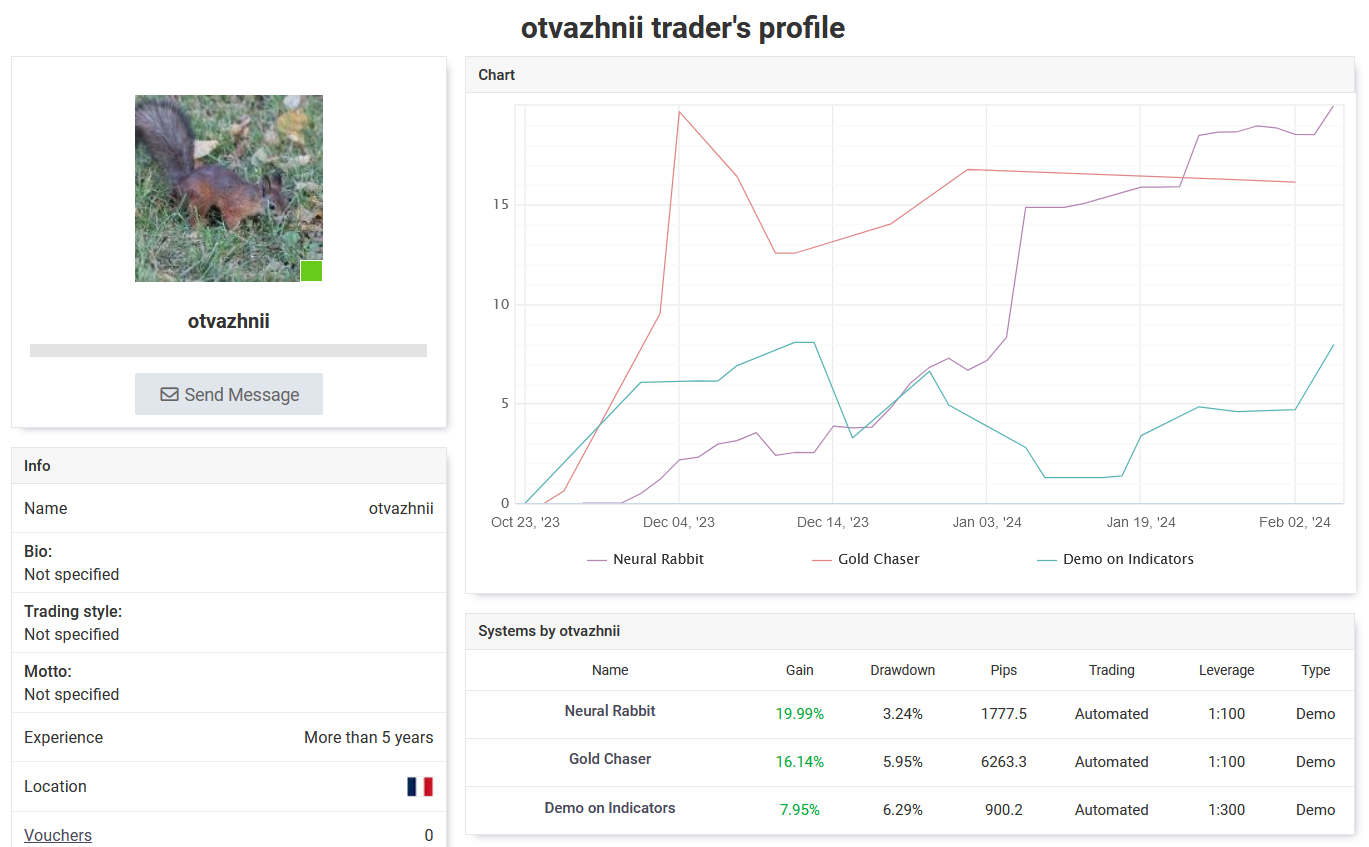

myfxbook.com/members/otvazhnii

It has all my best strategies - Neural Rabbit, Gold Chaser etc - updated live. More strategies will be added in the very near future. All in one chart, it is so easy to compare!

If you want to drill down into details, it has lots of nice diagrams and piecharts. Profit per month, missed profit and more. Go check it out!

Intraday Rush 95$ down from 385$

Neural Rabbit 85$ down from 215$

Tokyo 85$ down from 215$

Merry Christmas and Happy New Year!!

End of Year Sale!!

Limited Time Only!!

https://www.mql5.com/en/blogs/post/754992

Hurry up! This offer will not be available forever!

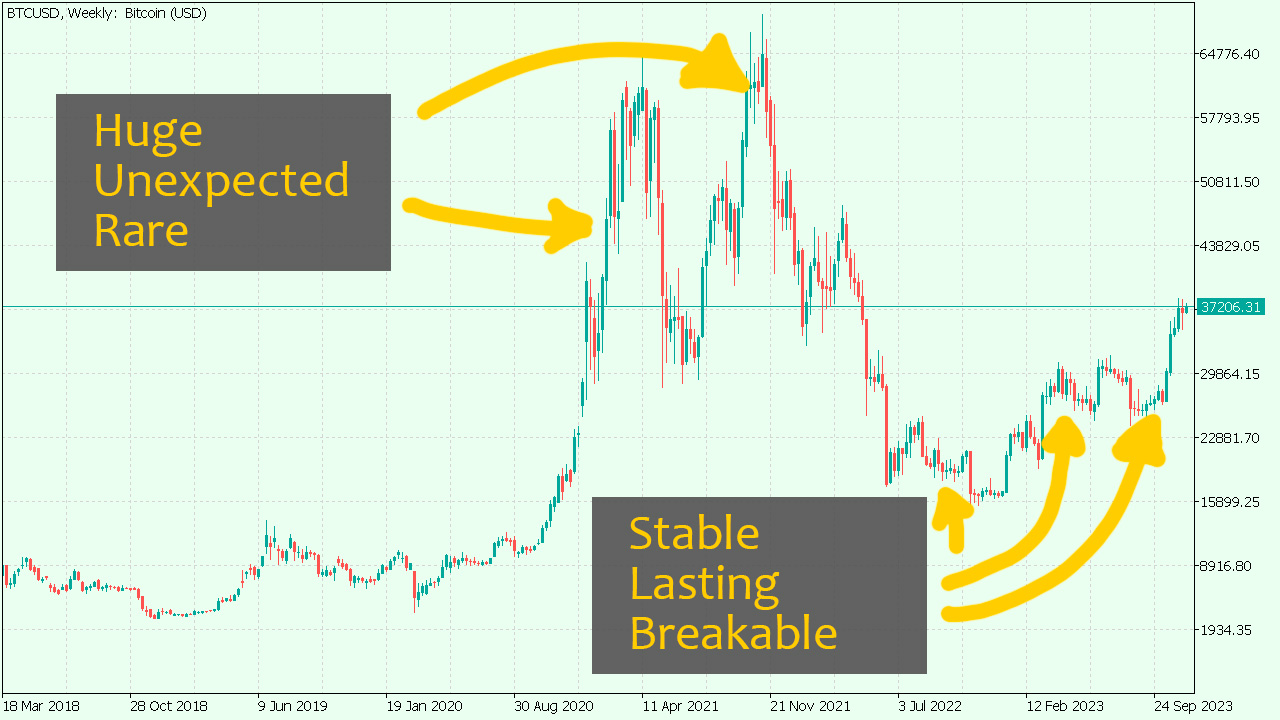

Bitcoin is not easy. Nor it is like other symbols. It seems like Bitcoin was nothing before 2013. It started growing exponentially about 10 years ago from nothing to something everyone desperately needed.

As there is no reliable history, I suggest to myself I should better turn to the 8-hour chart. Thus, I will still have 2 options. First, waiting for a big move up or down like it was in 2013, and then later in 2020, and then again in 2021 to the highest peak of 65K in Autumn of 2021. And then a huge fall to below 25K in 2022. And second, I can still trade in seemingly ever-lasting flat channels, like those in the second half of 2022 and then several times in 2023.

It will be a different approach, overall. It will be different from anything. Previously, I thought Gold was different from the major symbols. Gold pushes huge swaying moves. A Gold move feels like a trend almost every day. But Bitcoin is different from Gold, which is different from the major symbols.

I am going to do a million tests (as usual) for Bitcoin in the 8-hour chart to check if it is a good approach. My best hope I will be able to integrate this symbol to the advisor "Gold Chaser" in December, and it will work as one solid and even more reliable strategy.

Советник Gold Chaser ("Искатель золота") торгует полностью автоматически на 4 символах: XAUUSD (Gold), XAGUSD (Silver), BTCUSD (Bitcoin) и XBRUSD (Brent Oil). Я планирую в ближайшем будущем добавить еще криптовалюты и/или фондовые индексы. Возможности "неосновных" символов действительно отличаются от того, к чему привыкаешь с основным набором символов. Прежде всего, золото движется очень быстро. Также как и основные символы, золото реагирует на политическую обстановку, важнейшие экономические

These huge flat moves by Gold are like nothing else. It is hard to find a flat and yet profitable pattern like this in any other symbol. So why isn't there a good strategy to take on this profitability of wide and flat moves? Well, there is soon going to be a fully automatic strategy to trade Gold and probably other metals and commodities! Stay tuned! It's close. Maybe even as close as the next week!

Советник Intraday Rush торгует одновременно несколько символов в автоматическом режиме: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF и USDJPY. Советник использует измененный вариант популярного индикатора RSI (Relative Strength Index, "Индекс относительной силы"), чтобы принимать торговые решения на открытие и закрытие. Вы можете скачать бесплатный индикатор IRush , на основе которого работает этот советник, чтобы визуализировать торговлю. Главная особенность этого советника в том, что он может

My new indicator IRush shows: no way. GBPUSD daily is completely red right now. So it is bound to fall.

Friday, most likely, British GDP data will be negative. Bloomberg says: Friday negative GDP will be the mark of a starting recession.

So, it has not been a recession thus far? GBPUSD breaching 1.21 and not yet a recession?

My forecast is that it can try to continue the up move next week. And then it will fall back. I do not think it can break the 1.21 support level, but GBPUSD will be pinned to it because Britain may be going into a recession.

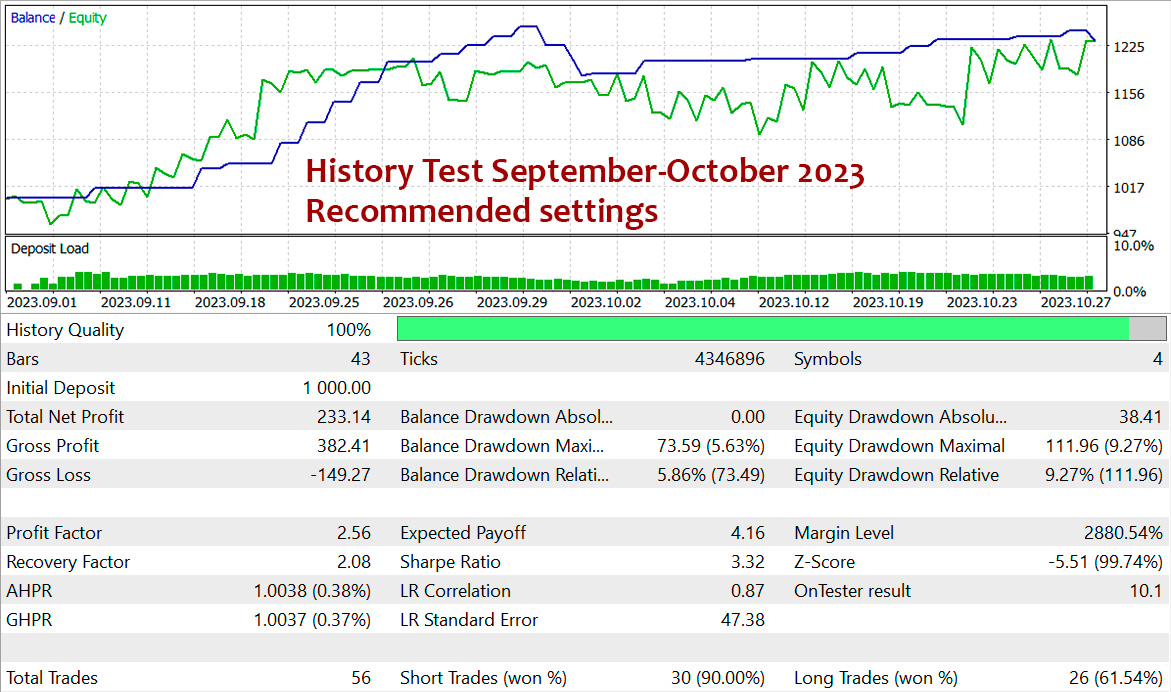

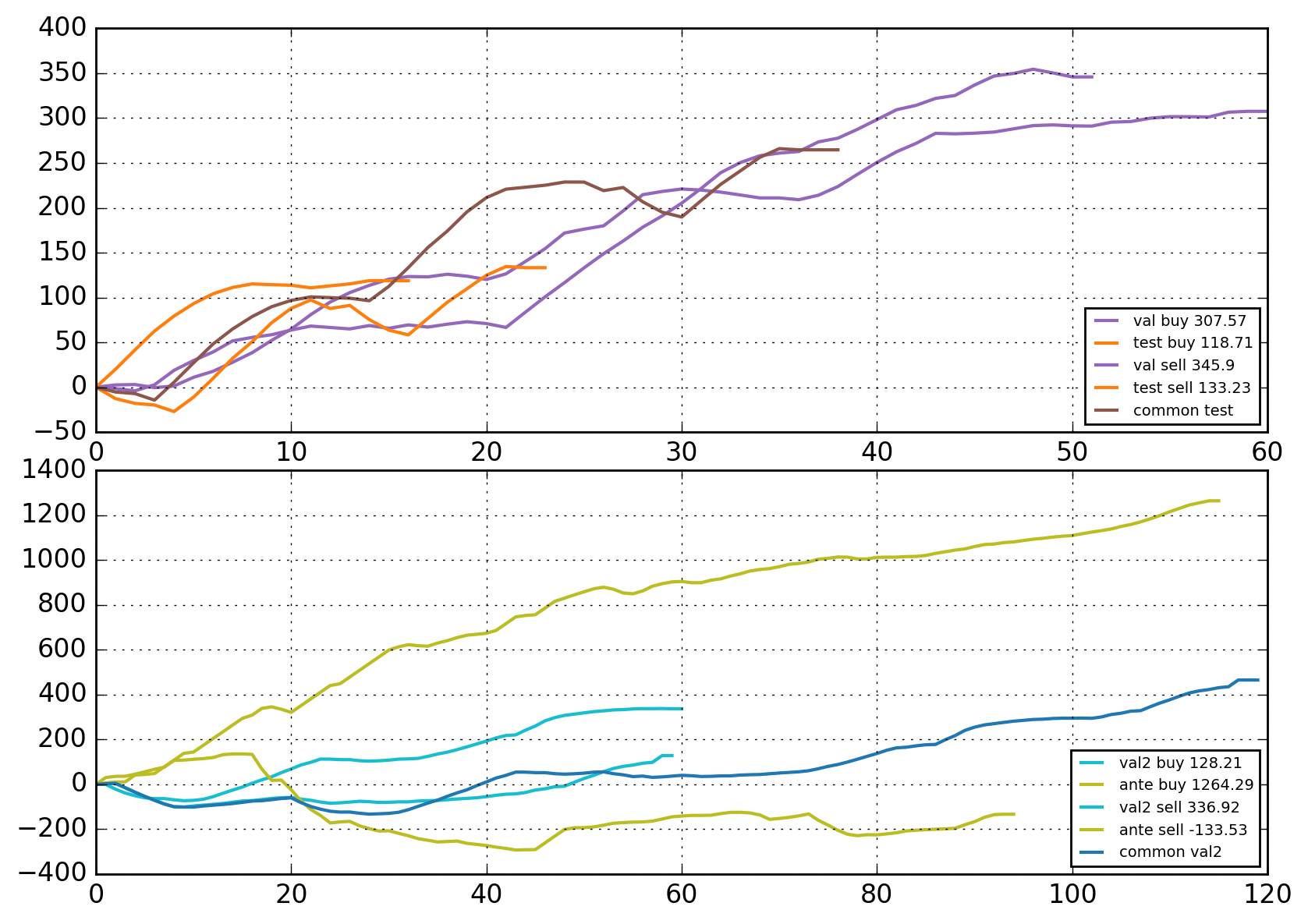

If the advisor had not had this error, it would have performed better than the current live signal shows. We can see it now in the history tests - for both default settings and recommended settings. What we see in the picture of the recommended settings is that the balance dropped at the beginning of October, but then it recovered by the end of October. It did not happen in the live signal because the advisor mishandled some of the trades.

Now the error has been fixed, and I am sure it can recover in the month of November.

Индикатор IRush использует модифицированную версию популярного индикатора RSI (Relative Strength Index, "Индекс относительной силы") для определения входов в рынок на дневном графике или меньше. Индикатор настроен и проверен для работы на основных символах: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF и USDJPY. Автоматическая торговля по этому индикатору реализована в советнике Intraday Rush . Советник умеет открывать, вести и закрывать свои сделки. Обязательно посмотрите, возможно, это то, что вы

USD Rate Decision September 20, and

GBP Rate Decision September 21

The previous important event "Euro Rate Decision" was, as they say, counter-intuitive. Usually, a higher interest rate is good for the currency, so there should have been an up move in EURUSD. It did not happen because if they still need to increase the interest rate, it is because they fear an inflation-induced recession. Luckily for EUR-buyers, the US Fed may think likewise. And the traders will react likewise on Wednesday. I really do not think the EURozone is performing worse than the USD-zone. So I am betting on an up move for EURUSD.

GBP is different. Great Britain is in trouble because it has been in trouble. Tories cut off the nice ties with the EURozone, but have never given anything in return. Migrants are still coming. China is still crushing. Boris Johnson is still funny. My bet is GBP will continue falling.

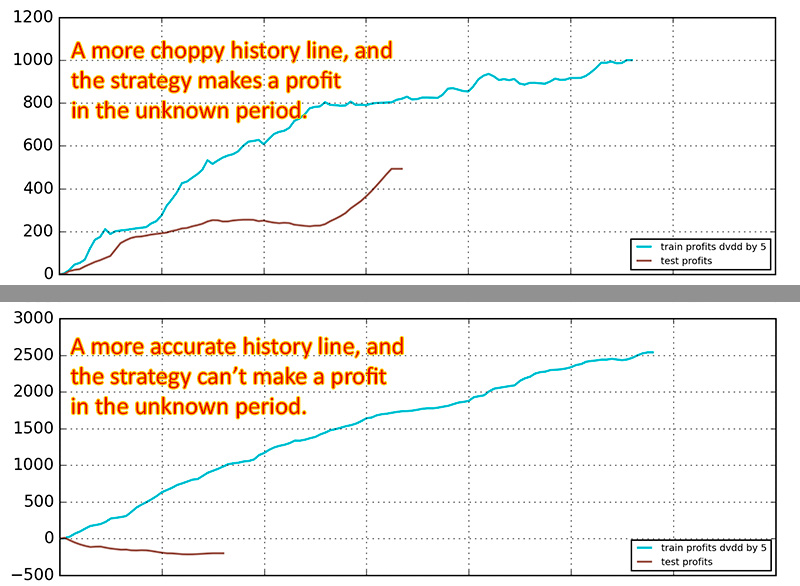

I am posting these pics with different daily moving averages because I am reflecting on how they can help tell good moves from bad moves for the algorithm of "Neural Rabbit". As we can see in this pic, even if I believe the down move will roll back very soon, a short trade could have made a decent profit thus far after both crossings. So maybe it is a good idea to integrate an MA filter before training (not after of course) so that it can help distinguish what a move is. It would trade very differently, but it would substantially decrease the amount of possible trades. So most probably I will add 2 options to choose from - with filter and without it. And it will total to 4 different options because we now have a "Training By_Accuracy" and a "Training By_Loss"... I am reflecting on it because it is my best strategy so far.

If a strategy makes 7 good decisions out of 10, it is 70% of accuracy. Good? Bad! It is bad if the loss is high because any bad forecast may be so bad that it will eat away all hopes for profitability. Therefore, it is the strategy with training by loss that is capable to handle well the unknown period, even though its history result may be thinly over the satisfactory level.

And this is what my newest strategy "Neural Rabbit" is about.

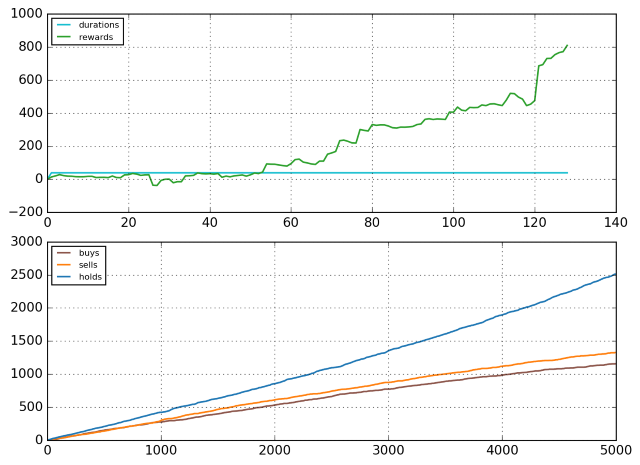

Below are 2 pictures - one is training and the other is validation with a small part of test data (the profile does not allow 2 pictures so it is only the training, check the Comments section of "Fast Neurons" for the second picture). It is good, I did it! I am going to put it on the signal starting next week. If it shows no bugs I will publish it as an update to the strategy of "Fast Neurons". It is going to be the first strategy on the mql5 market, which uses the "actor-critic" technique in Reinforcement Learning (specifically "Advantage Actor Critic" or A2C).

And then, a complicated technique should at least outperform simpler techniques, otherwise it is useless. Alright, I will try to understand why they insist on using the log function for probabilities just to make sure it does not overcomplicate things. If I get through, this will be my most advanced and sophisticated system for Forex trading yet.

All of this is being added to my strategies right now. "New York" is currently the most advanced strategy which balances wins and loses. "Multiq" combines data from multiple symbols to train a single neural network. And the ever-lasting "Excelsior" uses 2 competing neural networks. Check them out!

I am also working over a strategy for intraday trading, which will include 4 charts - monthly, weekly, daily, and 6-hourly! I am thinking to call it "Fast Neurons", check it out soon, too!

But we are not there yet.

The biggest jump will be using 4 threshold values instead of 2 as it is now.

Right now 2 networks in this strategy use 2 threshold values to open and close trades. For example, any signal over 0.8 is to open a trade, while any signal below the oppositve value of 0.2 is to close that opened trade. There is a very long run between 0.8 and 0.2, and the strategy loses time and does not close when it should. So I thought any signal over 0.8 to open and below 0.6 to close would be better.

It takes time to test this new approach. For the previous approach, it was 4 x 4 = 16 total options. Now it is 4 x 4 x 4 x 4 = 256 possible options to be tested to see if it performs better. I am doing it and when I am done with it we shall triumph!

This month of September I guess.

It was "Excelsior" that pushed me into the realm of possibilities offered by recurrent neural networks. As none of the standard approaches produced a robust result, I decided to experiment and combine two competing neural networks to make one trading decision. It did work in some periods, and it did not work so well in other periods.

Then I read "Reinforcement Learning: An Introduction" by Sutton and Barto and, after months of experiments and tests, I came up with a nice strategy called "Pipsovar". The one difference of reinforcement learning from recurrent networks is that it does not know its decisions and outcomes from the start. Instead, it explores the future by making all possible decisions on the go.

And finally, I created "Arsene Lupin", a strategy that brushes off the complexity forced by indicators and uses only relative prices changes. "Arsene Lupin" leverages my newest techniques to train and verify recurrent neural networks.

Excelsior is going to be updated this week. I have found a way to combine data from weekly and daily charts into one multivariate training.

Live trading has shown the drawbacks of separate training on weekly and daily charts. Week trading seems to be lagging too much behind. While day trading does not have enough of past perspective to rely on and to make correct trading decisions. It will now be 30 weekly bars + 30 daily bars combined into one multivariate thread of 30 states to forecast 1 (or 2) week ahead.

The tests I have made so far show a more reliable trading in the future in the past. We shall see if it can outperform itself in the real future!

I have recently started working on a new strategy using a reinforcement learning... For now, it cannot even reproduce its historical trading, but I am determined to find a good solution one way or another...

I have recently came accross "The Motley Fool Investing Philosophy":

1) Buy 25+ Companies Over Time

2) Hold Stocks for 5+ Years

3) Add New Savings Regularly

4) Hold Through Market Volatility

5) Let Winners Run

6) Target Long-Term Returns

I guess all of it is applicable to Forex trading and, in particular, to my newest advisor "Excelsior". It uses 8 symbols all traded from one chart. It trades in both weekly and daily charts. It can compensate losing trades if market volatility rises. And it uses a dynamic trail to get the bigget profit possible from trending winning trades. I am sure the advisor "Excelsior" can get the job done!

And may this clear-cut and well-designed approach from the Motley Fool help us get the profit in the coming year 2022!!