Nasir Uddin / Профиль

- Информация

|

нет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Nasir Uddin

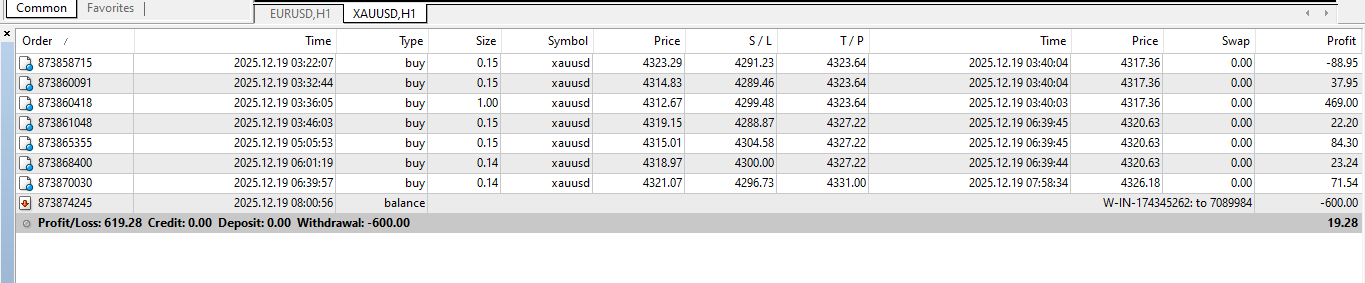

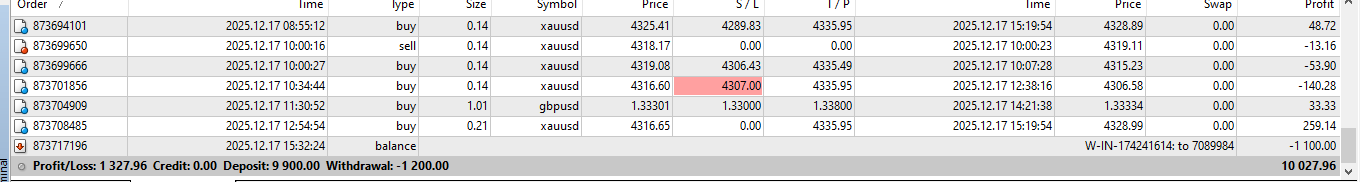

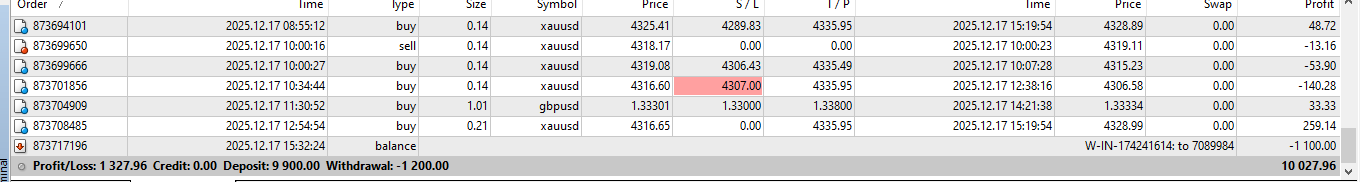

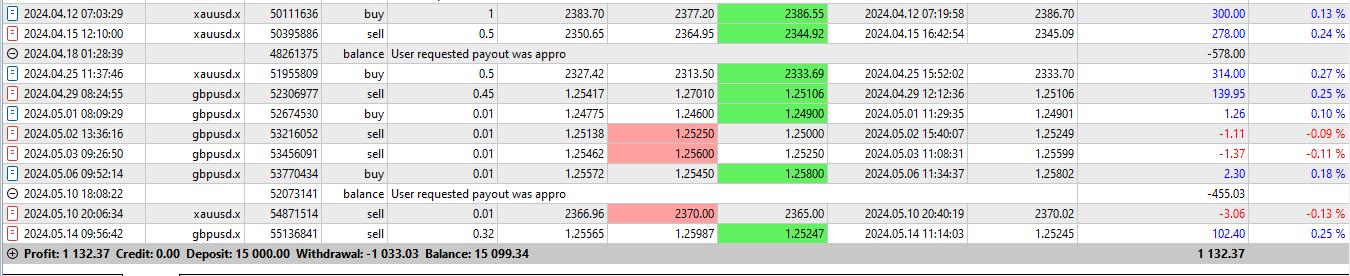

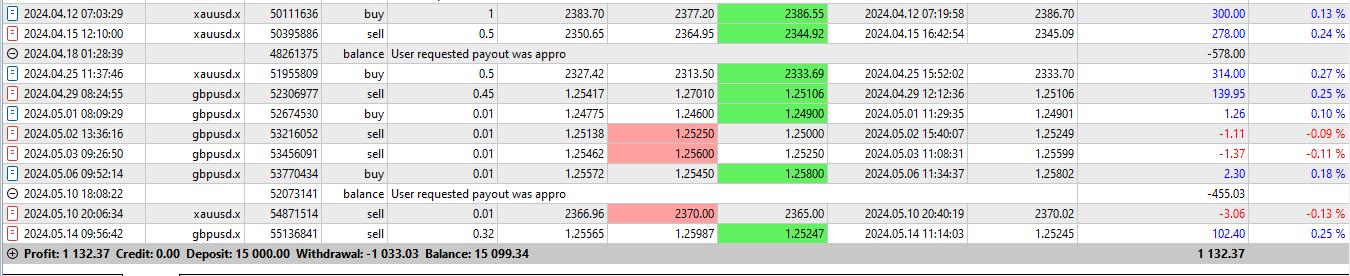

💰 Day closed: +$1,435 profit

Total realized: +$2,800

Withdrew $2,700 🏦

No open positions. All trades closed. Clean slate. ✅

#Trading #ProfitDay #Discipline

Total realized: +$2,800

Withdrew $2,700 🏦

No open positions. All trades closed. Clean slate. ✅

#Trading #ProfitDay #Discipline

Nasir Uddin

Just locked in profits and withdrew $1200. 💸

Rule #1 in trading: When you’re green, secure the bag. Fast withdrawals = peace of mind. No leaving money sitting around longer than necessary. Be safe out there. 📈🔒 #TradingDiscipline #WithdrawWins

Rule #1 in trading: When you’re green, secure the bag. Fast withdrawals = peace of mind. No leaving money sitting around longer than necessary. Be safe out there. 📈🔒 #TradingDiscipline #WithdrawWins

Nasir Uddin

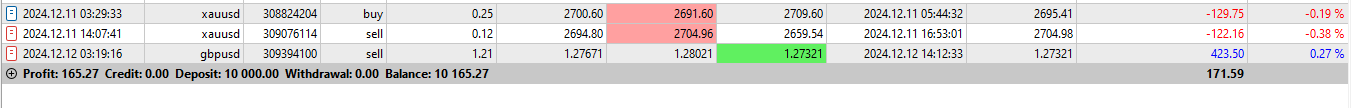

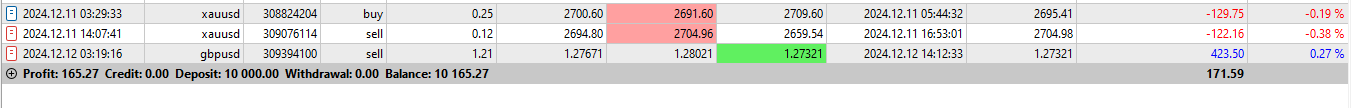

💰 Today's Profit: $423! 💰 But remember, Total Profit: $165 📈.

✅ Even though I had two losing trades at the start, I stuck to my money management rules and stayed disciplined. The market gives us new opportunities every day, but if you risk it all and lose your balance, you can't trade anymore! ⚠️

🎯 Risk management is key! Stay patient, follow your plan, and the profits will follow. 💪

#Forex #TradingDiscipline #RiskManagement #StayConsistent #ForexTrading #TradeSmart #ForexLife

✅ Even though I had two losing trades at the start, I stuck to my money management rules and stayed disciplined. The market gives us new opportunities every day, but if you risk it all and lose your balance, you can't trade anymore! ⚠️

🎯 Risk management is key! Stay patient, follow your plan, and the profits will follow. 💪

#Forex #TradingDiscipline #RiskManagement #StayConsistent #ForexTrading #TradeSmart #ForexLife

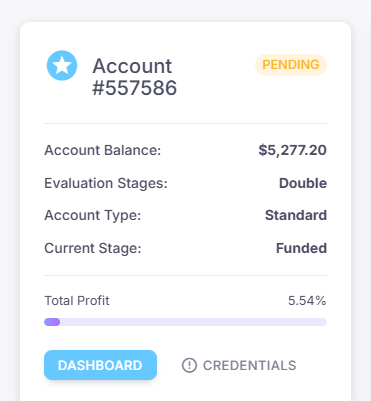

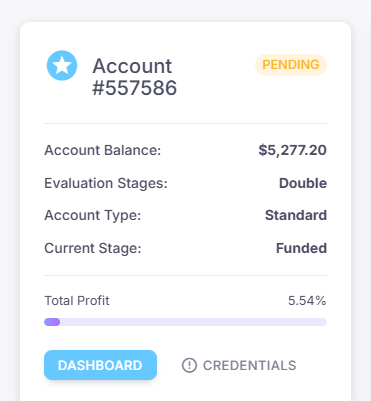

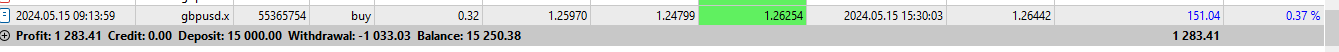

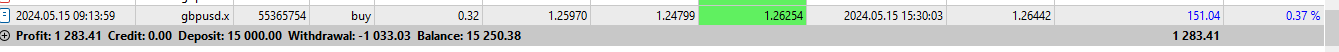

Nasir Uddin

💰 $279 Profit Today! 🎉

Big news! I just made $279 profit today and it's now time to level up! 🚀 My trading account is officially LIVE and fully funded! 🔥

This is just the beginning, and I’m excited to keep growing and pushing forward. Here’s to making smarter trades and achieving more success! 💪💼

#TradingJourney #LiveAccount #Profit #FinancialFreedom #TradingSuccess #LevelUp

Big news! I just made $279 profit today and it's now time to level up! 🚀 My trading account is officially LIVE and fully funded! 🔥

This is just the beginning, and I’m excited to keep growing and pushing forward. Here’s to making smarter trades and achieving more success! 💪💼

#TradingJourney #LiveAccount #Profit #FinancialFreedom #TradingSuccess #LevelUp

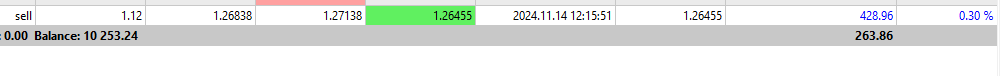

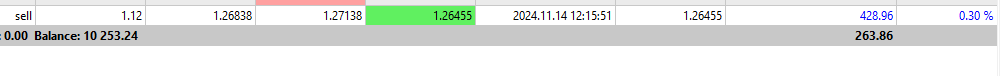

Nasir Uddin

💸 Today's Profit: $428! 💸

Grateful for the progress and the gains today! It's always exciting to see hard work paying off. 💪 Let’s keep the momentum going and continue to hustle towards even bigger goals! 🚀

#Success #Profit #Grateful #Hustle #GoalGetter #EntrepreneurLife #MakingMoves #KeepPushing

Grateful for the progress and the gains today! It's always exciting to see hard work paying off. 💪 Let’s keep the momentum going and continue to hustle towards even bigger goals! 🚀

#Success #Profit #Grateful #Hustle #GoalGetter #EntrepreneurLife #MakingMoves #KeepPushing

Nasir Uddin

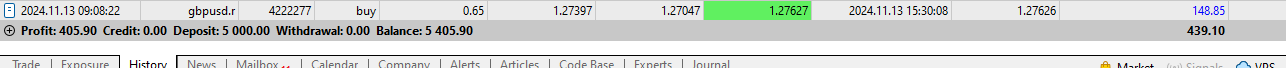

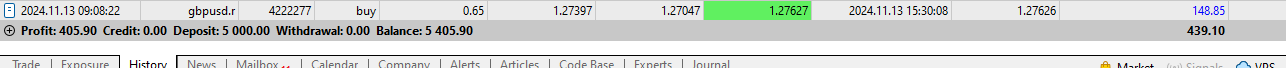

I’m pleased to inform you that my account has successfully passed the first phase! ✅ Additionally, today’s profit stands at $148. 💸📈

Thank you for your continued support! 🙏

Thank you for your continued support! 🙏

Nasir Uddin

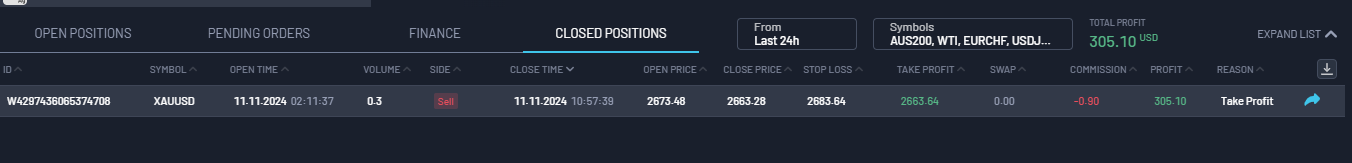

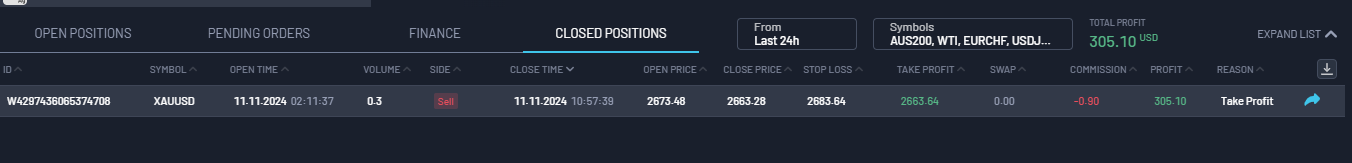

s Profit: $305! 🚀

What an incredible day! 🎉 We've hit a solid $305 profit today, and the momentum is just getting started! 💥 Whether you're already in the game or just getting started, this is proof that success is within reach. Keep pushing forward—there’s more to come!

🌟 Ready to take your profits to the next level? Let’s keep the energy high and make every move count. 💪

#SuccessInTheMaking #ProfitGoals #KeepGrowing

What an incredible day! 🎉 We've hit a solid $305 profit today, and the momentum is just getting started! 💥 Whether you're already in the game or just getting started, this is proof that success is within reach. Keep pushing forward—there’s more to come!

🌟 Ready to take your profits to the next level? Let’s keep the energy high and make every move count. 💪

#SuccessInTheMaking #ProfitGoals #KeepGrowing

Nasir Uddin

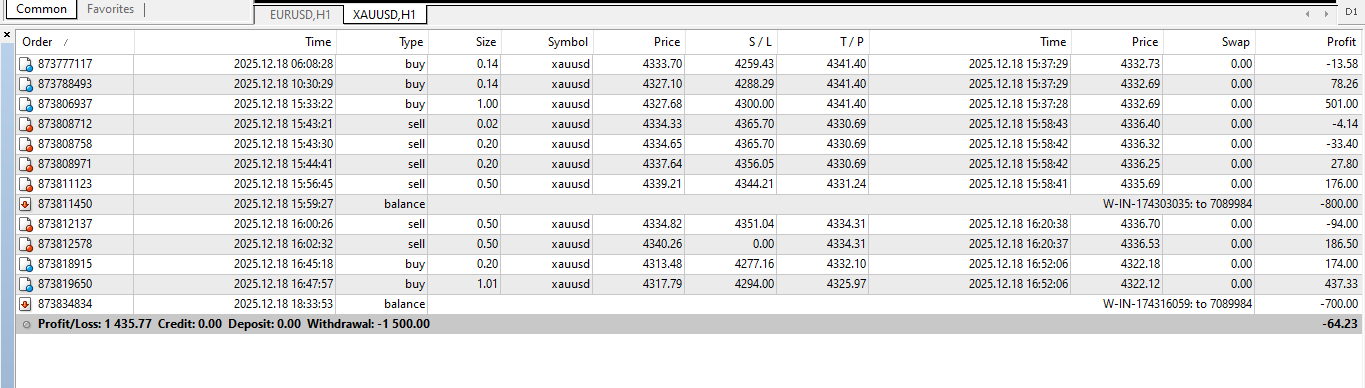

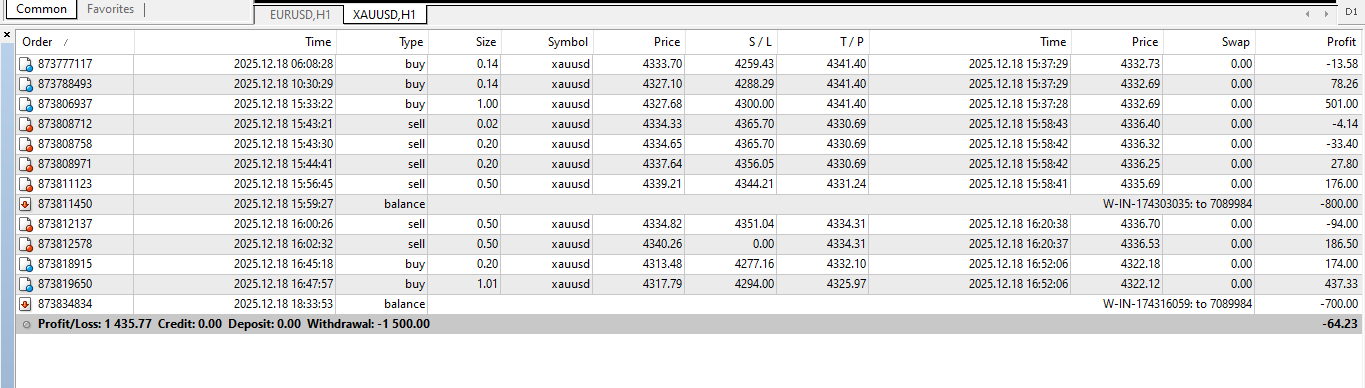

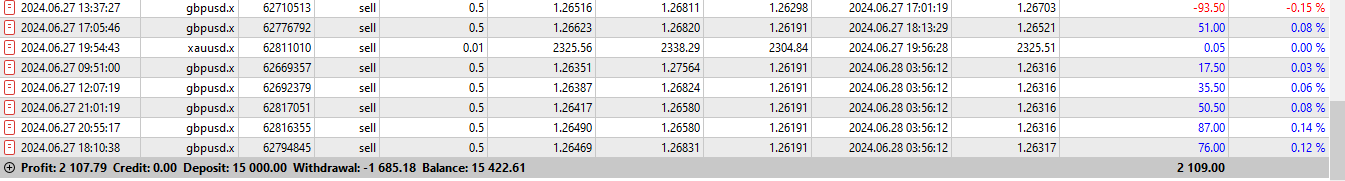

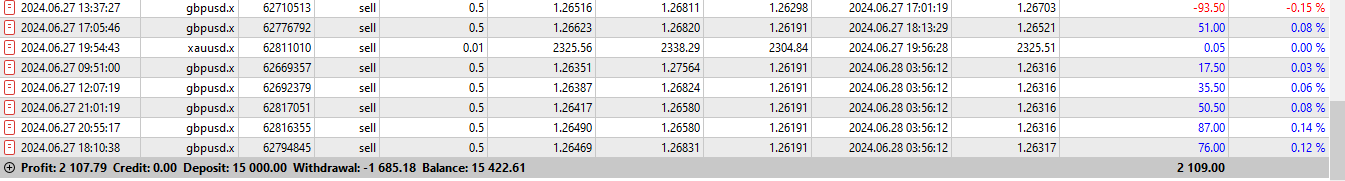

🎉 Our total profits have reached an impressive $2,107! 💰 From this, we've successfully withdrawn $1,685! 🏦 This journey hasn't been easy, but it proves that with determination and hard work, we can achieve great things.

Remember, every step forward, no matter how small, is progress. 🌟 Don't lose hope, keep pushing towards your goals. Your persistence will pay off! Thank you for being a part of this journey. Let's continue striving for success together! 💪🚀

#MQL5 #Motivation #Success #KeepGoing #DreamBig

Remember, every step forward, no matter how small, is progress. 🌟 Don't lose hope, keep pushing towards your goals. Your persistence will pay off! Thank you for being a part of this journey. Let's continue striving for success together! 💪🚀

#MQL5 #Motivation #Success #KeepGoing #DreamBig

Nasir Uddin

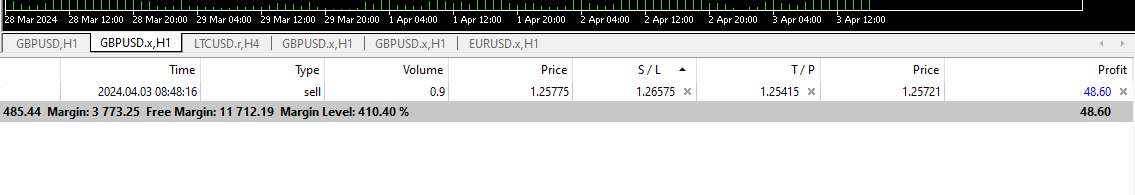

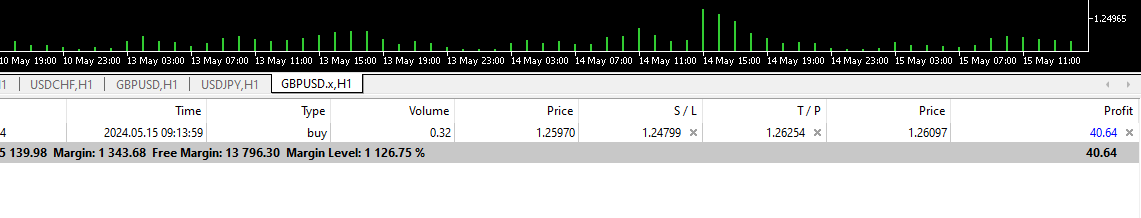

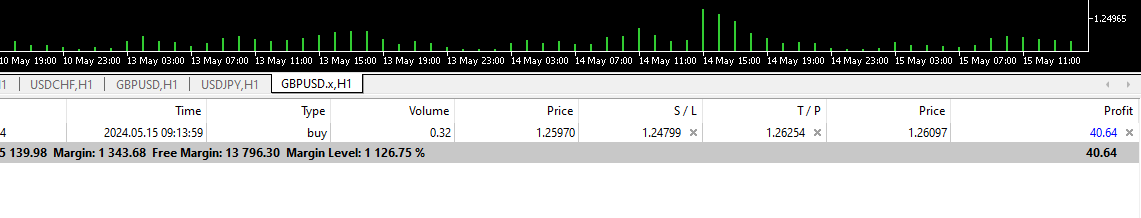

Today, the GBP/USD pair exhibited a strong bullish trend, making it an ideal day for a buy trade. The pair rallied due to favorable economic data from the UK, which boosted investor confidence in the British pound. Positive sentiments around the pound were further supported by market expectations of future interest rate adjustments by the Bank of England.

However, despite the clear buy signals, I chose not to engage in any trading today. This decision was influenced by a variety of personal and market factors. On the personal front, I felt it was prudent to take a step back and reassess my trading strategy. It's essential to maintain discipline and avoid impulsive decisions, especially in a volatile market environment. Additionally, I wanted to observe the market's reaction to key economic reports without the pressure of having an open position.

From a market perspective, even though the indicators were favorable, there were underlying risks that made me cautious. The global economic landscape remains uncertain, with ongoing geopolitical tensions and fluctuating market sentiments. These factors contribute to unpredictable market movements, which can be challenging to navigate.

Taking a break from trading can be beneficial. It allows for a clearer perspective and a better evaluation of market conditions. It also prevents potential overtrading, which can lead to significant losses. By not trading today, I prioritized a careful and calculated approach over potential short-term gains.

In conclusion, while today presented a strong buy opportunity for GBP/USD, my decision to stay out of the market was driven by a combination of personal strategy reassessment and cautious consideration of market volatility. This approach aligns with my long-term trading goals and risk management practices.

However, despite the clear buy signals, I chose not to engage in any trading today. This decision was influenced by a variety of personal and market factors. On the personal front, I felt it was prudent to take a step back and reassess my trading strategy. It's essential to maintain discipline and avoid impulsive decisions, especially in a volatile market environment. Additionally, I wanted to observe the market's reaction to key economic reports without the pressure of having an open position.

From a market perspective, even though the indicators were favorable, there were underlying risks that made me cautious. The global economic landscape remains uncertain, with ongoing geopolitical tensions and fluctuating market sentiments. These factors contribute to unpredictable market movements, which can be challenging to navigate.

Taking a break from trading can be beneficial. It allows for a clearer perspective and a better evaluation of market conditions. It also prevents potential overtrading, which can lead to significant losses. By not trading today, I prioritized a careful and calculated approach over potential short-term gains.

In conclusion, while today presented a strong buy opportunity for GBP/USD, my decision to stay out of the market was driven by a combination of personal strategy reassessment and cautious consideration of market volatility. This approach aligns with my long-term trading goals and risk management practices.

Nasir Uddin

"My take profit (TP) has been hit, affirming the efficacy of my market analysis prior to initiating the trade. Beginning with a comprehensive analysis of the market, I meticulously evaluated various factors including technical indicators, fundamental news, and prevailing market sentiment. This thorough assessment informed my decision to enter the trade, ensuring a calculated and strategic approach. As a result, achieving my TP reinforces the effectiveness of this meticulous analysis, validating the precision of my trading strategy."

Nasir Uddin

Opening a buy trade on GBPUSD can be a strategic move influenced by various factors such as technical analysis, market sentiment, and economic indicators. Whether it hits the take profit (TP) level or not depends on a multitude of variables including the prevailing market conditions, geopolitical events, and central bank policies. Engaging with other traders on social media can provide valuable insights and perspectives, but ultimately, the outcome of the trade will be determined by the dynamic interplay of these factors within the foreign exchange market.

Nasir Uddin

The foreign exchange market, or Forex, is indeed one of the largest and most dynamic financial markets in the world. Trillions of dollars are traded here every day, making it an enticing arena for traders seeking profit. The allure of Forex lies in its potential for unlimited earnings, where savvy traders can capitalize on fluctuations in currency exchange rates to generate substantial returns.

However, success in Forex trading is not guaranteed, nor is it easy. It requires a combination of skill, knowledge, discipline, and patience. Unlike traditional investments like stocks or bonds, Forex trading operates 24 hours a day, five days a week, across different time zones, making it a fast-paced and highly volatile market.

To navigate this intricate landscape successfully, traders must develop a solid understanding of economic indicators, geopolitical events, and market psychology. They need to analyze charts, interpret technical indicators, and stay informed about global news that could impact currency prices.

Patience is indeed a virtue in Forex trading. While the potential for unlimited earnings exists, it's essential to approach trading with realistic expectations and a long-term perspective. Profits may not come overnight, and there will inevitably be periods of losses and setbacks. However, by staying disciplined and adhering to a well-thought-out trading plan, traders can increase their chances of success over time.

One crucial aspect of successful Forex trading is managing risk effectively. This involves using stop-loss orders to limit potential losses, diversifying trading strategies, and not risking more than you can afford to lose. Additionally, traders should regularly monitor their profits and losses, adjusting their strategies as needed to adapt to changing market conditions.

Withdrawals are an integral part of Forex trading, allowing traders to realize their profits and manage their capital effectively. It's essential to have a clear plan for withdrawals, whether it's taking out a portion of profits regularly or reinvesting them strategically. Withdrawals can also help traders maintain a healthy balance between risk and reward, preventing them from becoming overexposed in the market.

In conclusion, Forex trading offers immense potential for profit, but it requires patience, discipline, and a strategic approach. By staying informed, managing risk effectively, and regularly assessing profits and withdrawals, traders can navigate the Forex market with confidence and strive for success over the long term.

However, success in Forex trading is not guaranteed, nor is it easy. It requires a combination of skill, knowledge, discipline, and patience. Unlike traditional investments like stocks or bonds, Forex trading operates 24 hours a day, five days a week, across different time zones, making it a fast-paced and highly volatile market.

To navigate this intricate landscape successfully, traders must develop a solid understanding of economic indicators, geopolitical events, and market psychology. They need to analyze charts, interpret technical indicators, and stay informed about global news that could impact currency prices.

Patience is indeed a virtue in Forex trading. While the potential for unlimited earnings exists, it's essential to approach trading with realistic expectations and a long-term perspective. Profits may not come overnight, and there will inevitably be periods of losses and setbacks. However, by staying disciplined and adhering to a well-thought-out trading plan, traders can increase their chances of success over time.

One crucial aspect of successful Forex trading is managing risk effectively. This involves using stop-loss orders to limit potential losses, diversifying trading strategies, and not risking more than you can afford to lose. Additionally, traders should regularly monitor their profits and losses, adjusting their strategies as needed to adapt to changing market conditions.

Withdrawals are an integral part of Forex trading, allowing traders to realize their profits and manage their capital effectively. It's essential to have a clear plan for withdrawals, whether it's taking out a portion of profits regularly or reinvesting them strategically. Withdrawals can also help traders maintain a healthy balance between risk and reward, preventing them from becoming overexposed in the market.

In conclusion, Forex trading offers immense potential for profit, but it requires patience, discipline, and a strategic approach. By staying informed, managing risk effectively, and regularly assessing profits and withdrawals, traders can navigate the Forex market with confidence and strive for success over the long term.

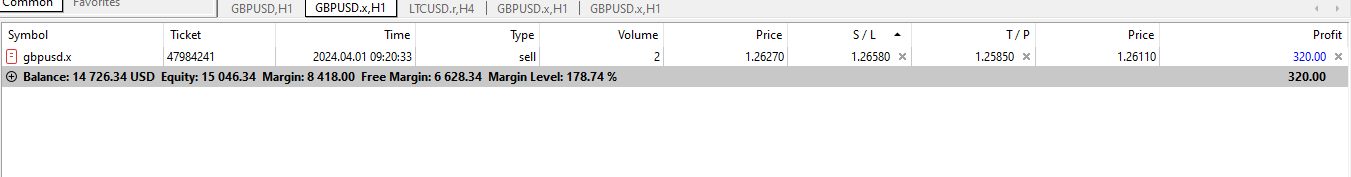

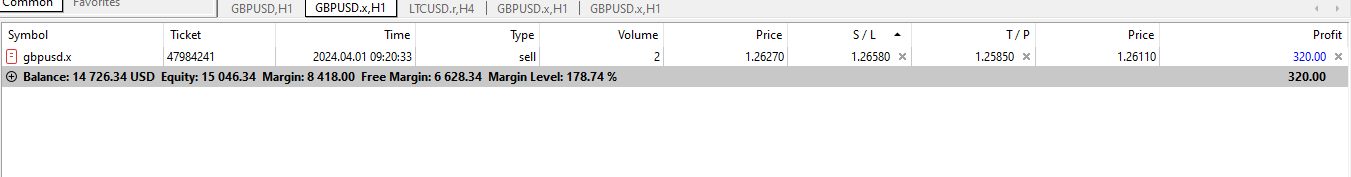

Nasir Uddin

Based on the current scenario, with profits of 320 and the GBP/USD sell trade still running, the question arises whether the pair will continue to decline or not. Given the dynamic nature of the forex market, it's important to consider various factors influencing GBP/USD exchange rates.

Firstly, analyze the prevailing market sentiment. If there are ongoing geopolitical tensions, economic uncertainties, or significant announcements affecting either the British pound or the US dollar, these could sway the direction of the trade. Additionally, closely monitor any central bank decisions or monetary policy changes, as these often impact currency valuations.

Technical analysis plays a crucial role as well. Evaluate key support and resistance levels, trend patterns, and momentum indicators to gauge the potential direction of the trade. Look for any signs of reversal or continuation patterns that could indicate further downside movement for GBP/USD.

Moreover, consider external factors such as economic data releases, geopolitical events, and market sentiment shifts. Any unexpected developments in these areas could influence market participants' perceptions and subsequently impact currency prices.

Ultimately, to make an informed decision on whether the GBP/USD sell trade will continue to decline, it's essential to conduct thorough analysis, considering both fundamental and technical factors. Additionally, managing risk and implementing appropriate stop-loss strategies can help mitigate potential losses in case the trade doesn't go as anticipated.

Firstly, analyze the prevailing market sentiment. If there are ongoing geopolitical tensions, economic uncertainties, or significant announcements affecting either the British pound or the US dollar, these could sway the direction of the trade. Additionally, closely monitor any central bank decisions or monetary policy changes, as these often impact currency valuations.

Technical analysis plays a crucial role as well. Evaluate key support and resistance levels, trend patterns, and momentum indicators to gauge the potential direction of the trade. Look for any signs of reversal or continuation patterns that could indicate further downside movement for GBP/USD.

Moreover, consider external factors such as economic data releases, geopolitical events, and market sentiment shifts. Any unexpected developments in these areas could influence market participants' perceptions and subsequently impact currency prices.

Ultimately, to make an informed decision on whether the GBP/USD sell trade will continue to decline, it's essential to conduct thorough analysis, considering both fundamental and technical factors. Additionally, managing risk and implementing appropriate stop-loss strategies can help mitigate potential losses in case the trade doesn't go as anticipated.

: