Duong Vo Van / Профиль

- Информация

|

10+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Друзья

120

Заявки

Исходящие

Duong Vo Van

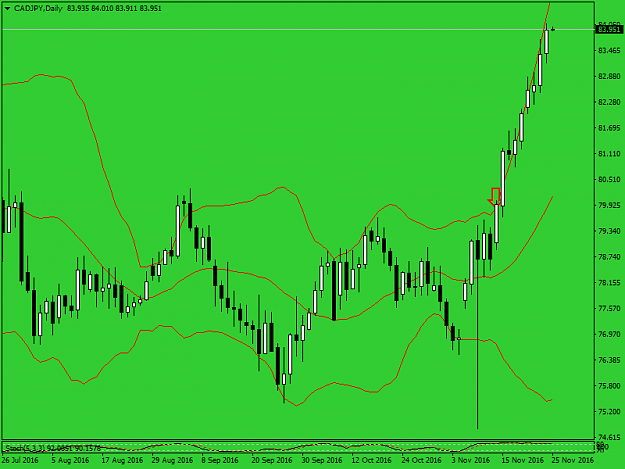

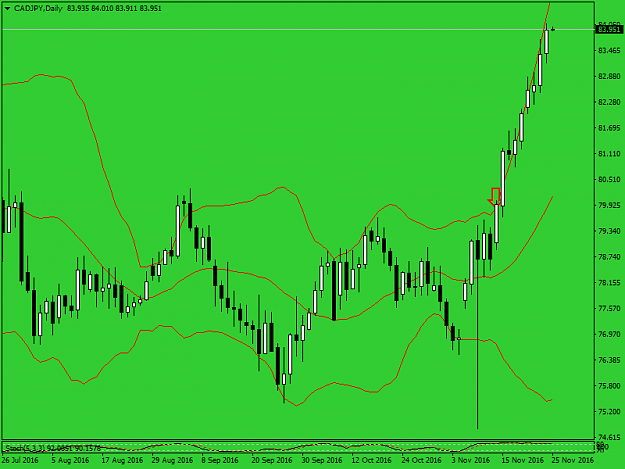

One trading method I read on forex forum from Author 9jatrader:

First and fore most am not introducing any indicator or Holy Grail in trading. Am introducing a possible where and how you can catch a strong trend- for those who love trending market. Trending market is really easy to trade when you are able to catch the trend at the beginning. I have been backtesting this strategy for a quite a while now, with "Seven" platforms. This is to avoid overtrading by placing all the pairs that met the entry point on one platform. I skipped some also, though I have them in my journal as if I took them. Overtrading would have mess up my backtesting. My major reason for backtesting and checking/study the old charts is the fact that if we are able to catch trend at the beginning, getting hit by retracement will be minimized. Also we would be able to trade profitable no matter the size of the account.

1. The method works best on daily and longer time frames, because there is so much noise on the shorter time frames. I tried on 4hrs only ones, it failed me, though I don't trade 4hrs and other shorter time frames.

2. It works also when market has been moving sideways and it's about breaking out of it. I will post charts to give you a clear picture.

3. It's good for swing and position traders.

The indicator am using is none other than one of the indicators professional traders have been using profitably - Bollinger Bands. For those who're already using Bollinger Bands, it would be much easier, I feel so. If you like to use it it's easy to learn. When market shows some kind exhaustion/sideways we have to be patient and know that a big move is on the way. Monitor both the weekly and the daily charts. When weekly is strongly closing/has closed above the Bollinger Middle Band and at the same time a bullish candle candles closes above Upper Band, then there is the opportunity to start bullish trade. Reverse is the case with bearish trading. For bearish trading, when candle closes/has closed below Middle band on the weekly and first candle that closes below Lower Band on the daily shows that bearish movement has started. If the weekly strongly closed above Middle Band and the daily has not been able to close above Upper Band,there is no need to get in yet. You have to be patient. There are exceptional cases please. You would see in USDJPY long - while the weekly closed above Middle Band the daily candles were still around below upper band, until the first closed above upper band on the daily chart, then you get in. Also in my first entry on NZDJPY my SL was triggered. Even though the SL was triggered by retracement, I knew that uptrend has started. No problem. You would see on the NZDJPY chart where I monitor Bollinger Lower Band rejection to get in again. I closed it before the US election. Then I got in again. When SL is triggered don't worry, uptrend has started.

https://www.forexfactory.com/attachment.php?attachmentid=2077472&d=1480028719

https://www.forexfactory.com/attachment.php?attachmentid=2077473&d=1480028738

First and fore most am not introducing any indicator or Holy Grail in trading. Am introducing a possible where and how you can catch a strong trend- for those who love trending market. Trending market is really easy to trade when you are able to catch the trend at the beginning. I have been backtesting this strategy for a quite a while now, with "Seven" platforms. This is to avoid overtrading by placing all the pairs that met the entry point on one platform. I skipped some also, though I have them in my journal as if I took them. Overtrading would have mess up my backtesting. My major reason for backtesting and checking/study the old charts is the fact that if we are able to catch trend at the beginning, getting hit by retracement will be minimized. Also we would be able to trade profitable no matter the size of the account.

1. The method works best on daily and longer time frames, because there is so much noise on the shorter time frames. I tried on 4hrs only ones, it failed me, though I don't trade 4hrs and other shorter time frames.

2. It works also when market has been moving sideways and it's about breaking out of it. I will post charts to give you a clear picture.

3. It's good for swing and position traders.

The indicator am using is none other than one of the indicators professional traders have been using profitably - Bollinger Bands. For those who're already using Bollinger Bands, it would be much easier, I feel so. If you like to use it it's easy to learn. When market shows some kind exhaustion/sideways we have to be patient and know that a big move is on the way. Monitor both the weekly and the daily charts. When weekly is strongly closing/has closed above the Bollinger Middle Band and at the same time a bullish candle candles closes above Upper Band, then there is the opportunity to start bullish trade. Reverse is the case with bearish trading. For bearish trading, when candle closes/has closed below Middle band on the weekly and first candle that closes below Lower Band on the daily shows that bearish movement has started. If the weekly strongly closed above Middle Band and the daily has not been able to close above Upper Band,there is no need to get in yet. You have to be patient. There are exceptional cases please. You would see in USDJPY long - while the weekly closed above Middle Band the daily candles were still around below upper band, until the first closed above upper band on the daily chart, then you get in. Also in my first entry on NZDJPY my SL was triggered. Even though the SL was triggered by retracement, I knew that uptrend has started. No problem. You would see on the NZDJPY chart where I monitor Bollinger Lower Band rejection to get in again. I closed it before the US election. Then I got in again. When SL is triggered don't worry, uptrend has started.

https://www.forexfactory.com/attachment.php?attachmentid=2077472&d=1480028719

https://www.forexfactory.com/attachment.php?attachmentid=2077473&d=1480028738

Duong Vo Van

6 Quotes From Famous Trader Richard Dennis That Will Help Your Trading

1.

“Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is testimony to the fact that the majority is wrong a lot of the time. The vast majority is wrong even more of the time. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.”

This applies to the current situation in the stock market, in my opinion. Many “experts” are predicting the next crash and many said that it would have already happened by now.

History does repeat itself, and a crash surely could happen tomorrow, but that shouldn’t deter you from your trading strategy if the market conditions are still in your favor.

Being able to block out the news will allow you to stay level-headed and keep your emotions at bay when analyzing the markets.

Many trade based on fear and greed, which is why most traders lose money. Be confident in your strategy and plan, and you will be well on your way.

2.

“Trade small because thats when you are as bad as you are ever going to be. Learn from your mistakes.”

“A tiny sprout growing in fine sand casting long shadow” by Evan Kirby on Unsplash

Keeping your lot sizes small and risking a low percentage of your account on any given trade ensures one thing:

Your account will live to see another day.

When traders over-leverage and risk high percentages of their account, they can easily lose all of their money before they have enough time to realize what happened.

It is absolutely crucial to preserve your capital when trading.

3.

“I always say you could publish rules in a newspaper and no one would follow them. The key is consistency and discipline.”

Many traders think that the more complicated you make your system, the better chances you have of making money. In my experience and the experience of many in our trading community, simple is better. The simpler your plan and strategy, the more you can focus on the main indicators and price.

The rules of trading are simple, yet many choose to not follow them. Staying true to your rules 100% of the time will give you a much greater shot at success.

4. & 5.

“When you are getting beat to death, get your head out of the mixer.”

“You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.”

One of the mistakes I made as an early trader was very relatable to this quote by Richard.

When I would start to experience a number of losses in a row, I would try to double down on my position sizes in an attempt to recover everything I just lost, plus more.

This quote speaks perfectly to me and many traders who try to beat the markets when the markets are beating them.

If you experience a rough time in the markets where you are losing a series of trades, do everything you can to stay focused on staying true to your trading plan.

This is a good time to even take a step back from the markets and collect yourself emotionally if the losses are taking a toll on your psychology.

6.

“I could trade without knowing the name of the market.”

In our trading community, we focus on stocks, forex, and commodities.

The great thing is that our main principles and rules apply to every market. This gives us a great advantage as technical traders.

Focusing on price as our main indicator means that we don’t spend all the time analyzing economic and financial information of a company in the stock market, which would not even apply to any currency within the forex market.

Money moves from market to market, so being able to use our strategy across multiple markets saves a lot of time, energy, and hassle of trying to learn a lot of not-so-beneficial information.

Richard Dennis has given a lot of wisdom from his trading career, and I hope I was able to transfer that to you in a beneficial way. Thanks for taking the time to read this post and as always, happy trading!

1.

“Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is testimony to the fact that the majority is wrong a lot of the time. The vast majority is wrong even more of the time. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.”

This applies to the current situation in the stock market, in my opinion. Many “experts” are predicting the next crash and many said that it would have already happened by now.

History does repeat itself, and a crash surely could happen tomorrow, but that shouldn’t deter you from your trading strategy if the market conditions are still in your favor.

Being able to block out the news will allow you to stay level-headed and keep your emotions at bay when analyzing the markets.

Many trade based on fear and greed, which is why most traders lose money. Be confident in your strategy and plan, and you will be well on your way.

2.

“Trade small because thats when you are as bad as you are ever going to be. Learn from your mistakes.”

“A tiny sprout growing in fine sand casting long shadow” by Evan Kirby on Unsplash

Keeping your lot sizes small and risking a low percentage of your account on any given trade ensures one thing:

Your account will live to see another day.

When traders over-leverage and risk high percentages of their account, they can easily lose all of their money before they have enough time to realize what happened.

It is absolutely crucial to preserve your capital when trading.

3.

“I always say you could publish rules in a newspaper and no one would follow them. The key is consistency and discipline.”

Many traders think that the more complicated you make your system, the better chances you have of making money. In my experience and the experience of many in our trading community, simple is better. The simpler your plan and strategy, the more you can focus on the main indicators and price.

The rules of trading are simple, yet many choose to not follow them. Staying true to your rules 100% of the time will give you a much greater shot at success.

4. & 5.

“When you are getting beat to death, get your head out of the mixer.”

“You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.”

One of the mistakes I made as an early trader was very relatable to this quote by Richard.

When I would start to experience a number of losses in a row, I would try to double down on my position sizes in an attempt to recover everything I just lost, plus more.

This quote speaks perfectly to me and many traders who try to beat the markets when the markets are beating them.

If you experience a rough time in the markets where you are losing a series of trades, do everything you can to stay focused on staying true to your trading plan.

This is a good time to even take a step back from the markets and collect yourself emotionally if the losses are taking a toll on your psychology.

6.

“I could trade without knowing the name of the market.”

In our trading community, we focus on stocks, forex, and commodities.

The great thing is that our main principles and rules apply to every market. This gives us a great advantage as technical traders.

Focusing on price as our main indicator means that we don’t spend all the time analyzing economic and financial information of a company in the stock market, which would not even apply to any currency within the forex market.

Money moves from market to market, so being able to use our strategy across multiple markets saves a lot of time, energy, and hassle of trying to learn a lot of not-so-beneficial information.

Richard Dennis has given a lot of wisdom from his trading career, and I hope I was able to transfer that to you in a beneficial way. Thanks for taking the time to read this post and as always, happy trading!

Duong Vo Van

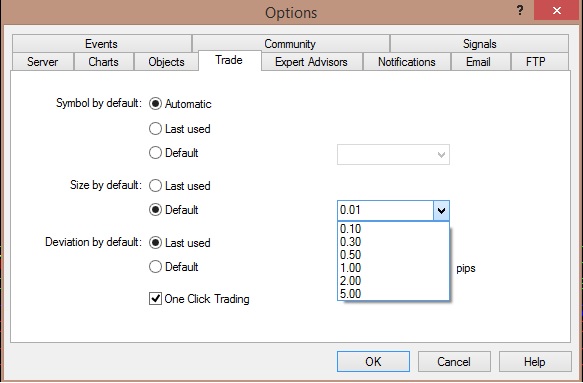

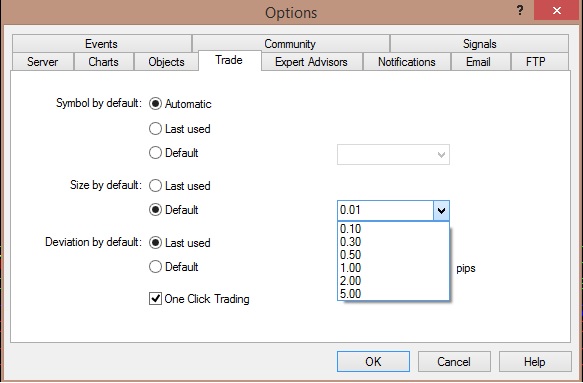

You only need 100$ to copy my signal, and you set up Lot size 0.01 ( Mt4 : Tool / Options / Trade)

With 1000$ account, Lot size 0.1

With 10000$ account, Lot size 1

With 1000$ account, Lot size 0.1

With 10000$ account, Lot size 1

Duong Vo Van

I'm willing to communicate with everyone through my email : kevin.bigsg@gmail.com. If you have something unclearly, don't hesitate to contact me through email.

: