Jian Ming Xu / Профиль

- Информация

|

7+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

manager

в

shenzhen

Опыт работы с иностранной валютой более 15 лет;

Специализация в области медицинской психологии, специализируется на психоанализе и фундаментальном анализе;

Он взорвался три раза и потерял более миллиона долларов;

В настоящее время занимается торговлей;

Транзакционные предпочтения: ручная + количественная помощь;

Максимальная репатриация 20 процентов;

Специализация в области медицинской психологии, специализируется на психоанализе и фундаментальном анализе;

Он взорвался три раза и потерял более миллиона долларов;

В настоящее время занимается торговлей;

Транзакционные предпочтения: ручная + количественная помощь;

Максимальная репатриация 20 процентов;

Друзья

15

Заявки

Исходящие

Jian Ming Xu

Most traders trade during volatile market conditions. These people are herbivores in the trading market, slowly disappearing amidst the torment of the market makers and the depletion of transaction fees, ultimately leading to disappointment

Jian Ming Xu

Making a little money depends on the trader's own efforts, making a lot of money depends on the market situation and luck

Jian Ming Xu

When rising, breaking through the dense trading range becomes a support position, and if unable to break through the dense trading range, it becomes a pressure position

Jian Ming Xu

In short-term trading, I have a very important principle: if you don't hit a low within three days, you will close your short position, and if you don't hit a high within three days, you will close your long position

Jian Ming Xu

We can never know the truth of history, but we must study history: in order to move forward, we must find clues in the dark, which is the charm of trading

Jian Ming Xu

Industrial products, due to their obvious resource attributes and intense price fluctuations, can have relatively small positions in related varieties

Jian Ming Xu

Strong varieties will remain strong, and weak varieties will also remain weak. More is the strongest variety, and empty is the weakest variety

Jian Ming Xu

You can watch the market every day, but you must not do it every day to avoid paying fees that exceed your profits

Jian Ming Xu

If there is a large market, place a heavy position, if there is a small market, place a light position, and if there is no market, wait and see. It is better to give up opportunities and operate less, than to minimize risks

Jian Ming Xu

Just like any trade, trading always comes with personal emotions. Daily trading, due to being constantly fixed on the market, makes personal emotional changes even more intense. Do not let yourself fall into a certain obsession, do not have a bad mood towards the market, do not place too much emphasis on oneself and let oneself fall into uncontrollable losses, do not let oneself become meat on the chopping board due to lack of determination in stopping losses, and must maintain a calm and relaxed attitude

Jian Ming Xu

Intraday market fluctuations are often sudden and contingency, because every day is a new day, and new situations may arise, so it is very important to feel market sentiment and explore entry opportunities through the price fluctuations on the market. In this process, you should be empty in your heart, without any obsession, and listen to the language of the market wholeheartedly. Everything is based on the market trend, and dance with the market

Jian Ming Xu

Intraday trading does not require entering the market every day, only doing the market that you can understand, only doing the market that belongs to you, and having a sense of awe towards the market. Stop gains can be decisive, and stop losses must be decisive in order to survive in the market。

Jian Ming Xu

First of all, you have to stand at the starting point to have a chance to reach the end! I'll take a step forward and look forward to meeting you at the finish line

Jian Ming Xu

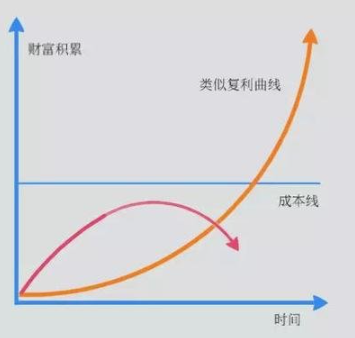

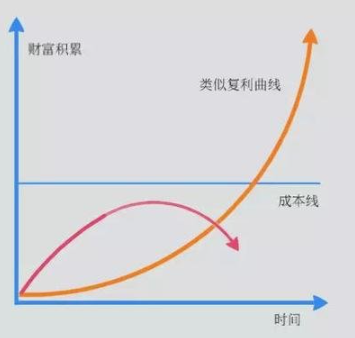

Traps and Opportunities under the Compound Interest Model

What is compound interest? In fact, it is to treat each profit together with the original principal as the next principal, constantly snowballing.

In this mode, we can earn generous profits with a very small principal. For example, if I start with only $20 and make a 2% profit each time with a 100% winning rate, my assets will come to $144 after 100 wins. If other conditions remain the same and the profit increases to 20% each time, then 20 successful transactions will bring my assets to $766. This looks tempting, and even I can earn tens of millions of dollars in a short period of time with $20.

But do you really understand compound interest?

What are the pitfalls of the compound interest model?

Firstly, it is obvious that our assumption of a 100% winning rate does not exist. At this point, it involves a pullback. Assuming that I gain 2% each time and lose 10% each time, I need to maintain an 85% winning rate in order to make long-term stable profits. That is to say, for 6 transactions, I can only make one mistake. This is actually difficult to achieve, so the profit and loss ratio has become important. I cannot keep the profit and loss ratio at a 1:5 level, as such a loss would have a huge psychological impact on me. After long-term practice, I have found that a profit to loss ratio of around 1.5:1 to 2:1 is the most suitable. Just maintaining a winning rate of over 50% can help me maintain profitability in the long term.

There is another misconception about the compound interest model: is every transaction reproducible?

Why is there this problem? Only by using the same strategy can the winning rate be stable. Only with a stable winning rate can your funding curve be smooth and risk be controlled. If you trade every time based on your feelings, without a stable strategy and a stable winning rate, you may encounter consecutive losses at any time, and a single consecutive loss may ruin your previous achievements in the compound interest model.

The polishing of strategies will not be elaborated here. Everyone should find a fixed strategy that is suitable for themselves, and continuously verify and optimize the strategy using the real market to achieve the best balance point of profit loss ratio, victory rate, and stability.

The biggest enemy of compound interest is the mentality of gamblers. If you take the profits and losses of a transaction too seriously, it will magnify the weight of the transaction, may make a big profit, but it may also cause a big loss. If you repeatedly have the mentality of gamblers, there will definitely be times of failure, and perhaps one failure will fall into the abyss, so the miracle of compound interest will not occur.

What is compound interest? In fact, it is to treat each profit together with the original principal as the next principal, constantly snowballing.

In this mode, we can earn generous profits with a very small principal. For example, if I start with only $20 and make a 2% profit each time with a 100% winning rate, my assets will come to $144 after 100 wins. If other conditions remain the same and the profit increases to 20% each time, then 20 successful transactions will bring my assets to $766. This looks tempting, and even I can earn tens of millions of dollars in a short period of time with $20.

But do you really understand compound interest?

What are the pitfalls of the compound interest model?

Firstly, it is obvious that our assumption of a 100% winning rate does not exist. At this point, it involves a pullback. Assuming that I gain 2% each time and lose 10% each time, I need to maintain an 85% winning rate in order to make long-term stable profits. That is to say, for 6 transactions, I can only make one mistake. This is actually difficult to achieve, so the profit and loss ratio has become important. I cannot keep the profit and loss ratio at a 1:5 level, as such a loss would have a huge psychological impact on me. After long-term practice, I have found that a profit to loss ratio of around 1.5:1 to 2:1 is the most suitable. Just maintaining a winning rate of over 50% can help me maintain profitability in the long term.

There is another misconception about the compound interest model: is every transaction reproducible?

Why is there this problem? Only by using the same strategy can the winning rate be stable. Only with a stable winning rate can your funding curve be smooth and risk be controlled. If you trade every time based on your feelings, without a stable strategy and a stable winning rate, you may encounter consecutive losses at any time, and a single consecutive loss may ruin your previous achievements in the compound interest model.

The polishing of strategies will not be elaborated here. Everyone should find a fixed strategy that is suitable for themselves, and continuously verify and optimize the strategy using the real market to achieve the best balance point of profit loss ratio, victory rate, and stability.

The biggest enemy of compound interest is the mentality of gamblers. If you take the profits and losses of a transaction too seriously, it will magnify the weight of the transaction, may make a big profit, but it may also cause a big loss. If you repeatedly have the mentality of gamblers, there will definitely be times of failure, and perhaps one failure will fall into the abyss, so the miracle of compound interest will not occur.

Jian Ming Xu

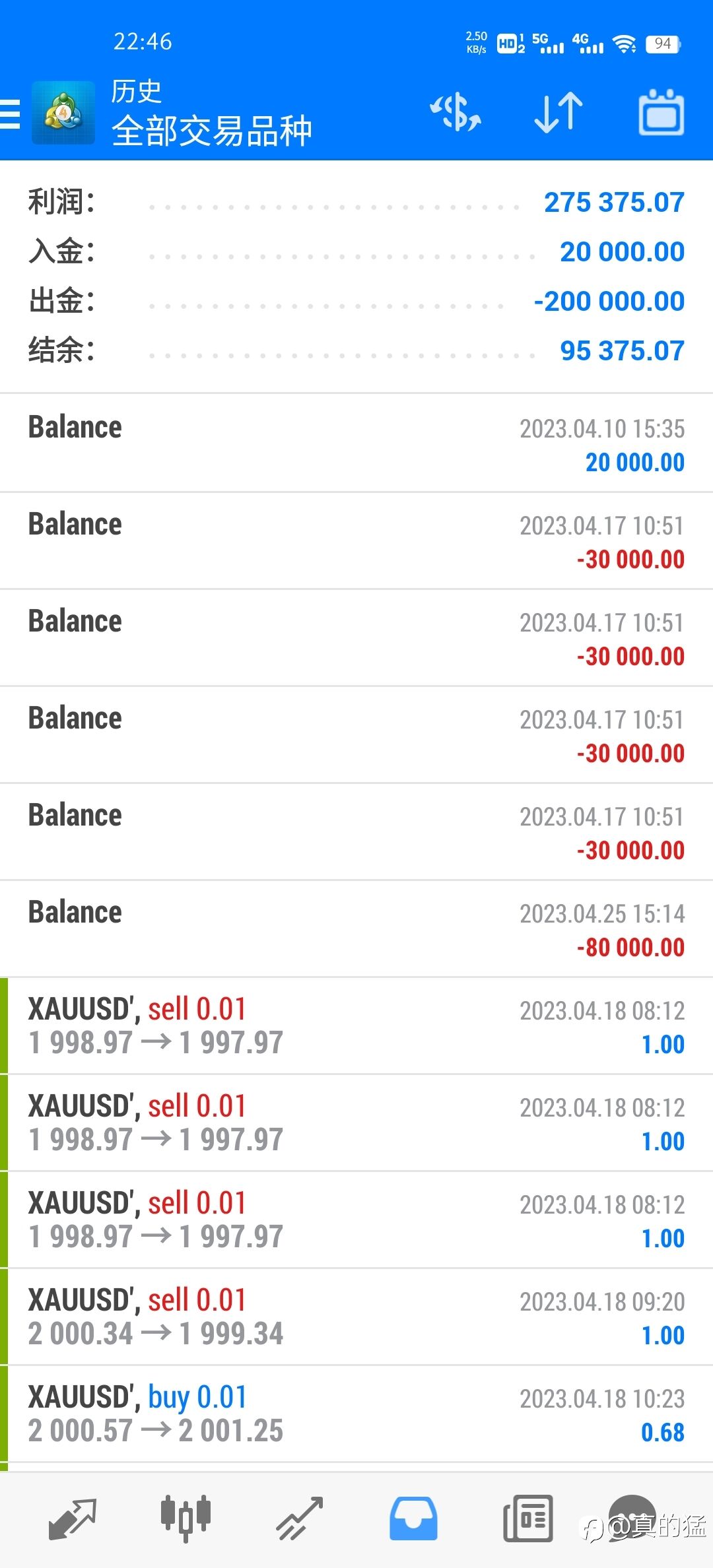

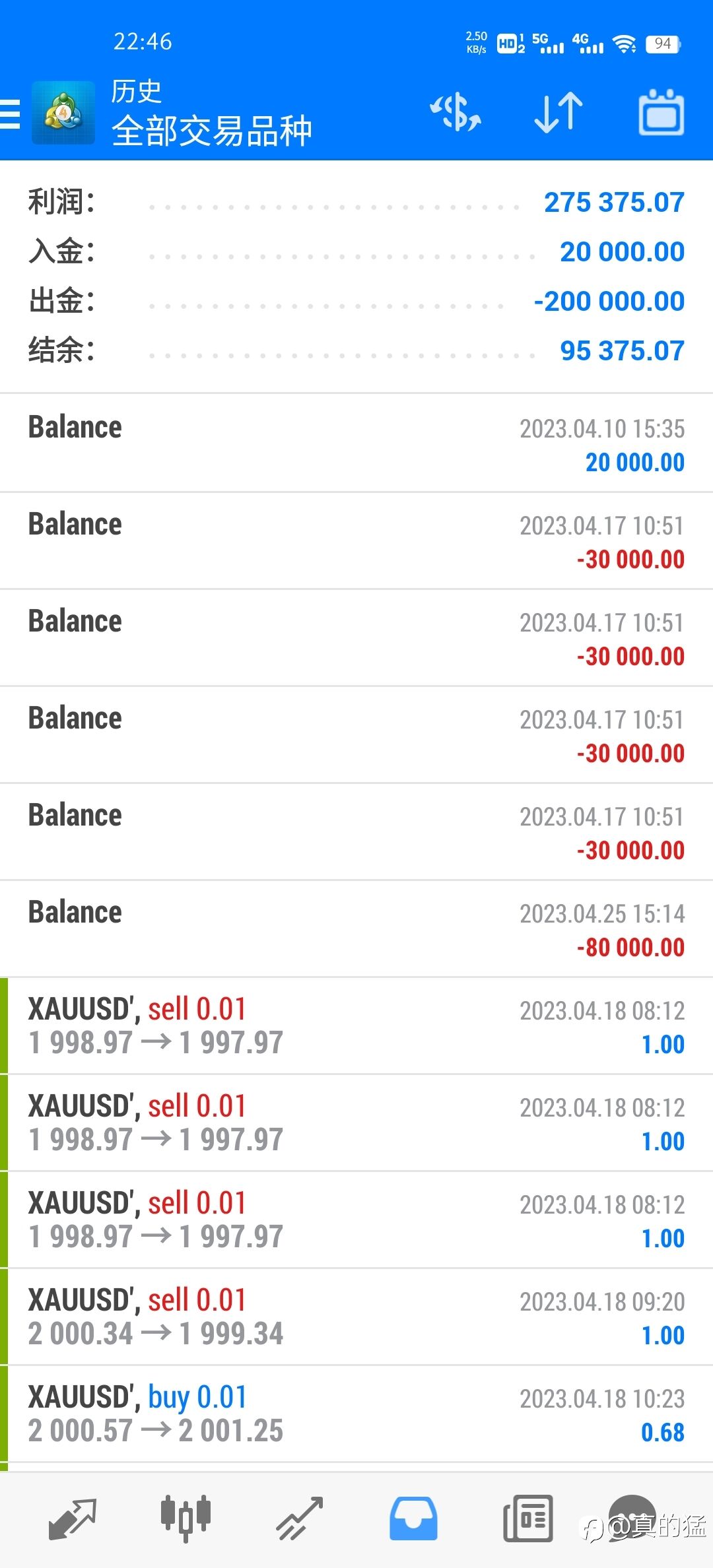

Earning $200000 from $20000 takes 8 months. Although the profit is considerable, the position is larger and the pullback is also larger. The maximum pullback reaches 35%, and the risk is proportional to the profit

Jian Ming Xu

How did I start trading?

Speaking of the past, I was also young and had great ideals. I felt like a hero who came to save the world. Why did I embark on the path of trading later?

In fact, it was mainly because I wanted to earn more money to support my girlfriend at that time, and my first love was always so beautiful. When I first graduated from school, I was assigned to a mobile phone parts factory. When I worked in the factory, I realized that my salary couldn't meet my girlfriend's needs, so I started looking for other opportunities to make money. I happened to encounter a company while searching for job opportunities.

The company hopes to achieve tens of thousands of outstanding results on its affiliated platform, and is eager to do so. Therefore, it begins to research stocks, spot gold, silver, and oil, learn relevant knowledge and technical indicators, and hope to gain more profits through trading. With the continuous deepening of learning and practice, it has been discovered that through research and analysis of market conditions, price trends can be predicted, and trading can yield returns. I believe this is a fast way to achieve wealth freedom. At that time, I was very excited and felt that I had mastered the secret of wealth. So, I began to conduct simulated trading, constantly adjusting my trading strategy and operating methods by observing the market situation and using technical indicators. Later, in an opportunity, I received a small amount of funds to support and began to engage in real trading.

At the beginning, I kept an eye on the market and had almost no time to take care of my girlfriend. I persisted in risk control, set stop loss and stop profit goals, and continued to study market conditions and technical indicators, continuously optimizing trading strategies and operating methods, and cautiously operating the first funds. At that time, there was a slight profit and loss, but it was indeed better than the income from work. I felt that the chives who had just entered the foreign exchange market generally had good luck, so I became less and less active at work, almost wanting to hold onto my computer 24 hours a day and make orders. It can be imagined that this situation did not last long, and the factory had two or three conversations with me, forcing me to start full-time trading.

Speaking of the past, I was also young and had great ideals. I felt like a hero who came to save the world. Why did I embark on the path of trading later?

In fact, it was mainly because I wanted to earn more money to support my girlfriend at that time, and my first love was always so beautiful. When I first graduated from school, I was assigned to a mobile phone parts factory. When I worked in the factory, I realized that my salary couldn't meet my girlfriend's needs, so I started looking for other opportunities to make money. I happened to encounter a company while searching for job opportunities.

The company hopes to achieve tens of thousands of outstanding results on its affiliated platform, and is eager to do so. Therefore, it begins to research stocks, spot gold, silver, and oil, learn relevant knowledge and technical indicators, and hope to gain more profits through trading. With the continuous deepening of learning and practice, it has been discovered that through research and analysis of market conditions, price trends can be predicted, and trading can yield returns. I believe this is a fast way to achieve wealth freedom. At that time, I was very excited and felt that I had mastered the secret of wealth. So, I began to conduct simulated trading, constantly adjusting my trading strategy and operating methods by observing the market situation and using technical indicators. Later, in an opportunity, I received a small amount of funds to support and began to engage in real trading.

At the beginning, I kept an eye on the market and had almost no time to take care of my girlfriend. I persisted in risk control, set stop loss and stop profit goals, and continued to study market conditions and technical indicators, continuously optimizing trading strategies and operating methods, and cautiously operating the first funds. At that time, there was a slight profit and loss, but it was indeed better than the income from work. I felt that the chives who had just entered the foreign exchange market generally had good luck, so I became less and less active at work, almost wanting to hold onto my computer 24 hours a day and make orders. It can be imagined that this situation did not last long, and the factory had two or three conversations with me, forcing me to start full-time trading.

Jian Ming Xu

Reminiscences of a stock operator :is the most important book that has influenced my investment philosophy,Livermore is a practical strategist with superb skills and a far superior understanding of the stock market. His understanding of the stock market has great reference significance for us now。

Jian Ming Xu

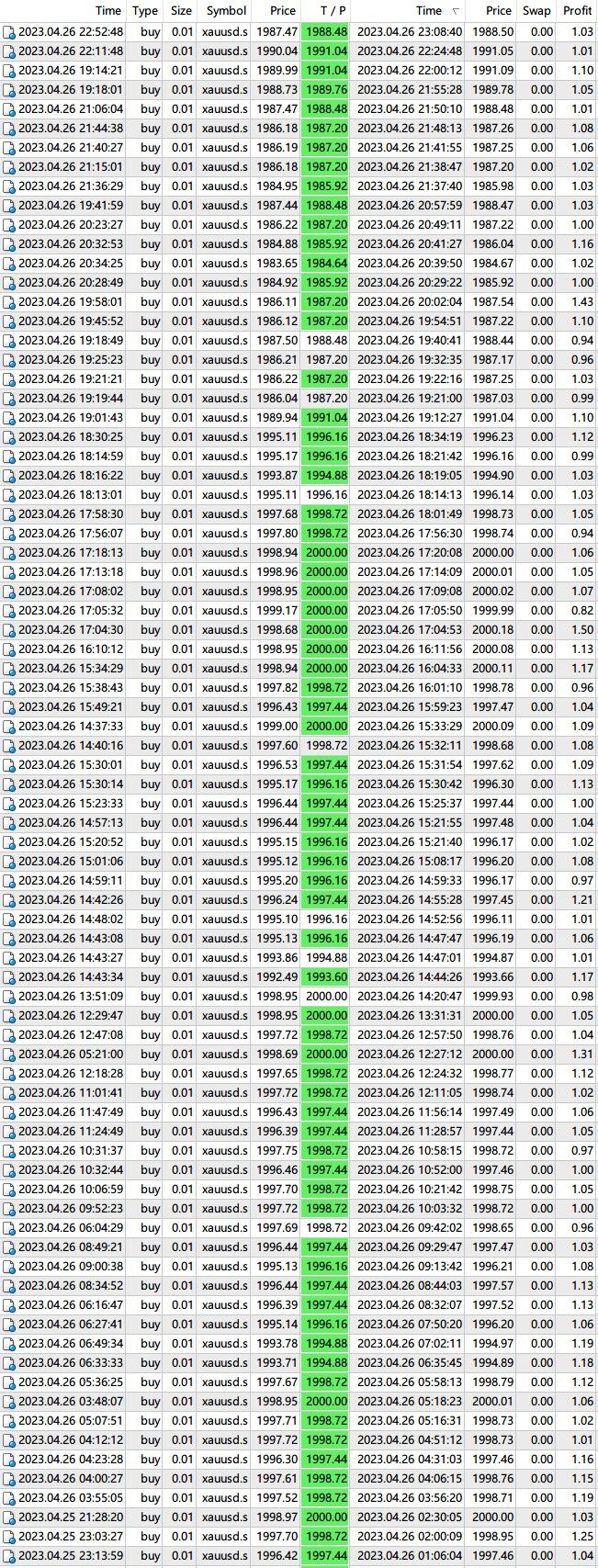

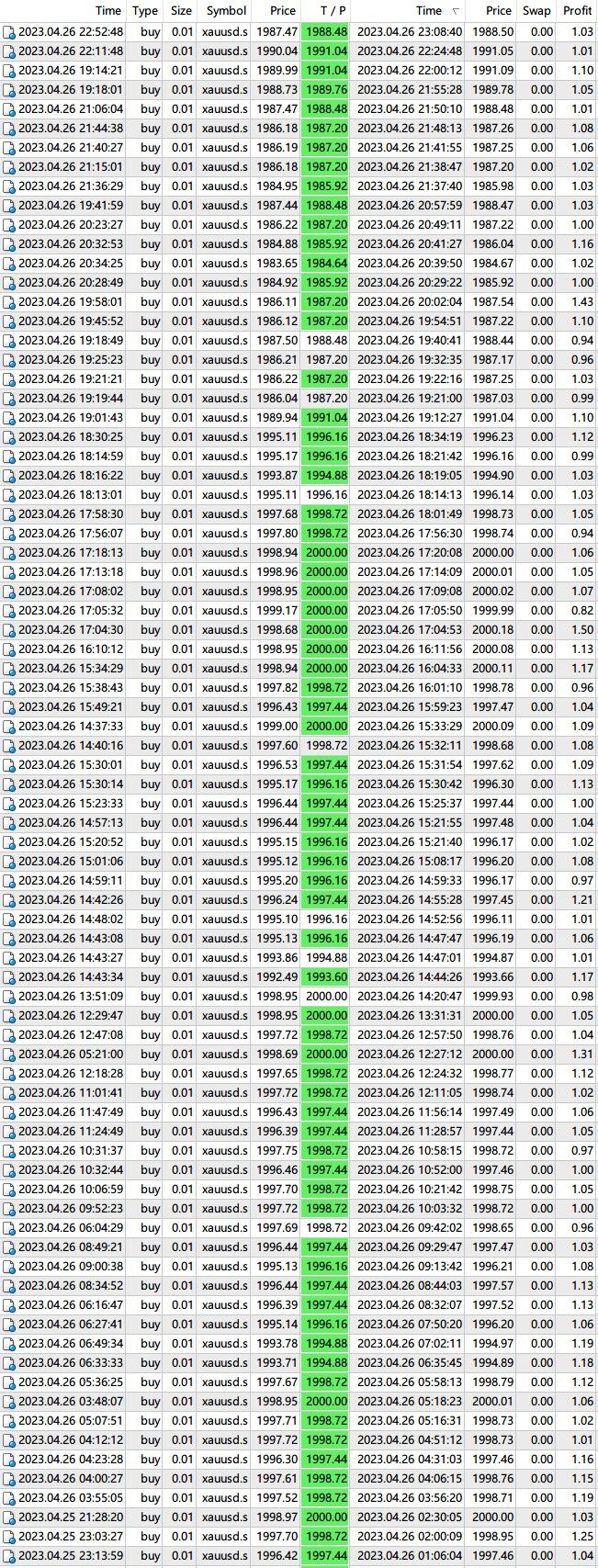

Dangerous strategy:

The transaction record is very beautiful, and this strategy similar to Martin's actually has a very high potential risk because the profit loss ratio is extremely unreasonable

The transaction record is very beautiful, and this strategy similar to Martin's actually has a very high potential risk because the profit loss ratio is extremely unreasonable

: