Claws and Horns / Профиль

Claws and Horns

News of the day. 29.03.2016

USA

The S&P/Case-Shiller Home Price Index for January is due in the US at 3:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to be up to 5.9% from 5.7%. The index is an important indicator of the US property market which represents the property prices change in 20 of the biggest US states. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Data on Consumer Confidence for March is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 92.2 to 94.0 points. The data represents consumer confidence in current economic conditions. A high reading strengthens the US Dollar. A reading below forecasts weakens the US Dollar.

At 6:30 pm (GMT+2) Fed’s Chair Janet Yellen delivers her speech to the US Congress. She gives commentaries on current economic conditions and answers questions from congressional representatives. The speech can lead to an increase in market volatility.

USA

The S&P/Case-Shiller Home Price Index for January is due in the US at 3:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to be up to 5.9% from 5.7%. The index is an important indicator of the US property market which represents the property prices change in 20 of the biggest US states. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Data on Consumer Confidence for March is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 92.2 to 94.0 points. The data represents consumer confidence in current economic conditions. A high reading strengthens the US Dollar. A reading below forecasts weakens the US Dollar.

At 6:30 pm (GMT+2) Fed’s Chair Janet Yellen delivers her speech to the US Congress. She gives commentaries on current economic conditions and answers questions from congressional representatives. The speech can lead to an increase in market volatility.

Claws and Horns

News of the day. 28.03.2016

USA

Data on Personal Income and Personal Spending for February is due in the US at 2:30 pm (GMT+2). The indicator of Personal Income represents an income of individuals from different sources. A high reading strengthens the US Dollar. A low reading weakens the US Dollar. A growth in the indicator suggests consumer readiness to spend money in current economic conditions. The indicator of Personal Spending measures expenditures of households and nonprofit organizations on goods and services.

Data on Pending Home Sales for February is due in the US at 4:00 pm (GMT+2). The data is one of the main indicators of the property market which represents the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Dallas Fed Manufacturing Business Index for March is due in the US at 4:30 pm (GMT+2). The index is released by the FRB of Dallas and is based on a monthly survey of manufacturing companies in Texas. The survey provides an assessment of such indicators as output volume, number of orders and prices.

USA

Data on Personal Income and Personal Spending for February is due in the US at 2:30 pm (GMT+2). The indicator of Personal Income represents an income of individuals from different sources. A high reading strengthens the US Dollar. A low reading weakens the US Dollar. A growth in the indicator suggests consumer readiness to spend money in current economic conditions. The indicator of Personal Spending measures expenditures of households and nonprofit organizations on goods and services.

Data on Pending Home Sales for February is due in the US at 4:00 pm (GMT+2). The data is one of the main indicators of the property market which represents the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Dallas Fed Manufacturing Business Index for March is due in the US at 4:30 pm (GMT+2). The index is released by the FRB of Dallas and is based on a monthly survey of manufacturing companies in Texas. The survey provides an assessment of such indicators as output volume, number of orders and prices.

Claws and Horns

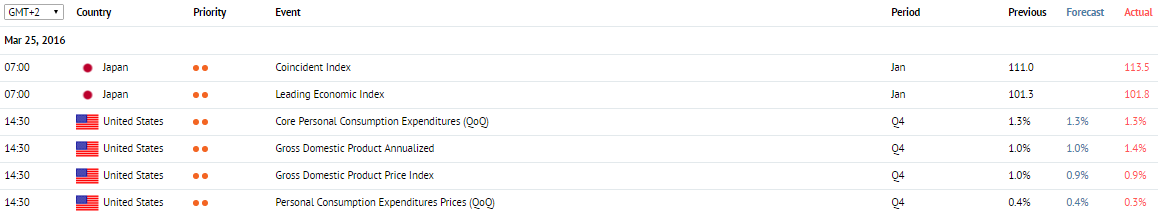

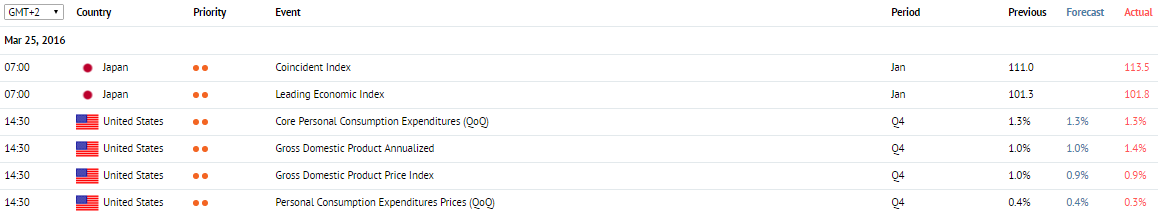

News of the day. 25.03.2016

Japan

The coincident index for January is due in Japan at 7:00 am (GMT+2).The index is based on 11 indicators and shows the current state of the economy. A result above 50 represents economic growth and strengthens the Yen. A result below 50 indicates a slowdown of the economy that, in its turn, has a negative impact on the Yen.

The leading economic index for January is due in Japan at 7:00 am (GMT+2). The index, based on 13 indicators, is used to assess short- and medium-term economic conditions. A result above 50 is a positive factor for the Yen. A result below 50 is a negative factor for the Yen.

USA

Data on GDP annualized for the fourth quarter is due in the US at 2:30 pm (GMT+2). The indicator represents the total value of goods and services created in the country during a period of time. The data is used to assess the pace of a growth/decline of the economy. A high reading strengthens the US Dollar. A low reading, on the contrary, weakens the US Dollar.

Japan

The coincident index for January is due in Japan at 7:00 am (GMT+2).The index is based on 11 indicators and shows the current state of the economy. A result above 50 represents economic growth and strengthens the Yen. A result below 50 indicates a slowdown of the economy that, in its turn, has a negative impact on the Yen.

The leading economic index for January is due in Japan at 7:00 am (GMT+2). The index, based on 13 indicators, is used to assess short- and medium-term economic conditions. A result above 50 is a positive factor for the Yen. A result below 50 is a negative factor for the Yen.

USA

Data on GDP annualized for the fourth quarter is due in the US at 2:30 pm (GMT+2). The indicator represents the total value of goods and services created in the country during a period of time. The data is used to assess the pace of a growth/decline of the economy. A high reading strengthens the US Dollar. A low reading, on the contrary, weakens the US Dollar.

Claws and Horns

News of the day. 24.03.2016

Germany

The Gfk consumer confidence survey for April is due at 9:00 am (GMT+2). The indicator is expected to remain unchanged at 9.5 points. The data is based on survey responses from consumers regarding how optimistic or pessimistic they feel about current economic activity. A positive result represents an optimistic mood and can support the Euro. A result below 0 indicates consumer pessimism and pressures the Euro.

UK

Data on retail sales for February is due in the UK at 11:30 am (GMT+2). The indicator is expected to fall both in annual and monthly terms, from 5.2% to 3.5% and from 2.3% to -1.0% respectively.

EU

Data on the ECB’s targeted LTRO is due at 12:15 pm (GMT+2). The ECB’s targeted LTRO is aimed at expanding the money supply. The indicator measures the amount of money the ECB allots to the eurozone commercial banks as asset-based loans. The banks are required to pay back the funds at the fixed rate equal to the MRO rate +10 basis points.

USA

Data on durable goods orders for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to -2.3% from 4.7%. The data represents the value change for durable goods that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the US Dollar.

Data on initial jobless claims for the week ended 18 March is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published weekly on Thursdays and allows approximating what nonfarm payrolls will be. A fall in the indicator strengthens the US Dollar. A growth in the indicator is seen as a negative factor.

Germany

The Gfk consumer confidence survey for April is due at 9:00 am (GMT+2). The indicator is expected to remain unchanged at 9.5 points. The data is based on survey responses from consumers regarding how optimistic or pessimistic they feel about current economic activity. A positive result represents an optimistic mood and can support the Euro. A result below 0 indicates consumer pessimism and pressures the Euro.

UK

Data on retail sales for February is due in the UK at 11:30 am (GMT+2). The indicator is expected to fall both in annual and monthly terms, from 5.2% to 3.5% and from 2.3% to -1.0% respectively.

EU

Data on the ECB’s targeted LTRO is due at 12:15 pm (GMT+2). The ECB’s targeted LTRO is aimed at expanding the money supply. The indicator measures the amount of money the ECB allots to the eurozone commercial banks as asset-based loans. The banks are required to pay back the funds at the fixed rate equal to the MRO rate +10 basis points.

USA

Data on durable goods orders for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to -2.3% from 4.7%. The data represents the value change for durable goods that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the US Dollar.

Data on initial jobless claims for the week ended 18 March is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published weekly on Thursdays and allows approximating what nonfarm payrolls will be. A fall in the indicator strengthens the US Dollar. A growth in the indicator is seen as a negative factor.

Claws and Horns

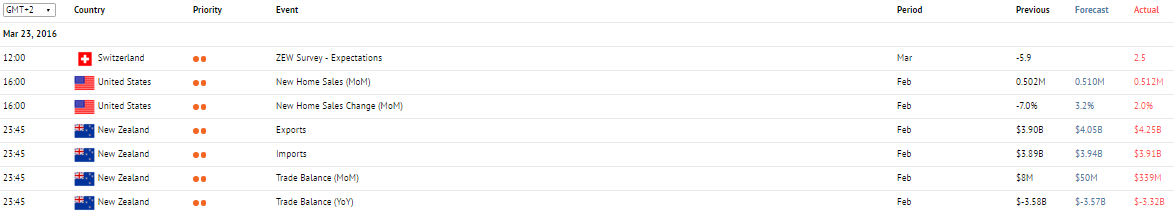

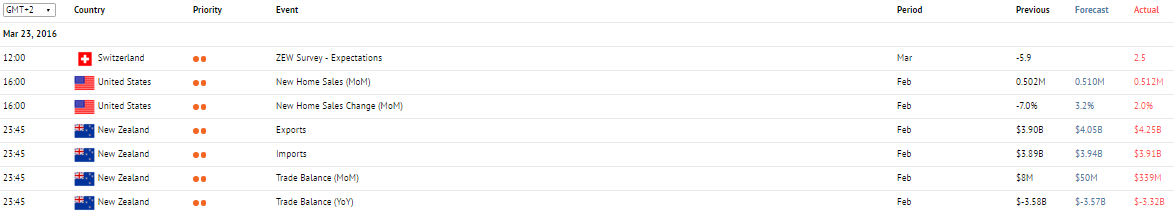

News of the day. 23.03.2016

Switzerland

At 12:00 pm (GMT+2), the Centre for European Economic Research releases the indicator of expectations for March. The indicator represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the Franc, while a low reading weakens the Franc.

The Swiss National Bank releases its Quarterly Bulletin at 4:00 pm (GMT+2). This publication provides information about monetary policy and current economic conditions.

USA

Data on new home sales for February is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to be up to 0.510 billion from 0.494 billion. The data is considered as an important indicator of the US property market. A growth in the indicator represents general improvements in economic conditions. A high reading supports the US Dollar. A low reading weakens the US Dollar.

New Zealand

Data on imports and exports for February are due in New Zealand at 11:45 pm (GMT+2). The indicator of imports represents the total value of goods and services imported into the country. A growth in imports suggests a growth in consumption. The indicator of exports represents the total value of goods and services exported from the county. A growth in exports has a positive impact on the economy of New Zealand.

Data on trade balance for February is due in New Zealand at 11:45 pm (GMT+2). The indicator represents the difference between the value of imports and exports. Positive values represent a trade surplus and strengthen the NZ Dollar. Negative values imply the balance is in deficit and weaken the NZ Dollar.

Switzerland

At 12:00 pm (GMT+2), the Centre for European Economic Research releases the indicator of expectations for March. The indicator represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the Franc, while a low reading weakens the Franc.

The Swiss National Bank releases its Quarterly Bulletin at 4:00 pm (GMT+2). This publication provides information about monetary policy and current economic conditions.

USA

Data on new home sales for February is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to be up to 0.510 billion from 0.494 billion. The data is considered as an important indicator of the US property market. A growth in the indicator represents general improvements in economic conditions. A high reading supports the US Dollar. A low reading weakens the US Dollar.

New Zealand

Data on imports and exports for February are due in New Zealand at 11:45 pm (GMT+2). The indicator of imports represents the total value of goods and services imported into the country. A growth in imports suggests a growth in consumption. The indicator of exports represents the total value of goods and services exported from the county. A growth in exports has a positive impact on the economy of New Zealand.

Data on trade balance for February is due in New Zealand at 11:45 pm (GMT+2). The indicator represents the difference between the value of imports and exports. Positive values represent a trade surplus and strengthen the NZ Dollar. Negative values imply the balance is in deficit and weaken the NZ Dollar.

Claws and Horns

News of the day. 22.03.2016

Australia

House price index for the fourth quarter is due in Australia at 2:30 am (GMT+2). The index is expected to be down to 0% from 2%. It is the indicator of property prices dynamics. A growth in the index strengthens the Australian Dollar. A fall in the index weakens the Australian Dollar.

At 7:30 am (GMT+2), RBA's Governor Glenn Stevens gives a speech on current economic conditions in the country. His comments can lead to an increase in volatility on the market.

Japan

All industry activity index for January is due in Japan at 6:30 am (GMT+2). The indicator is expected to grow to 1.9% from -0.9%. The index represents expenditures of large manufacturers in all sectors excluding the financial one. The data is considered as a leading indicator of productivity growth. Generally, an increase in the index strengthens the Yen, while a fall weakens the Yen.

UK

Consumer Price Index for February is due in the UK at 10:30 am (GMT+2). On a year-over-year basis, the index is expected to remain at 0.3%. On a monthly basis, a growth to 0.4% from -0.8% is forecasted.The index is one of the key indicators of inflation in the country. It represents changes in the price level of goods and services. A high reading strengthens the Pound. A low reading weakens the Pound.

Germany

Markit manufacturing PMI for March is due in Germany at 10:30 am (GMT+2). The indicator is expected to be up to 50.8 from 50.5 points. The index is one of the key indicators of the state of Germany’s economy. It reflects economic conditions in the manufacturing sector and its prospects. A result above 50 is perceived positive and strengthens the Euro. A result below 50, on the contrary, pressures the Euro.

Markit services PMI for March is due in Germany at 10:30 am (GMT+2). The indicator is expected to be down to 55.0 from 55.3 points. The index represents economic conditions in the service sector and is based on survey responses from executives of companies operating in this sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50, on the contrary, pressures the Euro.

The data on business climate for March is due in Germany at 11:00 am (GMT+2). The indicator is expected to be up to 105.9 from 105.7 points. The index is based on survey responses from executives of more than 7000 companies regarding their opinion on current business conditions. A growth in the indicator strengthens the Euro. A decline, on the contrary, is seen as a negative factor and pressures the Euro.

The Centre for European Economic Research (ZEW) releases its survey for March at 12:00 pm (GMT+2). The indicator is expected to grow to 5.9 from 1.0 points. The index is based on survey responses from leading financial experts in Europe regarding their opinion on current economic conditions. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

The Centre for European Economic Research (ZEW) releases its survey for March at 12:00 pm (GMT+2). The indicator is expected to be up to 53.0 from 52.3 points. The index is based on survey responses from leading financial experts in Europe regarding their opinion on current economic conditions. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

EU

Markit manufacturing PMI for March is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be up to 51.4 from 51.2 points. The index is based on survey responses from executives of manufacturing companies regarding their opinion on current economic conditions in the sector. A result above 50 strengthens the Euro. A result below 50, on the contrary, weakens the Euro.

Markit services PMI for March is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be up to 53.5 from 53.3 points. The index represents current and future economic conditions in the service sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50, on the contrary, pressures the Euro.

Data on economic sentiment for March is due in the eurozone at 12:00 pm (GMT+2). The indicator is expected to fall to 8.2 from 13.6 points. The index, released by the Centre for European Economic Research (ZEW), is based on survey responses from 350 leading financial experts in Europe regarding their opinion on current economic conditions in Europe, the US and Japan. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

USA

Housing price index for January is due in the US at 3:00 pm (GMT+2). The index is expected to be up to 0.5% from 0.4%. It is the indicator of property prices dynamics. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Markit manufacturing PMI for March is due in the US at 3:45 pm (GMT+2). The index represents current and future economic conditions in the manufacturing sector. A reading above 50 is perceived positive and strengthens the US Dollar. A reading below 50 is perceived negative and weakens the US Dollar.

Australia

House price index for the fourth quarter is due in Australia at 2:30 am (GMT+2). The index is expected to be down to 0% from 2%. It is the indicator of property prices dynamics. A growth in the index strengthens the Australian Dollar. A fall in the index weakens the Australian Dollar.

At 7:30 am (GMT+2), RBA's Governor Glenn Stevens gives a speech on current economic conditions in the country. His comments can lead to an increase in volatility on the market.

Japan

All industry activity index for January is due in Japan at 6:30 am (GMT+2). The indicator is expected to grow to 1.9% from -0.9%. The index represents expenditures of large manufacturers in all sectors excluding the financial one. The data is considered as a leading indicator of productivity growth. Generally, an increase in the index strengthens the Yen, while a fall weakens the Yen.

UK

Consumer Price Index for February is due in the UK at 10:30 am (GMT+2). On a year-over-year basis, the index is expected to remain at 0.3%. On a monthly basis, a growth to 0.4% from -0.8% is forecasted.The index is one of the key indicators of inflation in the country. It represents changes in the price level of goods and services. A high reading strengthens the Pound. A low reading weakens the Pound.

Germany

Markit manufacturing PMI for March is due in Germany at 10:30 am (GMT+2). The indicator is expected to be up to 50.8 from 50.5 points. The index is one of the key indicators of the state of Germany’s economy. It reflects economic conditions in the manufacturing sector and its prospects. A result above 50 is perceived positive and strengthens the Euro. A result below 50, on the contrary, pressures the Euro.

Markit services PMI for March is due in Germany at 10:30 am (GMT+2). The indicator is expected to be down to 55.0 from 55.3 points. The index represents economic conditions in the service sector and is based on survey responses from executives of companies operating in this sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50, on the contrary, pressures the Euro.

The data on business climate for March is due in Germany at 11:00 am (GMT+2). The indicator is expected to be up to 105.9 from 105.7 points. The index is based on survey responses from executives of more than 7000 companies regarding their opinion on current business conditions. A growth in the indicator strengthens the Euro. A decline, on the contrary, is seen as a negative factor and pressures the Euro.

The Centre for European Economic Research (ZEW) releases its survey for March at 12:00 pm (GMT+2). The indicator is expected to grow to 5.9 from 1.0 points. The index is based on survey responses from leading financial experts in Europe regarding their opinion on current economic conditions. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

The Centre for European Economic Research (ZEW) releases its survey for March at 12:00 pm (GMT+2). The indicator is expected to be up to 53.0 from 52.3 points. The index is based on survey responses from leading financial experts in Europe regarding their opinion on current economic conditions. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

EU

Markit manufacturing PMI for March is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be up to 51.4 from 51.2 points. The index is based on survey responses from executives of manufacturing companies regarding their opinion on current economic conditions in the sector. A result above 50 strengthens the Euro. A result below 50, on the contrary, weakens the Euro.

Markit services PMI for March is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be up to 53.5 from 53.3 points. The index represents current and future economic conditions in the service sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50, on the contrary, pressures the Euro.

Data on economic sentiment for March is due in the eurozone at 12:00 pm (GMT+2). The indicator is expected to fall to 8.2 from 13.6 points. The index, released by the Centre for European Economic Research (ZEW), is based on survey responses from 350 leading financial experts in Europe regarding their opinion on current economic conditions in Europe, the US and Japan. A reading above zero represents an optimistic mood and strengthens the Euro. A reading below forecasts represents a generally negative mood and weakens the Euro.

USA

Housing price index for January is due in the US at 3:00 pm (GMT+2). The index is expected to be up to 0.5% from 0.4%. It is the indicator of property prices dynamics. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Markit manufacturing PMI for March is due in the US at 3:45 pm (GMT+2). The index represents current and future economic conditions in the manufacturing sector. A reading above 50 is perceived positive and strengthens the US Dollar. A reading below 50 is perceived negative and weakens the US Dollar.

Claws and Horns

News of the day. 21.03.2016

USA

Chicago Fed national activity index for February is due at 2:30 pm (GMT+2). The index is considered as an indicator of economic activity in the region. Values above 0 are perceived positive and strengthen the US Dollar. Values below 0, on the contrary, pressure the US Dollar.

Data on existing home sales for February is due in the US at 4:00 pm (GMT+2). The indicator is expected to be down to 5.40 billion from 5.47 billion. The data characterises the state of the property market and is considered as one of the key indicators of the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

USA

Chicago Fed national activity index for February is due at 2:30 pm (GMT+2). The index is considered as an indicator of economic activity in the region. Values above 0 are perceived positive and strengthen the US Dollar. Values below 0, on the contrary, pressure the US Dollar.

Data on existing home sales for February is due in the US at 4:00 pm (GMT+2). The indicator is expected to be down to 5.40 billion from 5.47 billion. The data characterises the state of the property market and is considered as one of the key indicators of the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Claws and Horns

News of the day. 18.03.2016

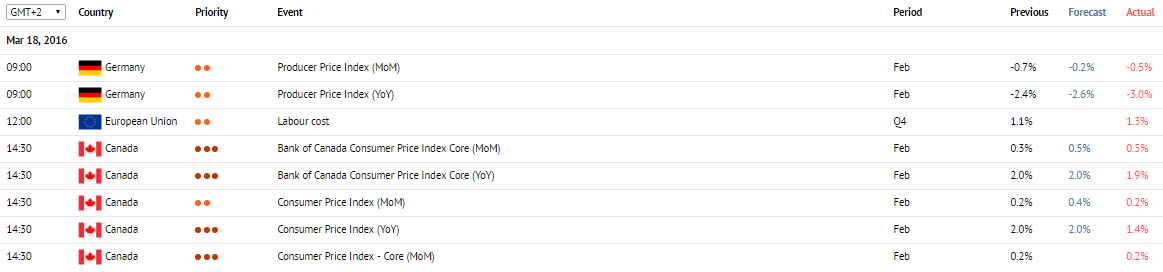

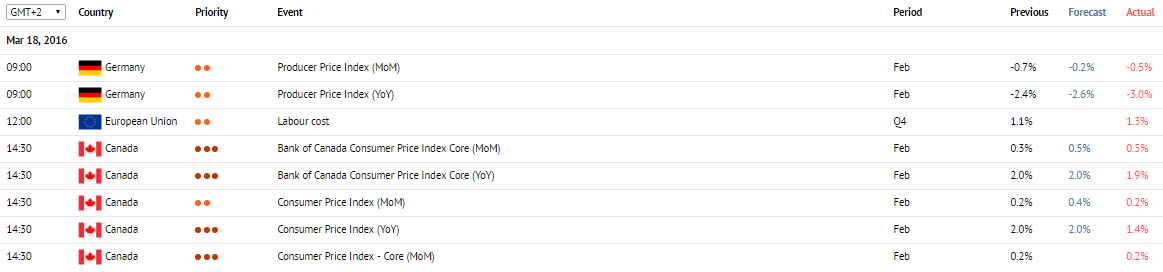

Germany

Producer price index for February is due in Germany at 9:00 am (GMT+2). The index is expected to decline to -2.6% from -2.4% in annual terms and to be up to -0.2% from -0.7% in monthly terms.

EU

Data on labour cost for the fourth quarter is due in the EU at 12:00 pm (GMT+2). The indicator represents changes in average hourly labour costs. A growth in the indicator strengthens the Euro, while a fall in the indicator weakens the Euro.

Canada

Consumer price index for February is due in Canada at 2:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to remain unchanged at 2%. The index represents changes in the value of the basket of goods and services. A high reading is seen as anticipatory of a rate increase. A growth in the index strengthens the Canadian Dollar, while a fall in the index weakens the Canadian Dollar.

Germany

Producer price index for February is due in Germany at 9:00 am (GMT+2). The index is expected to decline to -2.6% from -2.4% in annual terms and to be up to -0.2% from -0.7% in monthly terms.

EU

Data on labour cost for the fourth quarter is due in the EU at 12:00 pm (GMT+2). The indicator represents changes in average hourly labour costs. A growth in the indicator strengthens the Euro, while a fall in the indicator weakens the Euro.

Canada

Consumer price index for February is due in Canada at 2:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to remain unchanged at 2%. The index represents changes in the value of the basket of goods and services. A high reading is seen as anticipatory of a rate increase. A growth in the index strengthens the Canadian Dollar, while a fall in the index weakens the Canadian Dollar.

Claws and Horns

News of the day. 17.03.2016

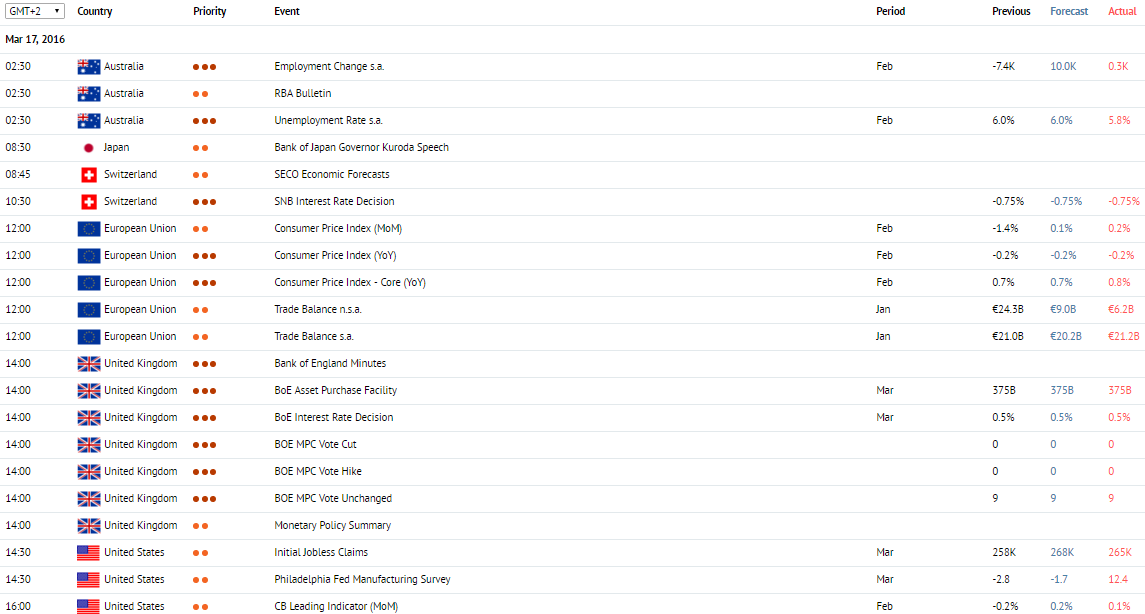

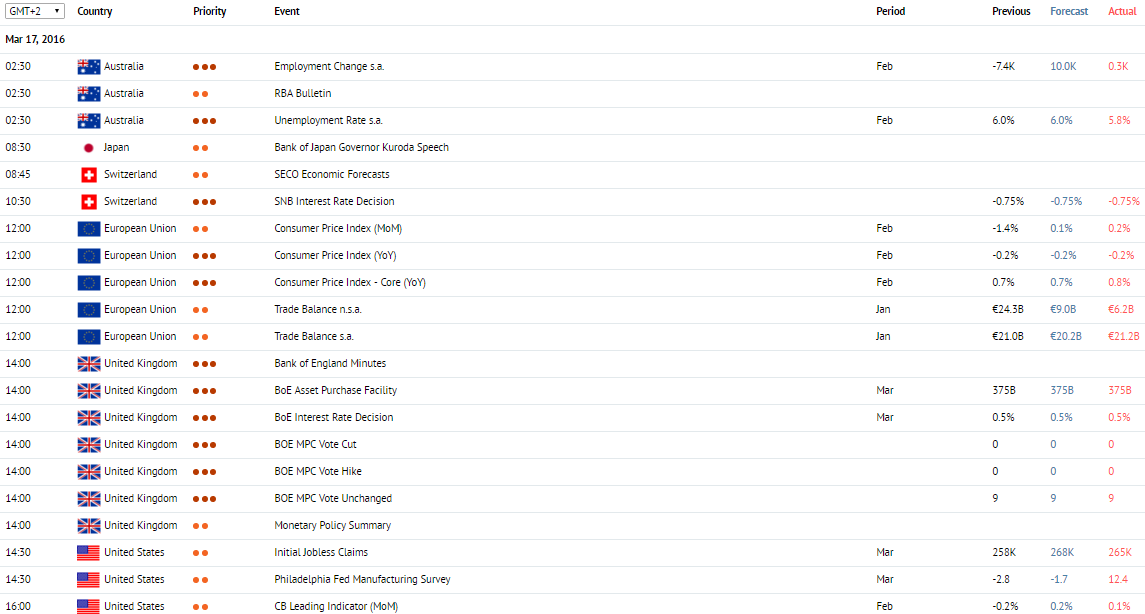

Australia

At 2:30 am (GMT+2) the Reserve Bank of Australia releases its quarterly bulletin which contains articles and speeches regarding economic and financial developments as well as the Bank’s operations.

Japan

At 8:30 am (GMT+2) the Bank of Japan Governor Haruhiko Kuroda holds a press conference regarding current issues in monetary policy.

Switzerland

The Swiss National Bank announces its decision on interest rates at 10:30 am (GMT+2). A rate increase strengthens the Franc, while a decrease weakens it.

EU

Data on consumer price index is due in EU at 12:00 pm (GMT+2). As expected, February’s indicator will remain unchanged at -0.2% in annual terms, while on a year-over-year basis, a growth to 0.1% from -1.4% is forecasted. CPR is the key indicator of inflation in the eurozone which represents the change in the value of the basket of goods and services. A growth in the index strengthens the Euro. A fall in the index weakens the Euro.

Data on EU trade balance is due at 11:00 pm (GMT+2). As expected, the balance surplus will decrease to €20.2 billion from €21.0 billion, while the not seasonally adjusted indicator will come in at €9.0 billion from €24.3 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the Euro. Negative values indicate the balance deficit and weaken the Euro.

UK

At 2:00 pm (GMT+2), following the announcement of the interest rate decision, the Bank of England minutes are released. They contain commentaries about the recent decisions.

The Bank of England announces its interest rate decision at 2:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. Depending on economic conditions and the level of inflation, the Bank of England makes its decision on interest rates. A rate increase strengthens the Pound. If interest rates remain unchanged or get cut, the Pound weakens.

USA

Data on Philadelphia Fed Manufacturing Survey is released in the US at 2:30 pm (GMT+2). In March, the indicator is expected to be up to -1.7 from -2.8 points. The indicator is based on surveys of executives of the biggest manufacturing companies in Philadelphia regarding their opinion on current economic conditions and prospects for the next 6 months. Negative values weaken the US Dollar. Values above expectations strengthen the US Dollar.

Data on initial jobless claims for the week ended 11 March is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow to 268 K from 259 K. The indicator is released every Thursday and represents the number of new unemployment claims. The data allows approximating what nonfarm payrolls will be. A fall in the indicator strengthens the US Dollar. A growth in the indicator, on the contrary, is perceived as a negative factor for the US Dollar.

Data on the leading indicator, released by the Conference Board, is due in the US at 4:00 pm (GMT+2). In February, the indicator is expected to be up to 0.2% from -0.2%. The leading indicator is compiled from 10 economic indicators, including data on initial jobless claims, building permits and average weekly hours. A positive reading strengthens the US Dollar.

Australia

At 2:30 am (GMT+2) the Reserve Bank of Australia releases its quarterly bulletin which contains articles and speeches regarding economic and financial developments as well as the Bank’s operations.

Japan

At 8:30 am (GMT+2) the Bank of Japan Governor Haruhiko Kuroda holds a press conference regarding current issues in monetary policy.

Switzerland

The Swiss National Bank announces its decision on interest rates at 10:30 am (GMT+2). A rate increase strengthens the Franc, while a decrease weakens it.

EU

Data on consumer price index is due in EU at 12:00 pm (GMT+2). As expected, February’s indicator will remain unchanged at -0.2% in annual terms, while on a year-over-year basis, a growth to 0.1% from -1.4% is forecasted. CPR is the key indicator of inflation in the eurozone which represents the change in the value of the basket of goods and services. A growth in the index strengthens the Euro. A fall in the index weakens the Euro.

Data on EU trade balance is due at 11:00 pm (GMT+2). As expected, the balance surplus will decrease to €20.2 billion from €21.0 billion, while the not seasonally adjusted indicator will come in at €9.0 billion from €24.3 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the Euro. Negative values indicate the balance deficit and weaken the Euro.

UK

At 2:00 pm (GMT+2), following the announcement of the interest rate decision, the Bank of England minutes are released. They contain commentaries about the recent decisions.

The Bank of England announces its interest rate decision at 2:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. Depending on economic conditions and the level of inflation, the Bank of England makes its decision on interest rates. A rate increase strengthens the Pound. If interest rates remain unchanged or get cut, the Pound weakens.

USA

Data on Philadelphia Fed Manufacturing Survey is released in the US at 2:30 pm (GMT+2). In March, the indicator is expected to be up to -1.7 from -2.8 points. The indicator is based on surveys of executives of the biggest manufacturing companies in Philadelphia regarding their opinion on current economic conditions and prospects for the next 6 months. Negative values weaken the US Dollar. Values above expectations strengthen the US Dollar.

Data on initial jobless claims for the week ended 11 March is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow to 268 K from 259 K. The indicator is released every Thursday and represents the number of new unemployment claims. The data allows approximating what nonfarm payrolls will be. A fall in the indicator strengthens the US Dollar. A growth in the indicator, on the contrary, is perceived as a negative factor for the US Dollar.

Data on the leading indicator, released by the Conference Board, is due in the US at 4:00 pm (GMT+2). In February, the indicator is expected to be up to 0.2% from -0.2%. The leading indicator is compiled from 10 economic indicators, including data on initial jobless claims, building permits and average weekly hours. A positive reading strengthens the US Dollar.

Claws and Horns

News of the day. 16.03.2016

UK

At 2:30 pm (GMT+2), the Chancellor of Exchequer presents the budget report which contains forecast for next year regarding key macroeconomic indicators.

USA

Consumer Price Index for February is due in the US at 2:30 pm (GMT+2). The index is expected to decline both in annual and monthly terms, from 1.4% to 0.9% and from 0.0% to -0.2% respectively. The index is the key indicator of inflation in the country that represents the change in the value of the basket of goods and services. A positive reading strengthens the US Dollar. A negative reading weakens the US Dollar.

Data on building permits for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be down to 1.200 million from 1.202 million. The data shows the number of approved permits for building of new houses. Building volumes have close connections with consumer income. Thus, a growth in the indicator represents economic growth. High values generally strengthen the US Dollar.

Data on housing starts for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to 1.150 million from 1.099 million. The data represents the number of new building starts. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Data on capacity utilization for February is due in the US at 3:15 pm (GMT+2). The indicator is expected to come in at 76.9% from 77.1% earlier. The indicator is the percentage expression of the production capacity utilisation in the economy of the country which represents economic growth and the level of demand. A value up to 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% represents inflation acceleration. A growth in the indicator generally strengthens the US Dollar.

Data on industrial production for February is due in the US at 3:15 pm (GMT+2). The indicator is expected to be down to -0.3% from 0.9%. The data represents changes in industrial output in the US and is considered as one of the major indicators of the state of the national economy. A growth in industrial production supports the US Dollar. A fall in the indicator, on the contrary, pressures the national currency.

The Monetary Policy Committee announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. Interest rate is an important economic indicator which determines commercial banks’ interest rates and the USD exchange rate. An interest rate increase strengthens the US Dollar, while a decrease has a negative impact on the US Dollar.

Fed’s press conference is due at 8:30 pm (GMT+2). After a decision on interest rates is announced, Fed’s Chair Janet Yellen is answering questions about current economic conditions in the US. Her commentaries usually have a significant impact on the market and can either strengthen or weaken the US Dollar.

New Zealand

Data on New Zealand’s GDP for the fourth quarter is due at 11:45 (GMT+2). According to the forecast, the indicator will decline to 2.0% from 2.3% on a year-over-year basis. In quarterly terms, the country’s economic growth is expected to slow down to 0.6% from 0.9%.

UK

At 2:30 pm (GMT+2), the Chancellor of Exchequer presents the budget report which contains forecast for next year regarding key macroeconomic indicators.

USA

Consumer Price Index for February is due in the US at 2:30 pm (GMT+2). The index is expected to decline both in annual and monthly terms, from 1.4% to 0.9% and from 0.0% to -0.2% respectively. The index is the key indicator of inflation in the country that represents the change in the value of the basket of goods and services. A positive reading strengthens the US Dollar. A negative reading weakens the US Dollar.

Data on building permits for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be down to 1.200 million from 1.202 million. The data shows the number of approved permits for building of new houses. Building volumes have close connections with consumer income. Thus, a growth in the indicator represents economic growth. High values generally strengthen the US Dollar.

Data on housing starts for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to 1.150 million from 1.099 million. The data represents the number of new building starts. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Data on capacity utilization for February is due in the US at 3:15 pm (GMT+2). The indicator is expected to come in at 76.9% from 77.1% earlier. The indicator is the percentage expression of the production capacity utilisation in the economy of the country which represents economic growth and the level of demand. A value up to 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% represents inflation acceleration. A growth in the indicator generally strengthens the US Dollar.

Data on industrial production for February is due in the US at 3:15 pm (GMT+2). The indicator is expected to be down to -0.3% from 0.9%. The data represents changes in industrial output in the US and is considered as one of the major indicators of the state of the national economy. A growth in industrial production supports the US Dollar. A fall in the indicator, on the contrary, pressures the national currency.

The Monetary Policy Committee announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. Interest rate is an important economic indicator which determines commercial banks’ interest rates and the USD exchange rate. An interest rate increase strengthens the US Dollar, while a decrease has a negative impact on the US Dollar.

Fed’s press conference is due at 8:30 pm (GMT+2). After a decision on interest rates is announced, Fed’s Chair Janet Yellen is answering questions about current economic conditions in the US. Her commentaries usually have a significant impact on the market and can either strengthen or weaken the US Dollar.

New Zealand

Data on New Zealand’s GDP for the fourth quarter is due at 11:45 (GMT+2). According to the forecast, the indicator will decline to 2.0% from 2.3% on a year-over-year basis. In quarterly terms, the country’s economic growth is expected to slow down to 0.6% from 0.9%.

Claws and Horns

News of the day. 15.03.2016

Australia

The publication of RBA meeting's minutes is due at 2:30 am (GMT+2). The minutes are released two weeks after the publication of interest rate decision and contain commentaries regarding this decision as well as detailed information on voting process.

Japan

The monetary policy statement, released at 5:00 am (GMT+2), provides information on voting results regarding the recent interest rate decision as well as on the factors that influenced this decision.

The Bank of Japan releases interest rate decision at 5:00 am (GMT+2). A rate increase strengthens the Yen, while a decrease weakens the Yen.

Data on industrial production for January is due in Japan at 6:30 am (GMT+2). The data represents changes in industrial output and is considered as one of the major indicators of the state of the national economy. A growth in the indicator supports the Yen. A fall in the indicator pressures the Yen.

The Governor of the Bank of Japan holds a press conference at 8:30 am (GMT+2). During the press conference, Haruhiko Kuroda comments on the recent interest rate decision and the outlook for monetary policy.

USA

Data for February on retail sales ex autos is due in the US at 2:30 pm (GMT+2). In monthly terms, the indicator is expected to remain unchanged at 0.1%. The data is considered as the most precise indicator of consumer expenditures and represents changes in the volume of retail sales. A growth in the indicator is the positive factor for the economy and strengthens the US Dollar. A fall in the indicator weakens the US Dollar.

NAHB Housing Market Index is due in the US at 4:00 pm (GMT+2). The index is based on surveys of homeowners aimed at estimating the current value of property and further price dynamics for the next 6 months. A value above 50 represents favourable situation on the property market, as participants find house prices acceptable.

Australia

The publication of RBA meeting's minutes is due at 2:30 am (GMT+2). The minutes are released two weeks after the publication of interest rate decision and contain commentaries regarding this decision as well as detailed information on voting process.

Japan

The monetary policy statement, released at 5:00 am (GMT+2), provides information on voting results regarding the recent interest rate decision as well as on the factors that influenced this decision.

The Bank of Japan releases interest rate decision at 5:00 am (GMT+2). A rate increase strengthens the Yen, while a decrease weakens the Yen.

Data on industrial production for January is due in Japan at 6:30 am (GMT+2). The data represents changes in industrial output and is considered as one of the major indicators of the state of the national economy. A growth in the indicator supports the Yen. A fall in the indicator pressures the Yen.

The Governor of the Bank of Japan holds a press conference at 8:30 am (GMT+2). During the press conference, Haruhiko Kuroda comments on the recent interest rate decision and the outlook for monetary policy.

USA

Data for February on retail sales ex autos is due in the US at 2:30 pm (GMT+2). In monthly terms, the indicator is expected to remain unchanged at 0.1%. The data is considered as the most precise indicator of consumer expenditures and represents changes in the volume of retail sales. A growth in the indicator is the positive factor for the economy and strengthens the US Dollar. A fall in the indicator weakens the US Dollar.

NAHB Housing Market Index is due in the US at 4:00 pm (GMT+2). The index is based on surveys of homeowners aimed at estimating the current value of property and further price dynamics for the next 6 months. A value above 50 represents favourable situation on the property market, as participants find house prices acceptable.

Claws and Horns

News of the day. 14.03.2016

EU

Data on industrial production for January is due in the EU at 12:00 pm (GMT+2). The indicator is expected to grow both in annual and monthly terms, from-1.3% to 0.9% and from -1.0% to 1.5% respectively. The data represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the Euro, while a low reading weakens the Euro.

EU

Data on industrial production for January is due in the EU at 12:00 pm (GMT+2). The indicator is expected to grow both in annual and monthly terms, from-1.3% to 0.9% and from -1.0% to 1.5% respectively. The data represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the Euro, while a low reading weakens the Euro.

Claws and Horns

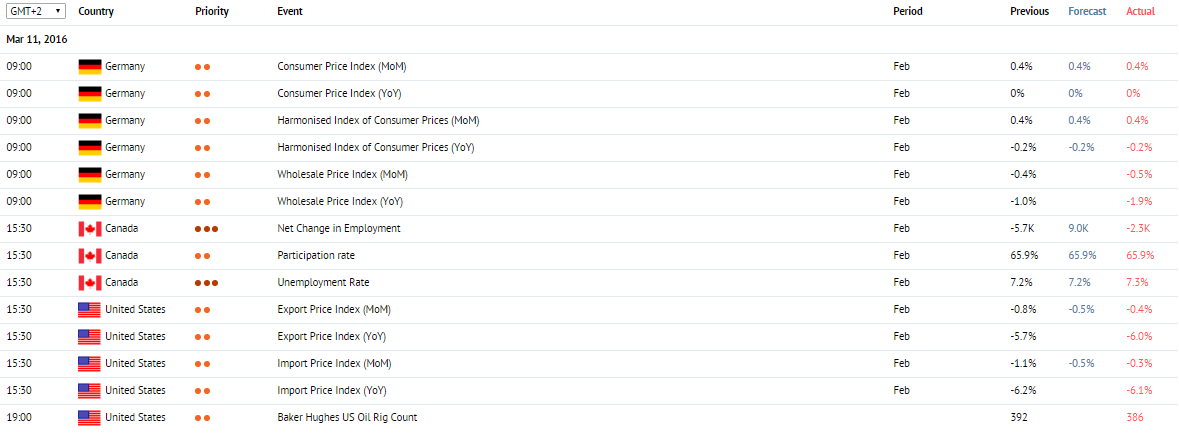

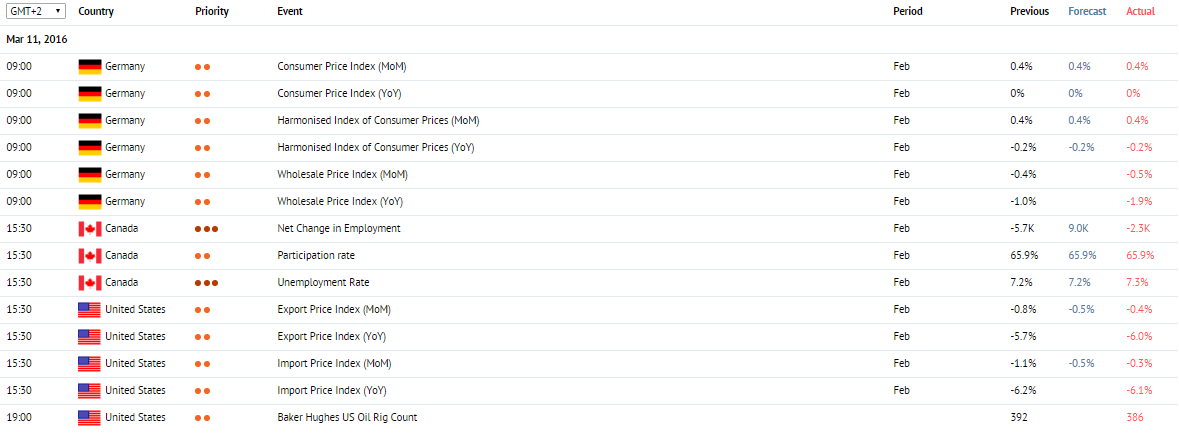

News of the day. 11.03.2016

Germany

Consumer price index for February is due in Germany at 9:00 am (GMT+2). The indicator is expected to remain unchanged both in annual and monthly terms, at 0% and 0.4% respectively.

Canada

Data on unemployment rate for February is due in Canada at 2:30 pm (GMT+2). The indicator is expected to come in at 7.2%, same as in the previous month. The indicator is released by the Statistics Canada and represents the percentage of the total labour force that is unemployed. Growing unemployment suggests a slowdown of the economy and weakens the Canadian Dollar, while a fall in indicator, on the contrary, is considered as a positive signal for the economy and strengthens the national currency.

USA

Export price index for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -0.4% from -0.8%. The index represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The indicator has a high impact on the market. A constant growth in the index pressures the US Dollar as high prices reduce demand.

Import price index for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -0.7% from -1.1%. The index represents the price change for imported goods and services and is seen as an indicator of inflation. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Germany

Consumer price index for February is due in Germany at 9:00 am (GMT+2). The indicator is expected to remain unchanged both in annual and monthly terms, at 0% and 0.4% respectively.

Canada

Data on unemployment rate for February is due in Canada at 2:30 pm (GMT+2). The indicator is expected to come in at 7.2%, same as in the previous month. The indicator is released by the Statistics Canada and represents the percentage of the total labour force that is unemployed. Growing unemployment suggests a slowdown of the economy and weakens the Canadian Dollar, while a fall in indicator, on the contrary, is considered as a positive signal for the economy and strengthens the national currency.

USA

Export price index for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -0.4% from -0.8%. The index represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The indicator has a high impact on the market. A constant growth in the index pressures the US Dollar as high prices reduce demand.

Import price index for February is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -0.7% from -1.1%. The index represents the price change for imported goods and services and is seen as an indicator of inflation. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Claws and Horns

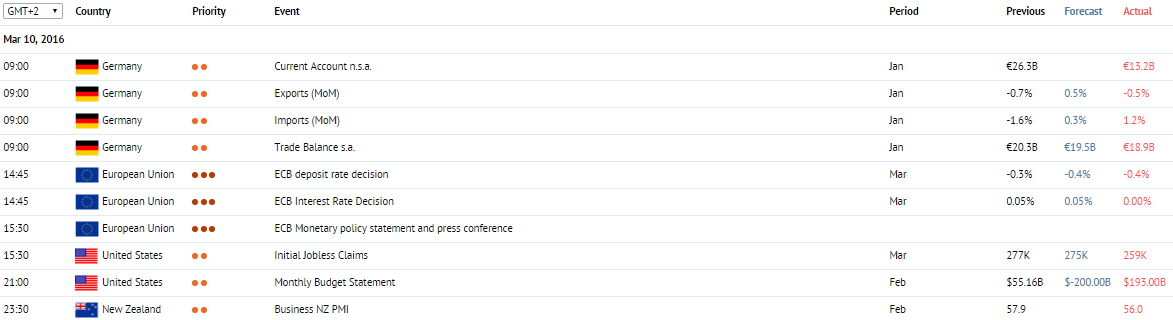

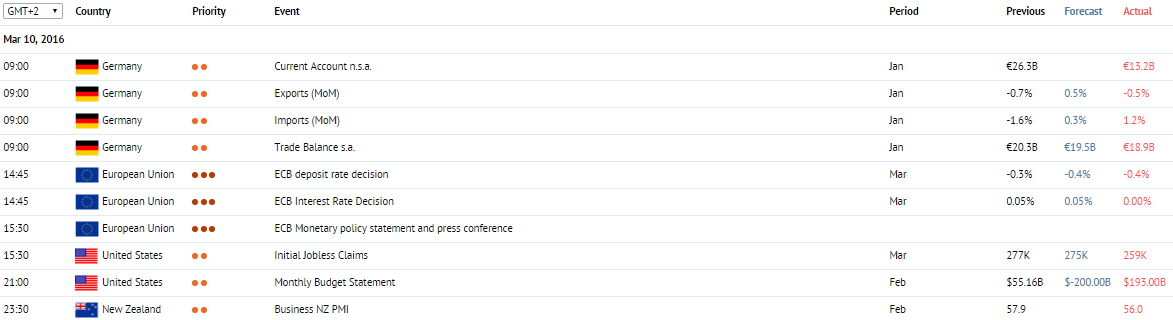

News of the day. 10.03.2016

Germany

Non-seasonally adjusted data on current account for January is due in Germany at 9:00 am (GMT+2). The indicator represents the difference between the amount of payments flowing into the country and the amount of payments leaving the country. The current account is in surplus when payments into the country exceed payments out. Otherwise, the current account is in deficit. A high reading strengthens the Euro. A low reading weakens the Euro.

Data on imports for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to grow to 0.3% from -1.6%. The data, released by the Federal Statistical Office of Germany, represents changes in the total volume of imported goods and services (purchases, grants, gifts).

Data on exports for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to grow to 0.5% from -1.6%. The data, released by the Federal Statistical Office of Germany, represents changes in the total volume of exported goods and services.

Data on trade balance for January is due in Germany at 9:00 am (GMT+2). A trade surplus is expected to increase to 19.5 billion from 18.8 billion euros. The indicator represents the difference between the value of exports and imports of goods and services. Positive values indicate exports exceed imports and imply the balance is in surplus. Otherwise, the balance is in deficit. A growth in exports has a positive impact on the country’s economy. A high reading strengthens the Euro, while a low reading weakens the Euro.

EU

The ECB announces in interest rate decision at 2:45 pm (GMT+2). The interest rate is expected to remain unchanged at 0.05%. A rate increase strengthens the Euro, while a decrease weakens the Euro.

The ECB press conference is due at 3:30 pm (GMT+2). After the interest rate decision is announced, the ECB Head comments on the recent monetary policy decision and answers questions about current economic conditions in the eurozone.

USA

Data on initial jobless claims for the week ended 4 March is due in the US at 3:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published every Thursday and allows approximating what nonfarm payrolls will be. A fall in the indicator is a positive factor for the US Dollar. A growth in the indicator, on the contrary, is considered as a negative factor.

Monthly Budget Statement is released in the US at 9:00 pm (GMT+2). The indicator represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the US Dollar, while negative values weaken the US Dollar.

New Zealand

Business PMI is due in New Zealand at 11:30 pm (GMT+2). The index is based on survey responses from purchasing managers regarding their opinion on the current state of the economy and its prospects. A reading above 50 represents a generally optimistic mood and strengthens the NZ Dollar. A reading below 50, on the contrary, represents a generally negative mood and weakens the national currency.

Germany

Non-seasonally adjusted data on current account for January is due in Germany at 9:00 am (GMT+2). The indicator represents the difference between the amount of payments flowing into the country and the amount of payments leaving the country. The current account is in surplus when payments into the country exceed payments out. Otherwise, the current account is in deficit. A high reading strengthens the Euro. A low reading weakens the Euro.

Data on imports for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to grow to 0.3% from -1.6%. The data, released by the Federal Statistical Office of Germany, represents changes in the total volume of imported goods and services (purchases, grants, gifts).

Data on exports for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to grow to 0.5% from -1.6%. The data, released by the Federal Statistical Office of Germany, represents changes in the total volume of exported goods and services.

Data on trade balance for January is due in Germany at 9:00 am (GMT+2). A trade surplus is expected to increase to 19.5 billion from 18.8 billion euros. The indicator represents the difference between the value of exports and imports of goods and services. Positive values indicate exports exceed imports and imply the balance is in surplus. Otherwise, the balance is in deficit. A growth in exports has a positive impact on the country’s economy. A high reading strengthens the Euro, while a low reading weakens the Euro.

EU

The ECB announces in interest rate decision at 2:45 pm (GMT+2). The interest rate is expected to remain unchanged at 0.05%. A rate increase strengthens the Euro, while a decrease weakens the Euro.

The ECB press conference is due at 3:30 pm (GMT+2). After the interest rate decision is announced, the ECB Head comments on the recent monetary policy decision and answers questions about current economic conditions in the eurozone.

USA

Data on initial jobless claims for the week ended 4 March is due in the US at 3:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published every Thursday and allows approximating what nonfarm payrolls will be. A fall in the indicator is a positive factor for the US Dollar. A growth in the indicator, on the contrary, is considered as a negative factor.

Monthly Budget Statement is released in the US at 9:00 pm (GMT+2). The indicator represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the US Dollar, while negative values weaken the US Dollar.

New Zealand

Business PMI is due in New Zealand at 11:30 pm (GMT+2). The index is based on survey responses from purchasing managers regarding their opinion on the current state of the economy and its prospects. A reading above 50 represents a generally optimistic mood and strengthens the NZ Dollar. A reading below 50, on the contrary, represents a generally negative mood and weakens the national currency.

Claws and Horns

News of the day. 9.03.2016

Australia

Data on investment lending for homes is due in Australia at 2:30 am (GMT+2). The indicator represents the number of long-term home construction loans. A growth in the indicator supports the Australian Dollar, while a fall weakens the national currency.

Data on home loans is due in Australia at 2:30 am (GMT+2). The indicator is expected to be down to -2.3% from 2.6%. The data represents the number of new issued home loans and is considered as one of the key indicators of the property market. A growth in the indicator strengthens the Australian Dollar, while a fall weakens the national currency.

UK

Data on industrial production for January is due in the UK at 11:30 am (GMT+2). The indicator is expected to grow to both in annual and monthly terms, to 0.1% from -0.4% and to 0.5% from -1.1%, respectively. The data represents industrial output in manufacturing, mining and utilities. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the Pound. A fall pressures the Pound.

The National Institute for Economic and Social Research releases GDP estimate for February at 5:00 pm (GMT+2). The indicator tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the Pound. A low reading, on the contrary, weakens the Pound.

Canada

The Bank of Canada releases its interest rate decision at 5:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. The interest rate is an important economic indicator which has an impact on commercial banks’ interest rates and the CAD exchange rate. A rate increase strengthens the Canadian Dollar. If the rate remains unchanged or gets cut, the national currency weakens.

New Zealand

The Reserve Bank of New Zealand releases its monetary policy statement at 10:00 pm (GMT+2). The publication provides information regarding how the Reserve Bank proposes to achieve its targets, how it proposes to formulate and implement monetary policy during the next five years and how monetary policy has been implemented since the last monetary policy statement.

The Reserve Bank of New Zealand releases its interest rate decision at 10:00 pm (GMT+2). The indicator is expected to remain unchanged at 2.5%. A rate increase strengthens the NZ Dollar, while a decrease weakens the national currency.

Australia

Data on investment lending for homes is due in Australia at 2:30 am (GMT+2). The indicator represents the number of long-term home construction loans. A growth in the indicator supports the Australian Dollar, while a fall weakens the national currency.

Data on home loans is due in Australia at 2:30 am (GMT+2). The indicator is expected to be down to -2.3% from 2.6%. The data represents the number of new issued home loans and is considered as one of the key indicators of the property market. A growth in the indicator strengthens the Australian Dollar, while a fall weakens the national currency.

UK

Data on industrial production for January is due in the UK at 11:30 am (GMT+2). The indicator is expected to grow to both in annual and monthly terms, to 0.1% from -0.4% and to 0.5% from -1.1%, respectively. The data represents industrial output in manufacturing, mining and utilities. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the Pound. A fall pressures the Pound.

The National Institute for Economic and Social Research releases GDP estimate for February at 5:00 pm (GMT+2). The indicator tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the Pound. A low reading, on the contrary, weakens the Pound.

Canada

The Bank of Canada releases its interest rate decision at 5:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. The interest rate is an important economic indicator which has an impact on commercial banks’ interest rates and the CAD exchange rate. A rate increase strengthens the Canadian Dollar. If the rate remains unchanged or gets cut, the national currency weakens.

New Zealand

The Reserve Bank of New Zealand releases its monetary policy statement at 10:00 pm (GMT+2). The publication provides information regarding how the Reserve Bank proposes to achieve its targets, how it proposes to formulate and implement monetary policy during the next five years and how monetary policy has been implemented since the last monetary policy statement.

The Reserve Bank of New Zealand releases its interest rate decision at 10:00 pm (GMT+2). The indicator is expected to remain unchanged at 2.5%. A rate increase strengthens the NZ Dollar, while a decrease weakens the national currency.

Claws and Horns

News of the day. 8.03.2016

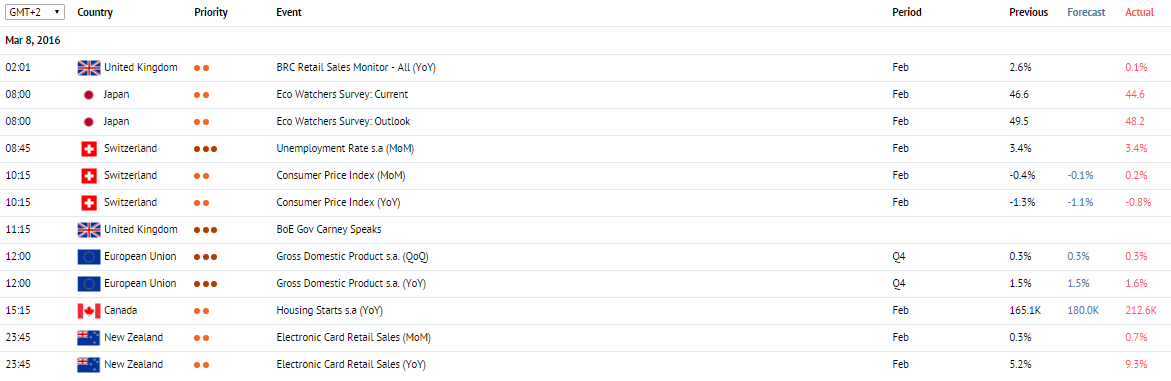

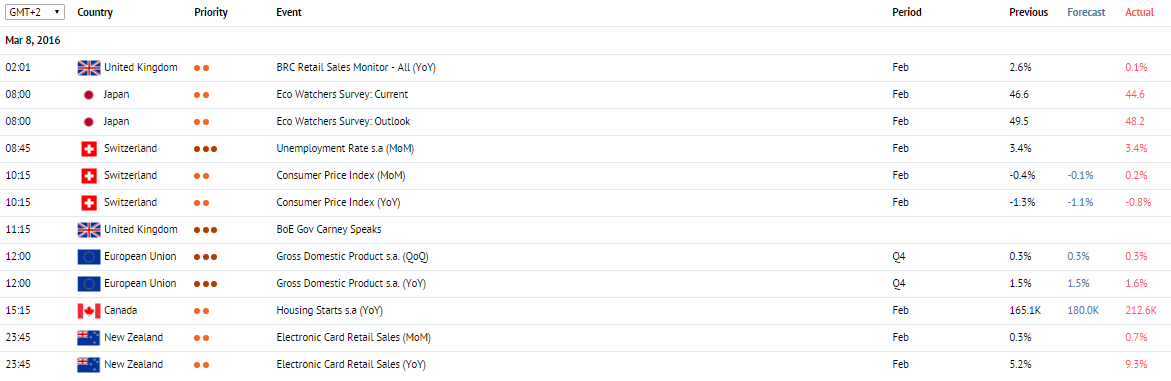

UK

The British Retail Consortium releases retails sales monitor for February at 2:01 am (GMT+2). The data represents changes in retail sales volumes for companies in the consortium. A high reading strengthens the Pound. A low reading weakens the Pound.

Japan

Eco Watchers Survey is due in Japan at 7:00 am (GMT+2). The index is based on survey responses from employees of the largest companies regarding their opinion on current and future economic trends. A result above 50 represents a positive economic outlook and strengthens the JPY. A result below 50, on the contrary, weakens the JPY suggesting that experts are generally pessimistic about short-term economic prospects.

Switzerland

Data on unemployment rate for February is due in Switzerland at 8:45 am (GMT+2). The indicator represents the percentage of the total labour force that is unemployed. A growth in unemployment rate indicates a slowdown of economic growth. A high reading weakens the Franc, while a low reading, on the contrary, strengthens the Franc.

Consumer Price Index for February is due in Switzerland at 10:00 am (GMT+2). The indicator is expected to be up to -1.1% from -1.3% and to -0.1% from -0.4% in annual and monthly terms, respectively.

EU

Data on GDP for the fourth quarter is due in the eurozone at 12:00 pm (GMT+2). The indicator is expected to remain unchanged both in annual and quarterly terms at 1.5% and 0.3%, respectively.

Canada

Data on housing starts for February is due in Canada at 3:15 pm (GMT+2). The indicator, released by the Canadian Mortgage and Housing Corporation, shows how many new single-family homes or buildings were constructed. Construction output is closely connected with personal income. Thus, a growth in the indicator represents overall economic growth. A high reading generally strengthens the Canadian Dollar. A low reading is a negative factor for the Canadian Dollar.

New Zealand

Data on electronic card retail sales is due in New Zealand at 11:45 pm (GMT+2). The indicator shows changes in the number of purchases made using debit or credit cards and represents current conditions in the retail sector. A high reading strengthens the NZ Dollar. A low reading is a negative factor for the NZ Dollar.

UK

The British Retail Consortium releases retails sales monitor for February at 2:01 am (GMT+2). The data represents changes in retail sales volumes for companies in the consortium. A high reading strengthens the Pound. A low reading weakens the Pound.

Japan

Eco Watchers Survey is due in Japan at 7:00 am (GMT+2). The index is based on survey responses from employees of the largest companies regarding their opinion on current and future economic trends. A result above 50 represents a positive economic outlook and strengthens the JPY. A result below 50, on the contrary, weakens the JPY suggesting that experts are generally pessimistic about short-term economic prospects.

Switzerland

Data on unemployment rate for February is due in Switzerland at 8:45 am (GMT+2). The indicator represents the percentage of the total labour force that is unemployed. A growth in unemployment rate indicates a slowdown of economic growth. A high reading weakens the Franc, while a low reading, on the contrary, strengthens the Franc.

Consumer Price Index for February is due in Switzerland at 10:00 am (GMT+2). The indicator is expected to be up to -1.1% from -1.3% and to -0.1% from -0.4% in annual and monthly terms, respectively.

EU

Data on GDP for the fourth quarter is due in the eurozone at 12:00 pm (GMT+2). The indicator is expected to remain unchanged both in annual and quarterly terms at 1.5% and 0.3%, respectively.

Canada

Data on housing starts for February is due in Canada at 3:15 pm (GMT+2). The indicator, released by the Canadian Mortgage and Housing Corporation, shows how many new single-family homes or buildings were constructed. Construction output is closely connected with personal income. Thus, a growth in the indicator represents overall economic growth. A high reading generally strengthens the Canadian Dollar. A low reading is a negative factor for the Canadian Dollar.

New Zealand

Data on electronic card retail sales is due in New Zealand at 11:45 pm (GMT+2). The indicator shows changes in the number of purchases made using debit or credit cards and represents current conditions in the retail sector. A high reading strengthens the NZ Dollar. A low reading is a negative factor for the NZ Dollar.

Claws and Horns

News of the day. 7.03.2016

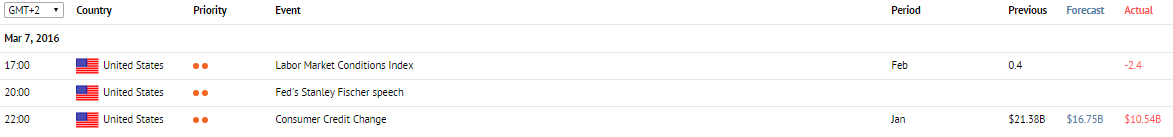

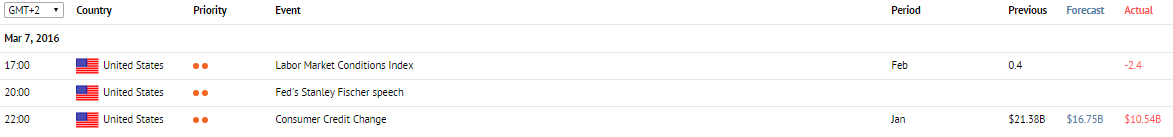

USA

Data on the Labour Market Conditions Index for February is due in the US at 05:00 pm (GMT+2). The index is calculated by Fed economists and is made up of 19 different indicators describing the labour market. The index is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Consumer Credit Change for January is due in the US at 10:00 pm (GMT+2). The index is expected to fall from 21.27 to 18.60 billion USD. Represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

USA

Data on the Labour Market Conditions Index for February is due in the US at 05:00 pm (GMT+2). The index is calculated by Fed economists and is made up of 19 different indicators describing the labour market. The index is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Consumer Credit Change for January is due in the US at 10:00 pm (GMT+2). The index is expected to fall from 21.27 to 18.60 billion USD. Represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Claws and Horns

News of the day. 4.03.2016

USA

Data on trade balance for January is due in the US at 3:30 pm (GMT+2). A trade deficit is expected to increase to 44.00 billion from 43.36 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the US Dollar. Negative values represent the balance deficit and weaken the US Dollar.

Data on nonfarm payrolls for February is due in the US at 3:30 pm (GMT+2). The indicator is expected to be up to 190K from 151K. It is one of the main indicators of employment in the US that represents the number of employees in non-agricultural sectors. The data has a high impact on the market. A high reading represents employment growth and strengthens the US Dollar. A low reading weakens the US Dollar.

Data on unemployment rate for February is due in the US at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 4.9%. It is one of the key macroeconomic indicators that represents the share of unemployment in the total labour force. A growth in the index weakens the US Dollar. A fall in the index strengthens the US Dollar.

Canada

Ivey PMI for February is due in Canada at 5:00 pm (GMT+2). The index, released by the Richard Ivey School of Business, is an indicator of business conditions. A reading above 50 represents an increase in business activity and strengthens the Canadian Dollar. A reading below 50 represents a decline and weakens the Canadian Dollar.

USA

Data on trade balance for January is due in the US at 3:30 pm (GMT+2). A trade deficit is expected to increase to 44.00 billion from 43.36 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the US Dollar. Negative values represent the balance deficit and weaken the US Dollar.

Data on nonfarm payrolls for February is due in the US at 3:30 pm (GMT+2). The indicator is expected to be up to 190K from 151K. It is one of the main indicators of employment in the US that represents the number of employees in non-agricultural sectors. The data has a high impact on the market. A high reading represents employment growth and strengthens the US Dollar. A low reading weakens the US Dollar.

Data on unemployment rate for February is due in the US at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 4.9%. It is one of the key macroeconomic indicators that represents the share of unemployment in the total labour force. A growth in the index weakens the US Dollar. A fall in the index strengthens the US Dollar.

Canada

Ivey PMI for February is due in Canada at 5:00 pm (GMT+2). The index, released by the Richard Ivey School of Business, is an indicator of business conditions. A reading above 50 represents an increase in business activity and strengthens the Canadian Dollar. A reading below 50 represents a decline and weakens the Canadian Dollar.

Claws and Horns

News of the day. 3.03.2016

Australia

Data on trade balance is due in Australia at 2:30 am (GMT+2). The indicator is expected to be up to -3100 million from -3535 million. The data represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the Australian Dollar. Negative values indicate the balance deficit and weaken the Australian Dollar.

Data on imports and exports are due in Australia at 2:30 am (GMT+2). The indicators represent changes on the volume of goods and services imported into exported from the country.

Germany

Markit services PMI is due in Germany at 10:55 am (GMT+2). In February, the indicator is expected to remain unchanged at 55.1 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50 is perceived negative and weakens the Euro.

UK

Markit services PMI is due in the UK at 11:30 am (GMT+2). In February, the indicator is expected to decline to 55.1 from 55.6 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived positive and strengthens the Pound. A reading below 50 is perceived negative and weakens the Pound.

USA

Data on initial jobless claims for the week ended 26 February is due in the US at 3:30 pm (GMT+2). The indicator is expected to come in at 271K from 272K in the previous week. The data is released every Thursday and represents the number of new unemployment claims that allows approximating what nonfarm payrolls will be. A fall in the index strengthens the US Dollar. A growth in the index, on the contrary, weakens the US Dollar.

Data on factory orders for January is due in the US at 5:00 pm (GMT+2). On a monthly basis, the indicator is expected to grow to 2.0% from -2.9%. The data represents changes in the volume of factory orders and allows estimating the pace of the growth of the manufacturing sector. A growth in the indicator supports the US Dollar. A fall, on the contrary, weakens the US Dollar.

ISM non-manufacturing PMI is due in the US at 5:00 pm (GMT+2). In February, the indicator is expected to decline to 53.2 from 53.5 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50, on the contrary, indicates a slowdown of the economy.

Australia

Data on trade balance is due in Australia at 2:30 am (GMT+2). The indicator is expected to be up to -3100 million from -3535 million. The data represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the Australian Dollar. Negative values indicate the balance deficit and weaken the Australian Dollar.

Data on imports and exports are due in Australia at 2:30 am (GMT+2). The indicators represent changes on the volume of goods and services imported into exported from the country.

Germany

Markit services PMI is due in Germany at 10:55 am (GMT+2). In February, the indicator is expected to remain unchanged at 55.1 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived positive and strengthens the Euro. A reading below 50 is perceived negative and weakens the Euro.

UK

Markit services PMI is due in the UK at 11:30 am (GMT+2). In February, the indicator is expected to decline to 55.1 from 55.6 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived positive and strengthens the Pound. A reading below 50 is perceived negative and weakens the Pound.

USA

Data on initial jobless claims for the week ended 26 February is due in the US at 3:30 pm (GMT+2). The indicator is expected to come in at 271K from 272K in the previous week. The data is released every Thursday and represents the number of new unemployment claims that allows approximating what nonfarm payrolls will be. A fall in the index strengthens the US Dollar. A growth in the index, on the contrary, weakens the US Dollar.

Data on factory orders for January is due in the US at 5:00 pm (GMT+2). On a monthly basis, the indicator is expected to grow to 2.0% from -2.9%. The data represents changes in the volume of factory orders and allows estimating the pace of the growth of the manufacturing sector. A growth in the indicator supports the US Dollar. A fall, on the contrary, weakens the US Dollar.

ISM non-manufacturing PMI is due in the US at 5:00 pm (GMT+2). In February, the indicator is expected to decline to 53.2 from 53.5 points. The index is based on survey responses from executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50, on the contrary, indicates a slowdown of the economy.

Claws and Horns

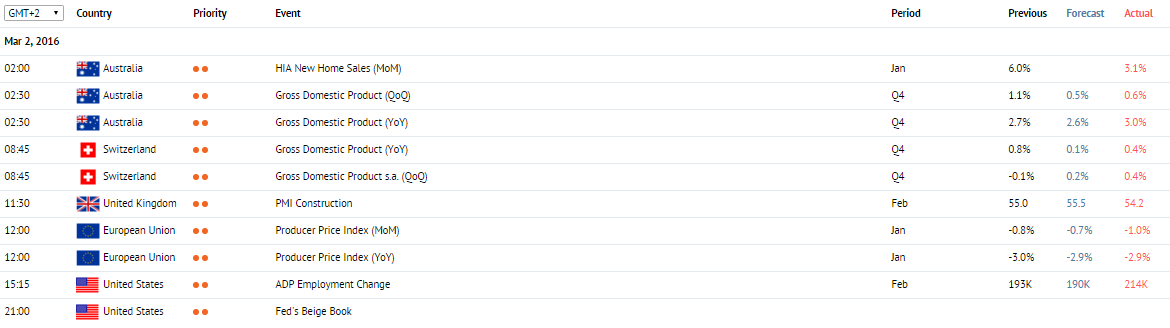

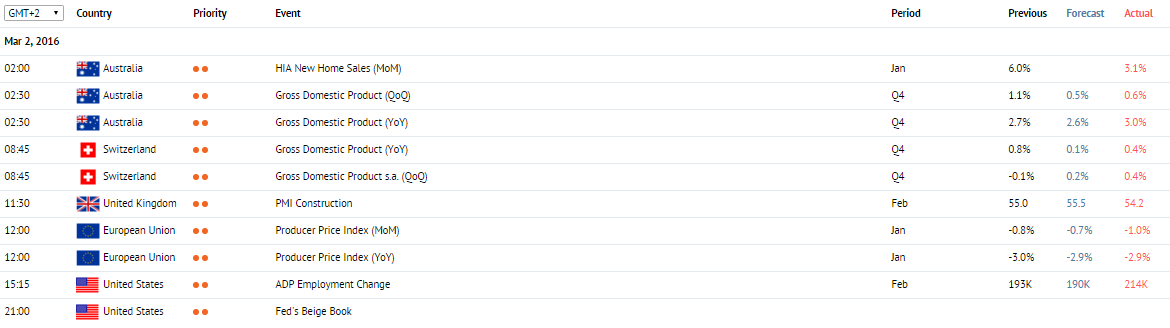

News of the day. 2.03.2016

Australia

Data on the GDP for the fourth quarter of 2015 is due at 03:30 am (GMT+2) in Australia. On a quarter-to-quarter basis, the index is expected to fall from 0.9% to 0.5%. Represents the value of all goods and services created in Australia and indicates the pace of a growth/decline of the economy. A high reading strengthens the AUD. A low reading weakens the AUD.

Switzerland

Data on the GDP for the fourth quarter of 2015 is due at 08:45 am (GMT+2) in Switzerland. On a quarter-to-quarter basis, the index is expected to grow from 0.0% to 0.2%, and on a year-to-year basis, it will fall from 0.8% to 0.1%. Represents the value of all goods and services created in Switzerland and indicates the pace of a growth/decline of the economy. A high reading strengthens the CHF. A low reading weakens the CHF.

UK

Data on the PMI Construction for February is due at 11:30 am (GMT+2) in the UK. The index is expected to grow from 55.0 to 55.5 points.

EU

Data on the Producer Price Index for January is due at 12:00 pm (GMT+2) in the EU. According to forecasts, on a month-to-month basis the index will grow from -0.8% to -0.7%, and on a year-to-year basis, it will increase from -3.0% to -2.9%. The index represents the price change for products created in the eurozone. A growth in the index usually strengthens the EUR. A fall in the index weakens the EUR.

USA

Data on the ADP Employment Change for February is due at 03:15 pm (GMT+2) in the US. According to forecasts, the index will fall from 205 to 185 thousands. The index represents employment change in non-agricultural sectors and is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Data on the Fed’s Beige Book is due at 09:00 pm (GMT+2) in the US. The report is prepared by the 12 Federal Reserve Banks and evaluates current economic conditions in the US. Optimistic commentaries strengthen the USD. Pessimistic commentaries weaken the USD.

Australia

Data on the GDP for the fourth quarter of 2015 is due at 03:30 am (GMT+2) in Australia. On a quarter-to-quarter basis, the index is expected to fall from 0.9% to 0.5%. Represents the value of all goods and services created in Australia and indicates the pace of a growth/decline of the economy. A high reading strengthens the AUD. A low reading weakens the AUD.

Switzerland

Data on the GDP for the fourth quarter of 2015 is due at 08:45 am (GMT+2) in Switzerland. On a quarter-to-quarter basis, the index is expected to grow from 0.0% to 0.2%, and on a year-to-year basis, it will fall from 0.8% to 0.1%. Represents the value of all goods and services created in Switzerland and indicates the pace of a growth/decline of the economy. A high reading strengthens the CHF. A low reading weakens the CHF.

UK

Data on the PMI Construction for February is due at 11:30 am (GMT+2) in the UK. The index is expected to grow from 55.0 to 55.5 points.

EU

Data on the Producer Price Index for January is due at 12:00 pm (GMT+2) in the EU. According to forecasts, on a month-to-month basis the index will grow from -0.8% to -0.7%, and on a year-to-year basis, it will increase from -3.0% to -2.9%. The index represents the price change for products created in the eurozone. A growth in the index usually strengthens the EUR. A fall in the index weakens the EUR.

USA

Data on the ADP Employment Change for February is due at 03:15 pm (GMT+2) in the US. According to forecasts, the index will fall from 205 to 185 thousands. The index represents employment change in non-agricultural sectors and is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Data on the Fed’s Beige Book is due at 09:00 pm (GMT+2) in the US. The report is prepared by the 12 Federal Reserve Banks and evaluates current economic conditions in the US. Optimistic commentaries strengthen the USD. Pessimistic commentaries weaken the USD.

: