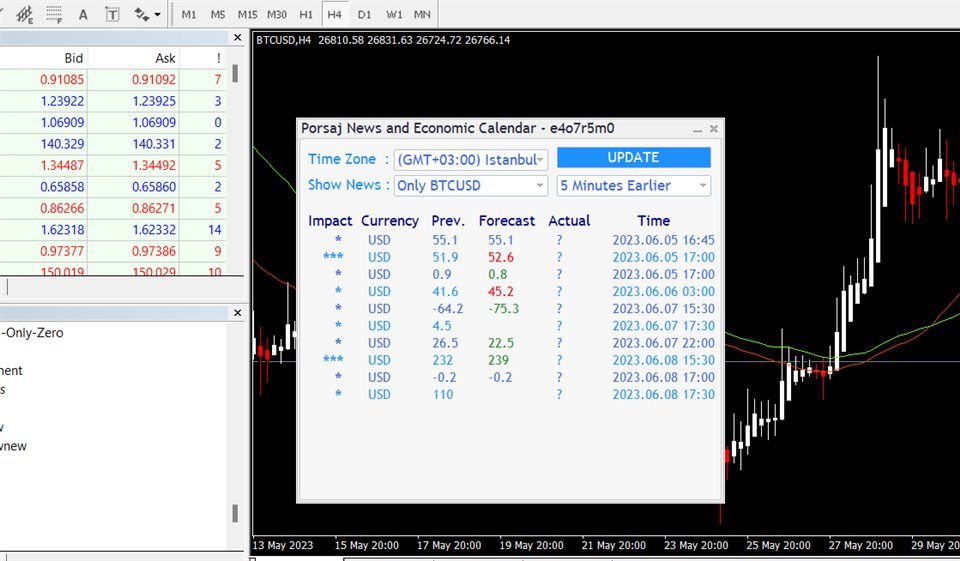

Porsaj News and Economic Calendar

- Утилиты

- Jan Bungeroth

- Версия: 8.7

- Обновлено: 6 февраля 2024

- Активации: 5

Note:

After installation, please go to Tools>Options>Expert Advisors and add https://porsaj.com to 'Allow WebRequest for listed URL'.

Still Problem?! Please check Internet connection!

An economic calendar in the context of forex refers to a tool or resource that provides information about upcoming economic events, indicators, and data releases that can potentially impact the financial markets, particularly the foreign exchange market. It helps traders stay informed about key economic announcements and plan their trading strategies accordingly.

Here are some key points about the economic calendar in forex:

-

Event Listings: The economic calendar displays a schedule of important economic events such as central bank meetings, interest rate decisions, GDP releases, employment reports, inflation data, retail sales figures, and more. These events are typically categorized by country, date, and level of importance.

-

Impact Assessment: Each event listed on the economic calendar is accompanied by an impact assessment or volatility indicator. This indicates the potential influence of the event on the market. High-impact events tend to have a greater effect on market volatility and can lead to significant price movements.

-

Market Expectations: The economic calendar often includes market consensus or expectations for the upcoming economic data or events. These expectations are based on forecasts made by economists, analysts, and financial institutions. Traders use this information to compare actual results with market expectations and gauge market sentiment.

-

Historical Data: Economic calendars may provide historical data, allowing traders to review past releases and their impact on the market. This historical perspective can help traders assess the significance of upcoming events and anticipate potential market reactions.

-

Currency Relevance: The economic calendar allows traders to filter events by currency or country, enabling them to focus on specific currency pairs that may be influenced by those events. It helps traders identify key events that are most likely to impact the currencies they are trading.

-

Real-Time Updates: Many economic calendars offer real-time updates, ensuring that traders have the latest information at their disposal. This is particularly important for time-sensitive releases, as traders can react quickly to market-moving events.

-

Trading Strategy Planning: By referring to the economic calendar, traders can plan their trading strategies in advance. They can avoid trading during high-impact events if they prefer to stay out of volatile market conditions or, conversely, actively seek trading opportunities during such events by anticipating market reactions.

It's important to note that while the economic calendar provides valuable information, it is just one tool among many that traders use to make informed decisions. Traders should consider other factors, such as technical analysis, market sentiment, and risk management, in conjunction with the economic calendar to formulate a comprehensive trading strategy.

Пользователь не оставил комментарий к оценке