Early Retirement MT5

- Эксперты

- Jesper Christensen

- Версия: 3.7

- Обновлено: 25 июня 2023

- Активации: 10

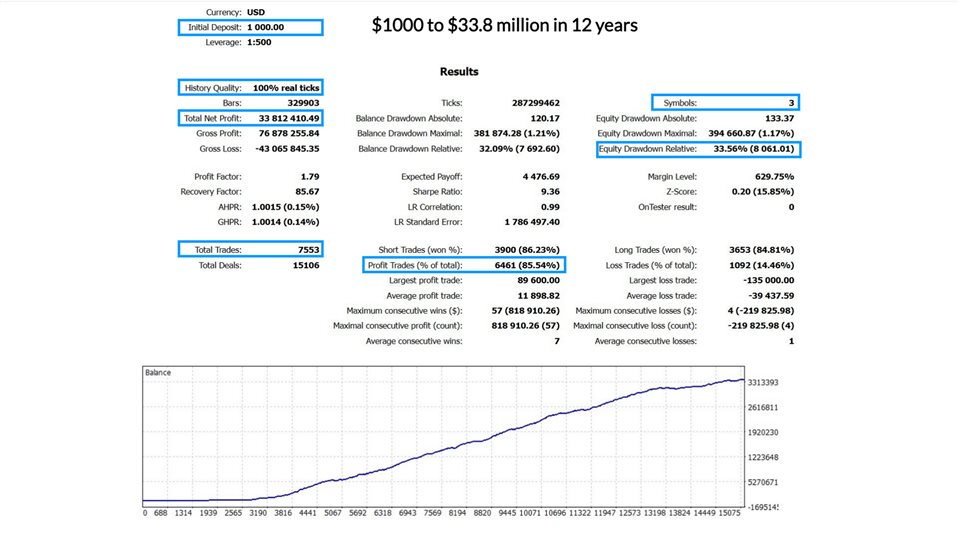

After years of perfecting breakout trading strategies I am ready to share my latest development. A breakout system that uses machine learning (ML) to constantly adapt to the current market behavior and scan for the highest probability setups.

Breakout trading is a tried and tested strategy, but as anything in trading, it does come with several challanges. The challenge as a manual trader is to locate the correct swing points, where the probability of a break out is the highest. It is subjective and discretioary, and let's be honest, few traders are able to stick to a discretionary trading strategy in the long run. The challenge with using algorithms to locate the optimal swing points, is that a computer program is static and does not have the creative response capabilities humans possess.

Early Retirement EA solves these issues by using machine learning (ML) to scan for previous patterns in the price data with high likelihood of repeating in the future, ie. locating the optimal price points where a breakout is the most likely to take place based on statistical analysis of previous market behaviour. It provides the best of both discretionary and algorhitmic trading. It always follows the strategy without deviations but at the same time it is capable to adjust to market dynamics and locate entry areas with the highest probability of making profits in a dynamic and creative way, just like a human trader would.

Early Retirement EA:

Does not use martingale, grid or any other risky strategies.

Every position has a stop loss and take profit order.

It is trained to trade on EURUSD, USDJPY and GBPUSD, but it can be used on any instrument.

Is safe on all account sizes. Start with as little as 100$/€ account deposit.

In the next update (expected by mid-end July 2023) a "trade panel" will be added as well as a "prop firm challange mode". This mode will include settings optimized for passing prop firm challanges.

A news filter will also be added in the next update so users who trade on prop firms, on which trading during news events is prohibited, can use the EA without manually stopping and starting the EA.

This is a true "long term - set and forget" EA. No need for the trader to interfere. But be aware that this system will go through periods of stagnation and drawdown. It cannot be avoided, even when using sophisticated machine learning principles to analyse the market. It is advised to use several non-correlated trading systems to minimize these periods of drawdown and equity-stagnation. However, as Early Retirement EA trades three different symbols, drawdowns are very balanced and will not drain the account, even when using moderate to high risk settings.

To test the EA:

As with any scalping system, to get accurate testing results it is necessary to use a custom EURUSD symbol with 100% tick data to run the test on. Using broker-provided history data will not be sufficient to test this EA as there are lots of gaps in this data and Early Retirement EA trades at price levels where price typically moves very fast and the amount of ticks per bar is much higher than average. Here is a guide on how to test Early Retirement EA: https://www.mql5.com/en/blogs/post/753185To use the EA:

1: Load the EA onto a M15 EURUSD chart.

2: In the input settings set the first input called “enable set and forget mode” to true.

3: Make sure the symbol tickers are written as they appear in your market watch. On most brokers this will be in thr format "EURUSD", but some brokers use a suffix, for exampel EURUSD.ecn.

4: Adjust the risk settings to fit your needs. Below are some examples:

Low risk/reward: 3% on EURUSD and 2% on GPBUSD and 2% on USDJPY. (use these settings if you have 1:30 leverage)

Moderate risk/reward: 5% on EURUSD, 3-4% on GBPUSD and USDJPY .(you need minimum 1:50 leverage with these settings)

High risk/reward = 8% on EURUSD, 5% on GBPUSD and USDJPY. (you need minimum 1:100 leverage with these settings)

Extreme risk/reward = 12% on EURUSD, 8% on GBPUSD and USDJPY (you need minimum 1:200 leverage with these settings)

5: Click ok, and the EA will start trading once in trading session. You can open GBPUSD and USDJPY charts so you can visually see the trades it takes on these pairs, but you do not need to do so.

Contact me after purchase if you have any questions related to setting up the EA. I can also tell you which risk settings I suggest based on your broker and account leverage.

Use the EA on a true ECN broker.

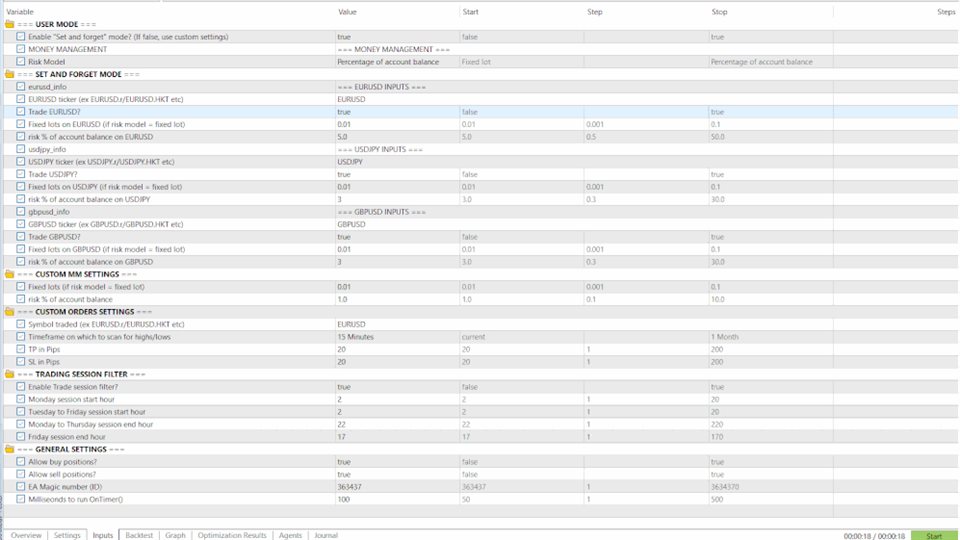

Explanation of the user inputs:

| === USER MODE === : | |

| Enable “Set and forget” mode | Set to true to use the EA as it is intended. If it is set to false you can create your own custom settings |

| === MONEY MANAGEMENT === | |

| Risk Model | Choose between risking a fixed lot or a percentage of your account balance per position |

| === SET AND FORGET MODE === | Below you can choose risk settings for each symbol traded using the “set and forget” mode. |

| EURUSD ticker (ex EURUSD.r/EURUSD.HKT etc) | Write the symbol ticker of EURUSD as it is written in your brokers marketwatch. |

| Trade EURUSD | Set to true to trade EURUSD, set to false to not trade EURUSD |

| Fixed lots on EURUSD | If the Risk Model is set to “fixed lot”, then this volume will be used on every position for EURUSD |

| risk % of account balance on EURUSD | If risk Model is set to “Percentage” then this input will be what you risk in percentage terms based on your balance per trade on EURUSD |

| USDJPY ticker (ex USDJPY .r/USDJPY .HKT etc) | Write the symbol ticker of USDJPY as it is written in your brokers marketwatch. |

| Trade USDJPY | Set to true to trade USDJPY , set to false to not trade USDJPY |

| Fixed lots on USDJPY | If the Risk Model is set to “fixed lot”, then this volume will be used on every position for USDJPY |

| risk % of account balance on USDJPY | If risk Model is set to “Percentage” then this input will be what you risk in percentage terms based on your balance per trade on USDJPY |

| GBPUSD ticker (ex GBPUSD .r/GBPUSD .HKT etc) | Write the symbol ticker of GBPUSD as it is written in your brokers marketwatch. |

| Trade GBPUSD | Set to true to trade GBPUSD, set to false to not trade GBPUSD |

| Fixed lots on GBPUSD | If the Risk Model is set to “fixed lot”, then this volume will be used on every position for GBPUSD |

| risk % of account balance on GBPUSD | If risk Model is set to “Percentage” then this input will be what you risk in percentage terms based on your balance per trade on GBPUSD |

| === CUSTOM MM SETTINGS === | The below settings will be used if |

| Fixed lots | If the Risk Model is set to “fixed lot”, then this volume will be used on every position for the symbol you choose |

| risk % of account balance | If risk Model is set to “Percentage” then this input will be what you risk in percentage terms based on your balance per trade on the symbol you choose |

| === CUSTOM ORDERS SETTINGS === | |

| Symbol traded | Insert the symbol you want to trade with custom settings here |

| Timeframe on which to scan for highs/lows | Which timeframe is used to look for swing highs and lows |

| TP in Pips | Take profit order in pips from entry |

| SL in Pips | Stop loss order in pips from entry |

| === TRADING SESSION FILTER === | |

| Enable Trade session filter? | Set to true to enable the session filter |

| Monday session start hour | Monday session start hour |

| Tuesday to Friday session start hour | Tuesday to Friday session start hour |

| Monday to Thursday session end hour | Monday to Thursday session end hour |

| Friday session end hour | Friday session end hour |

| === GENERAL SETTINGS === | |

| Allow buy positions? | Set to true to allow the EA to place buy orders |

| Allow sell positions? | Set to true to allow the EA to place sell orders |

| EA Magic number (ID) | EA Magic number (ID) |

Positive Review !