LL Hedge EA MT5

- Эксперты

- Leopoldo Licari

- Версия: 3.2

- Обновлено: 14 июля 2024

- Активации: 5

REMEMBER THAT TO OBTAIN POSITIVE RESULTS YOU MUST USE A RAW ACCOUNT WITH LOW SPREADS, TRADE ON SYMBOLS WITH LOWER SPREADS BETWEEN BID/ASK PRICE, ALWAYS FOLLOW THESE 3 FUNDAMENTAL RULES IN YOUR SET:

- TP AND DISTANCE MUST HAVE THE SAME VALUE

- SL MUST ALWAYS HAVE A DOUBLE VALUE OF TP AND DISTANCE

- LOT MULTIPLIER MUST HAVE A VALUE GREATER THAN 2 (BETTER 3)

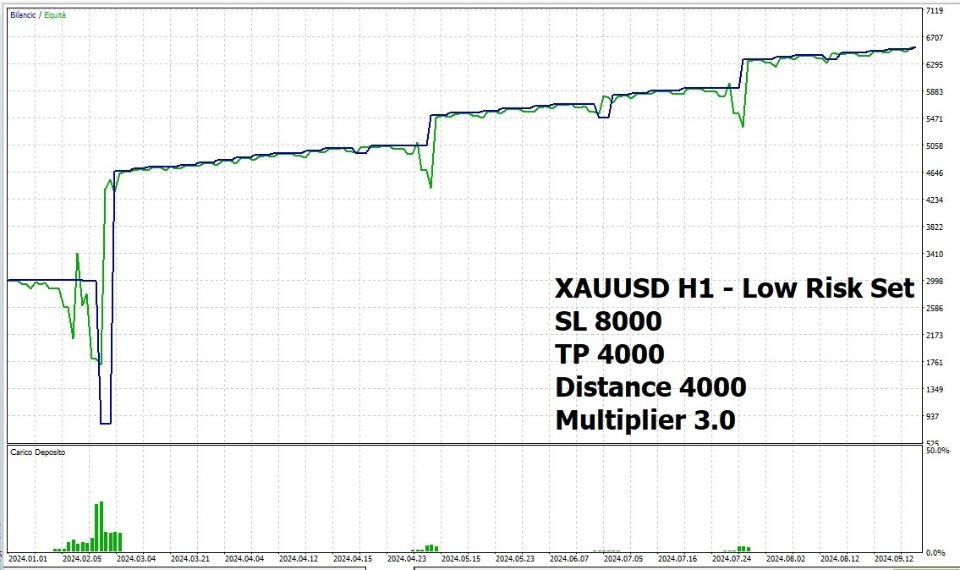

EURUSD M15 Set -> lotsize 0.01 | SL 50 | TP & Distance 25 | Coefficient 2.5 | Max Orders 20 | Money SL (according to your balance) - Recommended Deposit 10.000$

XAUUSD M15 Set (High Risk/Reward) -> lotsize 0.01 | SL 1500 | TP & Distance 750 | Coefficient 3 | Max Orders 20 | Money SL (according to your balance) - Recommended Deposit above 10.000$

XAUUSD H1 Set (Medium Risk/Reward)-> lotsize 0.01 | SL 4000 | TP & Distance 2000| Coefficient 3 | Max Orders 20 | Money SL (according to your balance) - Recommended Deposit 10.000$

XAUUSD H1 Set (Low Risk/Reward)-> lotsize 0.01 | SL 8000 | TP & Distance 4000| Coefficient 3 | Max Orders 20 | Money SL (according to your balance) - Recommended Deposit 3.000$

LL Hedge EA is an expert advisor based on a very simple hedging strategy.

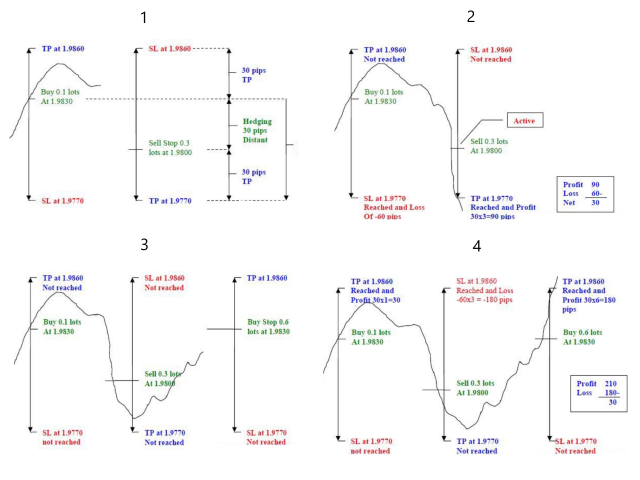

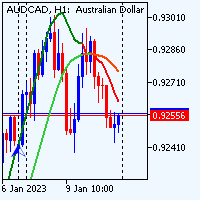

The hedging strategy works like this: the EA open a position in the trend direction (identified via MA cross). A few milliseconds after placing the Buy market order, the EA places a Sell Pending Stop with the selected lot multiplier and distance.

The TP and the SL are reversed for both orders, so if the first TP of the Buy is not reached, and the price goes down, the Sell Stop become an active Sell.

So when you hit the SL of the first Buy, you also hit the TP of the Sell, which is 2 o 3 times bigger than the SL, according to your selected multiplier.

If also the Sell TP is not reached by the market price, a Buy Stop Pending is placed over the original Buy entry, so everywhere the market wants to go, you also hit SL and TP at the same time... And TPs are always bigger than SLs.

An example of settings for TP, SL and Distance is a constant ratio of 25/50/25 or 50/100/50 for forex pairs, or 1000/2000/1000 for Gold. So TP and Distance will be the same value, then the SL will always be 2 times TP/Distance values.

You can also experiment by yourself to find alternative settings that suits your trading target.

The crucial point of this strategy is to find a time period when the market will move enough. So you should prefer high volatility pairs and assets, than a ranging one.

Also money management is the second key, so you have to choose a low start lot to let the EA open larger pending orders, I suggest 0.01 cause you also have to consider a multiplier of 2.5 or 3.0 for each consecutive order.

See images below for a visual explanation of the strategy.

Here are the input settings:

- Autotrade: true by default, the EA opens positions automatically. I suggest to use this function under your personal supervision. If you choose false, you have 2 buttons on the panel to start open a position.

- Initial Lotsize: is the lot of the first trade, both for autotrade or manual mode

- SL: here you can input the SL of every order in Pips (this value should be at least double than TP and Distance)

- TP: here you can input the TP of every order in Pips (this value should be the same as Distance and at least half than SL)

- Distance: here you can input the distance in pips inbetween hedging orders. Please note that this value should be the same as TP value, and also that this is your Drawdown area in points.

- Lot Multiplier: this is the coefficient for next pending order. I suggest to use 2 o 3, depends by your balance, just to avoid too much request.

- Max Orders: max numbers of open orders (both buy and sell)

- Money SL: here you can input the max loss you would have on a cycle. Value must be negative

Good tool, simplicity and efficiency combined, works well, and the the support has been great.