KT ROC Divergence MT5

- Индикаторы

- KEENBASE SOFTWARE SOLUTIONS

- Версия: 1.0

- Активации: 5

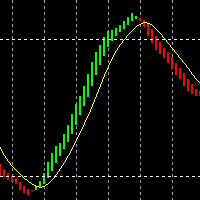

KT ROC divergence shows the regular and hidden divergences build between the price and Rate of change oscillator. Rate of change (ROC) is a pure momentum oscillator that calculates the change of percentage in price from one period to another. It compares the current price with the price "n" periods ago.

ROC = [(Close - Close n periods ago) / (Close n periods ago)] * 100

There is an interesting phenomenon associated with ROC oscillator. In ROC territory there is no upward limit, but there is a downside limit.

Features

- Marks regular and hidden divergences between the price and oscillator.

- Unsymmetrical divergences are discarded for better accuracy and lesser clutter.

- Support trading strategies for trend reversal and trend continuation.

- Divergences can be easily embedded in Expert Advisors.

- Can be used for entries as well as for exits.

- All Metatrader alerts are available.

What is the Divergence exactly?

Generally speaking, if the price is making higher highs, then oscillator should also be making higher highs. If the price is making lower lows, then oscillator should also be making lower lows.

When this normal behavior is not followed, that means the price and oscillator are diverging from each other.

There are two types of divergence:

Regular Bullish Divergence: When the price is making lower lows, but the oscillator is making higher lows.

Regular Bearish Divergence: When the price is making higher highs, but the oscillator is making lower highs.

Hidden Bullish Divergence: If the price is making higher lows, but the oscillator is making lower lows.

Hidden Bearish Divergence: If the price is making the lower highs, but the oscillator is making higher highs.

"Regular divergence is used to identify the trend reversals, and hidden divergence is used to determine the trend continuation."