Virtual Exchange Reserve Equity Monitor

- Утилиты

- Kevin Peter Abate

- Версия: 1.1

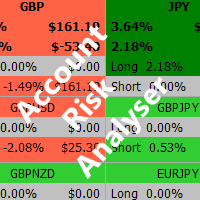

Virtual Exchange Reserve Equity Monitor

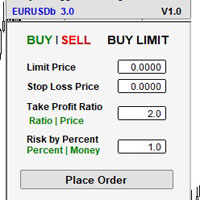

In an environment where exchanges offer increasingly high leverage ratios, it is all the more important for traders to tightly regulate their level of equity. This software is designed to be run in the background on any virtual private server that can run Meta Trader 4/5. It implements basic equity control functions ahead of the broker---allowing users to set their own equity trailing stop, an equity limit to lock-in a certain profit margin, and a universal stop that does not allow any individual position to incur a loss of equity greater than a certain percent of the account's equity.

The Virtual Exchange Reserve project is not affiliated with the government of any country, the central bank of any country, the operators of any currency, commodity or stock exchange, the developers of Bitcoin or any other cryptocurrency, Metaquotes Ltd., the developers of Meta Trader, or any regulatory agency. This software is provided "as is" and it is the user's own responsibility to use it correctly. This software is not programmed to open any positions or place any orders on behalf of the user; it is programmed to both close individual positions based on losses exceeding a set percent of the account's equity and to liquidate all the positions in an account, based on equity conditions decided by the user, rather than the broker.

Parameters

- inputStopPercent - Sets the maximum loss that any one position may incur at any time in terms of a percentage of account equity at that time.

- inputEquityLimit - Sets the percentage of equity gained, in terms of the account equity when the equity monitor was started, that will trigger the liquidation of all open positions in the account.

- inputTrailingStop - Sets the percentage of equity below the maximum equity attained after the equity monitor was started, that will trigger the liquidation of all open positions in the account.

Output

The software is written as a script for Meta Trader 4, which means that it cannot be back-tested like an "expert advisor". However, this also means that the output will appear in the appropriately named Experts tab of the Terminal sub-window that, by default, appears at the bottom of the screen. When the script is "executed on a chart", the script will begin by displaying the message "Equity monitor started..." and will continue to run until the script is removed from the chart or otherwise stopped. After starting, the software will then output the initial equity, the limit above current account equity at which all open positions will be closed, and the initial level of equity at which the equity trailing stop will be triggered and all open positions will be closed. If all of the open positions are closed by either the equity limit or the equity trailing stop, all pending orders will be deleted as well, so that the balance is fixed and no more positions will be "floated" once either level of equity is reached. It was designed this way, so that in the event that a stop is triggered that incurs a loss, no positions may be opened by pending orders, triggering subsequent equity stop events, before the user has the opportunity to resume trading activity in the account.

When the account value climbs into profitability, the output will include notifications that the "peak" equity level has increased and that the level of equity triggering the equity trailing stop was likewise increased. Of course, the output will also include notifications when the equity limit has been achieved and if the equity trailing stop was triggered. At that point the account will be entirely "static" with no open positions or pending orders. The new equity limit and stop levels will be re-calculated based on the final balance when the account is "static".

Major Caveat

Be sure to check that the price of the spread for the symbol and volume being traded is less than the maximum loss allowed for any individual position, before attempting to open a position in that symbol and at that volume, or the position could be liquidated immediately. It is the responsibility of the user to check for this condition while using the Virtual Exchange Reserve Equity Monitor.

CONCLUSION

Virtual Exchange Reserve implements reverse margin call capability for all of its software.