AGS Scalping 2

- Эксперты

- Filip Valkovic

- Версия: 2.41

- Обновлено: 14 ноября 2022

- Активации: 20

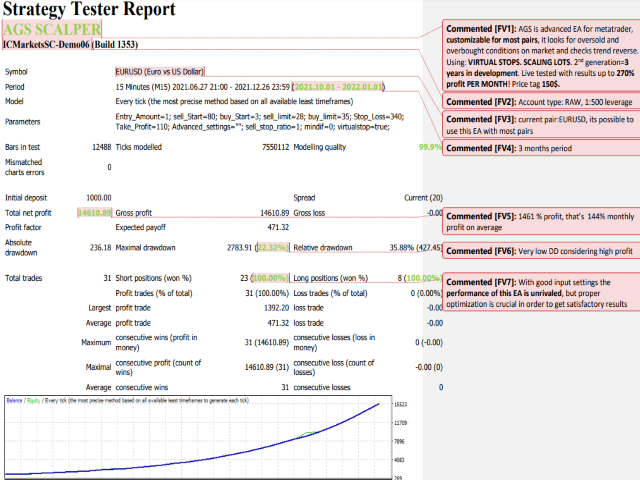

AGS Scalper 2 is a powerful and versatile trading robot with very customizable risk/profit

Trading strategy: identification of overbought and oversold conditions of the market, and checking for trend reverse

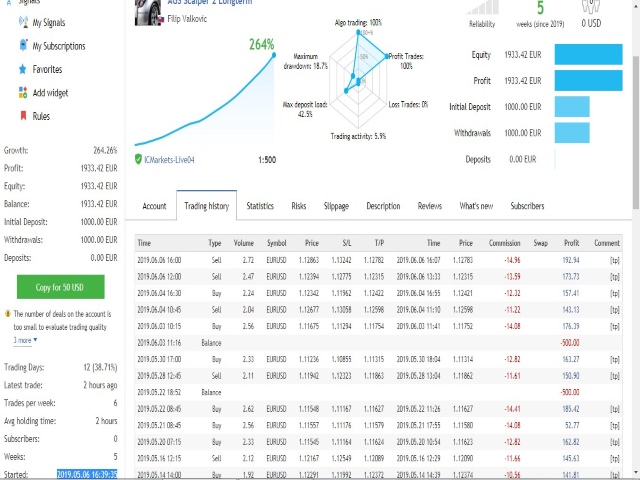

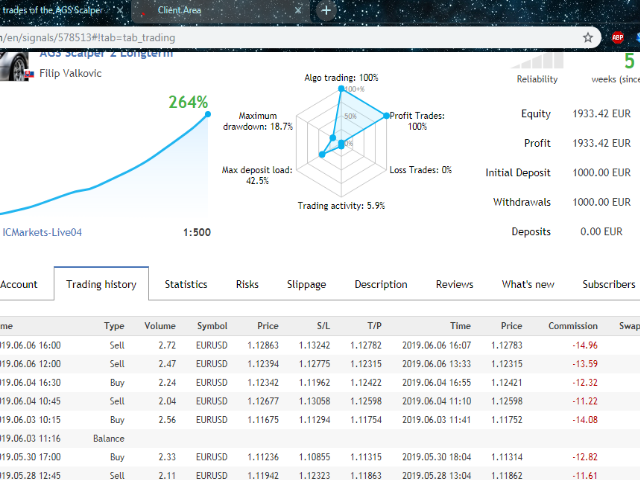

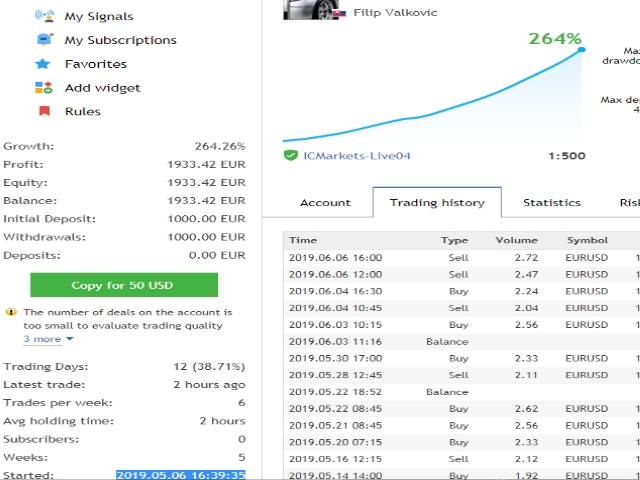

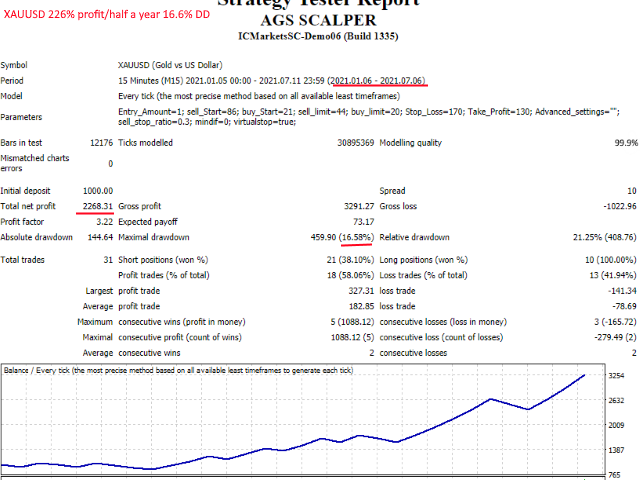

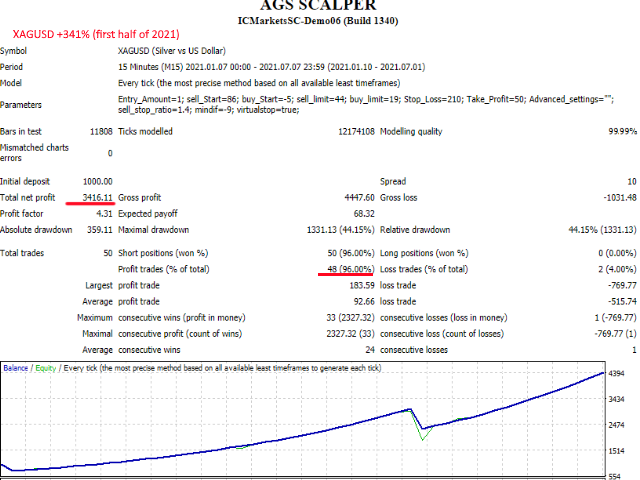

Just look at the first screenshot. I’ve made 264% profit per month!

- First month using this EA, I achieved win ratio 100% with maximal DD 18%. It was just from one pair, this EA can run on more pairs, maximizing profit and minimalizing risk.

- It was just the first version of AGS, it only got more complex and more capable since then, getting many impactful upgrades.

- I don’t know if you need to hear anything else. Its real, its here, and it is up to you to take the opportunity.

Main advantages:

- Powerful and profitable! – much higher profits than most EAs available on market

- Flexible - Can be used with most major/minor pairs and metals, optimization of input is needed to best fit targeted pair

- Every order with VIRTUAL Take Profit and Stop Loss! (USE VPS!)

- Cheap, really price is just symbolic for the value it offers!

- Using multi timeframes, indicators and machine learning to best identify market conditions

- No scam! – I was developing and testing this EA for years (live trading and backtracking as well) and I wish it could work so well for other people too!

Disadvantages:

- May be hard to use at start -need to optimize input to fit targeted pair, and it may take some time to learn how to optimize most effectively

- optimization every few months may be required!!!

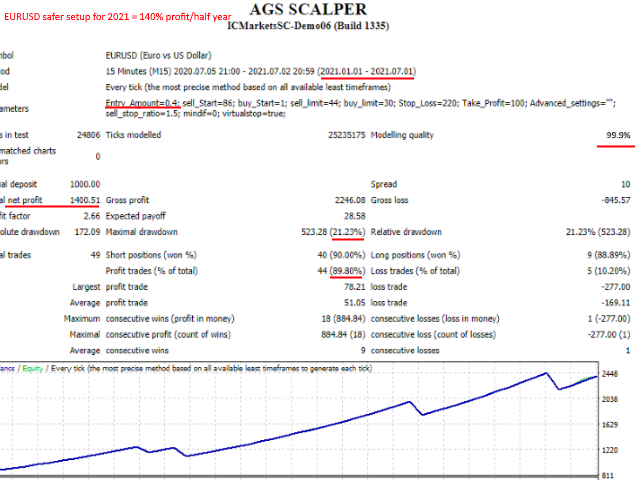

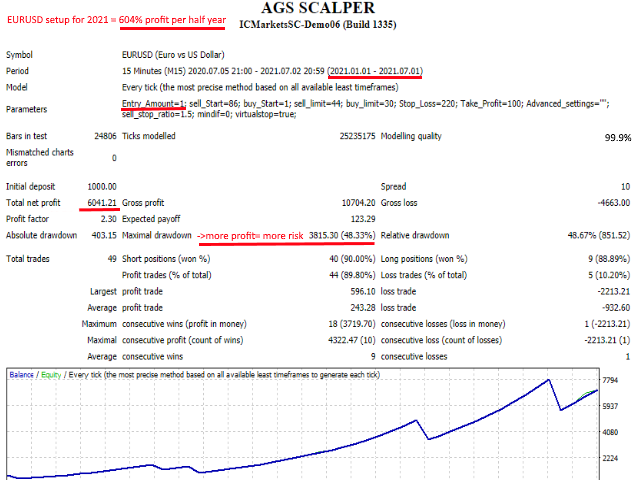

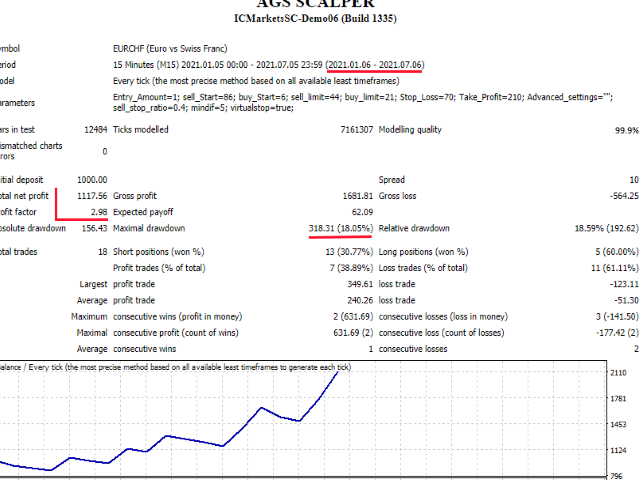

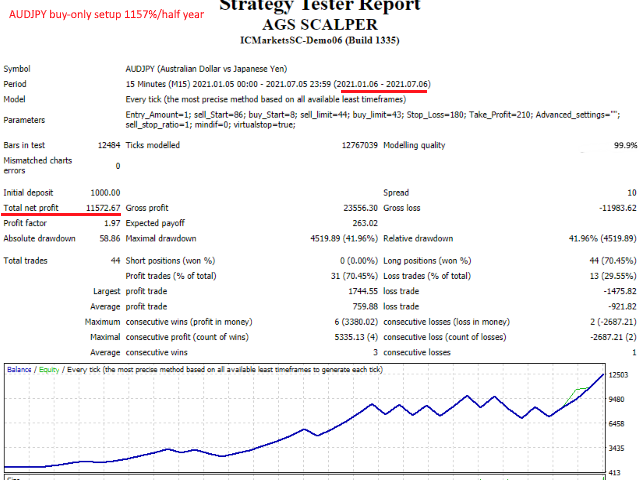

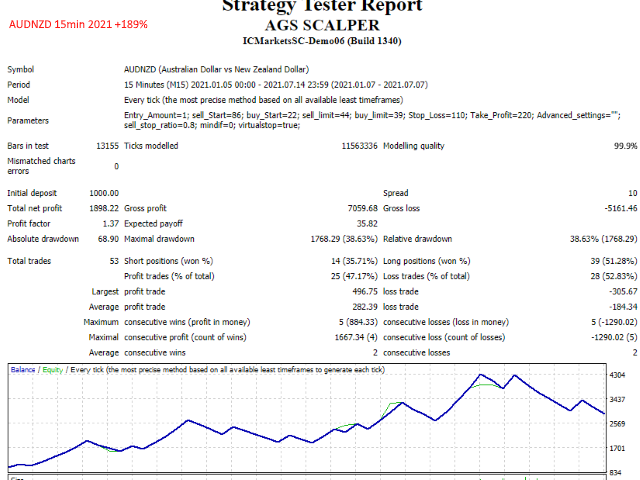

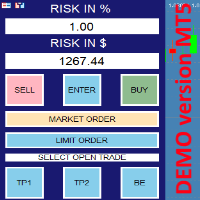

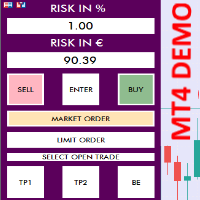

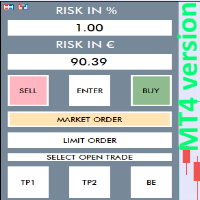

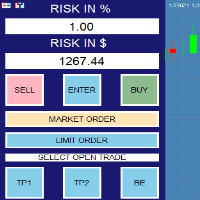

CHECK SCREENS!

- High REWARD-high RISK?, big lots and high risk involvement is required for profits like +200%-800%/month

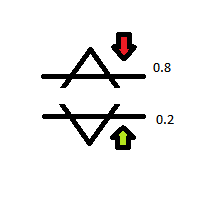

–> (the main settings idea for AGS is ‘trade confidence vs. trade count’ So on one side it can do more trades with less chance of winning or it will open less trades with higher probability of success )

Disclaimer: AGS best works as aggressive scalper using lots 1.0-2.0 per 1000$ account balance and also it is crucial to use adequate money management eg. every week or two take out half of profits!

Optimized for ECN accounts with leverage 1:500! Best results when using VPS!

Best works with: (15min or 5 min)

EURUSD USDCHF EURCHF AUDUSD AUDJPY NZDCAD XAGUSD XAUUSD

Input parameters:

Lot size (per 1K) = lot size per every 1000 of free margin, so AGS automatically scales order size (recommended 0.5-2.5 and !! CANNOT USE 0.01 !!)

Dynamiclot = if false, lot is fixed=same

Sell Start=higher the value is = more success probability when opening SHORT, but less trades are being open. Lowering value will launch more trades with higher risk of loosing(use 80-110)

Buy Start=lower the value is = more success probability when opening BUY, but less trades are being open. Increasing value will launch more trades with higher risk of loosing.(use -10 -20)

Sell Limit= similar as sell start -> higher value= more success%, lower value = more trades. This number sets strictness of trend identification for short pos. (use 45-80)

Buy Limit= similar as buy start -> lower value= more success%, higher value = more trades. This number sets strictness of trend identification for buy pos. (use 20-55)

When there are very long-lasting trends on the market, its better to use strict limits to not start trading against trend. Eg.: = SLimit >65 & BLimit <35

Stop Loss (use 150-300)

Take Profit (use 50-200)

Suitable SL and TP depends on your risk settings, lower risk=(SStart>90 & BStart<15), higher risk= (SStart<80 & BStart>20)

Sell SLR= sell_stop_ratio = SL for sells is different than buys (use 1.0-2.0) = SL-SELL*SLR

Sell/Buy TP ratio <-0.9-0.5> = TP for buys is bigger and TP for sells is lower= TP-BUY*(1+TPR) and TP-SELL*(1-TPR)

MD = minimal difference = for confirming trade, I usually use 0. Higher number = less trades, more success chance

Lower number = more trades, less success chance (recommended 0 or <-10,10> and limit:<-100,100>)

VirtualStop – choice between virtual (true) and fixed (false) StopLoss and TakeProfit (recommended always TRUE and using VPS )

Delay = option for ignoring trade opportunity right after one trade was executed already, delay on = more safety and less trades vs. delay off = higher potential profit mainly when your settings already show very high win percentage of trades.

VirtualStop: IF YOU ARE NOT USING VPS, YOUR SYSTEM NEEDS TO BE ALWAYS ONLINE in order to close trade when SL or TP is hit!