Terraforming 3 Coda

- Эксперты

- Lerato Silokwane

- Версия: 1.0

- Активации: 5

The EA trades on the DERIV Broker SYNTHETIC instruments:

Boom 500 Index, Boom 1000 Index, Crash 500 Index, Crash 1000 Index. Select the instruments accordingly in the input section.

The EA waits for extreme events and profits when things normalize.

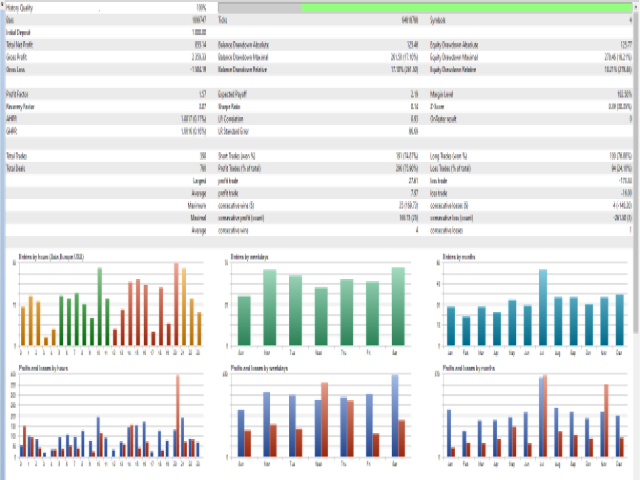

Frequency of trades is between 1 to 8 trades per week depending on opportunities identified as "High opportunity" and "Normal opportunity". High opportunity trades are 3 times normal volume.

EA has one other input " betsize_percentage". That determines how much of your total equity you want to invest per normal opportunity trade.

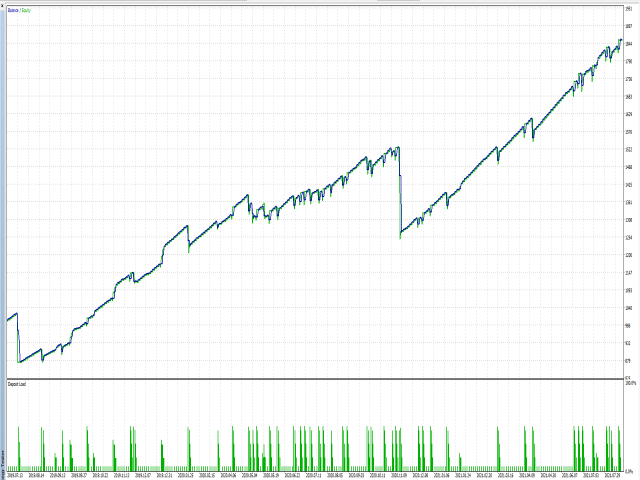

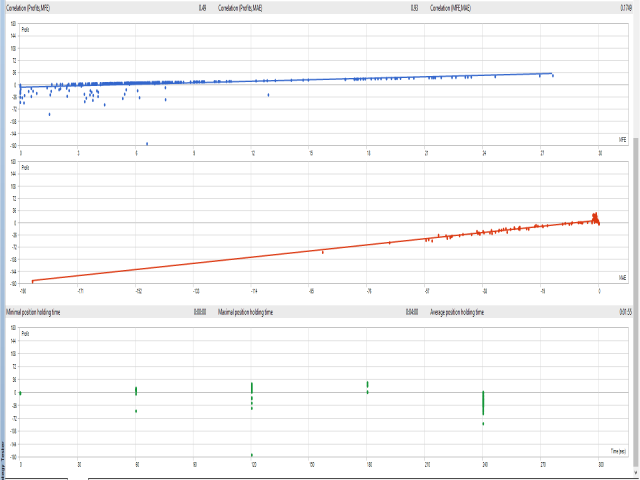

I recommend bet size of 5%. This means higher higher opportunity trades will be 15% of total Equity. The risk of bet sizes larger than 10% is that if the the EA is incorrect you might not have enough maintenance margin for the EA to make up the loss. However bigger bet sizes mean bigger rewards - The graphs shown are a strategy tester based on a bet size of 5% and a 1000 USD starting Equity.

Weigh your risks and rewards carefully. Happy algo-trading