OCTO Indicator

- Индикаторы

- Paul Boenisch

- Версия: 1.0

- Активации: 5

The OCTO Indicator is a new and easy to use zero-crossing trend/trend reversal indicator that provides entry signals for both long and short positions. It is based on High/Low divergence and correlation of the values over time.

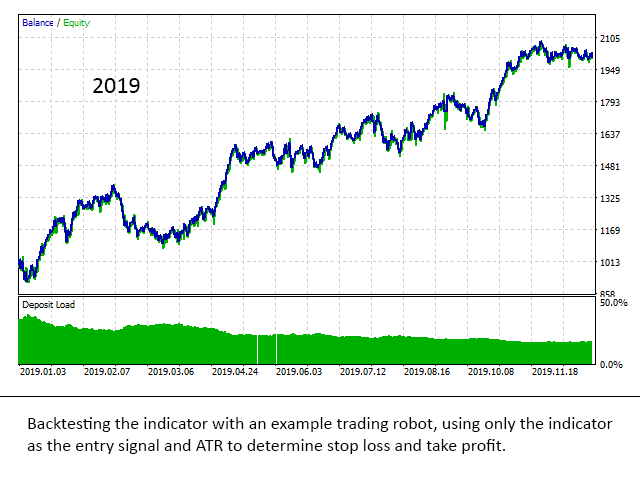

Reliability of the indicator has been backtested with an example trading robot.

How to use

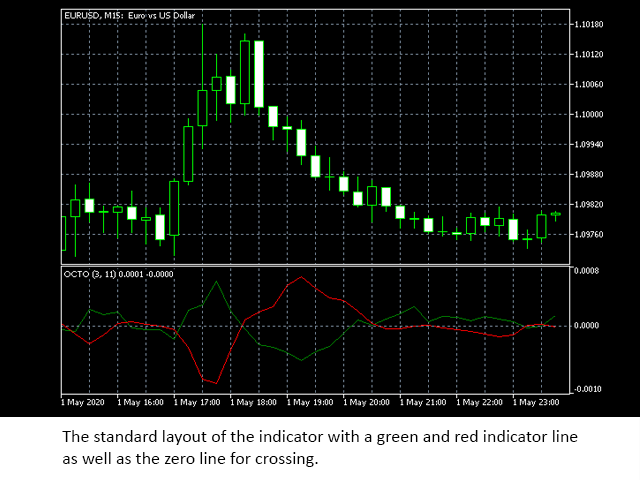

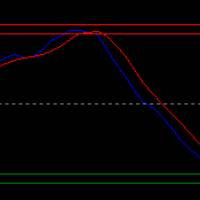

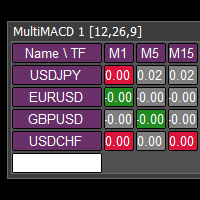

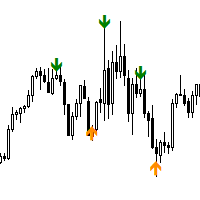

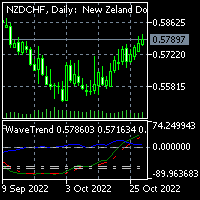

The OCTO indicator is added in a separate window, showing a red and a green indicator line, as well as the zero line for crossing. You can see an example of the standard look and feel in the screenshots.

Basic use of the indicator is simple as the complexity of calculations in the background has been streamlined into two straight-forward events:

- Whenever the green line is crossing the zero line in an upwards direction (from under zero to above zero), a potential entry opportunity for a long position is signaled

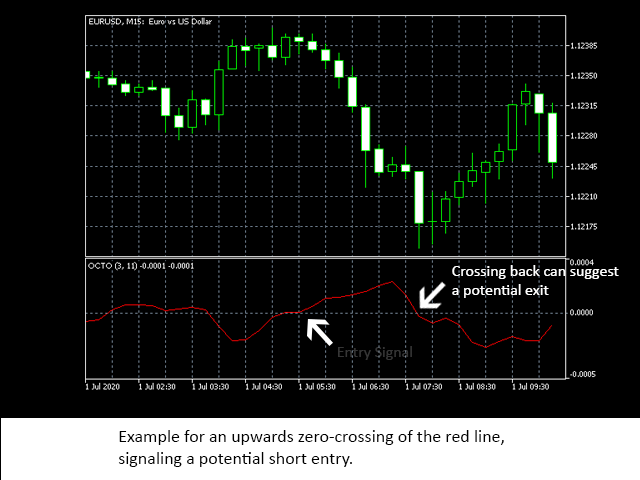

- Whenever the red line is crossing the zero line in an upwards direction (from under zero to above zero), a potential entry opportunity for a short position is signaled

Note that both, long and short signals are in the upward direction. You will find an example for each in the screenshots as well.

While this can already provide you with good entry opportunities, it is advised to also factor in the relation to the non-signaling line as well as the kind of the crossing. In other words: If the green line is signaling a potential long entry, also observe the red line (specifically the distance to the green line) and the slope of both lines. The clearer the separation between the two lines and the steeper the slope, the more confident the signal generally is.

Hint: The overlapping lines can be a bit confusing at first. Consider separating them into two individual indicator windows as shown in the screenshot examples while you familiarize yourself with the indicator.

Inputs

The OCTO indicator offers three inputs that allow adjusting the algorithms to certain situations:

- Long MA: Lower values will cause the indicator to be more focused on strong trend changes while higher values will generally create more entry signals, but with a lower confidence.

- Short MA: Lower values can lead to better reaction times to trend changes but also reduces reliability. Higher values will cause the indicator to be more focused on strong trend changes.

- Smoothing: Higher values can help smooth choppiness in the signal for more clarity but can also cause the indicator to react slower to trend changes.

It is important to note that the long and short MA are highly depending on each other and a good pairing is most important for reliable entry signals.

Hint: As you can see in the results section below, using the defaults provides profitability in a backtesting environment but requires experience with the indicator. Consider slightly increasing both, the long and short MA to provide you with clearer signals in the beginning.

Results

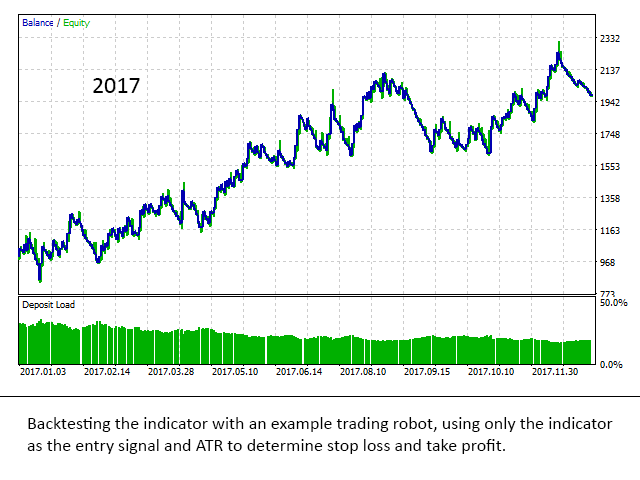

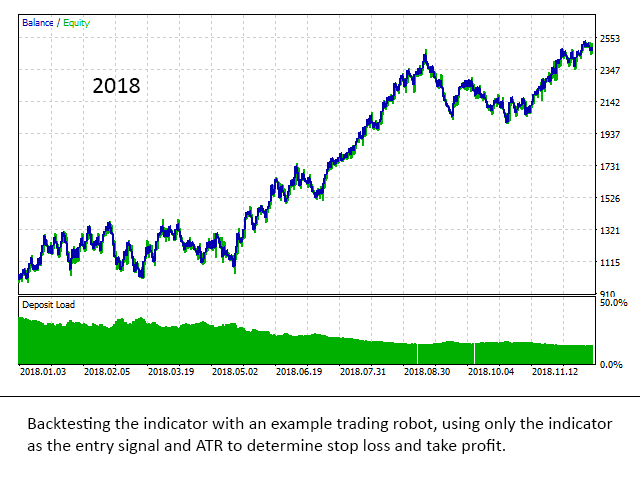

Next to the screenshots of the indicator itself you will also find the results of backtesting the indicator with an example trading robot.

This trading robot is using the OCTO indicator as its only entry signal (no additional verification, no other indicators), with the ATR used to determine stop loss and take profit values.You will find three screenshots, each showing one full year (2017, 2018, 2019). All three years use the default settings for the OCTO indicator and only the ATR has been adjusted per year to match each years predominant market behavior (trendy, choppy etc.). Testing has been done on the USD/EUR symbol on the M15 chart and the results show profitability in all three years.

Additionally, profitability when using the OCTO indicator can be further improved with a more sophisticated stop loss and take profit calculation (eg. adjusted to current market behavior in live trading instead of just the predominant market behavior per year) as well as tuning the above mentioned inputs of the indicator to the current market.

Final Words

To deliver a good product, it has to live by the requirements of its users and always aim to improve, so if you have any suggestions, feedback or other comments, you're very welcome to share. :)