DayRangeEMA

- Эксперты

- Janis Gredzens

- Версия: 1.0

- Активации: 20

Hello!

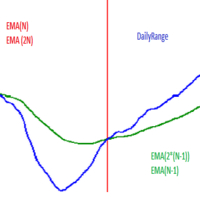

This EA uses selected time frame exponential moving averages and higher time frame (daily) exponential moving averages in combination with daily price action to determine whether or not to open a trade.

Below is a description of input parameters:

- MN - Magic number;

- PTS_Risk* - Variable that is connected with PROC_Risk in order to calculate position size;

- PROC_Risk* - Variable that is connected with PTS_Risk in order to calculate position size;

- ONE_ORDER_A_DAY - If true then open maximum of one order per day;

- DO_MAX_LOTS - If true then limit maximum open lots at a time;

- MAX_LOTS - Specify maximum amount of open lots at a time if DO_MAX_LOTS is true;

- DO_SL - If true then do specific SL points for order;

- SL_PTS - Set the SL points when DO_SL is true;

- DO_EXPIRATION - Whether or not we want our orders to have expiration time;

- EXPIRE_LOSSES_ON - If true then do expiration only for losing trades, else for all trades;

- Expiration_Days - Amount for expiration;

- DO_REVERSE - Open BUY when it is signal for SELL and vice versa;

- ALL_CONDITIONS - Makes entry conditions take into account pivot point state if true.

*PROC_Risk and PTS_Risk calculate Position size accordingly: if we lose PTS_Risk amount of points from the order, it will be equal to PROC_Risk of Current account equity.

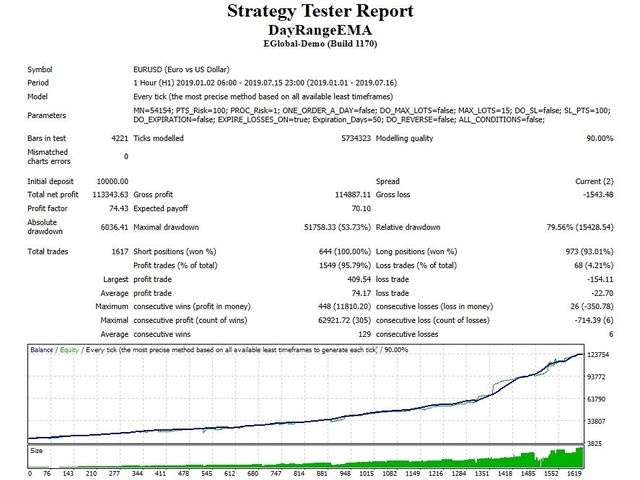

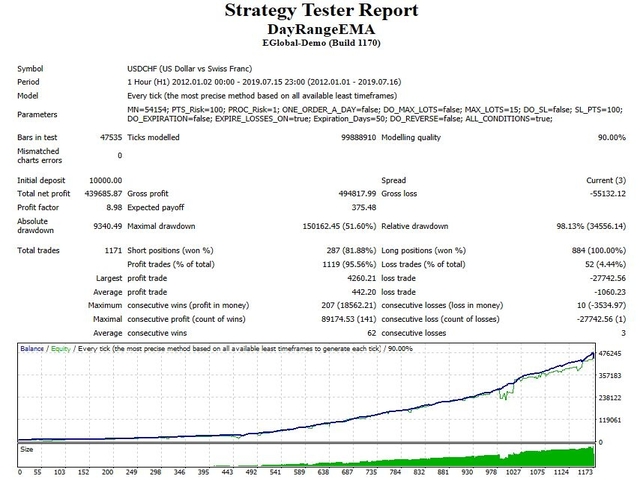

Currently I have found parameters (which can be seen in screenshots) that work for USDCHF and EURUSD H1 data on 90% quality backtesting for different time periods. I will do further testing and analysis and will do updates. I encourage everyone to test the parameters in demo version before buying the product. Good luck!