King Ai TD Sequential

- Индикаторы

- Choi Wing Leung

- Версия: 1.0

- Активации: 5

The brand new trading indicator using the TD Sequential strategy is presented by KING.Ai. This indicator were built base on the the theory of TD Sequential. TD Sequential difficult can by seen by human eye. Indicator can help to identical the pattern. KING.Ai Forex trader mainly use this strategy to "See Through" market. We do believe that it is a powerful method to predict reversal time of trend. Ross Hook were developed by Tom Demark, In the late 1970s he devised some indicators called TD Sequential, which successfully indicated in the area in which the market was sufficiently oversold for one expect a bottom to form or overbought for one to expect a top. General speaking, TD Sequential have following using:

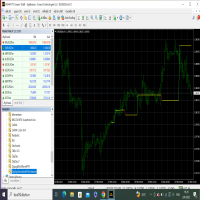

Method to apply (please also refer to the graphic):

- TD SETUP: TD Setup compares the current close with the corresponding close four bars earlier. There must be nine consecutive closes higher/lower than the close four bars earlier.

- TD Buy SETUP: TD Buy Setup will exist when TD Setup 9 bar is formed. It indicates a switch from positive to negative momentum or negative to positive momentum.

- TD Countdown: After a setup is finished the countdown can begin from bar 9 of the setup. TD Countdown compares the current close with the low/high two bars earlier and you count 13 bars. Unlike the Setup, the Countdown doesn’t have to be a sequence of 13 consecutive price bars. If the last candlestick doesn’t meet these requirements, it is marked with «+» above, and we look for bar 13 at the next one.

- TD Buy Countdown: It starts after the finish of a buy setup. The close of bar 9 should be less than the low two bars earlier. If satisfied bar 9 of the setup becomes bar 1 of the countdown. If the condition is not met than bar 1 of the countdown is postponed until the conditions is satisfied and you continue to count until there are a total of thirteen close.

KING.Ai Forex trader believe that such strategy must complement with other indicator to form a trading system.

- It is more obvious in DAY Chat. Please refer to the graphic.

Please do not use this indicator solely. You are recommended to integrate all your technical skills to determine the side of breakout, upward or downward, with trend analysis.