Ultra Hedge Scalper

- Эксперты

- Joel Protusada

- Версия: 19.0

- Обновлено: 25 августа 2019

- Активации: 5

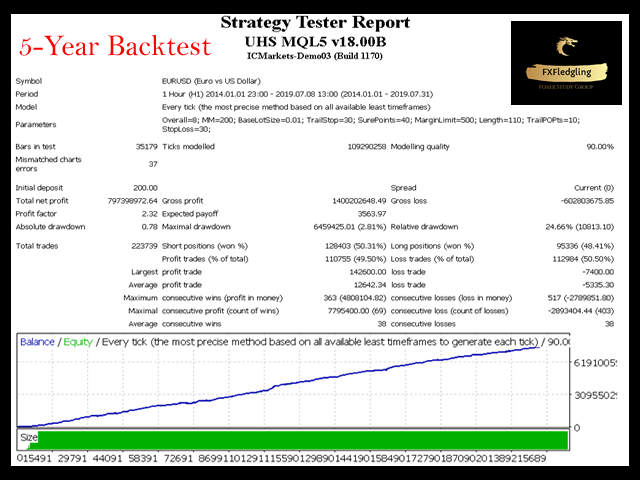

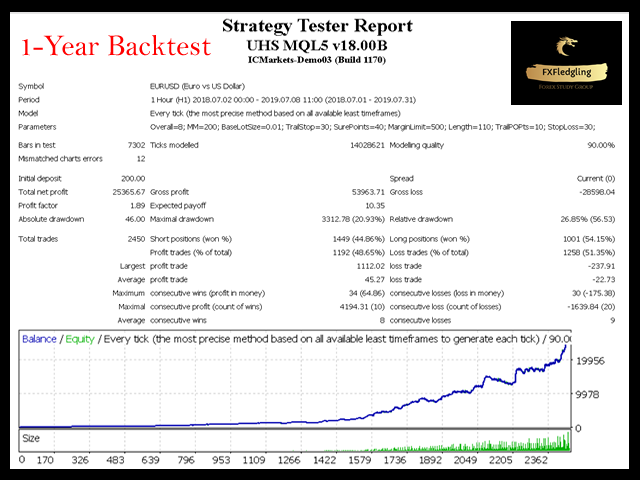

Ultra Hedge Scalper is a fully automated scalping Expert Advisor that combines scalping and hedging strategy that you can use to backtest a 10-year of data with modelling quality of at least 90%. It uses only an entry analysis based on a proprietary Candlestick Breakout System and settings to detect price breakout movement. The success secrets of the Expert Advisor if back-tested and forward-tested correctly are the combination of the entry method with the Money Management and multiple exit strategies. Once opportunity level is determined, it will open trades right away.

Maximize The Potential

To maximize the potential of the EA, you should change the value of the " Money Management" and "Trail Pending Order in Points" parameters, and reduce the values to acceptable levels to improve and increase result. For best result, backtest it, if possible use 5-year or more of data with modelling quantity of at least 90%.

Very Important

This Expert Advisor can not run with any EAs in the same account. As part of the money management plan, it calculates and monitors the Margin Level % and assumes that all open trades are created by it.

Features

- A scalping Expert Advisor that works best in H1.

- It takes advantage of the trending price movement of the market.

- Accuracy is on the trade entry when there's a price breakout.

- Uses two money management parameters only but you need to change the "Money Management" parameter for best result.

- Stop-loss is used. Tight SL is used of at least 30 points or 3 pips.

- Trail Stop is used with an option for an assured pips by setting the "Sure Profit on Trail Stop in Pips" parameter.

- Easy to set up.

Requirements

- Symbols: For best result use EURUSD only.

- Timeframe: H1

- Leverage 1:500

- Fund deposit: At least $200

- Account type: True ECN only with less than 2 pips of spread.

- Account currency: USD.

- The EA should run 24/5. For stable server and internet, you need a VPS.

Money Management Formula

Please see Parameters

Lots = (Account Balance / MM) * Baselotsize

Parameters

- Overall Target per Cycle - Target profit per cycle.

- Money Management - This is used to divide the Account Balance then multiplies it to BaseLotsize. Change this value to lower value for better result. 200 is recommended.

- Base Lotsize - The lotsize multiplier after calculating the Money Management parameter. Use default.

- Trail Stop Loss in Pips - This a trail stop to protect positive profit. Set zero to disable. Use default value.

- Sure Profit on Trail Stop in Pips - If trail stop is enabled. Use default.

- Margin Level % for New Trade - if you use an aggressive MM/lotsizing and trading multi-pairs, set this to monitor the margin level % to avoid over trading. But it is recommended to use the default value.

- Bars To Check - Number of bars for analysis. Use default. For more conservative setting, use higher number, but better if default is used.

- Trail Pending Order in Points - The pending order will follow the current price with a distance set in this parameter. Reduce for best performance. 10 is recommended.

- Stop Loss in Points - This is to protect the fund. Use default.

Best Parameter Settings

Overall Target per Cycle = 8 Money Management = 200 Base Lotsize = 0.01 Trail Stop Loss in Pips = 30 Sure Profit on Trail Stop in Pips = 40 Margin Level % for New Trade = 500 Bars To Check = 110 Trail Pending Order in Points = 10 Stop Loss in Points = 30