Three In One Combo

- Эксперты

- Catalin Zachiu

- Версия: 1.7

- Обновлено: 26 июля 2019

- Активации: 5

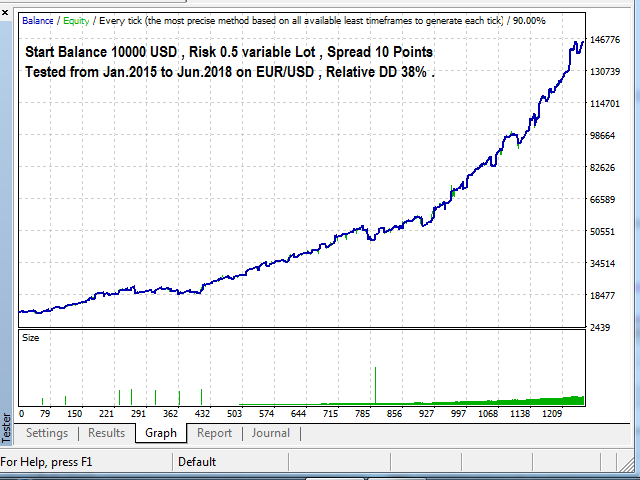

This is a four strategy in one EA , but two of them have the same closing conditions if the Profit Target or Stop Loss is not reached , Strategy 2 and 3.

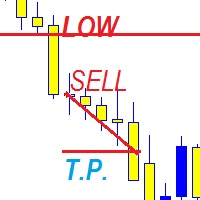

The first strategy places Buystop/Sellstop orders at key price levels with small stops and closes by implemented indicator,after a certain number of bars or Take Profit function.The user may choose what option for closing may preffer . Close by Macd Offset parameter closes the order by Macd only after the number of bars for the open order has passed to avoid premature closing . The strategy also has a breakeven function and a virtual stop function to avoid opening after gaps , leaving the stop behind .

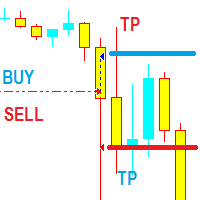

The second strategy buys or sells in the direction of price movement if the candle closes above or below a price level with a certain number of points and closes by implemented indicator or Take Profit or Stop Loss function.

The third strategy is based on gaps between canldes and open trades in the reverse sense of the price movement . The strategy closes trade by implemented indicator or by Take Profit or StopLoss function. It also has a smart Lot function that can increase lot size on winning trades and decreasing on loosing ones . The max spread allowed parameter helps to avoid too large spreads because the gaps usually occure on market oppening when spreads are larger .

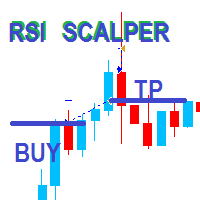

The fourth strategy is based on RSI indicator , it opens trade in the direction of price movement if the RSI is overbought or oversold and it has a recovery function in case the trade hits the Stop .If the first trade is positive the EA reverses the order direction , Long becomes short and viceversa untill it hits a loss and then starts normally again . The recovery factor has two steps of increasing lot size and then it resets to initial size to prevent any further possible losses .

Recommended pair : EUR/USD for Strategies 1, 2 and 3 ;

GPB/USD , USD/JPY for Strategies 1 and 4 ;

Timeframe H1 ;

Risk management is correctly calculated for accounts in USD ;

Breach Size setting reffers to how many points the level was breached and applies to strategy 2 ;

The Level setting reffers to how many candles to look back to establish the highest and the lowest price level ;

Recovery Factor applies to Strategy 4 to recover the pottential loss .