Forex Time Zone Indicator MT4

- Индикаторы

- Eda Kaya

- Версия: 1.3

Forex Time Zone Indicator for MetaTrader 4

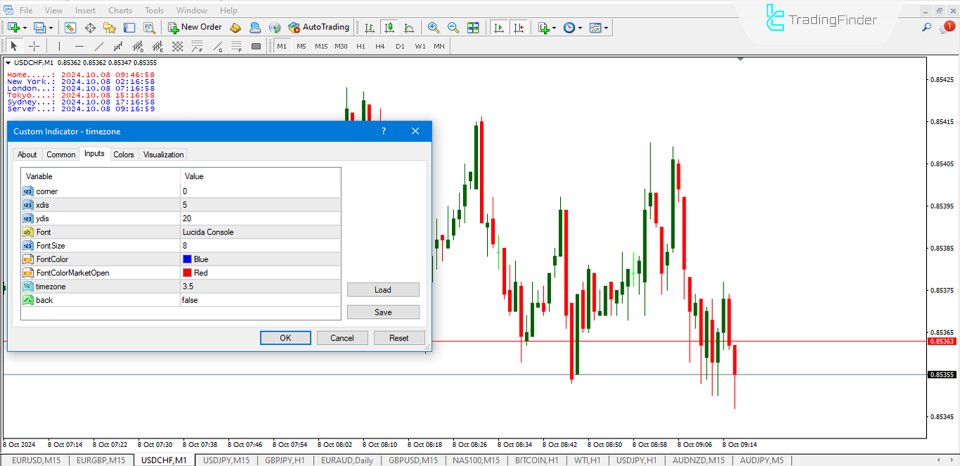

The Forex Time Zone Indicator for MetaTrader 4 is a fundamental resource for traders working in the global currency markets. No matter the trading methodology—scalping, intraday, or day trading—knowing when specific financial centers are active can significantly enhance trade timing and execution. As liquidity and trading volume flow across regions such as Asia, Europe, and North America, monitoring the timing of market activity becomes vital for capitalizing on market movements.

At any point in time, one of the four main trading hubs—Sydney, Tokyo, London, or New York—is operating. Recognizing when these centers open or close allows traders to align their strategies with peak activity periods for optimal market entry and exit.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Forex Time Zone Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4 | Trade Copier: Free Fast Local Trade Copier MT4

Time Zone Indicator Overview

| Category | Sessions & Kill Zones - Trading Hours - Market Rhythm |

| Platform | MetaTrader 4 |

| Skill Level | Beginner |

| Indicator Type | Forward-Looking – Non-Repainting |

| Timeframes | M1, M15, H1 |

| Style | Scalping – Intraday – Day Trading |

| Markets | Forex – Stocks – Global Indices |

Quick Insight into the Time Zone Indicator

Exchange rates in the Forex and broader financial markets often shift in response to institutional order flow during regional trading sessions. Traders equipped with this indicator can quickly assess the active periods for key assets based on region-specific liquidity cycles. It serves as an automated tool to display time-sensitive trading opportunities across the global map, guiding traders to act during the most impactful sessions.

Local vs. Server Times

The display integrates both Local Time (marked with a red label as “Home”) and the broker’s Server Time, enabling a dual-reference for session tracking. This dual visibility supports alignment between trader’s local context and the trading platform’s backend timing.

European and U.S. Market Sessions

As depicted, the U.S. market, centered around New York, is represented in the indicator. Inactive periods appear in blue, while active hours remain unshaded. The London session is also clearly marked, reflecting its high transaction volume. These overlapping hours—especially between London and New York—account for the bulk of daily market volatility and are considered prime trading hours for major pairs like EUR/USD and GBP/USD.

Asia-Pacific Market Timing

The Tokyo session is shown with active periods highlighted in red, representing the Asian financial hours. The Sydney session is also tracked, marking when the Australian market transitions from open to closed. This time frame typically influences price behavior in currencies such as AUD, NZD, JPY, and CNH, offering traders region-specific momentum cues.

Customizable Settings for Traders

• Corner: Sets indicator position on the chart

• X Offset: Horizontal adjustment set to 5

• Y Offset: Vertical spacing set to 20

• Font: "Lucida Console" is the selected font

• Font Size: 8 points for readability

• Market Closed Color: Blue

• Market Open Color: Red

• Time Zone Base: GMT alignment

• Background Display: Disabled when set to false

Conclusion

One of the most powerful functions of the Forex Time Zone Indicator for MetaTrader 4 is its ability to highlight overlapping sessions. For instance, the convergence of London and New York activity windows is associated with sharp price swings and higher trade frequency. This overlap offers ideal conditions for experienced traders looking to leverage liquidity surges and increased volatility.