DYJ NetPilot Pro

- Утилиты

- Daying Cao

- Версия: 7.0

- Обновлено: 19 апреля 2025

- Активации: 5

DYJ NetPilot is an Expert Advisor (Utilities) developed for the MetaTrader platform, designed to optimize trade exits by dynamically calculating the weighted average price (Pmix) of all open positions and adjusting exit levels accordingly.

Key Features:

-

Pmix Calculation: Computes the weighted average price (Price Mix) of open positions, providing a clear reference point for trade management.

-

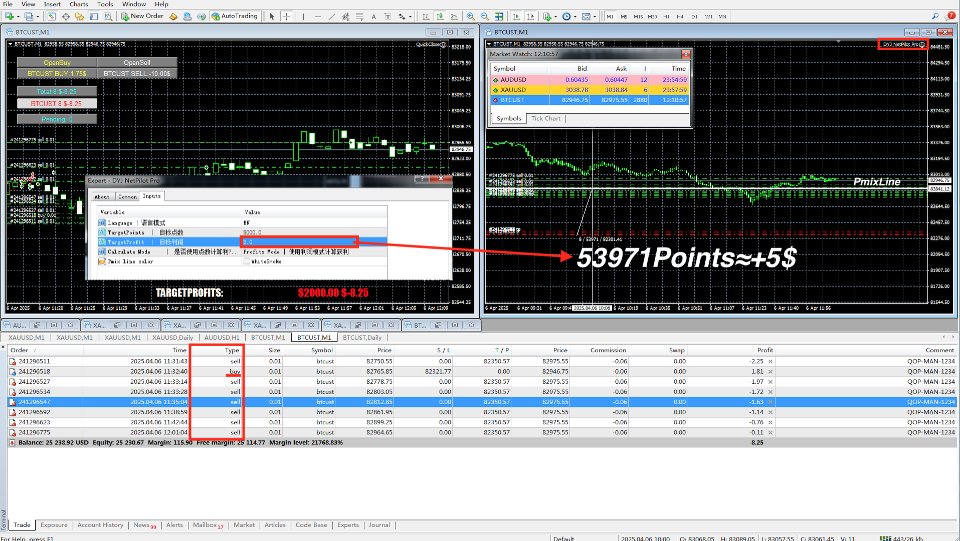

Dynamic Exit Strategy: Identify the prevailing direction (long/short positions) within open orders and establish unified exit levels — with the dominant side targeting profit-taking and the opposing side enforcing stop-loss — to ensure simultaneous closure of all trades at an aggregate profit.

-

Visual Indicators: Draws horizontal lines on the chart for both the calculated Pmix and the target exit price, offering real-time visual feedback.

-

Risk Management: Incorporates minimum stop-level checks and automatic adjustments to ensure that exit orders comply with broker requirements, thereby minimizing execution errors.

-

Customizable Parameters: Allows users to select target levels either in points or profit units, adapting to various trading strategies.

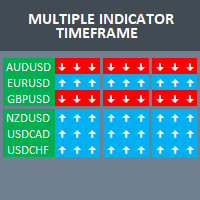

DYJ NetPilot is ideal for traders who require precise and automated trade exit management on instruments such as XAUUSD on lower timeframes (e.g., M1).

Optimal Matching Software QuickClose (Position Opening & Automated Closure Management System)

Dynamic Behavior of the Pmix Line and Evolution of Target Prices

The Pmix line dynamically adjusts based on the prevailing market trend:

-

When a bullish trend dominates, the Pmix line shifts upward, indicating an increase in the overall long position cost.

-

Conversely, during a bearish trend, the Pmix line moves downward, reflecting the advantage of short positions.

In tandem, the profit target price adapts accordingly:

-

In bullish conditions, the target price is set higher, aiming to capitalize on upward movements.

-

In bearish scenarios, the target price is lowered, seeking gains from downward trends.

This mechanism enables the system to engage in bidirectional trading, continuously averaging positions and tracking the trend. Regardless of market direction changes, the strategy employs a dynamic cycle of position scaling and profit-taking, aiming for a profitable exit as the market reverts.

During this process, the system may encounter significant volatility and multiple cycles of scaling and rebalancing, or it may maintain a prolonged state of equilibrium between long and short positions. Effective risk management—through appropriate settings of scaling steps, multipliers, and maximum position limits—is crucial to confine risks within acceptable bounds, allowing the strategy to withstand market fluctuations and ultimately achieve success.

Input Parameters

-

InpUseLanguage = English – Language selection

-

TargetPoints = 50 – TargetPoints

-

TargetProfit = 10 – TargetProfit

-

InpUseCalculateMode = CAL_POINTS – Calculate Mode

-

InpPmixColor = clrWhiteSmoke – Pmix line color