Fair Value Gap intraday Sessions ICT MT5

- Индикаторы

- Eda Kaya

- Версия: 1.5

Intraday Fair Value Gap Sessions ICT Indicator for MT5

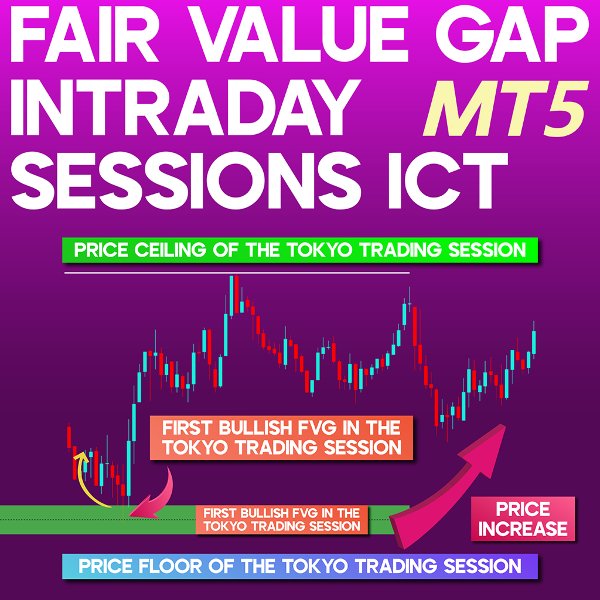

The Intraday FVG Sessions Indicator is a powerful analytical tool designed to help traders spot Fair Value Gaps (FVGs) within the New York, London, and Tokyo trading sessions. This indicator automatically highlights the high and low levels of each session using horizontal markers while identifying the first Fair Value Gap that appears within these timeframes.

By differentiating between bullish and bearish Fair Value Gaps, this tool aids traders who rely on ICT methodologies and liquidity-driven trading approaches, allowing for more precise price action analysis and potential market reversals.

«Indicator Installation & User Guide»

MT5 Indicator Installation | Fair Value Gap intraday Sessions ICT MT4 | ALL Products By TradingFinderLab | Best MT5 Indicator: Refined Order Block Indicator for MT5 | Best MT5 Utility: Trade Assistant Expert TF MT5 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT5 | Money Management: Easy Trade Manager MT5

Indicator Features

Below is a quick overview of the key functionalities of the Intraday FVG Sessions Indicator:

| Category | ICT - Liquidity - Market Sessions |

| Platform | MetaTrader 5 |

| Skill Level | Intermediate |

| Indicator Type | Continuation - Reversal |

| Time Frame | Multi-timeframe |

| Trading Style | Intraday Trading |

| Markets | Forex - Cryptocurrency - Stocks - Commodities |

How the Indicator Works

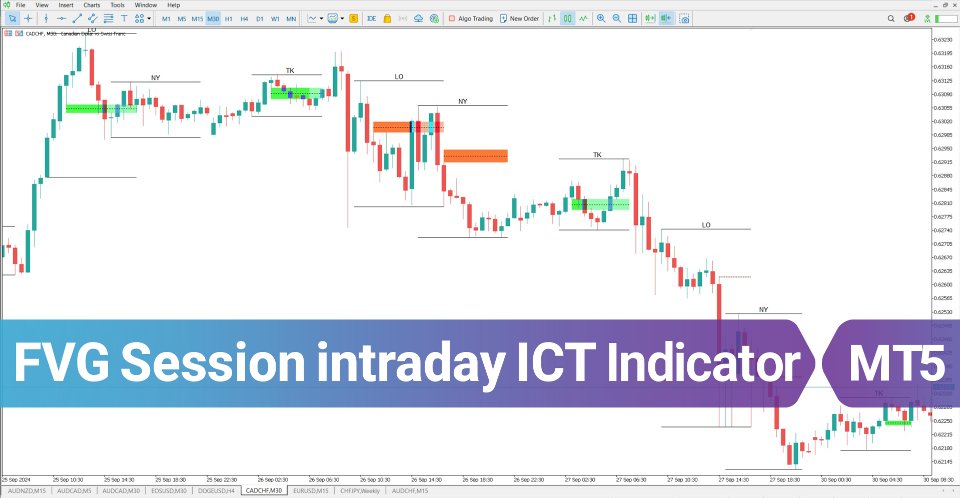

On MetaTrader 5, the Intraday FVG Sessions Indicator highlights bullish Fair Value Gaps in green and bearish Fair Value Gaps in red. If an FVG loses its validity due to price action, the zone gradually fades, indicating that it is no longer significant. This real-time adjustment helps traders assess the strength and reliability of market imbalances.

Example: Uptrend Scenario

In the 15-minute AUD/USD chart, the indicator detects a bullish FVG during the Tokyo session. As price moves upward, it later retraces into this FVG zone, where liquidity absorption occurs—often providing a potential buying opportunity for traders.

Example: Downtrend Scenario

On a 1-minute CAD/CHF chart, a bearish Fair Value Gap appears. As price revisits this zone, it triggers sell orders, making it a critical area for risk management. Traders typically place stop-loss orders just above these levels to mitigate potential losses.

Customizable Indicator Settings

Below are the key settings available for configuring the Intraday FVG Sessions Indicator:

- Tokyo market time: Define the Tokyo session timing

- London market time: Set parameters for the London session

- New York market time: Configure the New York session timeframe

- Width filter: Adjust the Fair Value Gap width

- Minimum width value: Set the threshold for FVG calculations

- Server-to-GMT difference: Modify the time offset based on GMT

Final Thoughts

The Intraday FVG Sessions Indicator is an essential asset for ICT traders and those using liquidity-based strategies on MetaTrader 5. By accurately identifying Fair Value Gaps (FVGs) across major financial sessions, this tool helps traders improve their market timing, entry precision, and overall trade execution.