Tesla Scalper V1 MT5

- Эксперты

- Benrashi Sagev Jacobson

- Версия: 1.0

- Активации: 10

PROMO:

▪ Only a few copies left at the current price!

▪ Final price: 2000$

Live Signal

PROMO:

▪ Only a few copies left at the current price!

▪ Final price: 2000$

Live Signal

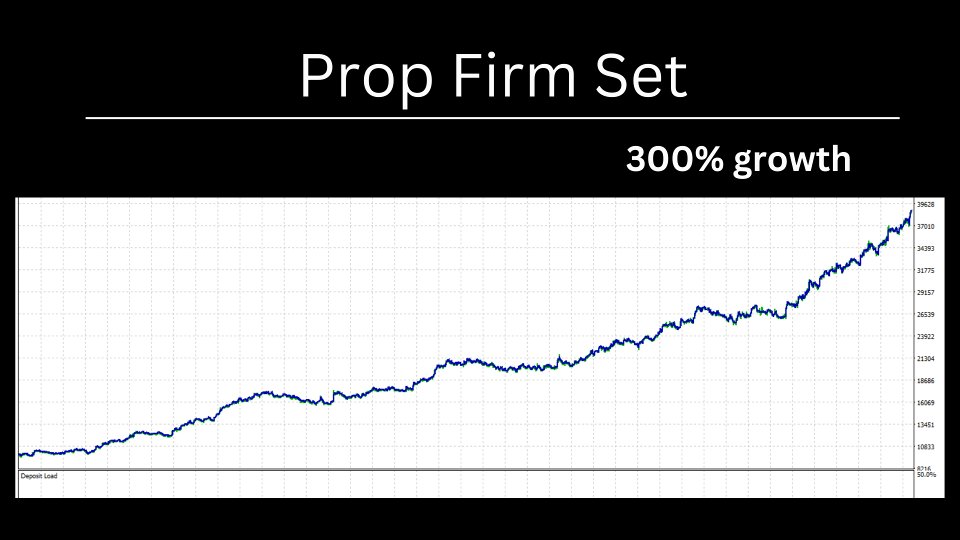

60 Thousand prop firm allocation and 400$ gained contact me to receive more information.

Analyzing Strategy Resilience and Adaptability

Various stress-testing techniques are used to explore how an EA may react to changing market conditions and parameter adjustments. Walk Forward Optimization (WFO) and Walk Forward Matrix (WFM) assess adaptability to previously unseen data and different trading environments while identifying potential points for re-optimization. Monte Carlo simulations introduce random variations to observe how the strategy performs under diverse conditions. Sequential testing alters entry, exit, and indicator parameters to examine areas of potential stability, while system permutation stress testing evaluates performance consistency across multiple parameter configurations. These methods aim to assess factors such as overfitting risk, adaptability to past market conditions, and sensitivity to market fluctuations.

Contact me to learn more about the reasoning behind the stress-tests and related information.Trading Strategy Overview

This strategy is built to take advantage of volatile market conditions by using stop orders that expire quickly, allowing trades to be executed only during periods of high volatility. Entry decisions are indicator-driven, with one indicator signaling when to open a stop order and another defining its placement to ensure precise execution. This method aims to filter out low-probability trades, focusing instead on significant market movements while maintaining controlled risk.

Prop Firm Compatibility

This strategy is suitable for use with various prop firms, with FTMO being the preferred option. However, using Darwinex Zero is not recommended, as account correlation could affect allocation.

Setup Recommendations

The strategy is designed to operate on the M15 (15-minute) timeframe. Using a broker with lower spreads or an ECN account is recommended to help reduce trading costs. Brokers following the EST+7/GMT-3 time zone during summer and GMT-2 in winter are preferred for better alignment between back-testing and live trading. While different time zones typically do not cause major performance variations, it is essential to set the exit time to 30 minutes before market close. Additionally, the "SingleTimeRangeFrom" value should be set to market open, and the second TimeRange value should be adjusted to 45 minutes before market close.