One Hour Strategy Analyzer

- Утилиты

- Tevon R Gardiner

- Версия: 1.0

- Активации: 5

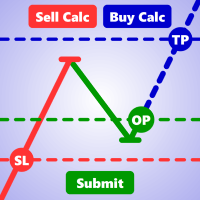

it's a fully built expert advisor with trading functionality with buy only or sell only or both options it's designed to be a tool that can be used for automate entry and exit in line with the overall Market Direction automatic risk management parameters fully comprehensive

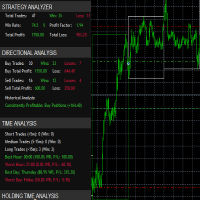

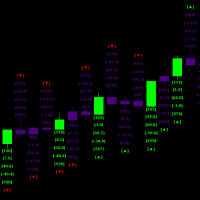

- STRATEGY ANALYZER Section

- Total Trades: Shows the overall number of trades taken

- Win Rate: Displays percentage of winning trades (color-coded green if >50%, red if <50%)

- Total Profit/Loss: Shows absolute profit and loss values

- Tracks largest wins and losses

- Monitors current and maximum drawdown

- DIRECTIONAL ANALYSIS Section

- Buy Trades Analysis:

- Total number of buy trades

- Number of winning and losing buy trades

- Total profit from buy trades

- Total losses from buy trades

- Sell Trades Analysis:

- Total number of sell trades

- Number of winning and losing sell trades

- Total profit from sell trades

- Total losses from sell trades

- Shows which direction (Buy/Sell) is more profitable historically

- Color codes profits in green and losses in red

- TIME ANALYSIS Section

- Trade Duration Categories:

- Short Trades (<5 minutes): Count and win rate

- Medium Trades (5-15 minutes): Count and win rate

- Long Trades (>15 minutes): Count and win rate

- Best Trading Hours:

- Shows the most profitable hour of trading

- Displays win rate and number of trades for that hour

- Worst Trading Hours:

- Shows the least profitable hour of trading

- Displays win rate and number of trades for that hour

- Best/Worst Trading Days:

- Identifies most and least profitable days of the week

- Shows performance metrics for each

- HOLDING TIME ANALYSIS Section

- Winning Trades Statistics:

- Average holding time for winning trades

- Profit per hour rate

- Shortest winning trade duration

- Longest winning trade duration

- Losing Trades Statistics:

- Average holding time for losing trades

- Loss per hour rate

- Shortest losing trade duration

- Longest losing trade duration

- Trade Psychology

- Helps maintain discipline by showing objective statistics

- Provides clear metrics for performance evaluation

- Helps identify patterns in trading behavior

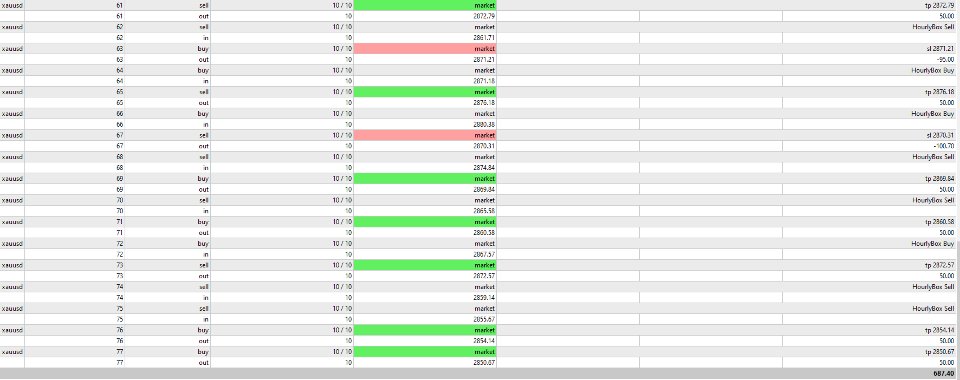

To use this EA effectively:

- Setup Process:

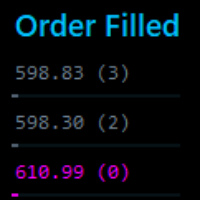

- Set your preferred trading direction (Both, Buy only, or Sell only)

- Adjust thresholds based on the currency pair's volatility

- The invisible stop loss and take profit is enabled by default it needs to be disabled in order to initiate the dashboard statistical data tracking in real time or in historical back testing

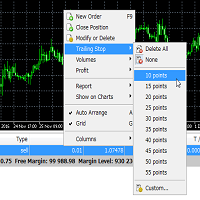

- Optimization Opportunities:

- Adjust RequiredConsecutiveBoxes based on market conditions

- Fine-tune movement thresholds for different currency pairs

- Modify stop loss levels based on volatility

- Adjust maximum trades based on your risk tolerance

- Best Practices:

- Start with conservative settings

- Use the dashboard to monitor performance

- Adjust parameters based on statistical feedback

- Pay attention to best/worst hours from the dashboard

- Use the directional analysis to potentially filter trade direction

- Risk Management Features:

- Maximum open trades limit

- Stop loss protection

- Slippage control

- Direction filtering

- Pattern confirmation requirements

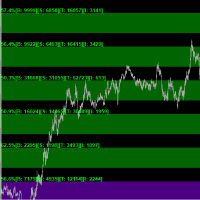

The EA combines technical analysis (box patterns) with risk management to automate trading decisions. It's designed to:

- Identify trending movements

- Confirm patterns before entry

- Manage risk through various parameters

- Provide visual feedback

- Track performance metrics

You can optimize its performance by:

- Analyzing the dashboard statistics

- Adjusting parameters based on performance

- Using direction filters during strong trends

- Setting appropriate risk levels

- Monitoring best/worst trading hours