MTF Candles Overlay MT4

- Индикаторы

- Prafull Manohar Nikam

- Версия: 1.1

- Обновлено: 10 февраля 2025

- Активации: 5

Features:

-

Timeframes from 1 Min to 1 Month

-

Minimal Inputs

-

Customize candle body, color etc.

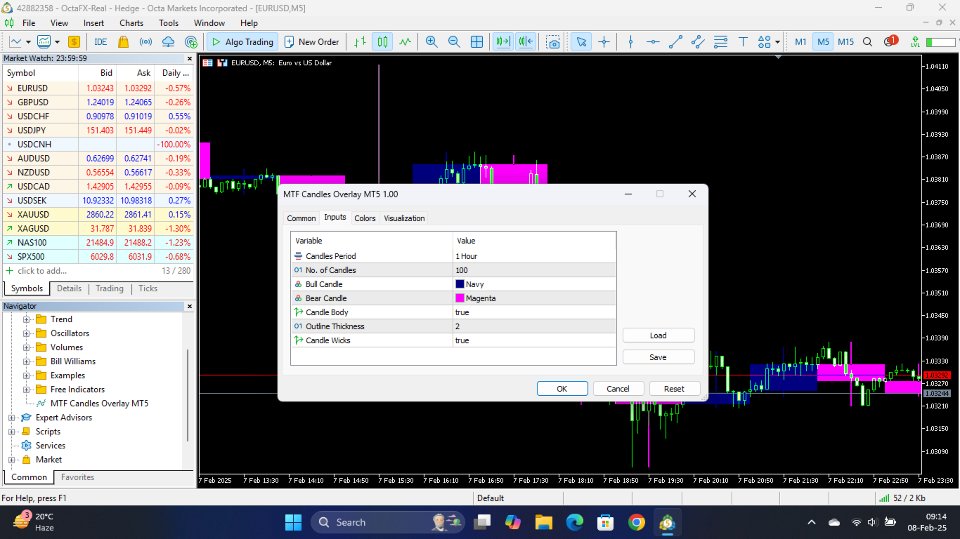

- Candles Period - Choose the timeframe for the overlay candles.

- No. of Candles - Number of overlay candles the indicator will show on the chart.

- Bull Candle - Choose the color for the bullish overlay candles.

- Bear Candle - Choose the color for the bearish overlay candles.

- Candle Body - If set to "true" overlay candles have solid bodies; If set to "false" overlay candles will only show outlines.

- Outline Thickness - When the "Candle Body" input is set to "false". You can change outline thickness by changing this value.

- Candle Wicks - If set to "true" overlay candles will show the wicks. By changing it to "false" you can remove wicks from the overly candles.

Tips for Implementing Multi Timeframe Analysis

-

Stick to a Consistent Timeframe Combination:

Determine which timeframes suit your trading style (e.g., daily, four-hour, 15-minute for swing trading) and stick with them for an extended period. Consistency helps in understanding how the market behaves across those specific intervals. -

Use the Top-Down Approach:

Always begin your analysis with the higher timeframe to establish the broader trend. This will help in avoiding trades that counter the dominant market direction, which can lead to unnecessary losses. -

Focus on Confluence:

Look for instances where multiple timeframes agree on the market’s direction. When the long-term trend aligns with signals on the intermediate and short-term charts, the trade has a higher probability of success. -

Avoid Overtrading:

While multiple timeframes offer numerous trading signals, it is important to be selective. Not every short-term fluctuation is worth trading. Focus on high-probability setups that are supported by the broader market trend. -

Practice and Patience:

Developing proficiency in multi timeframe analysis takes time. Utilize demo accounts to practice and refine your approach without risking real capital. -

Stay Updated with Market News:

Fundamental factors can influence trends across multiple timeframes. Incorporate a review of economic news and market sentiment into your analysis to complement your technical insights.