Timezone Filter EA

- Утилиты

- Martins Chukwudi Osodi -

- Версия: 1.0

Timezone Filter EA: Precision Trading with Session Control

The Timezone Filter EA is an essential tool for traders looking to refine their trading strategy by restricting trade execution to specific trading sessions. Designed for precision and discipline, this EA allows traders to filter which trading sessions they want to engage in—such as Asian, London, or New York sessions—while ensuring that no trades occur outside the defined time periods.

Key Features:

✅ Customizable Trading Sessions

- Traders can select the sessions they want to trade.

- Options to enable or disable specific trading hours based on personal strategy.

- Supports major sessions: Asian, London, New York, and custom time zones.

🔒 Strict Trade Enforcement

- The EA automatically closes trades placed outside the allowed time.

- Eliminates human error when executing trades during restricted periods.

⏳ Session-Based Trade Filtering

- Works for manual and automated trades.

- Prevents unwanted exposure to high volatility or low liquidity periods.

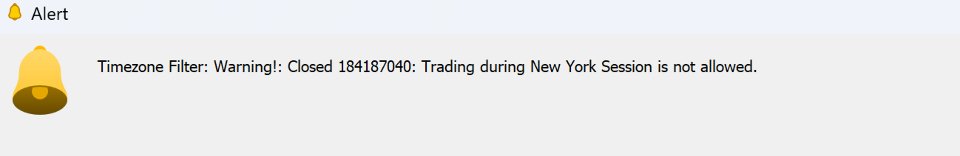

📊 Real-Time Monitoring

- Displays the active session in a user-friendly panel.

- Alerts traders when a trade is placed outside the allowed time.

How It Works:

-

Set Your Preferred Trading Sessions

- Input the trading session start and end times in the EA settings.

-

Monitor & Enforce Trading Rules

- The EA will track the current market time and allow trades only within the specified period.

-

Auto-Close Unauthorized Trades

- If a trader mistakenly enters a position outside the set time range, the EA will automatically close the trade to maintain strategy discipline.

Who Can Benefit?

✅ Day Traders – Avoid overtrading or trading in unfavorable sessions.

✅ News Traders – Prevent accidental trades in volatile periods.

✅ Swing Traders – Ensure trades align with optimal market hours.

✅ Algo Traders – Enhance automated strategies with strict time-based filters.

Final Thoughts

The Timezone Filter EA is a game-changer for traders who value timing, discipline, and risk management. By ensuring trades only occur during pre-defined market hours, traders can maintain a structured approach, reducing errors and increasing efficiency.