RSI Moving Average XB

- Индикаторы

- Pham Xuan Bach

- Версия: 1.0

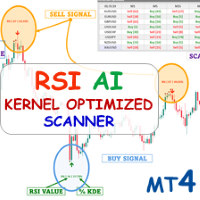

The relative strength index (RSI) refers to a momentum indicator that analyses the pace and variation of price movements. The value of RSI ranges from 0 to 100. Its purpose is to track price momentum changes. When the RSI of a security is above 70, it is considered overbought; it is deemed over sold when it is less than 30.

The Relative Strength Index is a technical indicator primarily used in the financial markets. For example, the relative strength Index in the stock market gives buying or selling signals to investors. In technical analysis, it is used to detect a broad trend, failure swings, divergences, double tops/bottoms, and crossover in the market.

- RSI is a momentum oscillator determining the pace and variation of security prices.

- The index signals purchase when it falls below 30 and reaches the oversold region. When the RSI hits the overbought zone (>70), it signals to sell (or hold if you are keeping it as a long-term investment).

- RSI is calculated using the formula RSI = 100 – (100 / )

- It can create chart patterns that are not visible on the price chart, like trend lines or double tops/bottoms.