Super Grid Strategy

- Эксперты

- Abdeljalil El Kedmiri

- Версия: 1.0

- Активации: 10

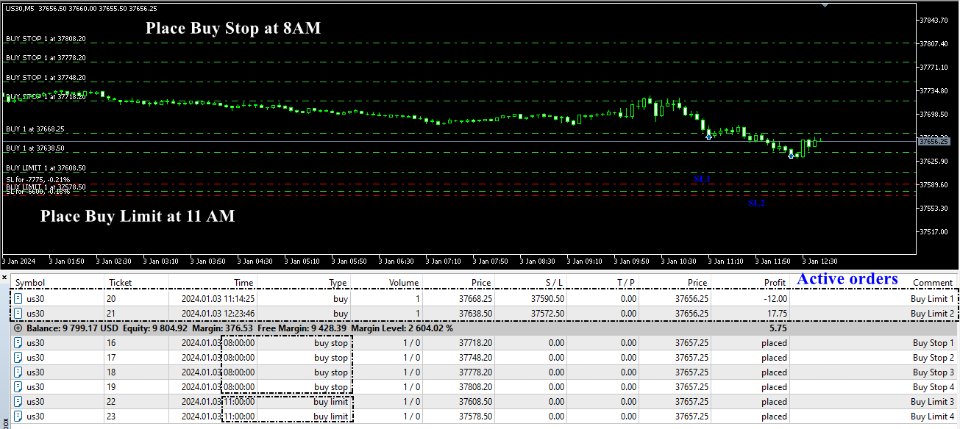

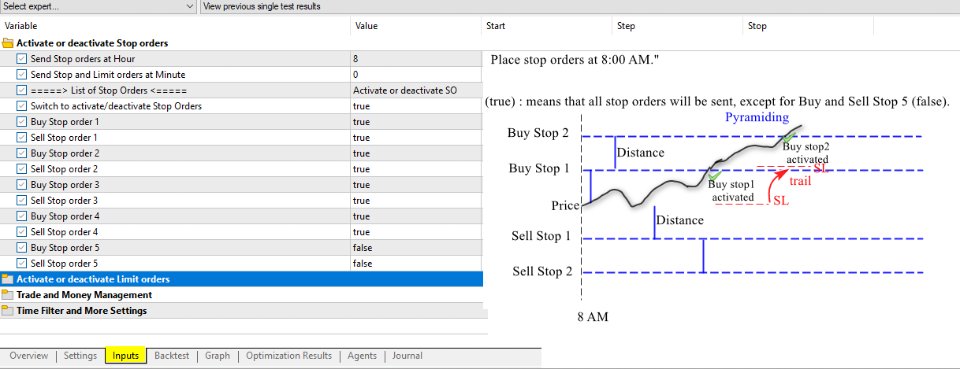

Super Grid Strategy EA is a versatile and powerful grid trading tool, perfect for both Forex and CFD traders. It places up to 20 pending orders (10 stop and 10 limit) at your preferred time, with customizable distances and spacing between orders for maximum flexibility.

Key features include:

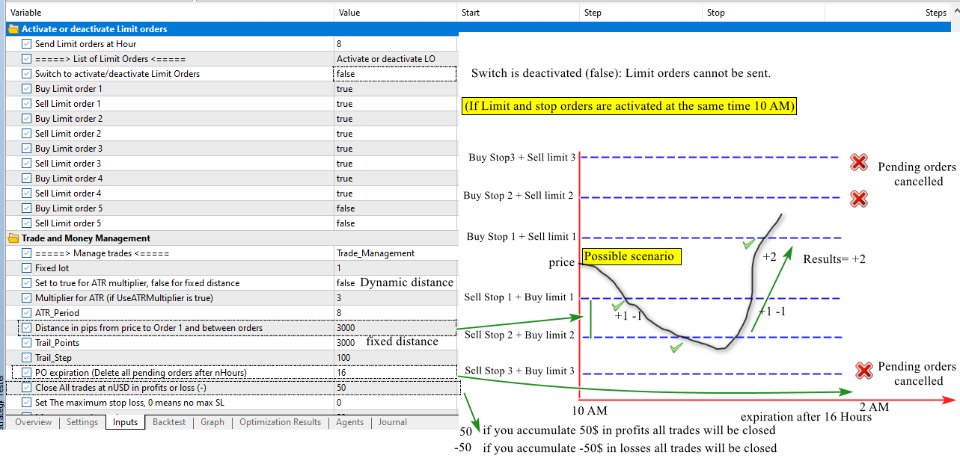

- Fixed Grid : Orders are placed at a fixed distance from the price and between each order, and this parameter can be adjusted based on market conditions.

- Dynamic Grid: Orders are adjusted based on market volatility using an ATR multiplier, allowing you to better capture market movements.

- Flexible Order Types: Easily switch between stop orders, limit orders, or a combination of both, depending on your strategy.

This EA is designed to help you capitalize on both bullish and bearish markets, making it ideal for capturing frequent price fluctuations. It also includes advanced risk management features, such as:

- Profit and loss closures in dollar amounts ( Close all orders)

- Pending order expiration settings (delete all pending orders after nHours)

- Trailing stop based on points (use strict stop, secure and accumulate profits)

The Super Grid Strategy EA follows a unique theory of market movement, using equidistant levels that can act as key support and resistance zones. This grid system allows for pyramiding and even hedging strategies, helping you maximize returns.

An additional feature, "Send Order at Market at Preferred Time," is included as a bonus. Buy orders can be placed at the same time as stop pending orders, and sell orders can be placed at the same time as limit pending orders.

To get the most out of this strategy, we recommend optimizing key parameters like order distance (fixed or volatility-based), timing of order placement, trailing stop, and pending order expirations.

If you encounter any difficulties backtesting, optimisation and setting up our EA in your accounts, I can remotely configure it for you using the AnyDesk app.

Some Grid trading strategies explination :

1. Classic Grid Strategy

2. Hedged Grid Strategy

If the price rises and hits the sell orders, they are triggered, and when it falls again, the buy orders get triggered.