GoldenPioneer EA

- Эксперты

- Kenji Yamamura

- Версия: 1.1

- Активации: 5

This Expert Advisor is a trading strategy targeting the XAUUSD on the 1-hour chart. It is based on entry and exit reversals using specific technical indicators and performs trend-following trades.

I don’t want to rely on just one EA; I want to build a portfolio and diversify my risks..." If that sounds like you, this EA is perfect for your needs.

This EA is designed with portfolio management in mind, making it an excellent complement to other EAs to achieve stable performance.

The Benefit of Low Trading Frequency:

1. Selective Entries: This EA doesn’t trade frequently but instead enters only on carefully chosen signals. By avoiding unnecessary trades, it reduces trading costs and aims to maximize profit efficiently.

2. Ideal for Risk Diversification: Since the EA trades infrequently, it works perfectly when combined with other EAs to diversify your overall risk. It allows you to create a more balanced portfolio while aiming for consistent returns.

3. Stress-Free Trading: With fewer trades, you won't be swayed by market noise, allowing you to execute your investment strategy calmly. You can use your time more effectively without being tied to daily trades.

Advantages of This EA in Portfolio Management:

Simple yet Solid: Due to its strict entry conditions and low trading frequency, the EA is less affected by market volatility, leading to more stable trading performance. This makes it ideal for balancing higher-risk strategies in your portfolio.

Low-Cost Operation: By reducing unnecessary trades, this EA minimizes transaction costs such as spreads and commissions. Its cost-efficient operation helps maximize long-term profits.

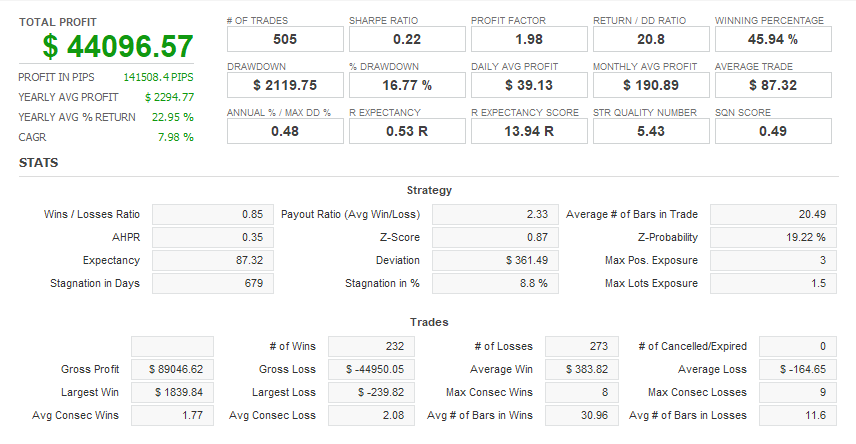

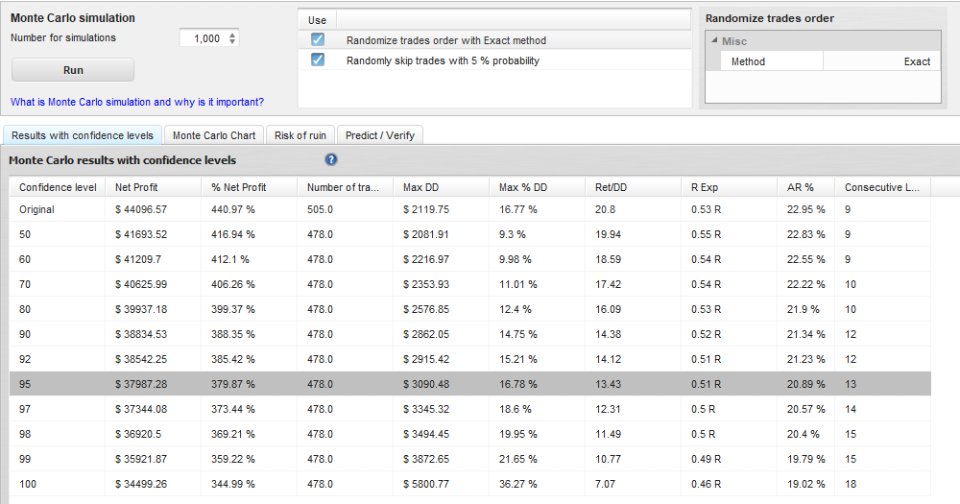

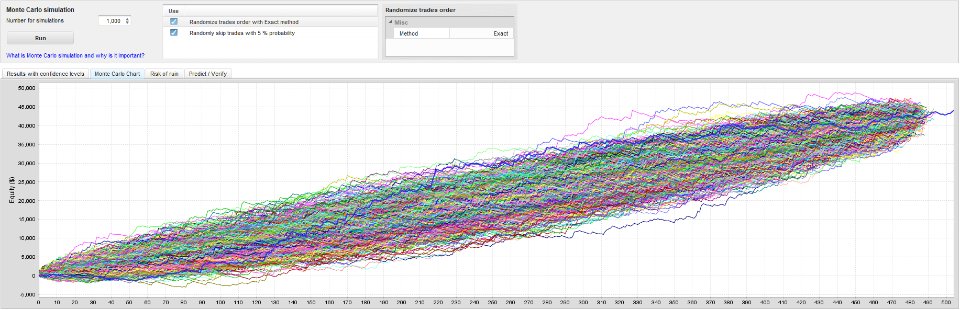

Proven by Backtesting: Tested with data from 2003 to 2024, this EA has demonstrated reliable results. It’s designed to perform well even with a low frequency of trades.

Strengthen Your Portfolio: When combined with other strategies, this EA can enhance overall portfolio performance by stabilizing returns and managing risk effectively. It’s particularly effective when paired with higher-frequency EAs or different currency pairs.

With this EA, you can manage your portfolio efficiently, control risks, and aim for stable returns. Experience the benefits of a low-frequency trading strategy today.

The following is a description of the key parameters in this logic.

1. UseMoneyManagement:

Description: When set to true, money management is enabled, and the lot size is automatically calculated based on the risk amount. If set to false, a fixed lot size (mmLotsIfNoMM) is used.

2. mmRiskedMoney:

Description: Specifies the amount of money at risk in a single trade. Based on this amount, the appropriate lot size is calculated.

3. mmDecimals:

Description: Defines the number of decimal places for the calculated lot size. This setting allows you to adjust the precision of the lot size.

4. mmMaxLots:

Description: Specifies the maximum allowable lot size when money management is enabled. This setting limits the trade size to prevent excessive risk.

5. mmLotsIfNoMM:

Description: The fixed lot size used when money management is disabled. This lot size is applied to all trades.

6. mmMultiplier:

Description: A multiplier applied to the calculated lot size. This is used to adjust the position size according to a specific trading strategy.

7. mmStep:

Description: Defines the step value for adjusting the lot size. This is useful for making small adjustments to the lot size.

8. InitialCapital:

Description: Specifies the initial capital amount used for risk calculations. If set to 0, the entire account balance is used as the basis for calculations.

These parameters, when properly configured, allow for effective risk management and planned, efficient asset management during trading. This logic is a powerful tool that enhances trading safety, supporting both asset preservation and profit maximization.