QuantFiTech Gold

- Эксперты

- QFT L.L.C-FZ

- Версия: 1.1

- Обновлено: 4 сентября 2024

- Активации: 5

The key to trading Gold is with good entry/exit points. Unfortunately, the most difficult part of trading Gold is in determining when good entry/exit points arise. This is where QuantumFinancialTech Gold renders service.

QuantumFinancialTech Gold is a Commodity trading tool that places automatic trades on XAUUSD chart buy studying various price actions that predict the likely movement of its price.

QuantumFinancialTech Gold was designed for the 1 minute(M1) XAUUSD chart

The over-arching concern involved in the development of QuantumFinancialTech Gold is high predictive accuracy. The development of QuantumFinancialTech Gold involved drawing from valuable insight from our other product, the QuantFiTech Gold, which can be found right here:

https://www.mql5.com/en/market/product/121802?source=Site+Market+MT5+Search+Rating006%3aquantfitech

The additional challenge involved with gold is the much higher volatility, which can be an advantage with sufficient predictive accuracy.

Predictive accuracy is an absolute must-have for any successful trading tool and no combination of money-management/loss-control schemes can make up for poor predictive accuracy. Co-incidentally, building a trend model with good predictive accuracy also happens to be the most difficult part of the construction of a successful Commodity trading tool. Other expert advisors simply integrate a complex of useless indicators with some martingale/hedge type money management scheme, such systems typically feature over-reliance on risky money-management schemes and because there is no real price action prediction being performed, these types of systems always end up wrecking your account.

Some other systems substitute A.I. in place of good analytical work, as if A.I. is some sort of panacea. The trouble with most A.I. based E.A. is over-fitting. Such E.A. often feature back-test results that promise impossible returns only to show up dead-on-arrival in live trading.

Other EAs advertise such features as “No Martingale”, or “Uses a Stop Loss”, which might seem great on first impression but upon closer scrutiny, it is often discovered that some ridiculous risk/reward ratio, in excesses of 10:1 are often being used, what that means is that the EA might have a high win rate initially, but all it takes is one single loss to dump supposed winning strategy in a hole. In order to properly estimate the risk/reward one must compare “average profit” to “average loss” per trade, figures which can be found in the strategy tester report. QuantumFinancialTech Gold shows typical risk/reward of approximately 1:1.

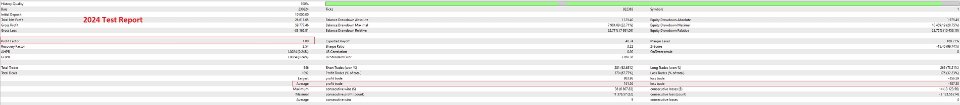

Forward Testing, an essential reliability test in developing a successful trading system, is completely ignored in a vast majority of EA, where reliance on backtest alone is usually preferred. The trouble with this approach is plainly obvious. A trading model must always perform a forward test to evaluate reliability and ensure that the system is not simply curve fitting. In QuantumFinancialTech Gold, optimal parameters of the model were determined using high quality data from 2018 to 2023, then the model was forward tested on 2024. The results showed that the back-tests and forward-tests were identical. More visual expositions of the back-test/forward test results can be found in the pictures below.

QuantumFinancialTech Gold features a unique loss recovery system that takes effect in the event that positions enter loss. In the loss recovery system, a number of possible systems are exploited depending on price actions and indicator signals.

Indicator Based Loss Recovery

The first system is based on the likelihood that the underlying indicator is still accurate, in which case, the indicator constitutes the basis of loss recovery. On this likelihood, when a position moves into loss by a sufficient amount, the indicator based loss recovery is initiated, which involves holding the losing position and opening new positions according to the signals that are issued by the trade indicator, only in this case the lot size of new positions are doubled as long as the loss recovery group is still opened. When the price of the asset moves in such a way that the net profit of the loss recovery group surpasses a threshold profit then the recovery group is closed. The advantage of performing loss recovery in this way instead of choosing some arbitrary "distance" to open loss recovery positions, which most loss recovery systems employ, is that the loss recovery system would be exploiting the predictive power of the indicator to recover from loss. If the indicator is indeed accurate, which we have with QuantumFinancialTech Gold, then loss recovery occurs comparatively quickly and the associated draw-down is minimized.

Pathology Based Loss Recovery

The second system is particularly important for a volatile commodity like Gold. This system is based on the likelihood that the market has entered into unusually volatile period, often caused by unfavorable news events. In such situations, the pathology based loss recovery is used. When the EA detects price patterns that are consistent with news events the indicator based loss recovery is terminated and subsequent positions, sized to the maximum lots in the indicator based loss recovery group, are opened along with the trend. The advantage in this method is reduced risk in recovery along with enabling trend following to capitalize on emerging trend.

Important Inputs:

· RiskLevel: LowRisk, MediumRisk, HighRisk

Recommendations:

· Currency Pairs: XAUUSD

· Timeframe: M1(1 minute)

· Minimum Deposit: $1000

· Account Type: ECN, very low spreads.

· Account Type: Hedge

· Recommended Brokers: IC Markets, FP Markets

· Use a VPS for the EA to work 24/7

An on-chart panel is available to enable the trader to close positions manually, depending on the position type.

Contact us through private message for any questions or issues on setting up the expert advisor.

After the success and profit I gained from QFT EURO & GBP EA, I went ahead and purchased QFT Gold. In one month my account grew 18% and I'm happy to say that the Risk/Reward on the Gold is really conservative with all the volatility and not aggressive but very accurate. Thank you QFT team, I'm a big fan and loyal customer. Can't wait to see what you got coming next.