Zenithor Expert

- Эксперты

- Ruengrit Loondecha

- Версия: 1.2

- Активации: 10

- Zenithor Expert

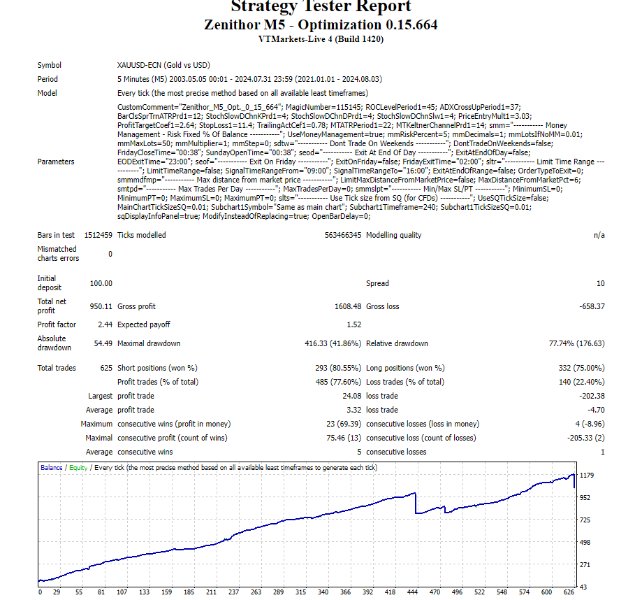

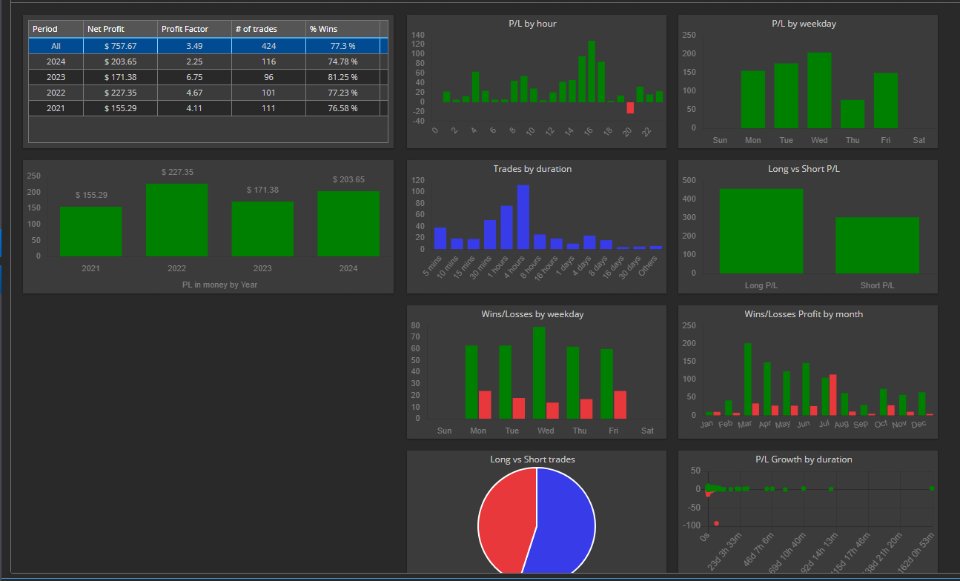

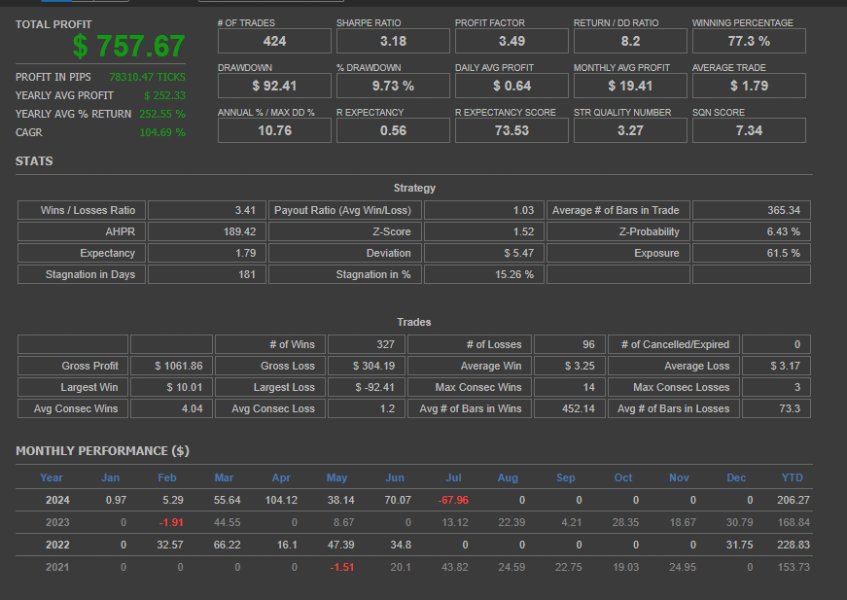

- Working best with GOLD - M5

- Require minimal 100-200$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts -

Rate of Change (ROC):

- ROC is a momentum indicator that measures the percentage change in price over a specified period. It helps identify the speed and direction of price movements, signaling potential trend reversals or continuations.

-

Bearish and Bullish Fractals:

- Fractals are chart patterns that identify potential reversal points. A bearish fractal consists of a high point with two lower highs on each side, while a bullish fractal consists of a low point with two higher lows on each side. These patterns help traders identify possible turning points in the market.

-

Average Directional Index (ADX):

- ADX measures the strength of a trend, regardless of its direction. High ADX values indicate a strong trend, while low values suggest a weak trend or range-bound market. ADX is often used to confirm the presence and strength of a trend.

-

Stochastic Oscillator (Stoch):

- The Stochastic Oscillator compares the closing price to the range of prices over a specific period. It ranges from 0 to 100, with readings above 80 indicating overbought conditions and below 20 indicating oversold conditions. It helps identify potential market reversals and momentum.

-

SuperTrend:

- SuperTrend is a trend-following indicator that uses ATR and a multiplier to plot dynamic support and resistance levels. It provides buy and sell signals based on the direction of the trend, helping traders identify potential entry and exit points.

Trade Style

-

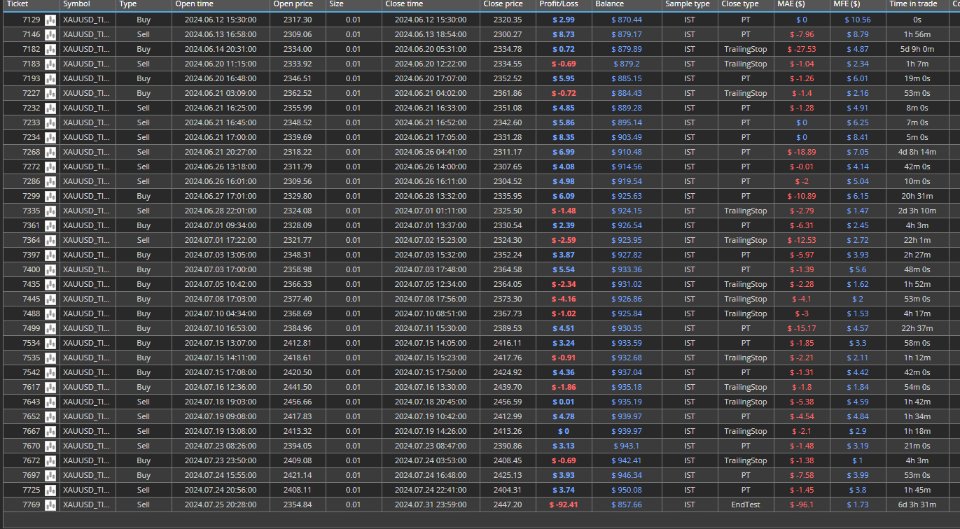

Stop Order with Heiken Ashi:

- A stop order is used to enter or exit a trade when a specified price level is reached. Heiken Ashi candlesticks smooth out price action to highlight the overall trend direction. This technique can help confirm trade entries and exits by reducing noise and false signals.

-

Stop Loss (SL) by Percentage:

- The stop-loss is set as a fixed percentage from the entry price. This approach limits potential losses to a predefined amount, ensuring consistent risk management across trades.

-

Take Profit (TP) by ATR Coefficient:

- The take-profit level is determined using a multiple of the ATR, which reflects market volatility. This method sets a dynamic profit target that adjusts to changing market conditions, providing a flexible approach to profit-taking.

-

Trailing Stop by MTKeltner:

- MTKeltner is a type of Keltner Channel that adjusts based on volatility, typically using ATR. A trailing stop based on the MTKeltner channel moves with the price, following the channel's upper or lower band. This trailing stop helps lock in profits while allowing the trade to run in favor of the trend, protecting gains as the market moves.