Live Orderbook

- Утилиты

- Sara Sabaghi

- Версия: 1.2

- Обновлено: 6 сентября 2024

- Активации: 5

On the occasion of the first days of publishing and attracting first customers, a 50% discount

$120 for first 10 user (3 license left)

Next price is $160 > $200 > $240

Don't forget to send a message after buying (not renting) to add you to our VIP group for free.

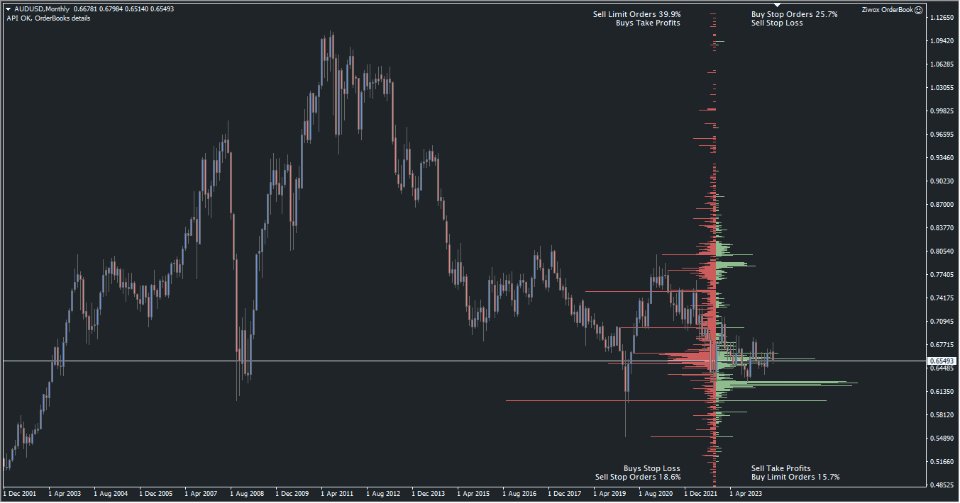

Order Book

An order book is an electronic list of buy and sell orders for a specific asset, organized by price level. It provides real-time data on market depth, showing the amount of pending orders including the specific levels at which they have set their stop loss and take profits. This tool is crucial for traders as it helps them understand the supply and demand dynamics of the asset, identify potential support and resistance levels, and gauge market sentiment.

The Order Book is segmented into two distinct parts. The left side is sell orders and the right side is buy orders. Orders above the current price are Buy stops and sell limits and orders below the Ask price are Buy limits and Sell stops. These levels including all Buy and Sell orders and their Takeprofits and Stop losses.

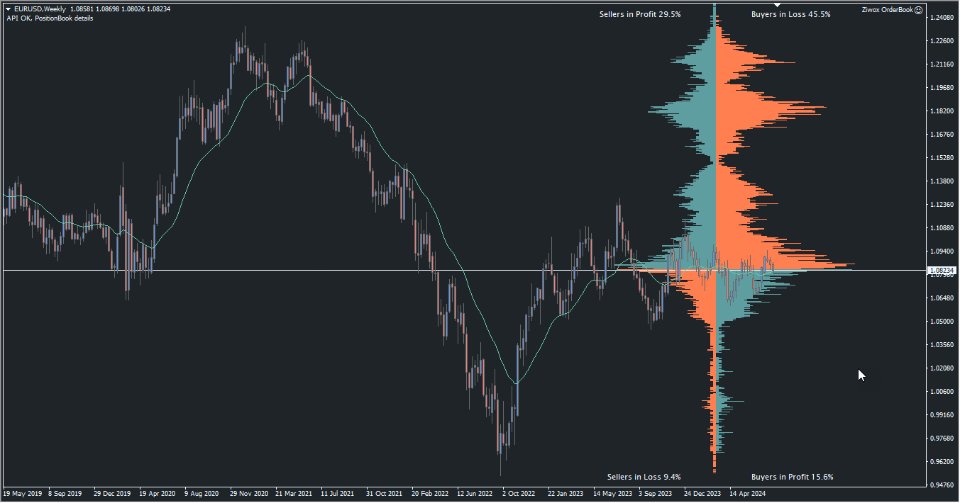

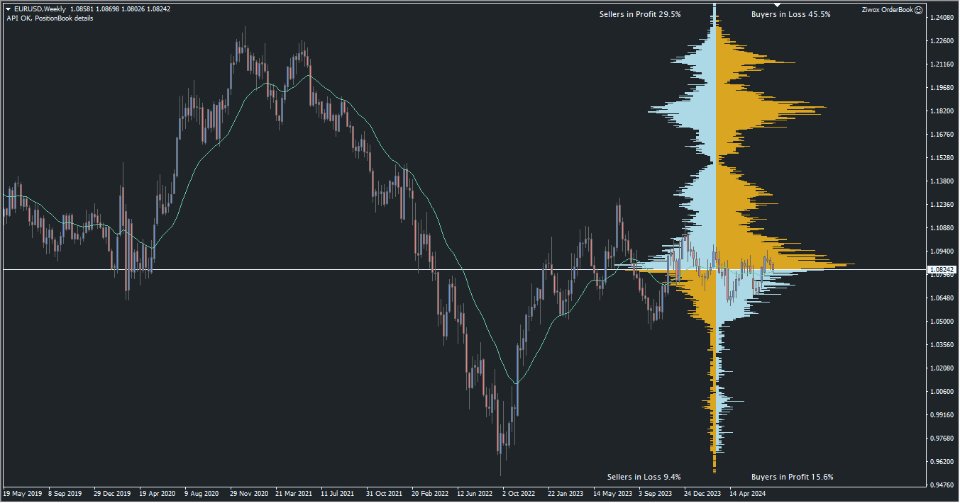

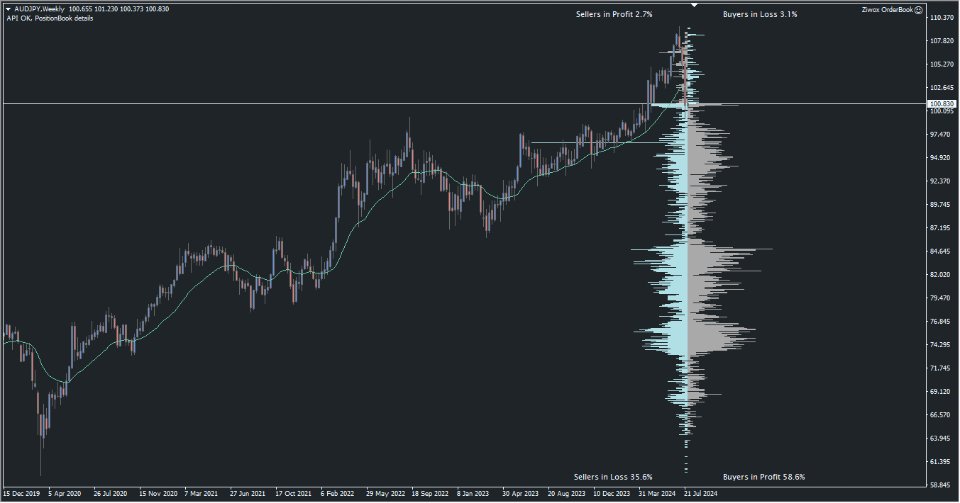

Position Book

The Position Book, focuses on displaying the open trades of market participants and shows the current positions held by traders. It indicates whether traders are net long or net short on an asset.

It is instrumental in revealing active trading positions, thereby allowing traders to discern market trends based on the positions that have yet to be closed.

Why you need it?

The Order Book serves as a crucial resource for Forex traders, offering insight into market sentiment and the behaviors of other market participants. By examining the Order Book, traders can identify support and resistance levels, which are essential for making informed trading decisions. Additionally, the Order Book is considered a leading indicator, which means it provides signals for potential price movements before they occur, aiding traders in optimizing their entry and exit strategies.

The Position Book is similarly significant as it reveals the currently open positions of traders, providing valuable insights into market sentiment. By studying these open trades, traders can better gauge the mood of the market and make predictions about future price movements. This information enables traders to manage risk more effectively by aligning their strategies with prevailing market trends.Practical Application of Order Book Signals

- Market Sentiment: Both the order book and the position book provide insights into market sentiment. The order book shows the current buying and selling interest, while the position book reveals the prevailing trader positions.

- Forecasting Movements: By analyzing the data from these books, traders can predict potential upward or downward pressure. A large number of buy orders at a certain level could indicate strong support, while a large number of sell orders might signal resistance.

- Strategic Planning: Traders can use the information to plan their entry and exit points. Understanding where significant and large accumulations orders are placed helps in avoiding stop hunting and optimizing trade execution as these often signal target levels where price may gravitate.

- Support and Resistance: High concentrations of Take Profit or Limit orders can signal support or resistance levels. The absence of Stop Losses around these levels increases their reliability.

- Losing Trades: Analyzing clusters of losing trades in the right order book can suggest areas where prices may bounce back upward once those positions are closed.

- Winning Trades: Conversely, a substantial presence of winning trades may indicate a potential market reversal, as rapid closures could push prices in the opposite direction.

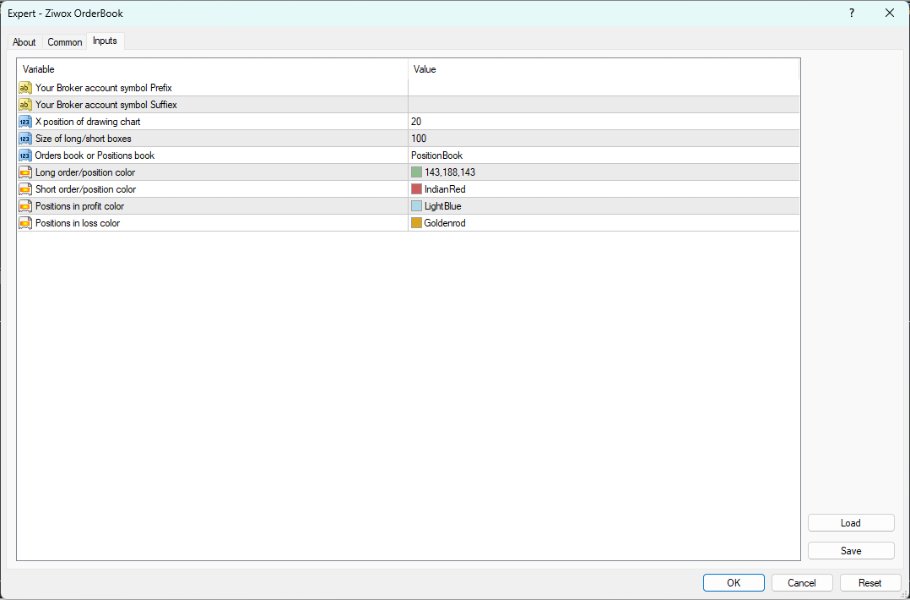

Inputs parameters

| NAME | NAME | Description |

|---|---|---|

| 1 | Symbol Prefix | If your broker or account has a specific character for symbol as a prefix like "eurusd.e", you must enter it here like ".e" |

| 2 | Symbol Suffiex | If your broker or account has a specific character for symbol as suffix, you must enter it here |

| 3 | X position of drawing chart | Shift the drawing orders or positions on chart in X position |

| 4 | Size of long/short boxes | Resize the Order histogram bar size by this number |

| 5 | Orders book or Positions book | Sellect which type of data do you like to get from API, Orders or Positions |

| 6 | Long order/position color | Style the Long orders and positions color |

| 7 | Short order/position color | Style the Short orders and positions color |

| 8 | Positions in profit color | Style the color of positions in profit |

| 9 | Positions in loss color | Style the color of positions in loss |

Notic:

- The main data is received by the OANDA

- OrderBook Data is updated every 1 hour and represents the latest 24 hours of market

OrderBook and PositionBook data just available for these pairs:

EURAUD, EURCHF, EURGBP, EURJPY, EURUSD

USDCAD, USDCHF, USDJPY

GBPCHF, GBPJPY, GBPUSD

AUDJPY, AUDUSD

NZDUSD

XAUUSD, XAGUSD

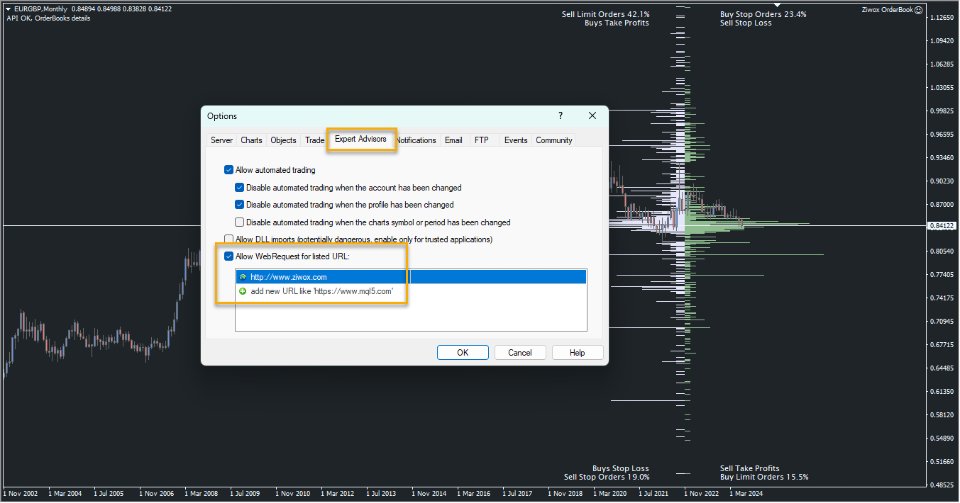

To get data from our servers, you must add this address in your Allow Webrequest link:

https: //www. ziwox.info

LEARN AND READ MORE IN DETAILS