ARES Breakout MT5

- Эксперты

- Romain Jean Philippe J Chatry

- Версия: 1.0

- Активации: 10

September discount is over - Next will be during December for Christmas.

ARES Breakout is designed to capitalize on the volatility that follows the Asian session. Utilizing sophisticated Moving Average calculations, this EA captures significant price movements, ensuring you benefit from the most dynamic market periods.

Trading is NOT a get-rich-quick scheme! Long-term investment in stable EAs is crucial for sustainable growth. ARES Breakout is designed for traders committed to long-term success. Remember, no trading strategy wins every single months in the long-term. If you come across something that appears to, there is a catch.

No GRID, No MARTINGALE: ARES Breakout is engineered to capitalize on market trends without the risks associated with GRID or MARTINGALE strategies. Our EA focuses on achieving substantial profits through its distinctive entry method, offering a balanced blend of risk management, precise target price placements, and optimal trade management.

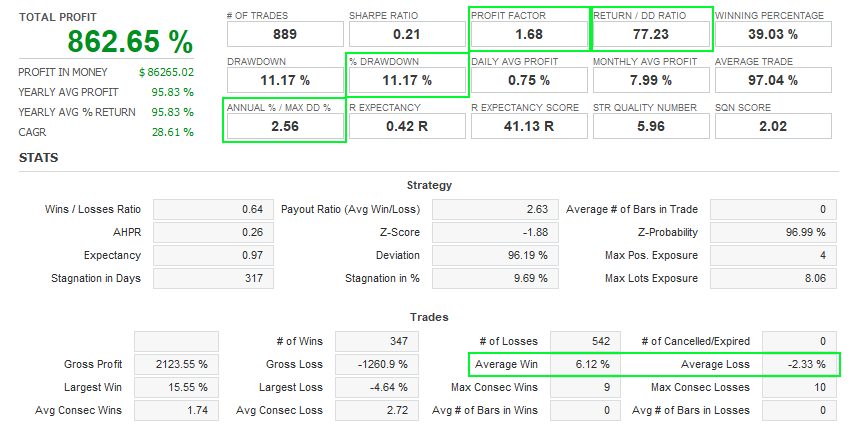

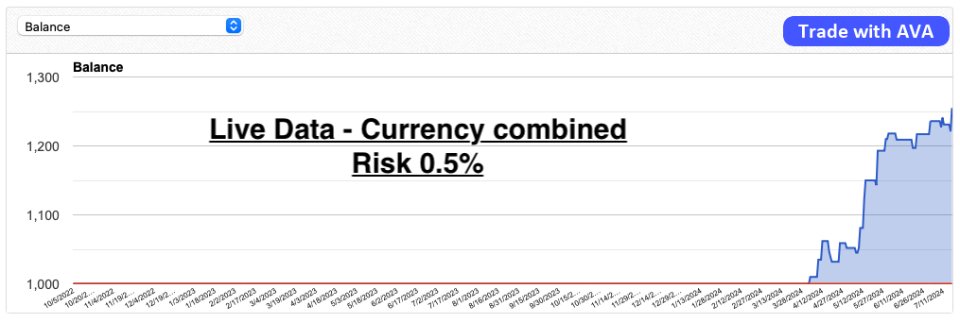

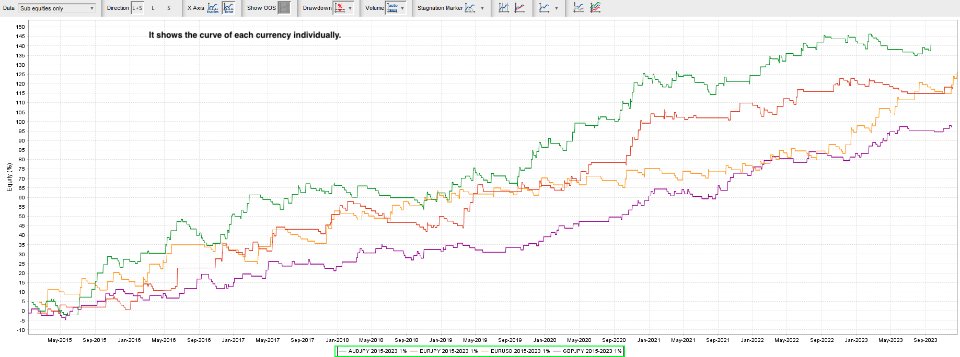

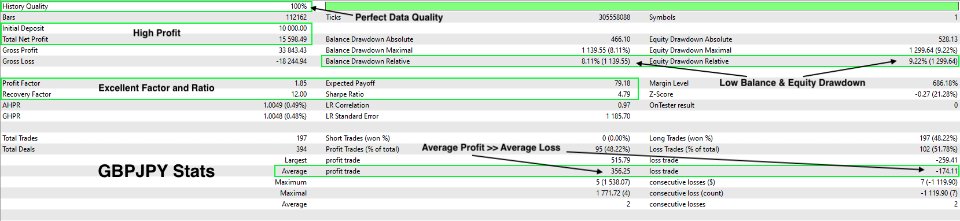

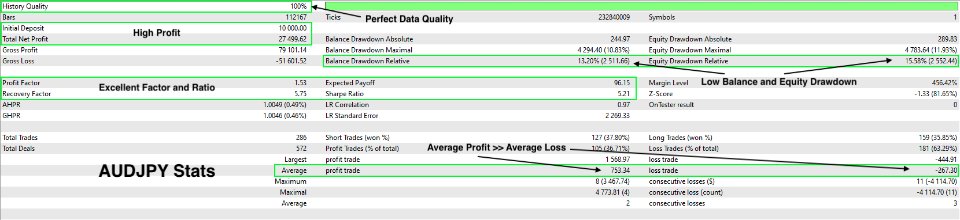

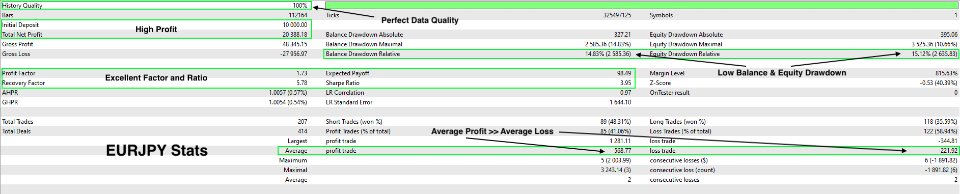

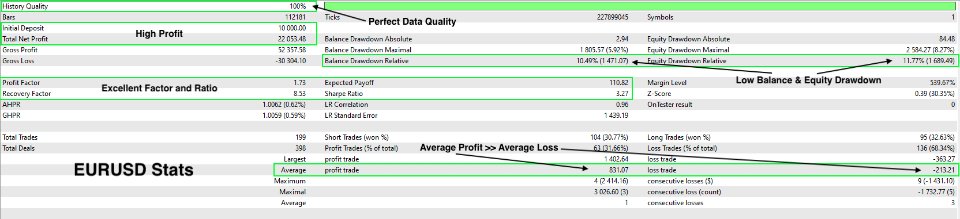

Data-Driven Performance: Backed by comprehensive historical data analysis from 2015 to 2023, ARES Breakout leverages high-quality data to ensure consistent and reliable performance. All testing is run with commission and spread to reflect live market condition. Remember, the quality of your inputs directly affects your outputs!

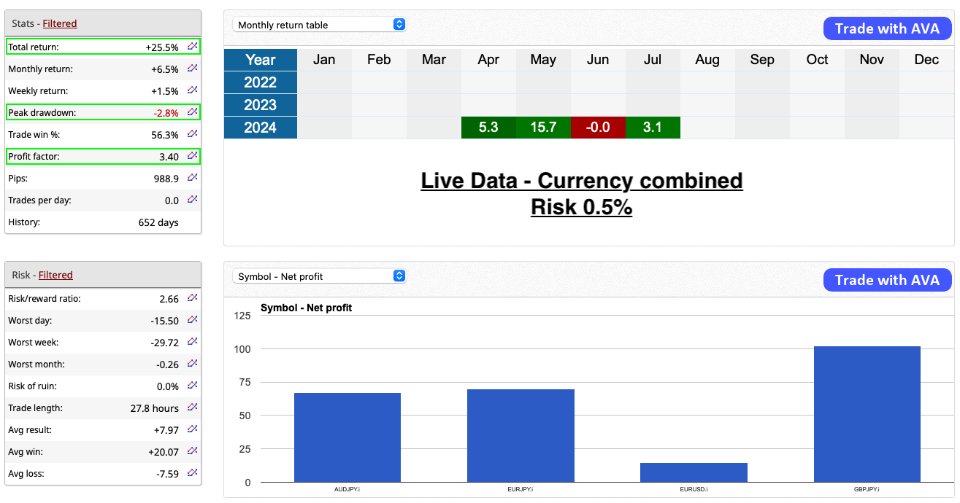

Recommended Settings:- Currency Pair: AUDJPY, EURJPY, EURUSD and GBPJPY

- Minimum Deposit: $1,000 (Optimal is $3,000 or more)

- Timezone: GMT +2 (Adjust if your broker’s server time differs)

- Account Type: ECN or Raw with low spreads - Hedging account

- Brokers: Any broker (perform due diligence). For reference, we use Blueberry Markets.

- Leverage: Minimum 1:100

- VPS: Highly recommended for 24/7 operation. We use AWS Lightsail and recommend setting up your VPS close to your broker’s server location to minimize latency.

Ideal & Description Parameters: https://www.mql5.com/en/blogs/post/758456

- Direction: Long and Short

- Timeframe: 30 Minutes

- Stop-Loss: Average True Range (ATR)

- Setup: Range Breakout (defined by Asian Session)

- Indicator: Simple Moving Average (SMA) or Exponential Moving Average (EMA) depending of the currency

- Trailing Method: Active (Breakeven/SL trailing) depending of the currency

- Constants: Pre-optimized for best performance, no changes needed. Please refer to screenshot if you ended up modifying them.

- Risk Management: Recommended risk is 0.3% to 2% of your capital. For high-risk/high-reward traders, increase the risk percentage to 3% or more.

Feel free to reach out with any questions or for further information: https://www.mql5.com/en/channels/arestradingcapital