Martin Automated Trading RSI Simple

- Эксперты

- Zhu Chen Liu

- Версия: 5.5

- Активации: 5

1. Overall Introduction

The program running name isMartin Trading Configuration - RSI, which is currently the complete version. There is also aRSI minimalist version with the same logic:Martin Trading Configuration - RSI- Lite

The main logic is to automatically monitor RSI indicators. When the configuration threshold is reached, it will automatically triggerorder opening,replenishment,stop profit, andstop loss operations.

I have found that the market is not friendly to Martin, and I have seen comments from everyone saying that there will be stock defaults, unsafe, and so on. Therefore, I would like to make the following explanations:

(1) Finance carries risks and trading needs to be cautious.

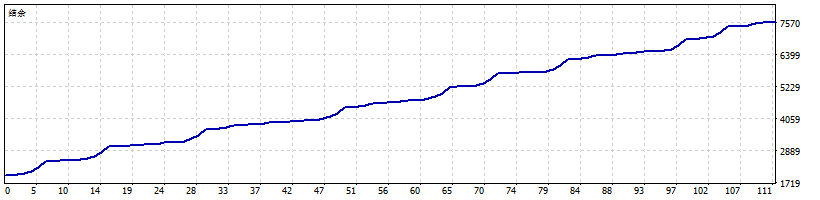

It is important for everyone to understand and effectively manage these risks. Martin's risk means high returns, and I tested it myself with a maximum investment of 2000, earning a profit of 20000 in less than a year. Of course, after the initial actual operation, he also paid for me crazily. Still in use now, achieving doubling in 3 months.

(2) Trend trading.

I not only have Martin, but also a trend trading that uses a variety of mixed indicators such as dual MA to determine the trend at the day level, achieving a 1-minute ultra short term EA. At present, it is possible to achieve close to no liquidation, but the annualized rate is only 200% and the rate reaches 60%, which is not the result I expected.

(3) My usage suggestions

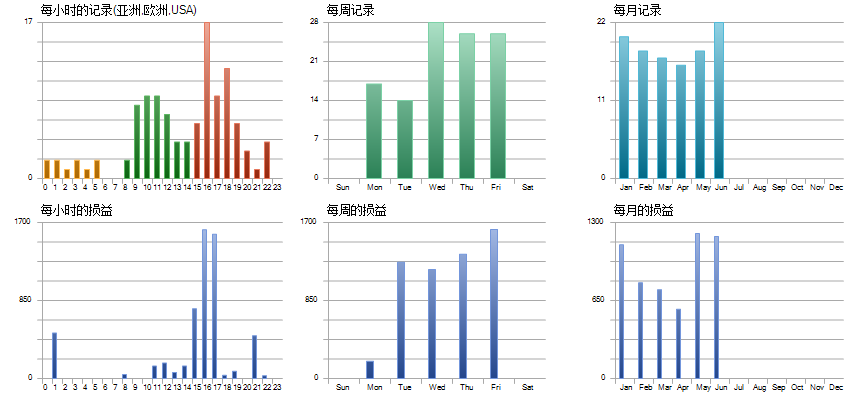

Currency: Europe and America

Time range: 1H, 1D, 15M, 5M

Minimum deposit: $2000

Account type: No special requirements, no overnight fees are required.

Levers: 1:100

Because the market is changing, there is an overfitting problem in EA. It is recommended to adjust the parameters around a month, and be accustomed to conducting recent backtesting and adjustments when available, but also not frequently in the past.

My default parameters may not be suitable for your basic drive and need to be adjusted at any time based on deposit and risk situations. If guidance is needed, it will incur additional fees. It is recommended that individuals try to use it themselves and learn the logic of adjustment.

(4) Can support customized development of functions, please contact me, the price is reasonable.

2. Configuration Instructions

(1) [Account Configuration]

//EA Magic Number | //Trading allows price deviation | There may be a trading deviation between the program and the server during trading. If the deviation is set to 5, the server can operate successfully at [1.0215, 1.0225] when operating buying and selling at platform 1.0220. If the deviation exceeds the range, the operation fails. //Program initial state, T running F pausing | Program configuration after startup state, when T is configured, it will be executed immediately after startup; When configuring F and starting, you need to click the start button //Whether to close the position when the program exits, T is flat and F is uneven. | Whether to force the position to close when the program exits, default to F //The spread threshold used for "filling in" operation judgment | Set the acceptable spread for variety operation, in order to determine whether to execute the operation when filling in the position and closing the profit in the future

(2) [RSI Indicator Basic Configuration]

//The upper limit of RSI indicator value | RSI upper limit threshold, default to 70.. Different varieties and cycles need to be tested without adjustment //Lower limit of RSI indicator value | RSI lower limit threshold, default to 30 //RSI calculation average cycle | Default 14, it is not recommended to manually modify the setting //Chart Period | The current chart period is set to 1 hour by default, and suitable parameters can be selected according to the situation

(3) [Opening Configuration]

//Number of open positions | One round of program opening, the size of the first purchase, and subsequent replenishment based on this as a basis for regular increase

Explanation: Breakthrough indicates that the first two columns of the current column in the configuration chart period are within Threshold

(4)[Replenishment Configuration]

//Replenishment Interval Point | When the first order is issued, it also indicates that the direction of the long or short position in this round of operation is determined. If it is considered as a long-term exchange rate of 1.0200, the current exchange rate value will be 1.0090 after a certain period of time. If the difference between two point positions is greater than 100, trigger the replenishment operation on the side //Replenishment multiplier: | Replenishment multiplier=Opening multiplier parameter x Multiplier ^ (Position before placing an order -1) //Replenishment time interval/m | Replenishment needs to be triggered after a certain period of time and should not be triggered too frequently //Maximum number of replenishment orders | //The spread threshold for replenishment judgment. If it exceeds the threshold, no replenishment operation will be performed. | When the current variety's spread fluctuation exceeds the set threshold, no replenishment operation will be performed. To prevent operations during periods of sharp declines and rises, it is expected that when the spread fluctuates greatly, the exchange rate will also fluctuate greatly.

(5)[Stop Profit Configuration]All conditions will be executed in parallel

//The stop profit judgment threshold is set, and no stop profit operation will be performed if the spread fluctuation of the current variety exceeds the set threshold. You can wait for the fluctuations to stabilize before making further moves // +++++++++++++++++++++++ //Condition 1: Profit point of the last opening order: | Stop profit point x (profit point multiple ^ (number of positions before placing an order -1)) //Condition 1: Profit point multiple |