Capitalgrid01

- Эксперты

- Mr Nisit Noijeam

- Версия: 1.5

- Активации: 10

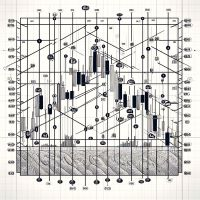

A grid trading strategy is a method used in financial markets, particularly in forex trading, that involves placing buy and sell orders at regular intervals above and below a set price level. This creates a grid-like pattern of orders on the chart, hence the name "grid trading." Here’s a detailed explanation:

Grid Trading Strategy

-

Basic Concept:

- Grid trading is designed to capitalize on market volatility. The strategy works best in ranging or sideways markets, where prices fluctuate within a certain range over time.

-

How It Works:

- Grid Levels: The trader sets up a series of horizontal lines (grid levels) at regular intervals above and below the current market price.

- Buy Orders: Buy orders are placed at intervals below the current price. As the price drops and hits these levels, buy orders are triggered.

- Sell Orders: Sell orders are placed at intervals above the current price. As the price rises and hits these levels, sell orders are triggered.

-

Profit Mechanism:

- The aim is to profit from the price fluctuations between the grid levels. As the price moves up and down, the buy and sell orders are executed, and each completed trade can generate a profit.

- Example: If the market is moving sideways and a buy order is executed at a lower grid level, it will be sold at a higher grid level as the price rises, thus capturing the difference as profit.

-

Risk Management:

- Stop Loss: Traders often set stop-loss levels to limit potential losses if the market moves strongly in one direction.

- Lot Size: Adjusting the size of the trading lots can help manage risk. Smaller lot sizes reduce the risk per trade but also reduce potential profits.

- Margin Management: Ensuring that there is sufficient margin to handle multiple open positions is crucial, as grid trading can involve holding several positions simultaneously.

-

Advantages:

- Simplicity: The strategy is straightforward and easy to implement.

- Profit from Volatility: It can be highly effective in volatile markets where prices frequently oscillate within a range.

-

Disadvantages:

- Trending Markets: Grid trading is less effective in trending markets where prices move strongly in one direction, as it can lead to a series of losing trades.

- Margin Requirements: It requires careful margin management because multiple trades can be open simultaneously, consuming a significant portion of available margin.

-

Automation:

- Many traders use automated trading systems or Expert Advisors (EAs) to execute grid trading strategies. These systems can place and manage orders based on pre-defined rules without the need for constant manual intervention.