Smart Stocks DCA MT5

- Эксперты

- MASTERBROK NEXUS SRL

- Версия: 1.1

- Активации: 5

Dollar Cost Average (DCA) Strategy Description

The Dollar Cost Average (DCA) strategy is an investment approach that involves consistently purchasing a fixed dollar amount of a particular asset at regular intervals, regardless of the asset's price. This method reduces the impact of volatility over time, as it averages out the purchase price of the asset, buying more shares when prices are low and fewer shares when prices are high. DCA is particularly effective in markets expected to grow over the long term, as it allows investors to mitigate the risk of market timing and benefit from potential upward trends.

REAL LIVE PORTFOLIO:

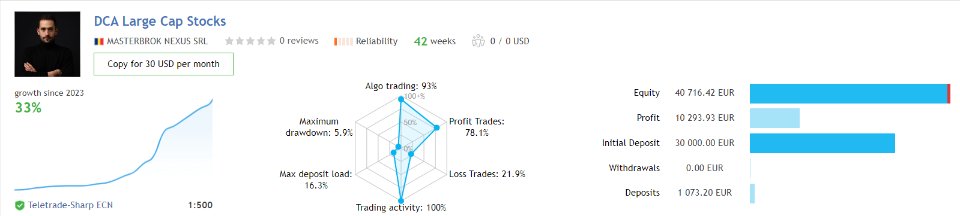

1. DCA Large Cap Stocks Live Results

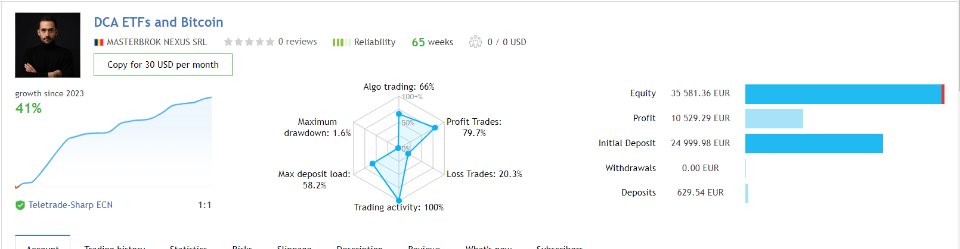

2. DCA ETF & Bitcoin Live Results

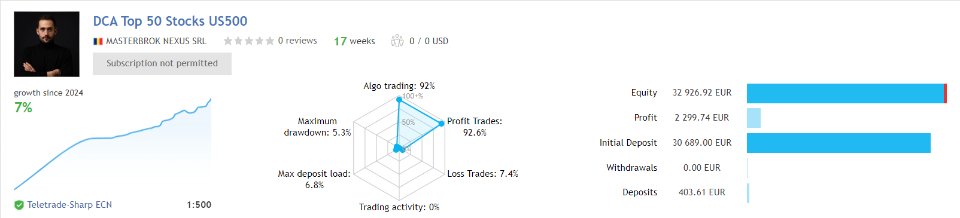

3. DCA 50 Stocks from US500 Live Results

Investment Strategies for Coupling with the EA

This EA is best utilized as part of a well-rounded investment strategy and portfolio, including:

-

Stock Portfolio with Industry and Sector Diversification: Diversifying investments across different industries and sectors can reduce risk and increase potential returns. By not putting all investments into a single sector, the portfolio can better withstand sector-specific downturns.

-

ETF Diversification: ETFs offer a way to diversify within a single investment vehicle. By holding a basket of stocks, bonds, or other assets, ETFs can spread risk across a broad range of securities. Diversifying across different ETFs can further enhance risk management and exposure to various market segments.

-

Growth Portfolio: A growth portfolio focuses on investing in companies expected to grow at an above-average rate compared to other companies. This strategy aims for capital appreciation rather than income, making it suitable for investors with a higher risk tolerance and a long-term investment horizon.

-

Dividend Portfolio: Investing in dividend-paying stocks can provide a steady income stream in addition to potential capital gains. This strategy is often favored by conservative investors seeking regular income and lower volatility.

-

Balanced Portfolio: Combining stocks, bonds, and other assets to balance risk and return, a balanced portfolio aims to provide growth and income while reducing volatility. This strategy is suitable for investors seeking a middle ground between aggressive growth and conservative income.

-

Thematic Investing: Thematic investing involves focusing on long-term trends or themes, such as technology, renewable energy, or healthcare. By investing in companies aligned with these themes, investors can capitalize on structural changes in the economy and society.

Coupling the EA with these diversified strategies can optimize investment outcomes, leveraging the DCA method's strengths while spreading risk and enhancing growth potential across different assets and market segments.

Expert Advisor Description

This Expert Advisor (EA) is designed to implement the DCA strategy specifically for markets anticipated to experience long-term growth, such as stocks, ETFs, and indices. It is not intended for use in forex markets, as it only executes buy orders.

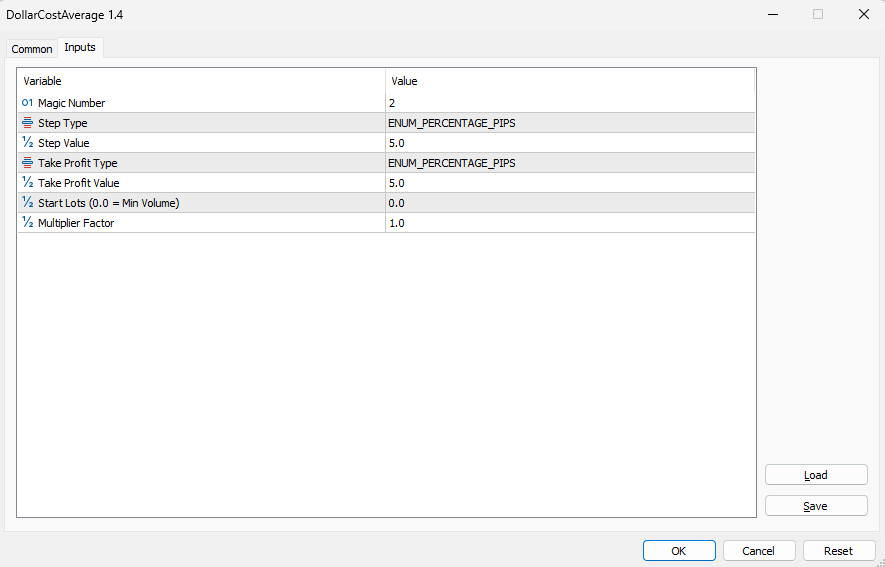

The EA offers the following configurable parameters:

- Magic Number: A unique identifier for the EA's trades.

- Step Type:

- Step Percentage Pips: Opens a new trade when the market drops by a specified percentage ("Step Value").

- Step Fixed Pips: Opens a new trade when the market drops by a fixed number of pips ("Step Value").

- Step Value: The threshold for opening new trades, based on the selected step type.

- Take Profit Type:

- Step Percentage Pips: Sets a take profit based on a percentage of the total investment in the instrument. For example, if $7500 has been invested and the Take Profit Value is 10%, the take profit for all trades combined will be set at $750.

- Step Fixed Pips: Sets a take profit at a fixed number of pips for the entire trade batch.

- Take Profit Value: The take profit threshold, depending on the selected take profit type.

- Start Lots: The volume of the initial trade. A value of 0.0 uses the minimum trading volume allowed.

- Multiplier: Multiplies the volume of subsequent trades by this factor, allowing the EA to buy more at lower prices and potentially yield higher profits when the market recovers.

This EA is a robust tool for systematic investment in growth markets, leveraging the DCA strategy to optimize trade entries and exits based on predefined conditions.

tags: dollar cost average expert advisor invest investment stocks etf reit indice indices spot market risk strategy