EUPulse

- Эксперты

- Javier Diaz Perete

- Версия: 1.0

EUPulse: The EUPulse trading robot is designed to operate on the EUR/USD currency pair. Optimized for an M30 (30-minute) trading timeframe, it offers a balanced approach for traders aiming to combine short-term and medium-term strategies.

Technical Indicators Used

-

Kaufman's Adaptive Moving Average (KAMA): This adaptive moving average adjusts based on market volatility, smoothing price data to filter out noise while staying responsive to significant price movements. The robot uses KAMA to identify reliable trend directions and reduce lag.

-

Bollinger Bands: These volatility bands are placed above and below a moving average and adjust based on standard deviation, expanding during high volatility and contracting during low volatility. EUFlow M30 utilizes Bollinger Bands to detect overbought or oversold conditions and identify potential breakout opportunities.

-

Trend Detection: Advanced algorithms analyze market trends, distinguishing between trending and ranging conditions. This feature helps the robot to align with prevailing market directions and adapt its strategies accordingly.

-

Simple Moving Average (SMA): A straightforward moving average that calculates the average price over a specific number of periods. The robot integrates SMA to provide a smooth trend analysis and support KAMA in confirming trend strength.

These indicators enable EUPulse to perform a comprehensive analysis of market conditions, identifying optimal entry and exit points based on a synthesis of price trends, volatility, and trend strength.

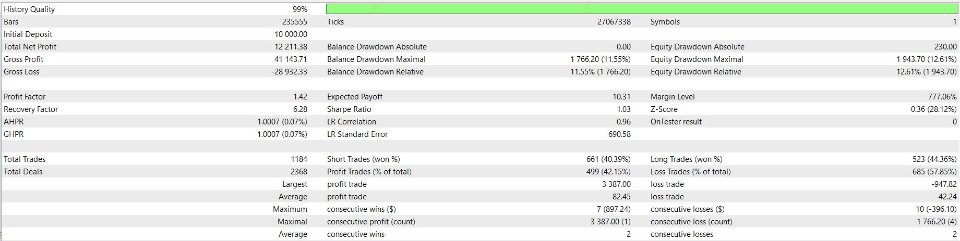

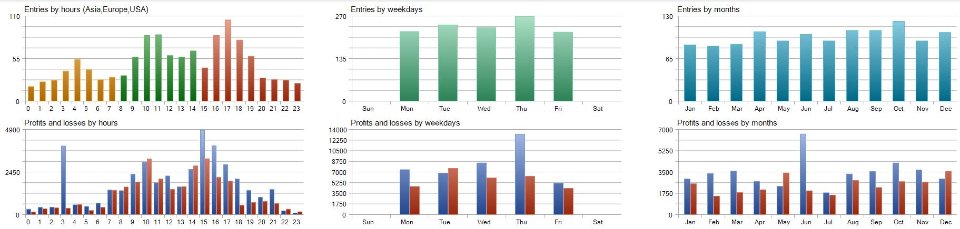

Development and Testing

- Forward Testing: Simulated in real-time market conditions to validate its effectiveness prior to release.

- Monte Carlo Robustness Testing: Passed Monte Carlo robustness tests, ensuring reliable performance across various market scenarios.

Configurable Parameters

- Magic Number: A unique identifier for the robot’s trades, enabling users to differentiate between trades from different robots or strategies.

- Use Money Management: (true/false) If set to true, the robot uses a percentage of the total balance instead of a fixed lot size.

- Risk Percent: The percentage of the account balance to be risked per trade when money management is enabled.

- Lots: The fixed lot size used when money management is set to false.

It is advisable to activate money management based on risk or adjust the number of lots according to the account balance.