Mongol indicator

- Индикаторы

- Sumiyabazar Buyanjargal

- Версия: 1.0

- Активации: 5

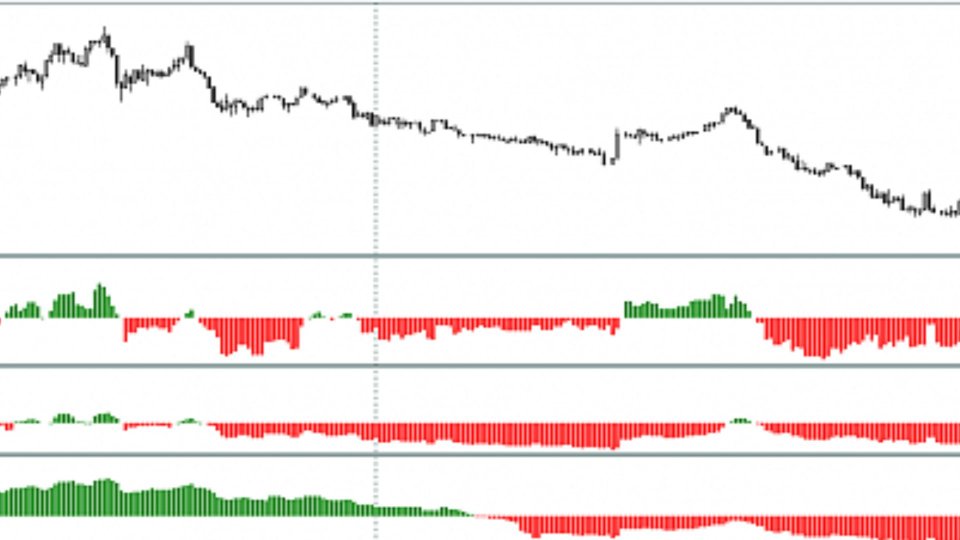

It's a variation of mid of HH and LL since it compares the higher of HH or LL against a period and twice the number of bars back to avoid whipsaws.

I used to display this against lines on a chart, but made a histogram out of it and it looks interesting.

It looks good at gauging trend strength and general turns (see image below).

The name of the indicator is BAM, which is an acronym for "Below and Above Mid".

Ways to use it:

1. To see general trend on longer TFs (more than 60 bars back).

2. To see market vs mid of HH LL range at any time.

3. It can tell you a possible trend has just started.

4. It can tell you when to possibly stay out against a trend.

I used to display this against lines on a chart, but made a histogram out of it and it looks interesting.

It looks good at gauging trend strength and general turns (see image below).

The name of the indicator is BAM, which is an acronym for "Below and Above Mid".

Ways to use it:

1. To see general trend on longer TFs (more than 60 bars back).

2. To see market vs mid of HH LL range at any time.

3. It can tell you a possible trend has just started.

4. It can tell you when to possibly stay out against a trend.