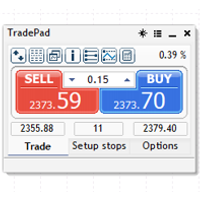

Trade Panel For Strategy Tester MT5

- Утилиты

- Salman Soltaniyan

- Версия: 1.0

- Активации: 10

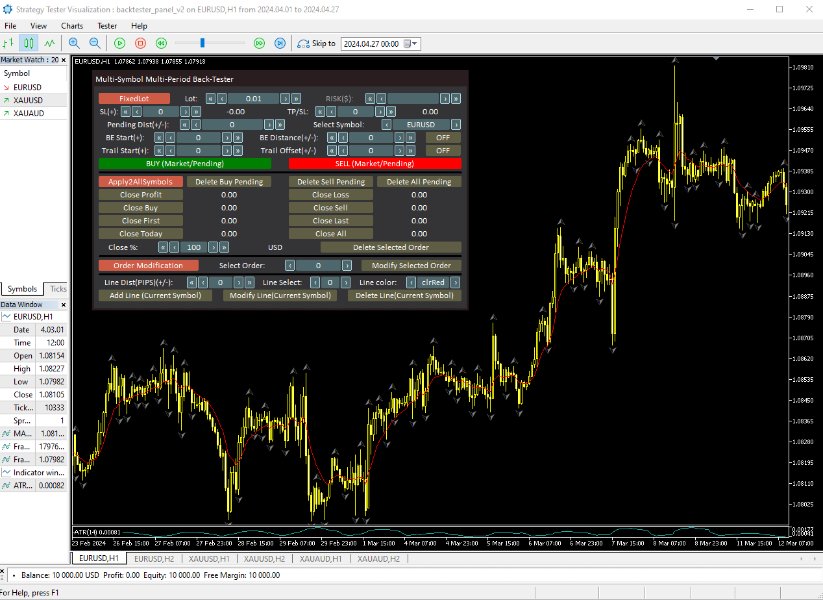

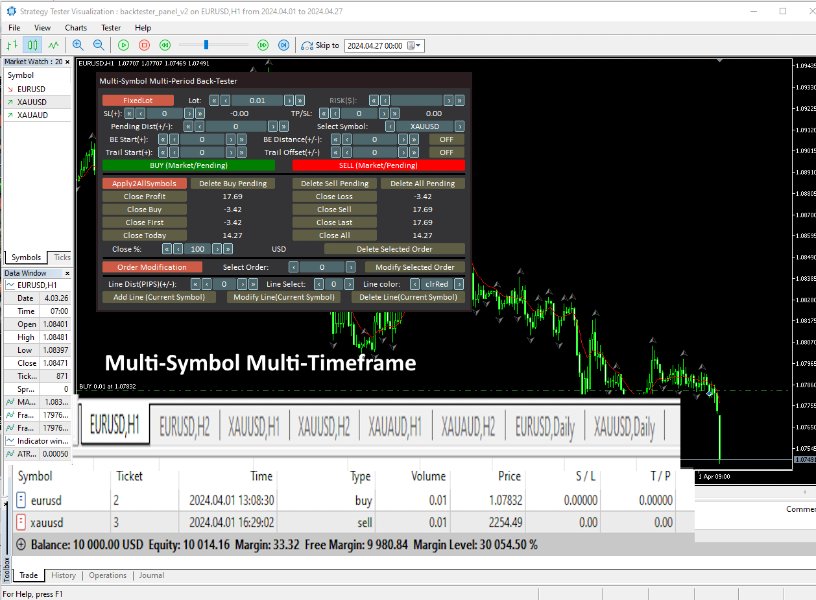

It's a trading dashboard appears on strategy tester, allows you to backtest your own strategies, testing them on multiple symbols and timeframes. It is equipped with useful features such as risk management, trailing stops, breakeven points, and more, enabling you to evaluate and refine your strategies effectively. Trading panels are typically designed to facilitate real-time trading and may not function properly on a strategy tester. However, this particular trading panel is specifically designed to operate smoothly and accurately on a strategy tester.

Attention, this application is designed for backtesting strategies in the strategy tester, and is not intended for real-time trading.

PANEL Fields

Section1. Order Placement - This section allows for the placement of market or pending orders, as well as the activation of break-even or trailing stop mechanisms, all while taking into account the predetermined risk amount. - Fixedlot/FixedRisk: Allows for the option to switch between entering positions based on lot size or risk percentage.

- Lot: The position size can be adjusted within this field when 'Fixed Lot' is chosen in the preceding option.

- Risk(%)($): The value of risk can be adjusted within this field when 'Fixed Risk' is chosen in the preceding option. The position size will be calculated based on the value entered here and the distance to the stop-loss level.

- SL and TP distance: The distance to the stop-loss and take-profit levels can be customized directly in these fields.

- TP/SL: If the 'fixed risk to reward' input parameter is set to 'true', the value of the take-profit (TP) to stop-loss (SL) ratio can be adjusted in this field. When this is the case, the take-profit level will be calculated based on the stop-loss distance and the specified risk-to-reward ratio.

- Select Symbol: The symbol chosen in this field correspond to one of the symbols listed in the input parameters and serves as the reference for opening, modifying, and closing positions.

- Buy/Sell Buttons: Allow the user to place both market orders, which execute the trade immediately at the current market price, as well as pending orders, which are executed when the price reaches a specified level in the future.

- Pending Dist(+/-) : If this entry is set to zero, market orders will be executed by using the buy/sell buttons. Alternatively, if a value is entered, pending orders will be placed. The type of pending order (buy limit, sell limit, buy stop, sell stop) is automatically determined based on the pending distance. For instance, a positive pending distance will result in a buy stop order being placed when the buy button is pressed, while a negative pending distance will trigger a buy limit order.

- BE Start(+): The distance from the opening price at which the Break Even function will be triggered can be customized within this input field.

- BE Distance(+/-): Once the Break Even function is activated, the stop-loss level will be adjusted to move to the opening price of the position, plus the value specified in this entry. This allows the trade to be protected at the original entry price, plus the additional buffer defined here.

- Trail Start(+): The distance from the opening price at which the Trailing Stop mechanism will be triggered can be customized within this input field.

- Trail Distance(+): The distance by which the stop-loss level will trail the market price once the Trailing Stop mechanism has been activated can be adjusted within this input field.

- Trail Offset(+/-): This field allows you to adjust the distance by which the stop-loss level will trail the specified indicator value (moving average or fractals) once the Trailing Stop mechanism has been triggered.

- Close Profit/Loss: Clicking these buttons will close only the positions that are currently in a profitable or losing state, without affecting any other open positions.

- Close Buy/Sell: Close only buy/sell positions.

- Close First/Last: Close first/last position in the list of positions in Trade tab of strategy tester.

- Close Today: Close positions which are opened today.

- Close All: Close all positions.

- Apply2AllSymbols/ Apply2SelectedSymbol: This toggle button determines the scope of the position closing actions in this section. When set to 'All Symbols', the buttons will close positions across all symbols. When set to 'Selected Symbol', the buttons will only affect positions for the currently selected symbol.

- Close %: This field allows you to adjust the percentage of the position that will be closed when using the ' %Close Selected Positoin' button.

- %Close Selected Positoin: Clicking this button will partially close the position selected in Section 3.2, by the percentage amount specified in the previous field (Section 2.7). This allows for selective partial closing of individual open position.

- Delete Selected Order: Delete pending order selected in section3.2.

Section 3.Modify Positions/Orders:

- Order/Position Modification: This toggle button specifies whether modifications should be applied to a pending order or an open position. By selecting the appropriate mode, you can easily determine where the modifications will be directed within your trading activities

- Select Order/Position: This field allows you to specify the order number or position number from the trade tab of the strategy tester that you want to modify.

- Modify Selected Order/Position: Upon adjusting the parameters in Section 1, clicking this button will apply the changes to the specific order or position that has been selected.

Section 4. Add horizontal lines

- Line Dist(PIPS)(+/-): This field allows you to adjust the distance (in PIPs) from the current Bid price that the line should be drawn. You can specify a positive or negative value to set the distance above or below the current Bid price.

- Line Select: Input the line number that corresponds to the line you wish to modify or delete. This feature enables you to specify the exact line within the interface for targeted adjustments or removal.

- Line Color: line color can be adjusted in this field.

- Add Line(Current Chart): By clicking this button, a line will be added to the current chart using the line distance and color specified in Section 4.1 and Section 4.3, respectively.

- Modify Line(Current Chart ): This button allows you to modify the line selected in Section 4.2. It utilizes the Line Distance specified in Section 4.1 to adjust the line position upward or downward, and applies the new color specified in Section 4.3.

- Delete Line(Current Chart ): Clicking this button will remove the line that has been selected in Section 4.2 from the current chart.

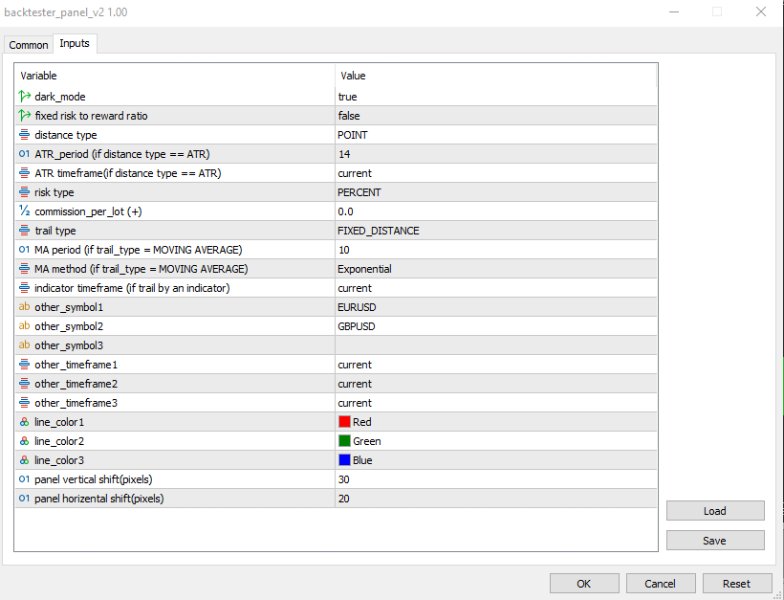

Expert Input Parameters

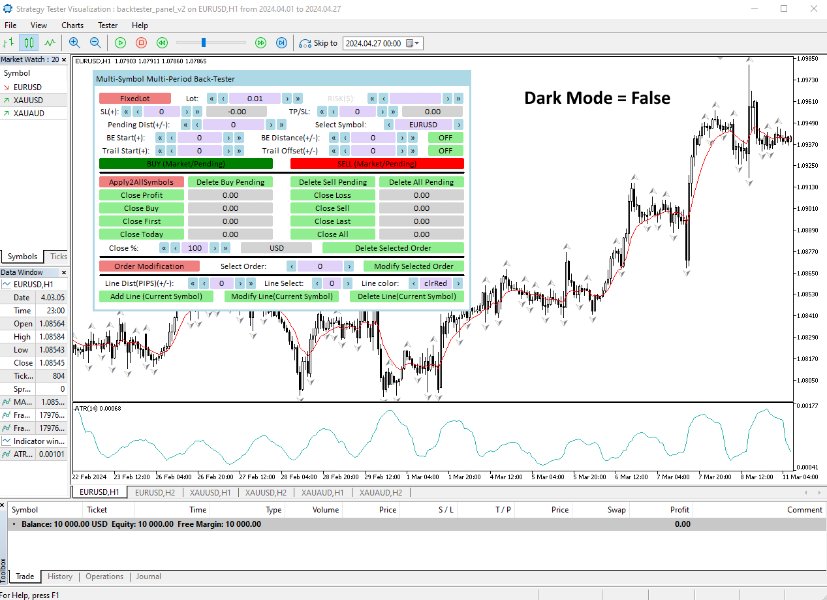

- dark mode(true/false): Choose the panel color scheme by selecting 'True' for dark mode or 'False' for light mod.

- fixed risk to reward(true/false): Enable this setting by selecting 'True' to calculate Take Profit based on the predefined Risk to Reward ratio, or choose 'False' to enter Take Profit directly without ratio calculation.

- distance type: Choose from three distance types - 1-Point, 2-PIP, 3-ATR. This selection impacts the values entered in Section 1 for 'SL', 'TP', 'Pending Dist', 'BE Start', 'BE Distance', 'Trail Start', and 'Trail Offset'. For instance, if ATR is chosen, entering '3' in the SL field implies the Stop Loss distance from the current price is 3 times the current value of the ATR indicator.

- ATR period: If you have selected 'ATR' as the Distance Type, this field allows you to choose the period to be used for the Average True Range (ATR) indicator calculation.

- ATR timeframe: When the Distance Type is set to 'ATR', this field enables you to select the timeframe for the Average True Range (ATR) indicator calculation. This allows you to base the distance values on the ATR measured over different time periods, providing flexibility in your trading parameters.

- risk type: Choose between two risk types - 1-Percent, 2-Money. This selection impacts the value entered in Section 1.3. If 'Percent' is chosen, the risk value entered in Section 1.3 is a percentage of the balance. If 'Money' is selected, the value represents the risk amount in dollars. The lot size is automatically calculated based on the risk value and Stop Loss (SL), ensuring that if the price hits the SL, the loss amount equals the specified risk in dollars.

- Commission per lot: Enter the amount of commission that the broker charges per lot. This parameter affects the values of profit and loss displayed on the panel, ensuring that the calculations take into account the commission fees when calculating the profit and loss of your trades.

- trail type: Choose from three types of trailing stops - 1-Fixed Distance: Trailing stop set at a fixed distance. 2-Moving Average: Trailing stop based on the Moving Average indicator. 3-Fractals: Trailing stop determined by Bill Williams' Fractals indicator. Selecting the appropriate trail type allows you to customize how your trailing stops behave in response to market movements

- MA period: If the Trail Type is set to 'Moving Average', this field allows you to specify the period for the Moving Average indicator.

- MA method: it refers to the method used for calculating the moving average indicator for the trail stop. This parameter allows traders to choose from different methods such as simple, exponential, smoothed, or linear weighted moving averages.

- indicator timeframe: When utilizing a moving average or Bill Williams' Fractals indicator as the trail type, this parameter allows you to specify the timeframe for the indicator. The chosen timeframe influences the calculation and responsiveness of the indicator, impacting the behavior of the trailing stop based on the selected indicator.

- other symbol1,2,3: These fields allows you to specify additional symbols that you want to view and trade on within the strategy tester. By listing the desired symbols here, you can expand the trading capabilities of the tester beyond the primary symbol.

- other timeframe1,2,3: These fields enable you to specify additional timeframes that you wish to include for viewing within the strategy tester. By entering the desired timeframes here, you can expand the range of time intervals available for analysis and testing in the strategy tester.

- line color1,2,3: These fields allow you to enter a list of line colors that can be used to customize the visual representation of horizontal lines on the chart.

- panel vertical shift(pixels): This parameter controls the vertical positioning of the panel in relation to the left axis on the char.

- panel horizontal shift(pixels): This parameter controls the horizontal positioning of the panel in relation to the upper axis on the char.