XP Layering and set BE tool

- Утилиты

- Mostafa Mahmoud

- Версия: 2.84

- Обновлено: 26 января 2025

- Активации: 5

Smart Trade Manager for Layering & BE

This AI-powered trading tool automates trade management by handling entry positions, Break-Even (BE), and Take Profit (TP) dynamically. It allows traders to layer trades and protect their profits without manual intervention.

Key Features:

- Secure profits automatically by setting BE once a trade reaches profit.

- Distribute trade volume across multiple entries to average the price.

- Set multiple TP targets to scale out of positions efficiently.

- Use tick-based calculations instead of pips for precision across different brokers.

How It Works:

- Automated trade management: The EA monitors your positions and adjusts SL, TP, and entries dynamically.

- Break-even protection: Moves SL to the entry price when conditions are met.

- Layering strategy: Opens additional positions when the market moves against or in favor of your trade.

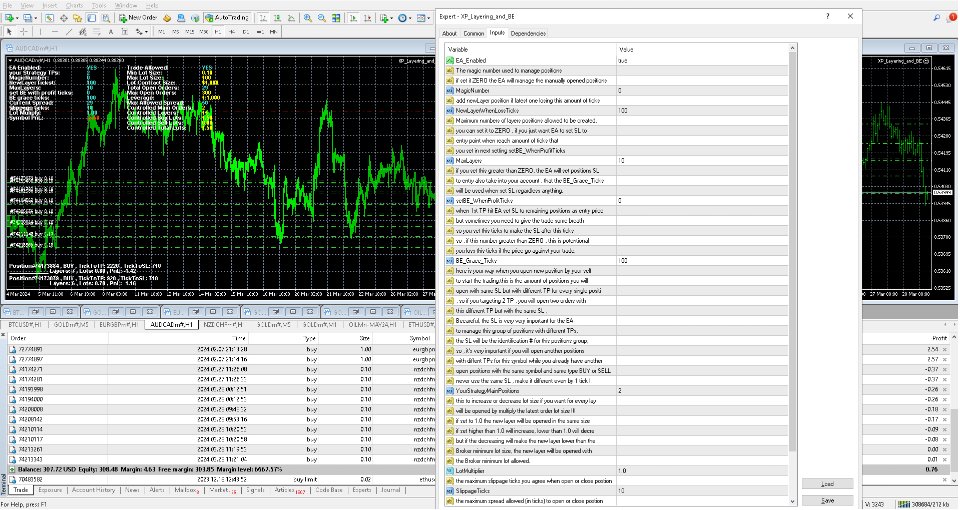

Input Settings:

1. Main Trade Strategy Settings

-

YourStrategyMainPositions: Defines the number of main positions to be opened initially.

- 0 : The EA will only open layering positions.

- 1 : The EA opens a single main position and layers additional ones until reaching MaxLayers .

- >1 : The EA manages multiple main positions with different TP levels.

-

NewLayerWhenLossTicks: Defines how many ticks a position should go against the trade before a new layer is opened.

-

InverseLayering: A revolutionary feature (added in 2024) that layers positions when the trade is profitable instead of during losses. This increases potential gains rather than accumulating losses.

2. Break-Even & TP Management

- SetBE_WhenProfitTicks: Moves SL to the entry price after the trade reaches a specified profit in ticks.

- BE_Grace_Ticks: Defines how many ticks away from entry price the SL should be set when moving to BE.

- setTPAsEntry_WhenLossTicks: If the price moves against your trade by the defined tick value, TP is set at entry price to exit ASAP.

- DynamicTPforLayers: Sets TP for newly opened layers with a specific target in ticks.

3. Order Handling Options

-

PositionsTypesToHandle: Choose whether to manage BUY, SELL, or BOTH position types.

-

LotMultiplier: Adjusts the lot size dynamically for each new layer.

- 1.0 : Keeps the same lot size.

- >1.0 : Increases lot size for each new layer.

- <1.0 : Decreases lot size, but will not go below the broker’s minimum allowed lot.

-

MaxSpreadTicks: Prevents opening or closing positions when the spread exceeds a defined value.

-

SlippageTicks: Controls the maximum slippage allowed for trade execution.

4. Automation & Risk Management

- UnloadExpertWhenEnd: Automatically unloads the EA when there are no active positions left.

- WaitSecondsBeforeExecution: Delays execution for a few seconds after applying the EA to allow traders to review settings before processing.

- SendPushNotification: Sends MetaTrader push notifications for every executed action.

- DelayRetryOnError: Prevents excessive retry attempts in case of execution errors due to market conditions.

Latest Updates:

2024-04-23:

- AutoOpenRemainingMainPositions: Ensures fast execution by automatically opening the remaining main positions.

- IncreaseTPforAutoMainPositions: Allows users to set a TP increase for automatically opened positions.

- OnlyPositionsNotPassedThisSeconds: Prevents automatic position copying if the last position was opened more than a set number of seconds ago.

2024-05-19:

- SetSLforLayersAsPreviousPosition: A risk-management feature that prevents multiplying losses by setting SL for layers when inverse layering is active.

2024-11-02 (Version 2.8):

- setTPAsEntry_WhenLossTicks: A scalping feature that automatically exits trades when a price move goes against the position.

- DynamicTPforLayers: Enables precise TP control for layered positions, allowing traders to capture profits at predefined intervals.

Why Use This EA?

No need to monitor trades manually.

Automatic TP and SL management.

Customizable settings for any trading style.

Backtested and optimized for performance.

Your feedback is highly appreciated!