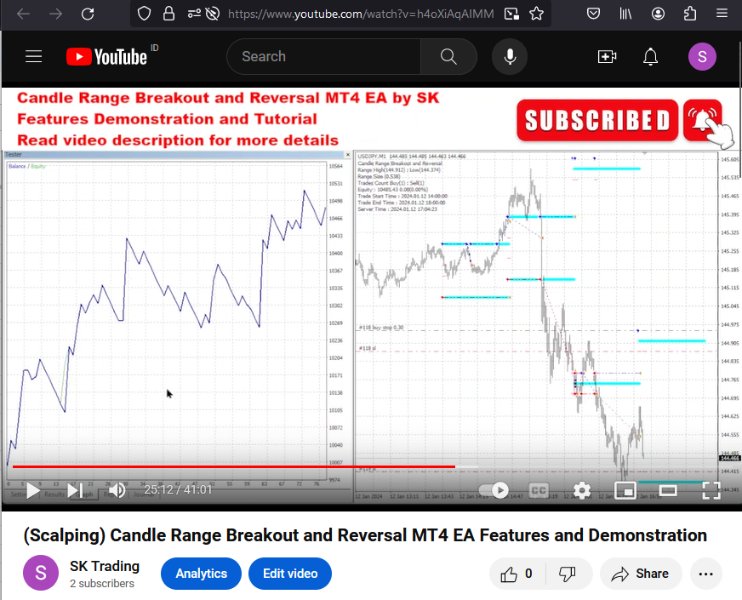

Candle Range Breakout and Reversal MT4 EA

Candle Range Breakout and Reversal MT4 EA by SK

What this EA does:

It find the high-low or open-close from the previous candle trade using that range.

Everytime there is a new candle, the range is updated to the previous candle.

This process is repeated until trading window ended.

That's why reversal strategy should be implemented.

If the range size is bigger than min range size specified by user,

user can add distance pts to activate Reversal Trade Strategy.

If the range size is big and price swing inside the range,

reversal trade can capitalize on that.

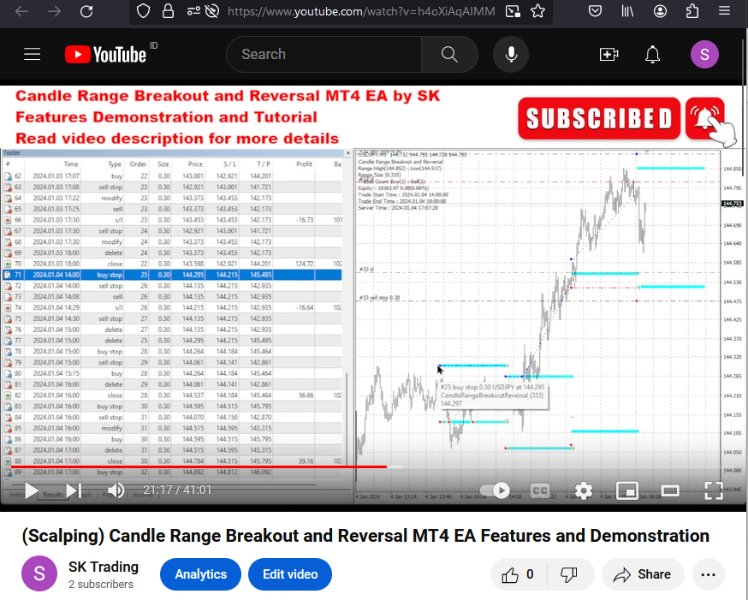

Features or Setting:

Parameters must be re-tune or recalibrate according to pairs

and market condition depending how big the price swing in average.

Previous orders should be closed and deleted at the end of trade.

Previous orders should be closed and deleted when there is new candle or new range.

Option to execute order instead of pending order stop

if price is out of range when trading time start.

Should be turn off to be safer.

But by turning on we can catch the trend or momentum.

Order Frequency to limit over trading

or to trade Long only or to trade Short only

if there is strong trend in fundamental or macroeconomics.

Trailing Stop, SL trail market price by pts

when triggered pts from Order Price.

Locking Stop or Breakeven Stop, Lock SL at Order Price by pts

when triggered pts from Order Price.

Partial Close, close partial(some) lot

when triggered pts from Order Price.

*Martingale* option to change lot size after number of trades.

Equity Stop to delete and close orders when triggered.

(*Orders from this EA or all orders within this account)

Disclaimer:

There is no winning guarantee.

Treat this EA as a tool to help you trade, to test on your theory or strategy or parameters.

Combine it with other techniques, fundamentals, macroeconomics.

Since this is a breakout strategy, always look for strong trend or strong momentum

like news, trading session opening (Asia Session, London Session, New York Session).

If you are trading on USD pair, look for USD news and New York opening Session.

Risk:

Sideways or weak momentum hitting multiple StopLoss

Recommendation:

USDJPY pair

Start trading time on New York Session where news or market might push price in one direction