VolumeFXanalyzer2

- Эксперты

- Thomas Bolognesi

- Версия: 1.0

- Активации: 5

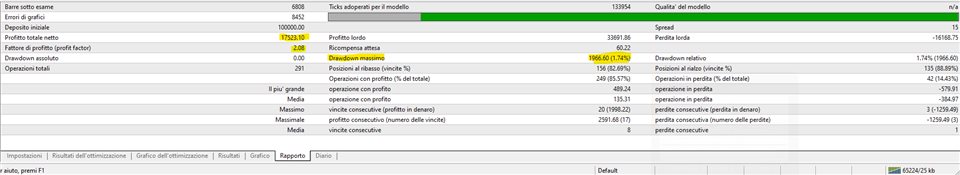

VolumeFxAnalyzer can trade on all Forex pairs and indices. It is a trend following type system that analyzes the various volumes and enters into volumetric confirmations and trend strength. The system also works very well on indices such as SP500.

-No martingala/anti-martingala System

- Position sizing and money manager in percentage % of Equity

- Take profit with multiplier

-Session Trading Personalizable

-Breakeven when position reaches some distance

-Partial Close, For take some profit during the operation

-Filter for trend change direction

-Magicnumber

-Panel Info With Account information

-Low Drawdown

-Good Profit

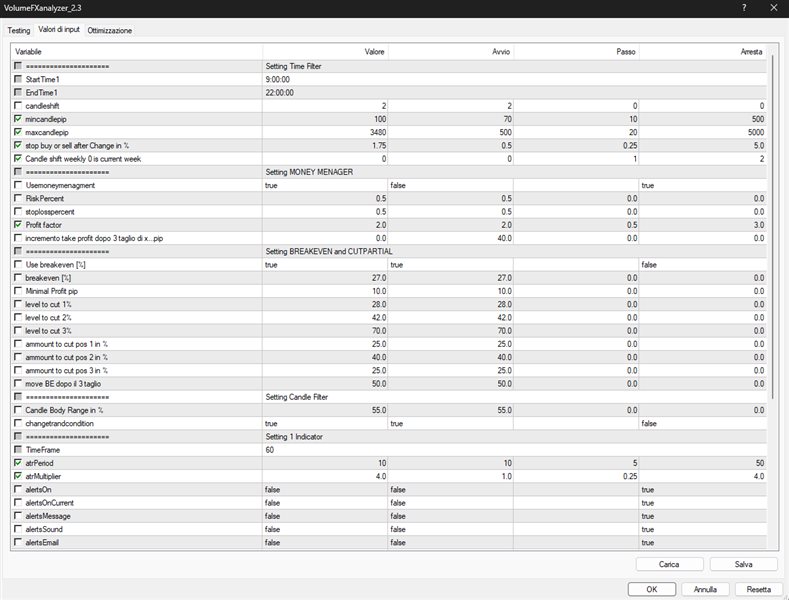

1. Setting Time Filter

-

StartTime1

- Defines the time (hour/minute) at which the EA begins taking trades or analyzing the market.

- Example: If set to 9.00, the EA will only open new trades at or after 9:00 broker/server time.

-

candleShift

- The candle index offset used in calculations.

- A value of 0 often refers to the current (forming) candle, 1 refers to the last closed candle, etc.

- Used if you want signals to be based on a specific candle in the past rather than the most recent one.

-

EndTime1

- Defines the time (hour/minute) at which the EA stops opening new trades.

- Example: If set to 17.00, the EA will not open trades after 17:00 broker/server time.

-

mincandepth

- The minimum candle size or range (often in pips or points) required before considering a trade.

- Helps filter out very small (quiet) candles.

-

maxcandepth

- The maximum candle size or range allowed for a valid signal.

- Helps avoid entering trades on extremely large, volatile candles.

-

stop buy or sell after Change in %

- A percentage-based filter that, once price has moved by a certain percentage from a reference point (e.g., the day’s open or the entry price), the EA will stop placing new trades in that direction.

- Used to avoid chasing big moves after a large percentage shift in price.

-

cancel this setting is current week

- This may indicate that the EA’s time filter or trade filter resets weekly.

- If true , it might mean the time filter is only valid for the current week and resets at the start of the next week.

2. Setting MONEY MANAGER

-

RiskPercent

- The percentage of your account balance (or equity) to risk per trade.

- Example: If set to 1.0, each trade will risk 1% of the account.

-

stoplosspercent

- Another percentage-based parameter related to stop loss sizing.

- Could mean the stop loss is calculated as a percentage of account balance or a percentage of price.

- The exact usage depends on the EA’s internal logic.

-

profit factor

- Often used to indicate a desired ratio of profit relative to risk (e.g., Risk:Reward).

- Could also be used to scale the take profit distance.

- For example, a profit factor of 2 might aim for a take profit twice the size of the stop loss.

-

incrementa take profit dopo 3 taglio di sl

- Translated: “Increase take profit after 3 stop loss hits” or “after 3 partial stop adjustments.”

- Suggests that if the EA experiences a certain condition (like multiple stop-loss triggers or partial closures), it then increases the take profit distance.

3. Setting BREAKEVEN and CUTPARTIAL

-

use breakeven

- Enables or disables the breakeven function.

- When true, the EA will move the stop loss to entry price (breakeven) after a certain profit threshold.

-

breakeven pips (sometimes labeled again further down)

- The number of pips in profit at which the stop loss is moved to breakeven.

-

minimal Profit pip

- The minimum amount of profit (in pips) needed before certain actions (like partial close or breakeven) can occur.

-

level to cut

- The profit level (in pips or price) at which a partial closure (cut) is triggered.

-

partial to cut

- The percentage or fraction of the position to close when partial closure is triggered.

- Example: 0.5 means closing half of the current position size.

-

cut to remain

- The fraction or lot size that remains open after the partial closure.

- Often used together with “partial to cut” to define how much stays in the market.

-

wait to cut pos in 1?

- Possibly a setting to wait a certain number of candles or a specific condition before performing the partial close.

- “in 1” might mean “on the next bar” or after one more bar/candle.

-

use trailing after partial

- When true, after the partial closure occurs, the EA activates a trailing stop on the remaining position.

-

time for trailing

- Defines how frequently or when the trailing stop updates (in bars, minutes, or some internal measure).

-

move BE dopo i 3 taglio

- Translated: “Move breakeven after 3 partial closures” or “3 cuts.”

- If you have multiple partial cuts, this setting might move the stop loss to breakeven after the third one.

4. Setting Candle Filter

-

Candle Body Range in %

- A filter that checks the candle’s body size relative to its total range (or possibly relative to average candle size).

- If the body is too small or too large (in percentage terms), the EA may skip trading signals.

-

shift

- Similar to candleShift, it refers to which historical candle to analyze for the filter.

- A shift of 1 usually means the last closed candle, 2 means two candles ago, etc.

5. Setting Indicator 1 (e.g., ATR)

-

atrPeriod

- The period used for the Average True Range (ATR) calculation (e.g., 14).

-

atrMultiplier

- A multiplier applied to the ATR value.

- Often used for setting stop loss or take profit levels (e.g., SL = ATR * atrMultiplier).

-

alertsOn

- Enables or disables pop-up or chart alerts.

-

alertsMessage

- Determines whether an alert message is displayed when a signal occurs.

-

alertsSound

- Plays a sound when an alert is triggered.

6. Setting 2 Indicator VOLUME / MA_Method (if applicable)

-

MA_Method

- The type of Moving Average used in calculations (e.g., 0 = Simple, 1 = Exponential, 2 = Smoothed, 3 = Linear Weighted).

- Sometimes used in volume-based or confirmation filters if the system uses a moving average on volume data.

-

Other volume-related parameters (not fully visible in the screenshot) could define:

- Volume threshold (minimum or maximum volume to trade)

- Lookback period (how many bars to average volume)

- Volume-based filters (e.g., trade only if volume is above a certain average)

Every month I will make some optimizations so that you always have the best performing system