ICT Implied Fair Value Gap for MT4

- Индикаторы

- Minh Truong Pham

- Версия: 1.2

- Обновлено: 28 ноября 2023

- Активации: 5

An Implied Fair Value Gap (IFVG) is a three candles imbalance formation conceptualized by ICT that is based on detecting a larger candle body & then measuring the average between the two adjacent candle shadows.

This indicator automatically detects this imbalance formation on your charts and can be extended by a user set number of bars.

The IFVG average can also be extended until a new respective IFVG is detected, serving as a support/resistance line.

Alerts for the detection of bullish/bearish IFVG's are also included in this script.

🔶 SETTINGS

This indicator automatically detects this imbalance formation on your charts and can be extended by a user set number of bars.

The IFVG average can also be extended until a new respective IFVG is detected, serving as a support/resistance line.

Alerts for the detection of bullish/bearish IFVG's are also included in this script.

🔶 SETTINGS

- Shadow Threshold %: Threshold percentage used to filter out IFVG's with low adjacent candles shadows.

- IFVG Extension: Number of bars used to extend highlighted IFVG's areas.

- Extend Averages: Extend IFVG's averages up to a new detected respective IFVG.

🔶 USAGE - Users of this indicator can primarily find it useful for trading imbalances just as they would for trading regular Fair Value Gaps or other imbalances, which aims to highlight a disparity between supply & demand.

- For trading a bullish IFVG, users can find this imbalance as an area where price is likely to fill or act as an area of support. (image 1)

- In the same way, a user could trade bearish IFVGs by seeing it as a potential area to be filled or act as resistance within a downtrend. (image 2)

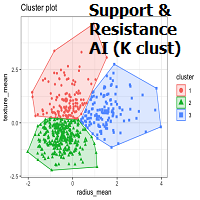

- Users can also extend the IFVG averages and use them as longer-term support/resistances levels. This can highlight the ability of detected IFVG to provide longer term significant support and resistance levels. (image 3)

- 🔶 DETAILS

Various methods have been proposed for the detection of regular FVG's, and as such it would not be uncommon to see various methods for the implied version.

We propose the following identification rules for the algorithmic detection of IFVG's:

🔹 Bullish - Central candle body is larger than the body of the adjacent candles.

- Current price low is higher than high price two bars ago.

- Current candle lower shadow makes up more than p percent of its total candle range.

- Candle upper shadow two bars ago makes up more than p percent of its total candle range.

- The average of the current candle lower shadow is greater than the average of the candle upper shadow two bars ago.

where p is the user set threshold.

🔹 Bearish

- Central candle body is larger than the body of the adjacent candles.

- Current price high is higher than low price two bars ago.

- Current candle upper shadow makes up more than p percent of its total candle range.

- Candle lower shadow two bars ago makes up more than p percent of its total candle range.

- The average of the candle lower shadow 2 bars ago is greater than the average of the current candle higher shadow.

where p is the user set threshold. - Central candle body is larger than the body of the adjacent candles.