EA Heiken Ashi Strategy

- Эксперты

- Zafar Iqbal Sheraslam

- Версия: 1.0

- Активации: 10

Certainly! An EA (Expert Advisor) Heiken Ashi strategy is a trading algorithm designed to automate trading decisions based on Heiken Ashi candlestick patterns. Heiken Ashi is a type of candlestick charting technique that aims to filter out noise and provide a smoother representation of price trends. It does this by averaging price data over a specified period.

Here's a simple outline of how you can create an EA Heiken Ashi strategy:

-

Heiken Ashi Calculation: You need to implement the Heiken Ashi formula to calculate the Heiken Ashi candlesticks. These calculations involve determining the open, close, high, and low prices for each Heiken Ashi candle.

-

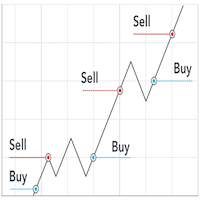

Entry Rules: Define the conditions for entering a trade. These conditions could be based on Heiken Ashi patterns or a combination of Heiken Ashi with other technical indicators like moving averages, RSI, or MACD. For example, you might enter a buy trade when a bullish Heiken Ashi pattern forms after a period of downtrend.

-

Exit Rules: Specify the criteria for exiting a trade. This could include setting take-profit and stop-loss levels based on Heiken Ashi patterns or other technical indicators. Additionally, you might use trailing stops to protect profits as the trade moves in your favor.

-

Risk Management: Implement proper risk management techniques, such as position sizing and money management. This ensures that you don't risk too much capital on a single trade and helps protect your account from significant losses.

-

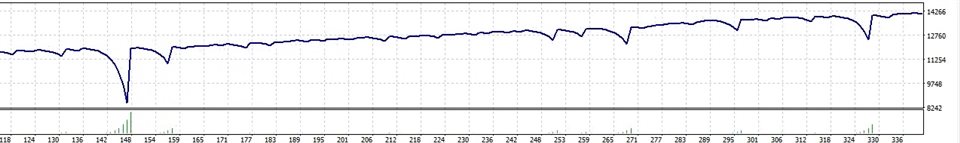

Backtesting: Backtest your EA on historical data to evaluate its performance. Make necessary adjustments to fine-tune the strategy based on the results of the backtesting.

-

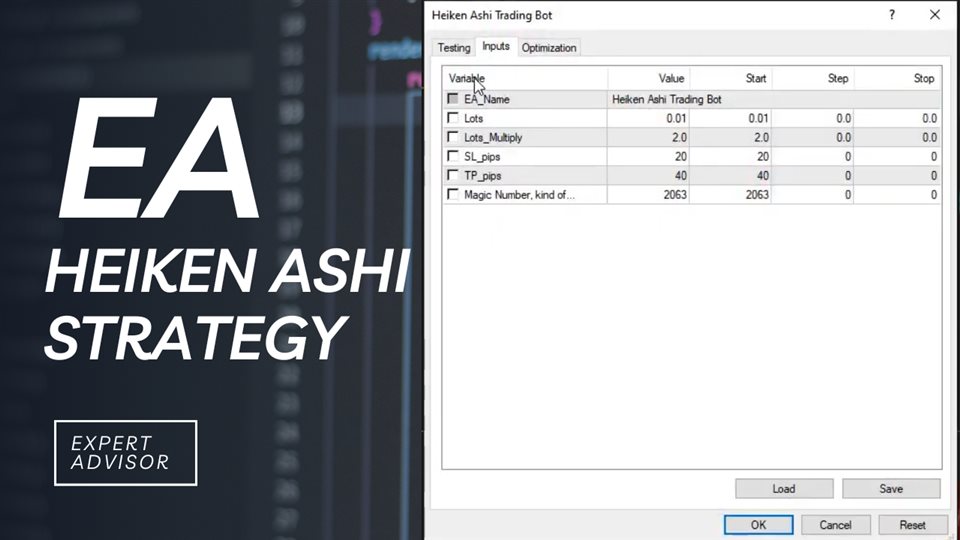

Optimization: Optimize your EA parameters, such as the period for calculating Heiken Ashi candles or the entry/exit conditions, to maximize its profitability while minimizing risk.

-

Forward Testing: Run your EA in a demo or live trading environment with real-time data to see how it performs under real market conditions. Be cautious and monitor its performance closely.

-

Continuous Monitoring and Updates: Even after deploying your EA, it's essential to continuously monitor its performance and make updates as necessary. Market conditions can change, and adjustments may be needed to adapt to new trends.

-

Risk Disclaimer: Clearly communicate the risks associated with using your EA and ensure that traders understand that past performance is not indicative of future results.

-

Documentation and Support: Provide comprehensive documentation and support for your EA to help users understand how it works and how to use it effectively.

Remember that creating a successful EA Heiken Ashi strategy requires a good understanding of both Heiken Ashi candlestick patterns and algorithmic trading. It's also crucial to have a robust risk management plan in place to protect your capital from significant losses. Additionally, consider testing your strategy thoroughly before deploying it in a live trading environment.