EA EMA High Low Price

- Эксперты

- Zafar Iqbal Sheraslam

- Версия: 1.0

- Активации: 5

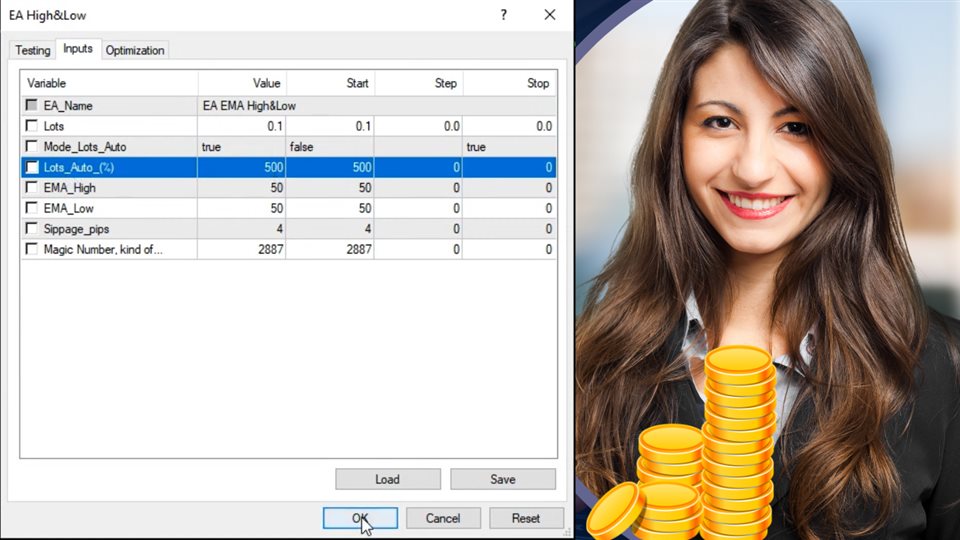

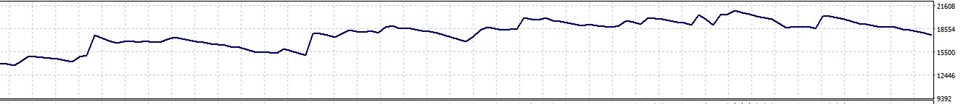

This "EA EMA High & Low Price" refers to the concept of using Exponential Moving Averages (EMA) in the context of tracking the highest (high) and lowest (low) prices of a financial instrument, such as a stock, currency pair, or commodity. The Exponential Moving Average is a widely used technical analysis tool that helps traders and analysts identify trends and potential reversals in price movements.

In this context, the "EMA High & Low Price" approach involves calculating the Exponential Moving Average of the high prices and low prices of the financial instrument over a specific period of time. The high prices refer to the highest prices recorded during that period, while the low prices refer to the lowest prices.

The EMA calculation assigns more weight to recent data points, making it sensitive to recent price changes. This sensitivity allows the EMA to respond more quickly to shifts in the market compared to other moving average types.

By plotting the EMA of both the high and low prices on a price chart, traders can gain insights into the overall trend direction and potential support and resistance levels. When the EMA of high prices is above the EMA of low prices, it might indicate a bullish trend, and when the opposite is true, it might indicate a bearish trend.

Remember that trading and investing involve risks, and using technical indicators like EMA should be done in conjunction with other forms of analysis and risk management strategies.