DailyRebound Portfolio Trader

- Эксперты

- Mika Matias Manty

- Версия: 2.0

- Обновлено: 5 октября 2024

- Активации: 10

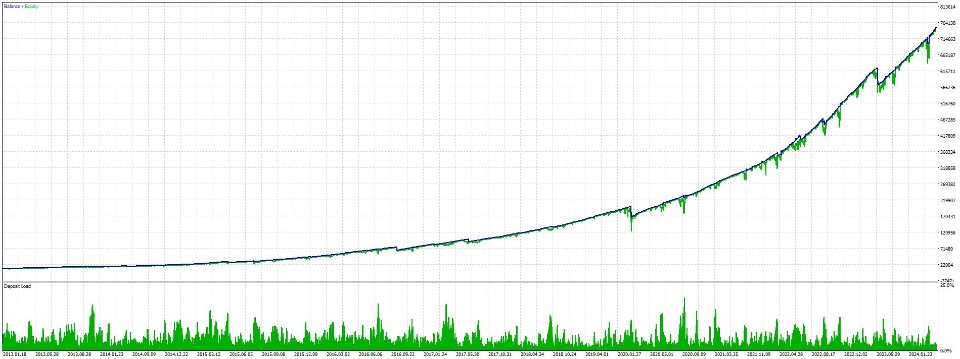

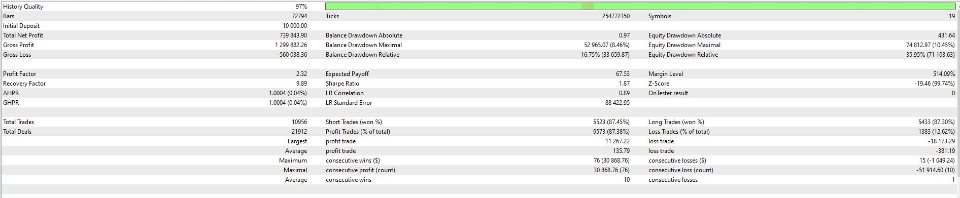

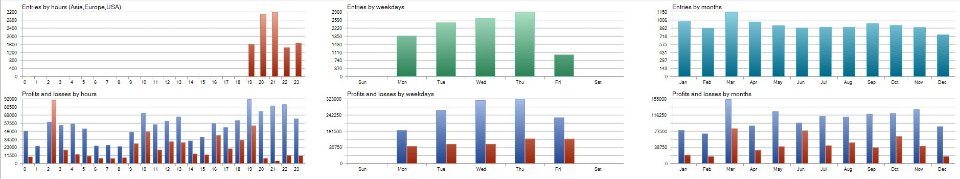

DailyRebound EA uses a simple and robust strategy to try to profit from exhaustion of very strong daily moves. If the price has been moving strongly to one-direction during the last 24 hours it's very likely to pull back slightly before the trading day ends or overnight. These end of the day and overnight pullbacks are what DailyRebound EA is after.

DailyRebound EA uses the (DCA) averaging-in approach for losing positions and exits when the complete basket is in small profit in such a case that initial trade does not reach its profit target, or stop loss levels are hit. DCA is done without Martingale. EA adds maximum one position per day to the trade basket. A position is added only if it considerably improves the average price of the trade basket. This keeps risks low and prevents rapid high drawdowns.

DailyRebound EA trades a high number of symbols as a portfolio to reduced risk and allow compounding of potential profits. Each symbol is traded with low risk and very small position sizes.

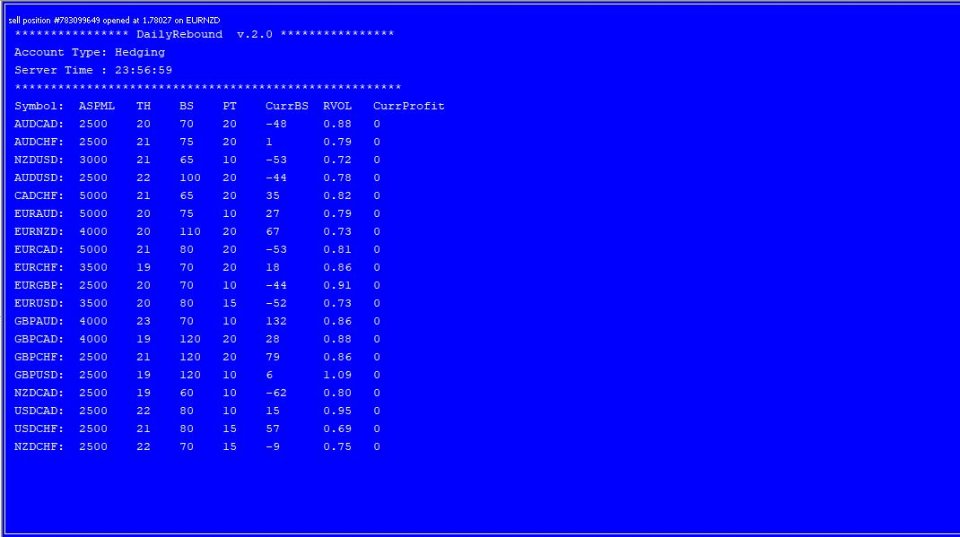

Maximum number of symbols to trade per EA instance is 20. Default settings are for 19 most suitable Forex pairs.

EA makes maximum one trade per day per symbol

EA supports both hedging and netting type accounts

Recommended minimum account balance is 5000$/€. Using lower balance increases risk and profit in percentage terms.

Two effective filtering and risk adjustment mechanisms are built into the EA:

1. Relative volume (RVOL) adjustment:

- If RVOL is higher than normal then lower risk will be used and if RVOL is very low then higher risk will be used for the trade

- If RVOL is extremely high the trade is skipped as there is increased risk that the large move was caused by a large event and it can continue as volume is still elevated

2.Auto Trend Filter and Loss Exit:

This is a strong trend filter which triggers if EA is in the trade sequence and there is continuous strong trend against the trade sequence. EA can stop averaging for a while and then take all skipped averaging trades when the strong move clearly slows down. If that happens EA will also exit the trade on the first sign of strength. This can lead to a close at the loss but also makes sure pullback in the trend is used to get out at somewhat advantageous moment. This feature can be configured with parameter "Auto Trend Filter and Loss Exit Basket Size" which sets the basket size where this mechanism will activate.

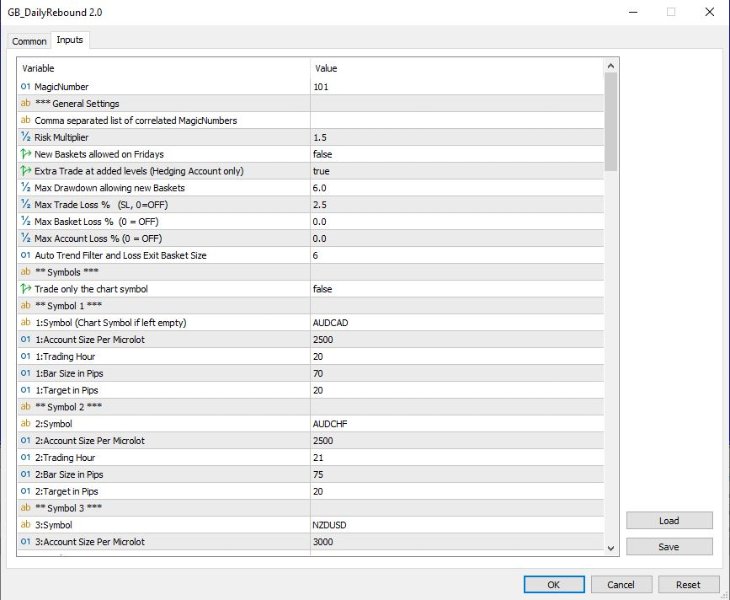

Portfolio level settings:

Risk Multiplier:

Multiplier for all position sizes

With default symbol settings:

Low risk = 0.5

Medium risk = 1.0 (Default)

High risk = 1.5

Extreme risk = 2.0

New Baskets allowed on Friday

Defines if new baskets can be started on Friday evening. Default is FALSE as this reduces over weekend risk

Extra Trade at added levels

If set to TRUE the EA will make additional trade at each averaging level to capture small scalp trade in addition to the averaging procedure. Enabling this increases slightly profitability and risk.

Max Drawdown allowing new Baskets

No trades are opened on new symbols if current balance to equity drawdown is more than this

Max Trade Loss % (SL, 0=OFF)

SL setup for each individual trade. If set each individual trade has SL set

Max Basket Loss % (0=OFF)

Drawdown level of one symbol basket where that particular basket will be closed at loss

Max Account Loss % (0=OFF)

Drawdown level of all DailyRebound EA trades where all EAs trades will be closed at loss

Auto Trend Filter and Loss Exit Basket Size

Basket Size (number or trades in the sequence) after which EA can start skipping levels in strong trend and also exit at loss if there is strong pullback in the trend.

Trade only the chart symbol

If set to TRUE the EA trades only the Symbol of the Chart to which it is attached to.

When first time backtesting this should be set to TRUE, have all Symbols in the MarketWatch and select Optimization "All symbols selected in MarketWatch". Then each Symbol is traded independently and MT5 will download all required data for the Symbols. When this is done once setting shall be set back to FALSE and then whole portfolio will be traded.

This is workaround to an issue in MT5 strategy analyzer. MT5 is not able to download automatically data for all the additional symbols in case of multi-symbol EA. For live trading this is not a problem and you shall leave this always to FALSE.

This is also useful for analyzing performance and impact of individual Symbols to the Portfolio

Symbol level settings:

Symbol

Symbol name. As visible in MarketWatch

Account Size Per Micro lot

Trade sizing for the symbol (assuming Risk Multiplier = 1.0)

Trading Hour

Defines when trades are entered. Entry time is <<Trading Hour>:00> Server Time

Bar Size In Pips

Bar Size in Pips of the Virtual daily bar required for entry. Virtual daily bar size is calculated over the last 24 H1 bars backwards from the Trading Hour

Target in Pips

Take profit set for the initial trade