KT STC Robot MT5

- Эксперты

- KEENBASE SOFTWARE SOLUTIONS

- Версия: 1.0

- Активации: 5

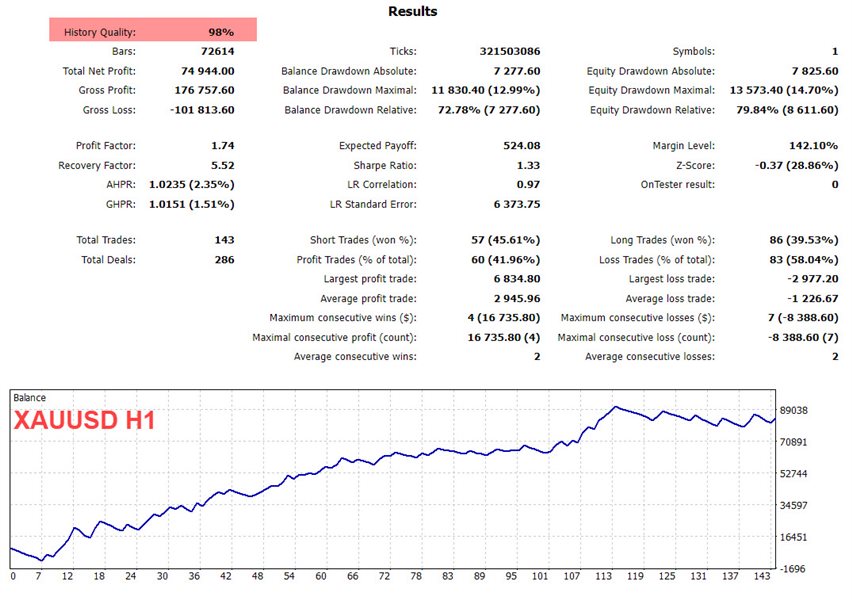

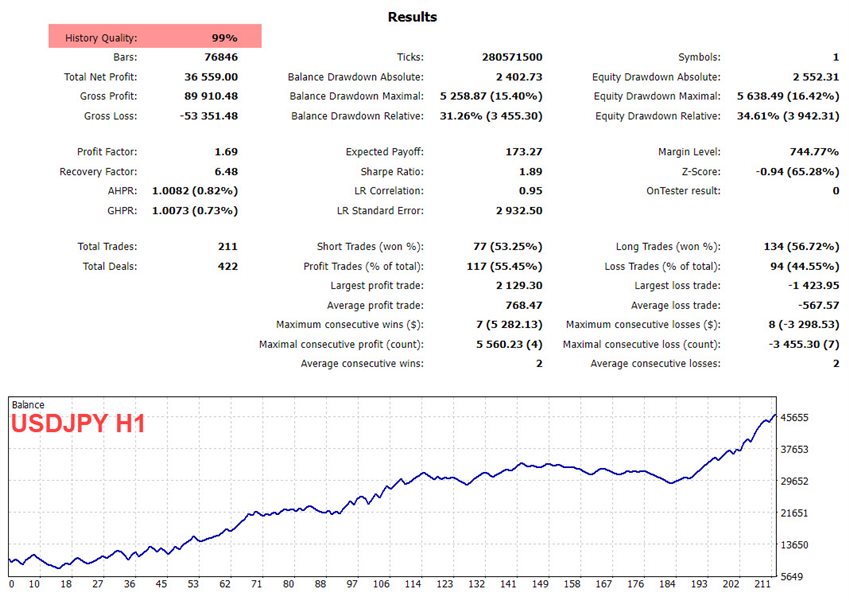

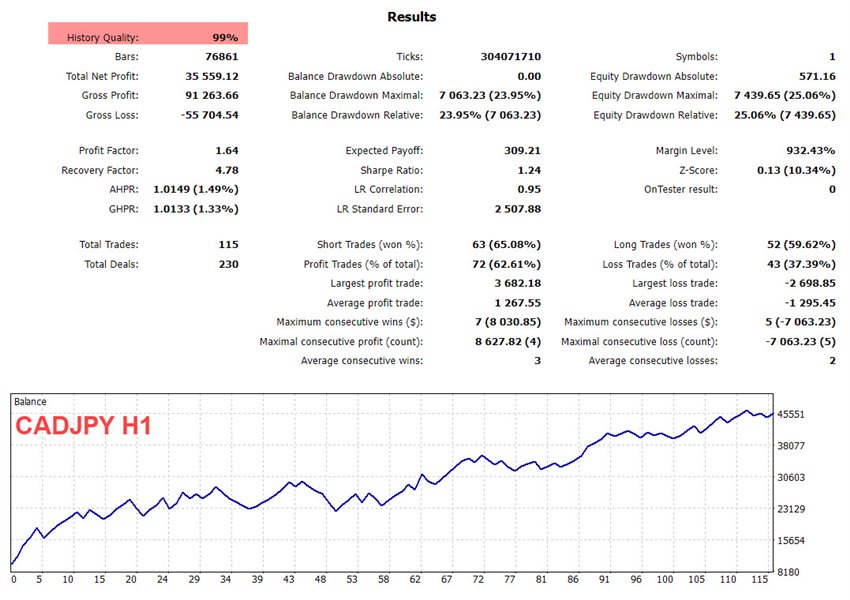

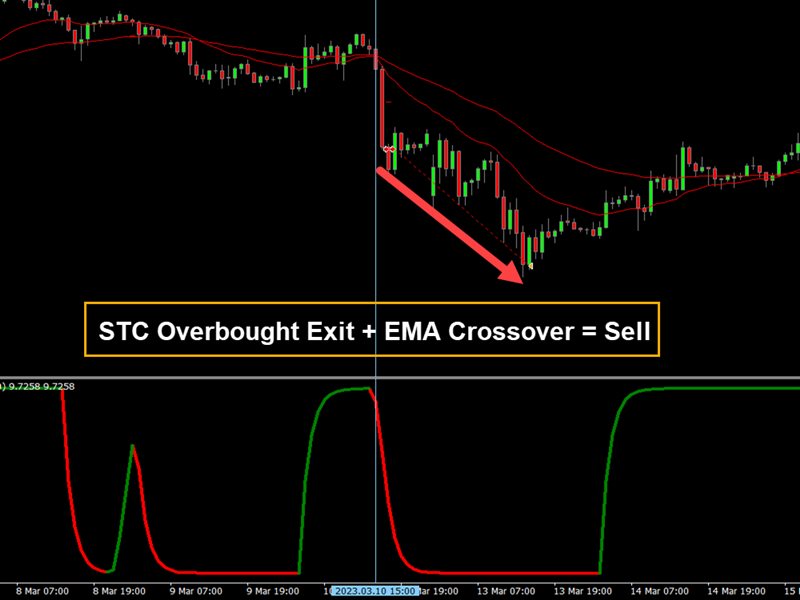

The KT Schaff Trend Cycle Robot implements a highly effective trading strategy by utilizing a combination of overbought/oversold cycles identified through the STC indicator and fast and slow exponential moving averages (EMA).

When the predefined entry rules are satisfied, it promptly initiates pending orders at high or low anchor points based on the analysis of the previous 10 bars.

Download the Set files.

Buy Entry:

- The STC indicator moves out of the oversold zone, indicating a potential reversal or upward momentum.

- The fast EMA is positioned above the slow EMA, indicating a bullish market sentiment.

Sell Entry

- The STC indicator moves out of the overbought zone, signaling a potential reversal or downward momentum.

- The fast EMA is positioned below the slow EMA, indicating a bearish market sentiment.

Once these entry criteria are satisfied, it executes a buy/sell order, allowing you to capitalize on favorable market conditions.

Features

- Broker Compatibility: It is designed to perform consistently well on various trading accounts, ensuring compatibility with different brokers and their specific trading conditions.

- Risk Management: Each trading order is protected by fixed ATR (Average True Range) stop-loss and take-profit levels. This risk management feature helps limit potential losses and secure profits at desired levels.

- Safe Trading Strategies: It implements safe trading practices, avoiding risky techniques such as martingale, grid, averaging, and other high-risk strategies that could potentially jeopardize trading capital.

- User-Friendly Interface: It offers a user-friendly interface with simple and intuitive input parameters. It is designed to be accessible and easy to use, even for traders with limited experience or technical knowledge.

- Self-Contained: Its a self-contained system without additional downloads or external dependencies. All necessary components and dependencies are embedded within the EA, simplifying the installation process and ensuring a seamless trading experience.

- Flexible Customization: Traders have the flexibility to customize and fine-tune the EA's parameters to align with their trading preferences and risk tolerance. This allows for a personalized trading experience and the ability to adapt into different market conditions.

- Real-time Trade Monitoring: It provides real-time trade monitoring and detailed performance statistics. Traders can track the progress of their trades, review historical performance, and make informed decisions based on comprehensive data.

- Built-in Risk Management: The EA incorporates built-in risk management features, including the option to set a maximum risk percentage per trade or a fixed lot size. This helps traders control their risk exposure and ensures prudent risk management practices.

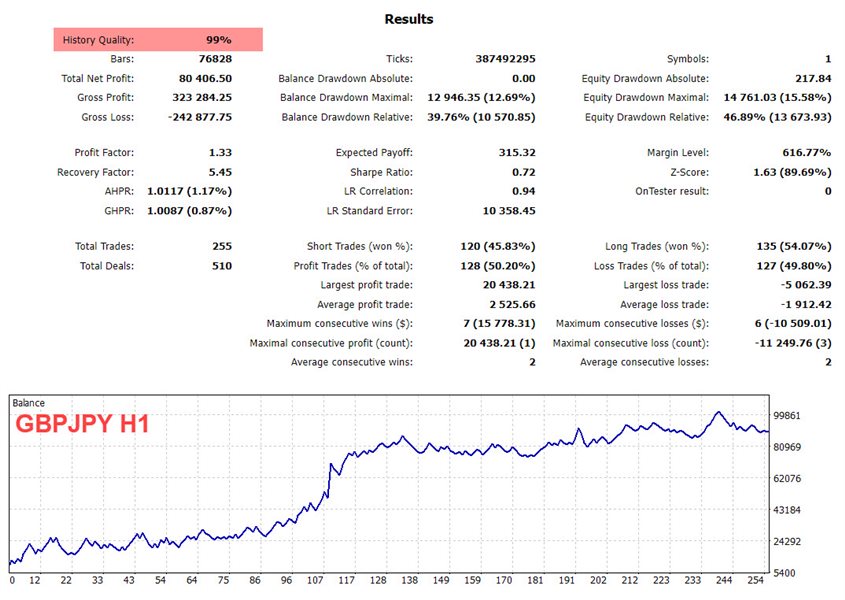

- Backtesting and Optimization: It allows traders to backtest their strategies and optimize parameters to enhance performance. This feature enables traders to refine their trading approach and maximize the EA's effectiveness before deploying it in live trading.