Работа завершена

Время выполнения 10 дней

Отзыв от заказчика

Отличный исполнитель. Сделал конвертацию Tradingview/Pinescript -> MT4/MT5 в лучшем виде.

Great developer. Converted Tradingview/Pinescript -> MT4/MT5 the best possible way.

Отзыв от исполнителя

Отличная работа!

Техническое задание

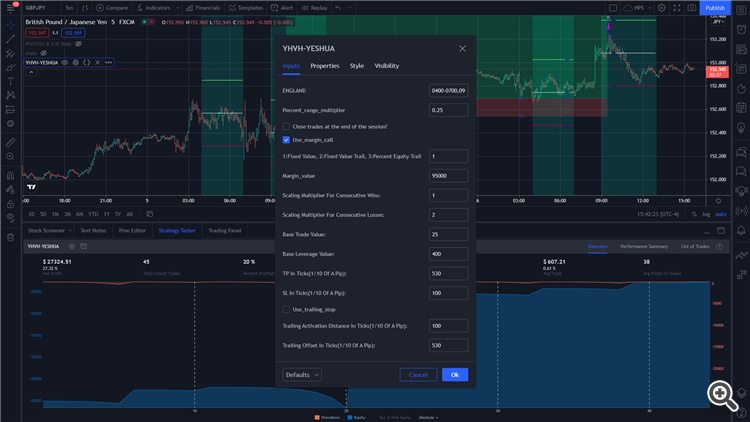

Конвертировать Tradingview Pinescript стратегию в МТ4 / MQL4

Исходный код стратегии содержит около 90 строк, прилагается.

Графические функции конвертировать не нужно.

//@version=3 strategy(title='YHVH-YESHUA', shorttitle='YHVH-YESHUA', overlay=true, default_qty_type=strategy.cash, default_qty_value=1000, initial_capital=100000, currency=currency.USD) // ||--------------------------------------------------|| // || Effective Trading Session: use_trade_session = true trade_session = input(title='ENGLAND', type=string, defval='0400-0700,0900-1300', confirm=false) isinsession = use_trade_session ? not na(time('1', trade_session)) : true bgcolor(color=use_trade_session and isinsession ? teal : na, transp=75, title='In Session BG') // ||--------------------------------------------------|| percent_range_multiplier = input(0.25) r = security(tickerid, 'D', atr(100)[1]) open_price = open open_price := change(use_trade_session and isinsession ? 1 : 0) > 0 ? open : open_price[1] buy_line = open_price + r * percent_range_multiplier sel_line = open_price - r * percent_range_multiplier plot(series=not isinsession ? na : open_price, title='Session Open Price', color=white, linewidth=1, style=linebr, transp=0) plot(series=not isinsession ? na : buy_line, title='Buy Line', color=green, linewidth=2, style=linebr, transp=0) plot(series=not isinsession ? na : sel_line, title='Sell Line', color=maroon, linewidth=2, style=linebr, transp=0) // Conditions to buy/sell on the first bar, since cross's arent detected. buy_on_1st_bar = change(open_price) != 0 and high > buy_line sel_on_1st_bar = change(open_price) != 0 and low < sel_line buy_trigger = crossover(high, buy_line) or buy_on_1st_bar sel_trigger = crossunder(low, sel_line) or sel_on_1st_bar // ||--------------------------------------------------|| // || Close trades at end of session: || close_at_end_of_session = input(defval=false, title='Close trades at the end of the session?', type=bool) if close_at_end_of_session and not isinsession strategy.close_all(when=true) // ||--------------------------------------------------|| // || --> // || Account Margin Management: f_account_margin_call(_ammount)=> _return = false _return := na(_return[1]) ? false : strategy.equity <= _ammount ? true : _return[1] // || --> // || --> f_account_fixed_trail_call(_ammount)=> _maximum_equity = strategy.equity _return = false _maximum_equity := na(_maximum_equity[1]) ? strategy.equity : max(_maximum_equity[1], strategy.equity) _return := na(_return[1]) ? false : strategy.equity <= _maximum_equity - _ammount ? true : _return[1] // || --> // || --> f_account_percent_trail_call(_percent)=> _return = false _maximum_equity = strategy.equity _maximum_equity := na(_maximum_equity[1]) ? strategy.equity : max(_maximum_equity[1], strategy.equity) _return := na(_return[1]) ? false : strategy.equity <= _maximum_equity * (_percent/100) ? true : _return[1] // || --> // || --> use_margin_call = input(true) margin_call_mode = input(defval=1, title='1:fixed value, 2:fixed value trail, 3:percent equity trail', type=integer, minval=1, maxval=3) margin_value = input(95000) trade_if_not_margin_call = use_margin_call ? (margin_call_mode == 1 ? not f_account_margin_call(margin_value) : margin_call_mode == 2 ? not f_account_fixed_trail_call(margin_value) : margin_call_mode == 3 ? not f_account_percent_trail_call(margin_value) : false) : true wins_multiplier = input(defval=1.00, title='Scaling Multiplier for Consecutive Wins:') losses_multiplier = input(defval=2.00, title='Scaling Multiplier for Consecutive Losses:') buy_cond = isinsession and trade_if_not_margin_call and buy_trigger and strategy.opentrades < 1 sel_cond = isinsession and trade_if_not_margin_call and sel_trigger and strategy.opentrades < 1 f_martingale_wins_multiplier(_multiplier) => _return = na _return := na(_return[1]) ? 1 : change(strategy.losstrades) > 0 ? 1 : change(strategy.wintrades) > 0 or change(strategy.eventrades) > 0 ? _return[1] * _multiplier : _return[1] f_martingale_loss_multiplier(_multiplier) => _return = na _return := na(_return[1]) ? 1 : change(strategy.wintrades) > 0 ? 1 : change(strategy.losstrades) > 0 or change(strategy.eventrades) > 0 ? _return[1] * _multiplier : _return[1] mode = na mode := change(strategy.wintrades) > 0 ? 1 : change(strategy.losstrades) > 0 ? -1 : nz(mode[1], 1) trade_multiplier = mode > 0 ? f_martingale_wins_multiplier(wins_multiplier) : f_martingale_loss_multiplier(losses_multiplier) trade_size = input(defval=25, title='Base trade value:') trade_leverage = input(defval=400, title='Base Leverage value:') trade_size_multiplied = (trade_size * trade_leverage) * trade_multiplier //plot(strategy.closedtrades) strategy.entry('B', long=true, qty=trade_size_multiplied, when=buy_cond) strategy.entry('S', long=false, qty=trade_size_multiplied, when=sel_cond) // ||----------------------------------|| // || Simple Profit and Loss Logic: || take_profit = input(defval=530, title='TP in ticks(1/10 of a pip):') stop_loss = input(defval=100, title='SL in ticks(1/10 of a pip):') // ||------------------------------------------|| use_trailing_stop = input(false) trailing_activation = input(defval=100, title='Trailing activation distance in ticks(1/10 of a pip):') trailing_offset = input(defval=530, title='Trailing offset in ticks(1/10 of a pip):') if (not use_trailing_stop) strategy.exit('B', from_entry='B', profit=take_profit, loss=stop_loss) strategy.exit('S', from_entry='S', profit=take_profit, loss=stop_loss) if (use_trailing_stop) strategy.exit('B', from_entry='B', profit=take_profit, loss=stop_loss, trail_points=trailing_activation, trail_offset=trailing_offset) strategy.exit('S', from_entry='S', profit=take_profit, loss=stop_loss, trail_points=trailing_activation, trail_offset=trailing_offset) // ||-----------------------------------------------|| // || Simple Profit and Loss open Trade ploting: || pip_digits_multiplier = 0.00001 trade_open_price = na trade_loss_price = na trade_profit_price = na trade_open_price := strategy.opentrades == 0 ? na : change(strategy.opentrades) > 0 ? open : trade_open_price[1] trade_loss_price := strategy.opentrades == 0 ? na : change(strategy.opentrades) > 0 ? (buy_trigger[1] ? trade_open_price - (stop_loss * (round(open)*pip_digits_multiplier)) : trade_open_price + (stop_loss * (round(open)*pip_digits_multiplier))) : trade_loss_price[1] trade_profit_price := strategy.opentrades == 0 ? na : change(strategy.opentrades) > 0 ? (buy_trigger[1] ? trade_open_price + (take_profit * (round(open)*pip_digits_multiplier)) : trade_open_price - (take_profit * (round(open)*pip_digits_multiplier))) : trade_profit_price[1] t_o = plot(series=trade_open_price, title='Trade Open Price Line', color=color(black, 0), style=linebr) t_l = plot(series=trade_loss_price, title='Trade Loss Price Line', color=color(black, 0), style=linebr) t_p = plot(series=trade_profit_price, title='Trade Profit Price Line', color=color(black, 0), style=linebr) fill(plot1=t_o, plot2=t_l, color=red, transp=80, title='Trade Loss Fill') fill(plot1=t_o, plot2=t_p, color=lime, transp=80, title='Trade Profit Fill')

Откликнулись

1

Оценка

Проекты

7

0%

Арбитраж

1

0%

/

100%

Просрочено

0

Свободен

2

Оценка

Проекты

480

41%

Арбитраж

78

12%

/

63%

Просрочено

77

16%

Работает

Информация о проекте

Бюджет

30+ USD

Исполнителю

27

USD

Сроки выполнения

от 1 до 3 дн.