1. Typical Settings of indicators MetaCOT 2 and their meaning

Each indicator of series MetaCOT 2 has basic settings, common for all indicators:

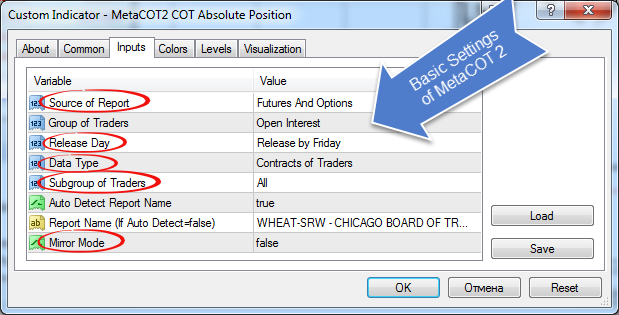

Fig 1.1. Basic settings

Here is the list and the value of this settings:

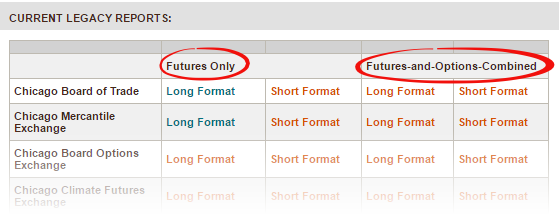

- Source of Report. Choose between two types of report: futures and futures and options:

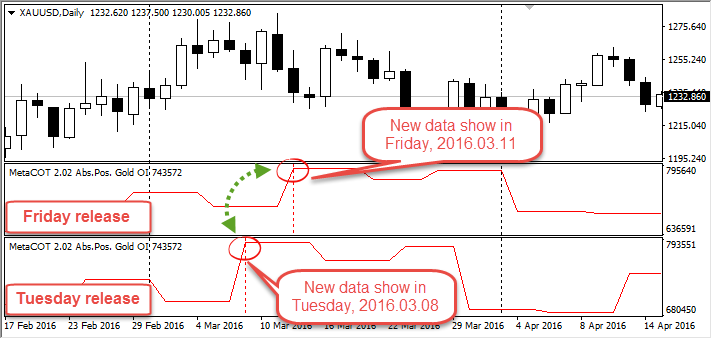

- Release Day. CFTC performs pre-screening every Tuesday and published it in on Friday. You may choose regim of showing data in indicator. Refresh it by Tuesday or Friday.

Choose 'Release by Friday' if you want analyse data by fact it release (by Friday). Choose 'Release by Tuesday' if you want analyse data by it time of it receipt. Different between this two types in this screenshot:

Fig 1.3. Different between 'Release by Friday' and 'Release by Tuesday' settings

Warning! If you work with MetaCOT in real-time mode or test expert advisor using CFTC report you need set 'Release Friday' only!

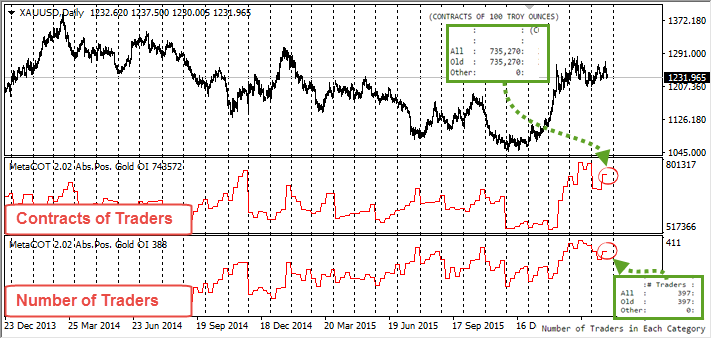

- Data Type. MetaCOT support two data type: 'Contracts of Traders' and 'Number of Traders'. If you choose ''Contracts of Traders', MetaCOT will be using dates based on contract. If you choose 'Number of Traders', MetaCOT will be using dates from total traders:

Fig 1.4. Different between 'Contracts of Traders' and 'Number of Traders' settings.

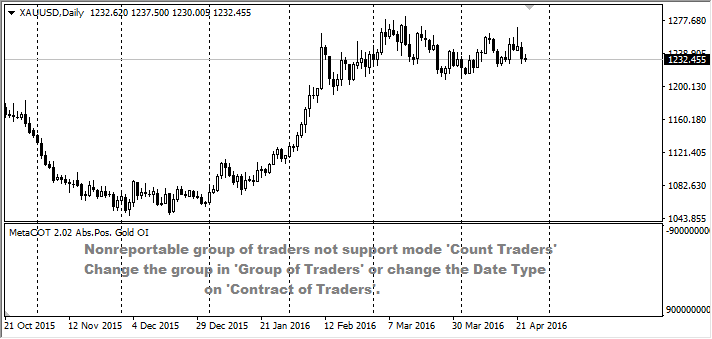

Warning! If You choose date type 'Number of Traders' and one group from Nonreportable Positions, for example 'Nonreportable Long' (for MetaCOT Absolute Position indicator), or 'Netto Noneportable' (for MetaCOT NettoPositions indicator), indicator will be empty:

Fig 1.5. Empty Numbers Traders

You need choose another group from Operators or Non-Commercial. or choose 'Contract of Traders'.

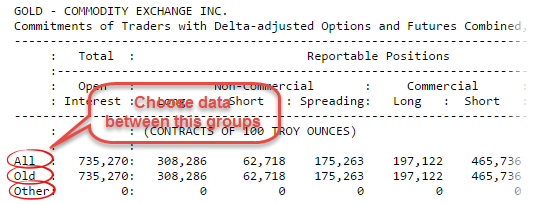

- Soubgroup of Traders. This group choose between three subgroups: 'All', 'Old' and 'Other':

Fig. 1.6. Choose between three groups of traders

Warning! If report not support type 'Other' (always equal 0) indicator will be empty:

Fig. 7. Empty indicator.

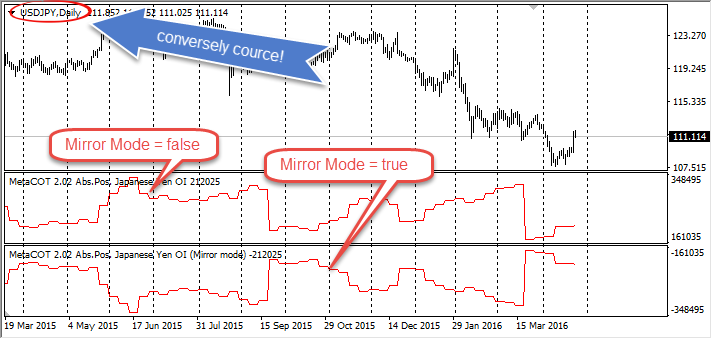

- Mirror Mode. This option inverted line indicators. For example see this screenshot:

This option use for symbols with conversely courses, for example USDJPY or USDCHF, because CFTC report based on futures with direct course, e.g. 6J (Japanese yen) future is JPYUSD and 6S (Swiss frank) is CHFUSD.

Fig 1.2. Site www.cftc.gov with two types report

Choose 'Futures And Options' (default value) if your want analyse Futures-and-Options-Combined reports type. Choose 'Futures Only' if your want analyse Futures Only reports.

2. Working with reports

MetaCOT 2 loading report automatically. For example, if you load indicator MetaCOT on symbol 'XAUUSD', it detect report with name 'GOLD - COMMODITY EXCHANGE INC' and load it. But on non-standard symbol automatically loading will be failed. In addition, You can load any report to any character, not just a preset. This can be done in two ways:

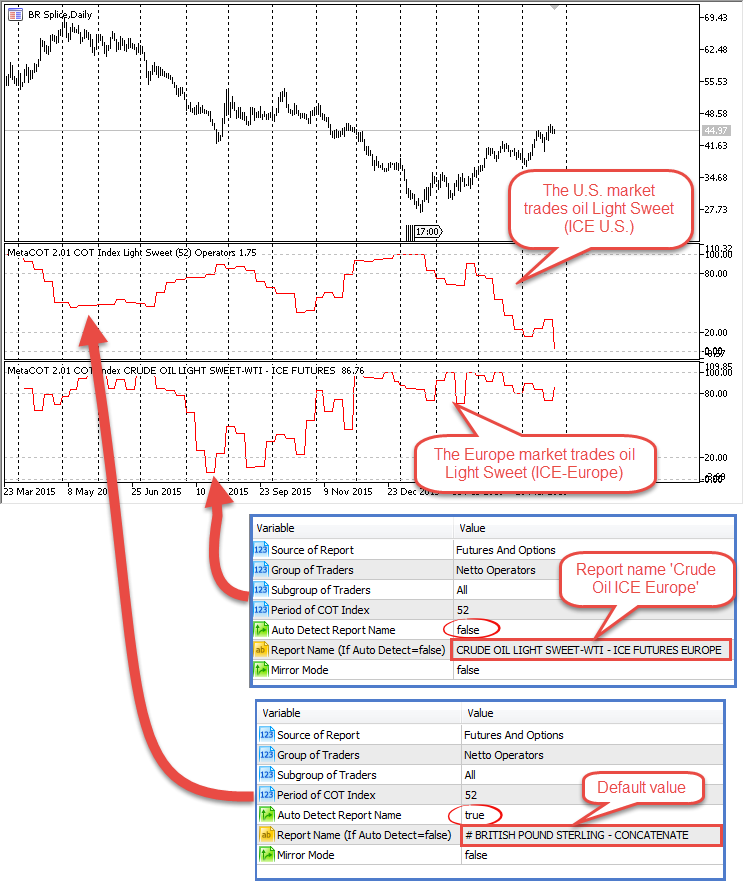

- Choose in settings of indicator 'Auto Detect Report Name' and set false. In setting 'Report Name (if Auto Detect=false)' set the name of the report that you want to load. For example load two markets of Crude Oil 'Light Sweet' in one chart of Crude Oil 'Brent':

Fig 2.1 Crude Oil 'Lite Sweet' on U.S. and Europe Markets.

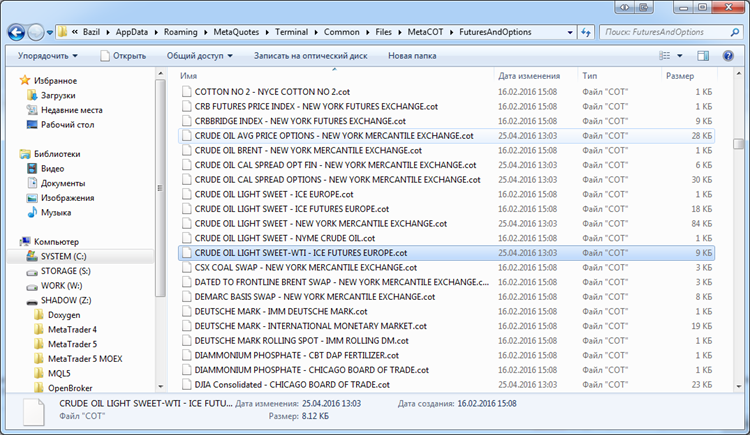

If You do not know what name of report you need load go in MetaCOT work folder by 'c:\Users\YourAccountName\AppData\Roaming\MetaQuotes\Terminal\Common\Files\MetaCOT\'. Find folder 'Futures' or 'Futures and Options' and go in it. In This folder locate the name of the report that You need:

Fig. 2.2.Files with reports.

Warning! Enter report name without the extension. If you enter "CRUDE OIL LIGHT SWEET-WTI - ICE FUTURES EUROPE.cot" - it will be wrong. You need enter "CRUDE OIL LIGHT SWEET-WTI - ICE FUTURES EUROPE" only! - You may add your symbol name in settings of MetaCOT 2. In this case MetaCOT will be automatically load you need report with this symbol. For example if you want MetaCOT automatically load report 'CRUDE OIL LIGHT SWEET-WTI - ICE FUTURES EUROPE' on chart with Crude Oil by name 'BR' (BR-3.16 or BR Splice), edit file 'COT - SYMBOLS.xml' ('c:\Users\YourAccountName\AppData\Roaming\MetaQuotes\Terminal\Common\Files\MetaCOT\'):

2.1. Comment old Crude Oil settings:<!-- ENERGIES --> <!--<Report Name = "CRUDE OIL LIGHT SWEET - NEW YORK MERCANTILE EXCHANGE" ShortName="Light Sweet"> <Symbol>BR</Symbol> <Symbol>CL</Symbol> </Report>--> <!-- <Report Name = "BRENT CRUDE OIL LAST DAY - NEW YORK MERCANTILE EXCHANGE" ShortName="Brent"> <Symbol>BR</Symbol> </Report> --> <Report Name = "NATURAL GAS - NEW YORK MERCANTILE EXCHANGE" ShortName="Natural Gas"> <Symbol>NG</Symbol> <Symbol>QG</Symbol> </Report>

2.2. Enter new tag with Crude Oil:<!-- ENERGIES --> <!-- <Report Name = "CRUDE OIL LIGHT SWEET - NEW YORK MERCANTILE EXCHANGE" ShortName="Light Sweet"> <Symbol>BR</Symbol> <Symbol>CL</Symbol> </Report> --> <!-- <Report Name = "BRENT CRUDE OIL LAST DAY - NEW YORK MERCANTILE EXCHANGE" ShortName="Brent"> <Symbol>BR</Symbol> </Report> --> <Report Name = "CRUDE OIL LIGHT SWEET-WTI - ICE FUTURES EUROPE" ShortName="Light Sweet Europe"> <Symbol>BR</Symbol> </Report> <Report Name = "NATURAL GAS - NEW YORK MERCANTILE EXCHANGE" ShortName="Natural Gas"> <Symbol>NG</Symbol> <Symbol>QG</Symbol> </Report>

2.3. Reload indicators and enjoy!